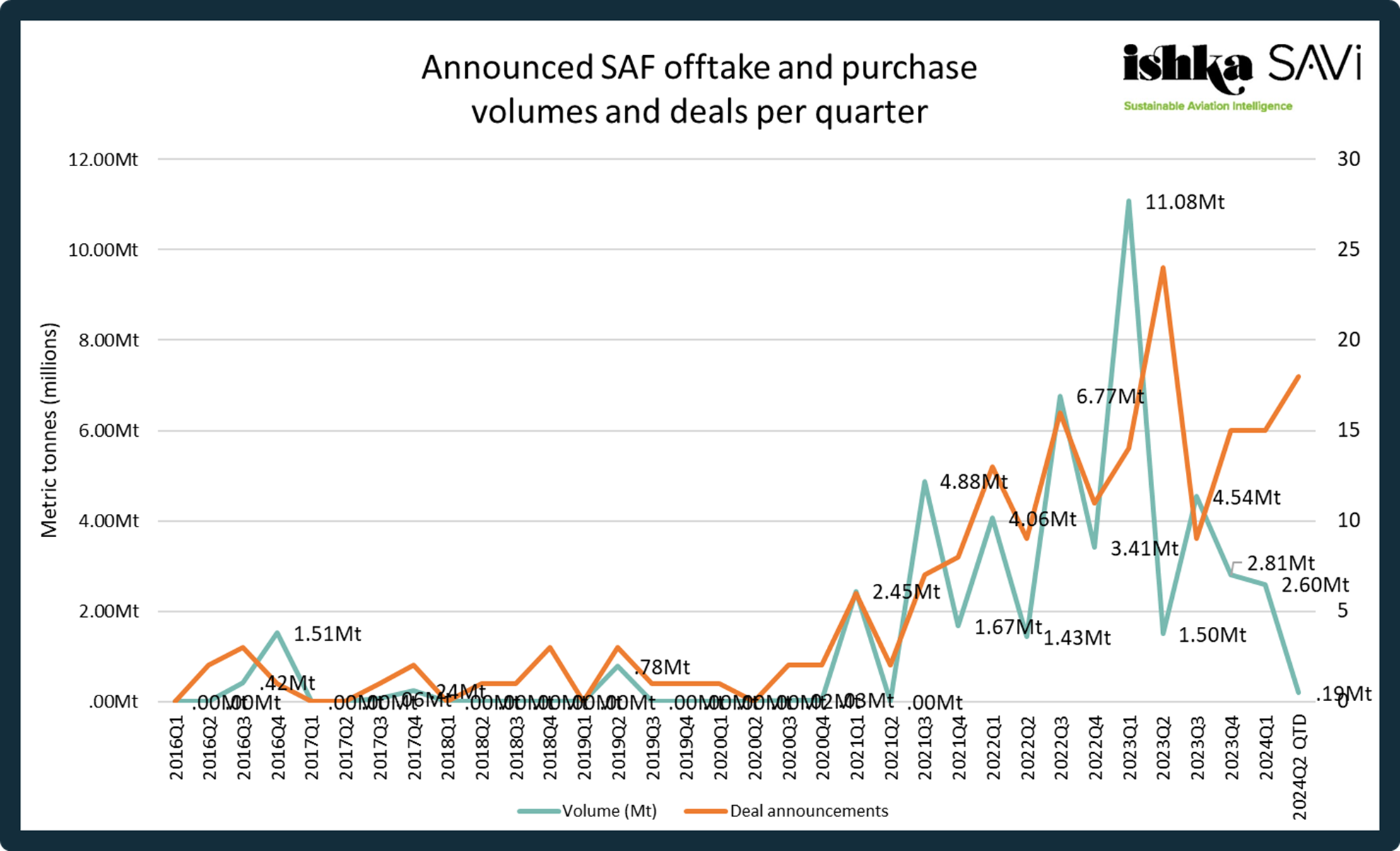

SAF offtake and purchase deals in the first five months of 2024 could amount to as little as 2.8 million metric tonnes based on announced volumes, over three times lower than the 12.5 million metric tonnes of SAF covered by deal announcements in the same period of 2023, Ishka SAVi SAF Tracker data reveals.

The decline in deal volumes follows slower growth in SAF offtake and purchase announcements throughout 2023 after a peak of 11 million metric tonnes in deals announced during Q1 2023. Since then, quarterly volumes based on deal announcements have been closer to 2021 levels.

Ishka SAVi examines trends in SAF offtake announcements five months into 2024.

The year so far: More deals but smaller sizes

SAF offtake and purchase agreement announcements vary not just in scale, length, and involved parties, but also in the amount of disclosure. Of the 196 announcements recorded by Ishka to date, 57 either did not pinpoint a specific volume or provided insufficient details to establish one (such as precise lifecycle emissions of the blended SAF versus fossil kerosene).

Of those 57 inexact announcements, a large portion (34) – as the graph above infers – took place in 2023 and 2024 to date, leading to total reported volumes that likely underrepresent recent SAF commitments. Nevertheless, the fact that many of those 34 deals consisted of partnerships, MoUs, or relatively small SAF certificate purchases suggests SAF volumes across all deals are likely down on a yearly basis, even when accounting for reduced disclosure of volumes.

Another aspect to consider is reduced activity by repeat SAF purchasers. Around half of the 14 SAF buyers with four or more SAF announcements to date (all of which made at least one announcement in each of the past two years) have been more restrained so far this year. Only five of the 14 – all large airline groups with the exception of Boeing – have made an announcement so far in 2024.

Changes to the SAVi SAF Leaderboard

The restraint of the largest SAF buyers over the past 12 months means that Ishka SAVi’s SAF Leaderboard has changed little over that period. The Leaderboard ranks airlines based on average annual SAF deliveries across future years covered by SAF purchases and offtakes. To balance operator size differences, the annual SAF amounts are compared with 2019 fuel usage* for each carrier.

The result is an estimate** providing an early indication of which airlines may achieve substantial SAF blending over the remainder of this decade, thereby lowering their carbon intensity on a well-to-wake basis (i.e. taking into account not only aircraft tailpipe emissions but also lifecycle fuel emissions).

Deutsche Post DHL currently leads this ranking with average SAF delivery for years covered by its deals representing approximately 8.7% of its 2019 fuel usage. It is followed by United Airlines at 5.9%, Japan Airlines at 4.9%, Cebu Pacific at 3.9%, Qantas at 3.8% and Wizz Air at 3.6%.

Given that Ishka’s calculation takes into account years when deliveries are only beginning to ramp up (closer in time) as well as later years for which only a small number of long-term deals apply (late 2030s and early 2040s), the percentages may not necessarily represent how close each airline is to meeting their 2030 voluntary SAF targets (most of which are 10% by 2030). For instance, SAF deals agreed by Qantas with Boeing and Airbus in 2023 give it, according to the airline, the “potential to meet most” of the group’s 10% by 2030 target.

* 2023 fuel usage will be included once the data has been gathered for all indexed airlines

** As covered in this report, this estimate is based on deal announcements. Volumes and deal lengths may sometimes be underrepresented due to limited disclosure.

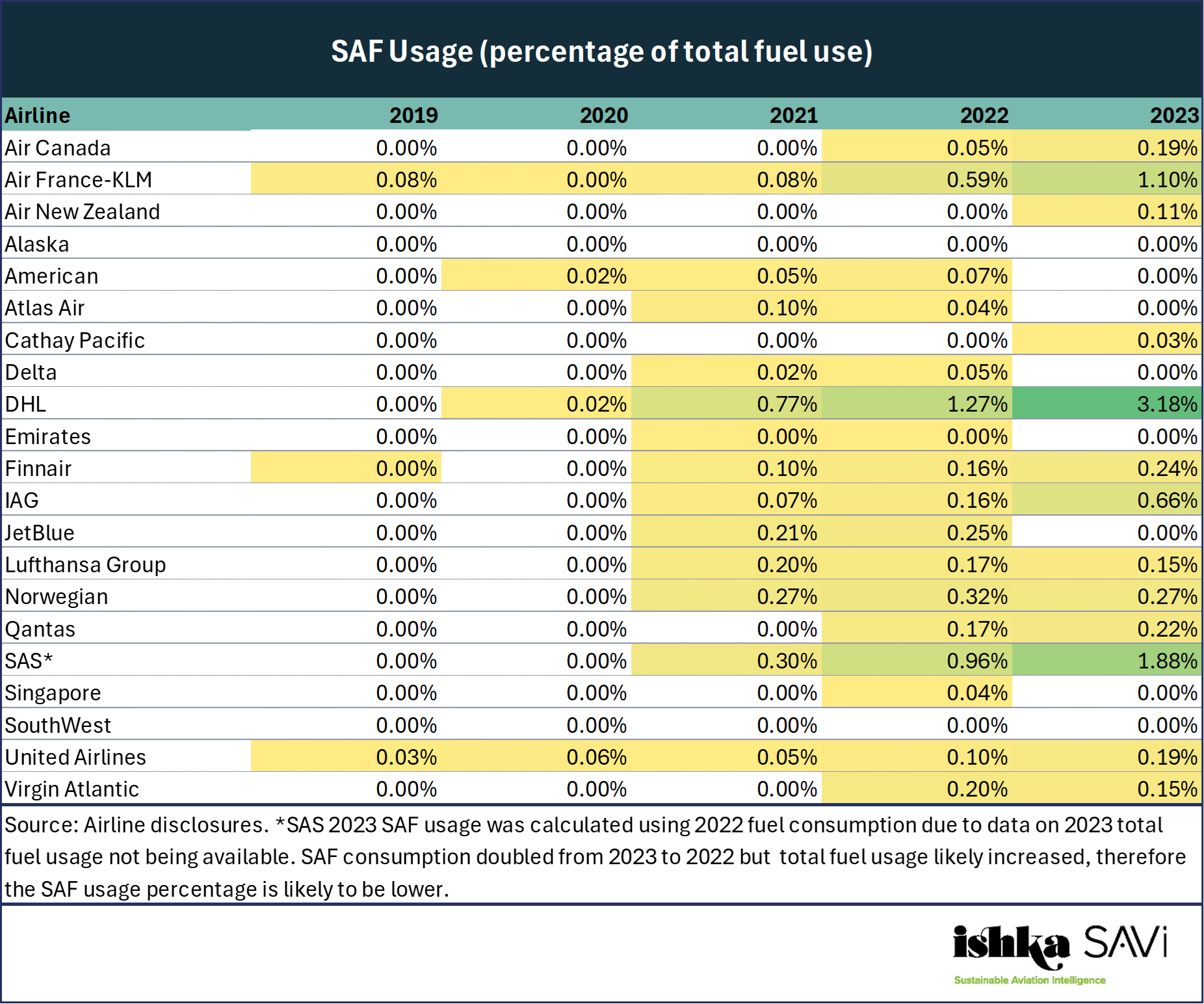

A glimpse into airline SAF usage

There is something to be said about prominent SAF purchasers starting to walk the talk. SAF production has increased significantly over the past few years, and while in 2023 it lagged industry projections, it still resulted in record-high usage by some airlines. Eleven of 21 analysed airlines had as of late May 2023 disclosed SAF usage both in 2023 and 2022. On average, those 11 airlines doubled SAF usage year-on-year, although with a few exceptions, SAF remained below 1% of their total fuel mix.

The Ishka View

Ishka’s tracking of SAF offtake and purchase agreements showed continued growth in 2023 versus 2022, countering other industry statistics pointing to a contraction. The 2023 growth – granular details of which are available via the SAF Tracker – was largely frontloaded in the first quarter of the year. Since then, a number of trends have become obvious: smaller deals, fewer announcements by leading offtakers, and overall reduced volumes. This raises two potential concerns: firstly, that coveted blue-chip airline offtakers pivotal to SAF project financing may be adopting a wait-and-see attitude before resuming their chase for long-term SAF supply deals; and secondly, that the number of airlines willing to voluntarily purchase SAF or sign long-term offtakes may be plateauing.

At the same time, it is worth taking any lessons with caution. Long-term deals for advanced SAF including power-to-liquid or e-SAF have become more common in the past year, and these are generally (with the exception of the Twelve-IAG deal) smaller in size. Public SAF deal announcements may also provide a partial view of the market, as few airlines have made comprehensive and regular disclosures on SAF offtake deals.