Insight

5 March 2026

On Watch: Spirit may reject more A320neo leases as airline...

As Spirit reviews its fleet in preparation for a potential Chapter 11 emergence, Ishka analyses whic...

1000s of aviation professionals across 80 countries rely on Ishka’s data and information services to chart their path to profitable growth

5 March 2026

As Spirit reviews its fleet in preparation for a potential Chapter 11 emergence, Ishka analyses whic...

5 March 2026

Lessors are in talks with part-out firms over dozens of potential A320neo airframes, including sever...

12 September 2025

The recent $28.2 billion acquisition of Air Lease Corporation by Sumitomo Corporation, SMBC Aviation...

3 March 2026

Lessors raised $2.4 billion in unsecured debt in February, bringing the total to date for 2026 to $6...

17 February 2026

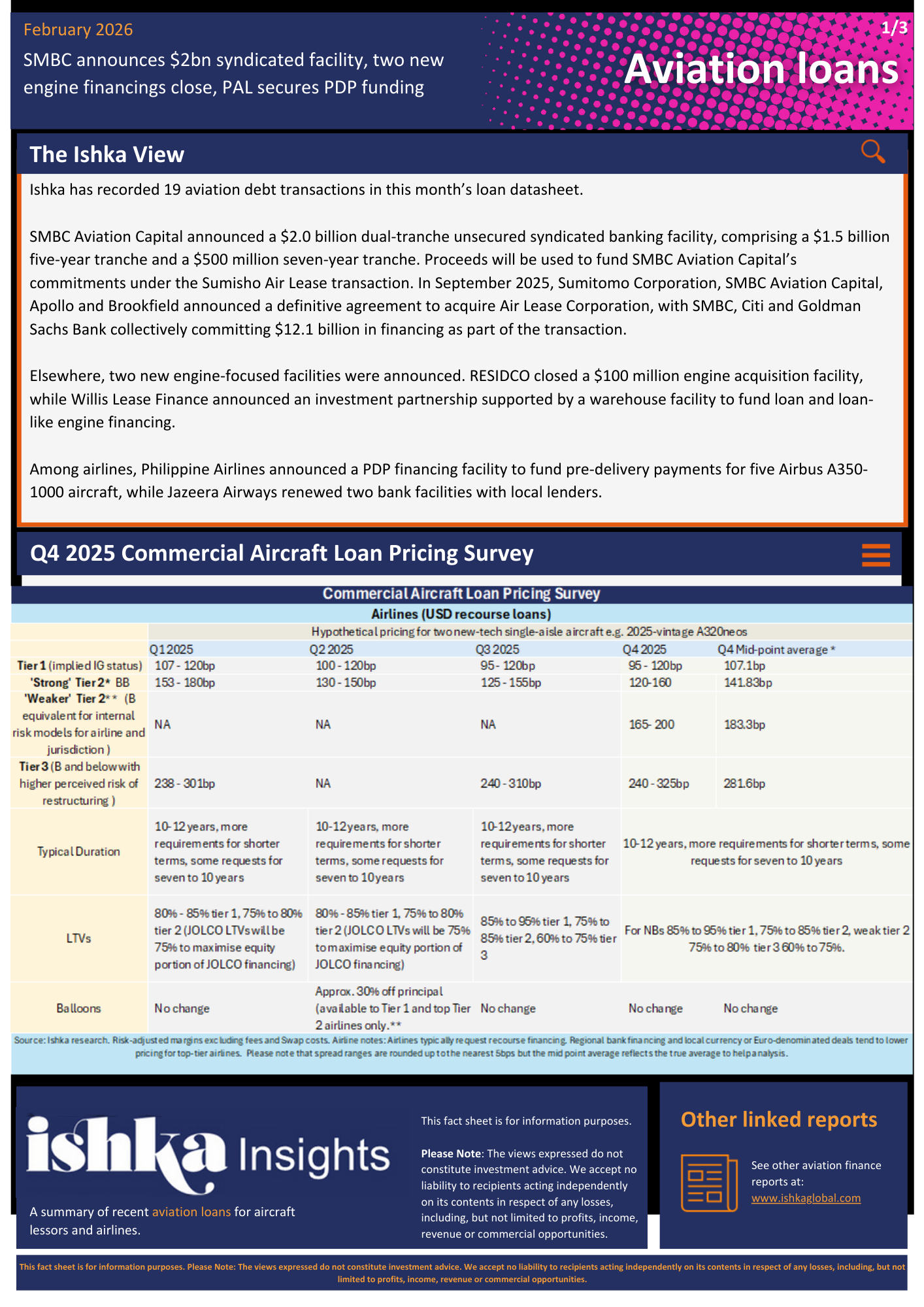

The latest Ishka loan datasheet examines recent loans for commercial aircraft lessors and airlines, ...

5 March 2026

This new report series examines policy progress enabling first-of-a-kind DAC projects and their scal...

Latest Video

Capital flows, trading conditions, asset appetite, deal activity, and a cryptic hint at a major Asia-based transaction...

24 - 25 March | Hilton Tower Bridge

Join us for Ishka Investing in Aviation: Europe and Ishka Horizon at the end of Q1.

Ishka and Airfinance Global have joined forces to give you unmatched visibility across the entire aviation finance deal lifecycle. From airline credit analytics to market trends, access the intelligence that drives smarter, faster decisions.

Get beyond the headlines with Ishka’s daily Insights reports including data-driven analysis and the respected Ishka View.

Gain an in-depth perspective on market-moving trends with detailed analysis and commentary from Ishka’s independent team of aviation specialists. Access rich, value-add data sets to export directly into your own internal workflows and presentations.

Make clear, informed and better aircraft investment and trading decisions with Transaction Economics.

The market has been demanding greater transparency in understanding aircraft asset values. Ishka’s leading-edge Transaction Economics service delivers the clarity investors and financiers have been seeking through unique, proprietary aircraft pricing and transaction data, dynamic aircraft values and lease rates data plus expert opinion acquired from 40-years’ experience in the industry.

Power your airline analysis and identify viable investment opportunities with Ishka’s advanced Airline Credit Profiles service.

Airline Credit Profiles delivers critical market intelligence you can trust to measure risk and trade with confidence. Our unique methodology integrates a wealth of essential data sets including our authoritative Ishka airline credit scores together with indispensible analysis from our global team of airline analysts.

NEW

Better results start with getting SAVi

As tighter ESG scrutiny and new regulatory pressures come into play, aviation dealmakers need to design and implement comprehensive strategies to navigate the path to net zero.

Access the richest, most meaningful aviation finance sustainability intelligence in the market to help meet your goals and stay ahead of competitors.

Opportunity knocks in aviation. Unlock it today with Ishka's Advisory services. Headed up by industry pioneer Eddy Pieniazek, our respected team of consultants demonstrates over 40-years’ experience advising leaders of the world’s top aviation finance, investment and leasing companies, airlines, manufacturers and service providers.

Our international team applies deep domain expertise and local market knowledge to uncover new investment opportunities, improve margins and maximise the potential of your existing assets.

Featuring aviation’s crème de-la-crème of movers and shapers, Ishka+ Events delivers an extensive range of conferences, briefings, seminars and training programmes for your entire team to enjoy, in-person onsite or rewatch post-event on-demand via our unique streaming and networking platform.

Our specialism is engaging and attracting new and seasoned institutional investors to discuss the latest opportunities and risks within commercial aviation and connect with key industry stakeholders.