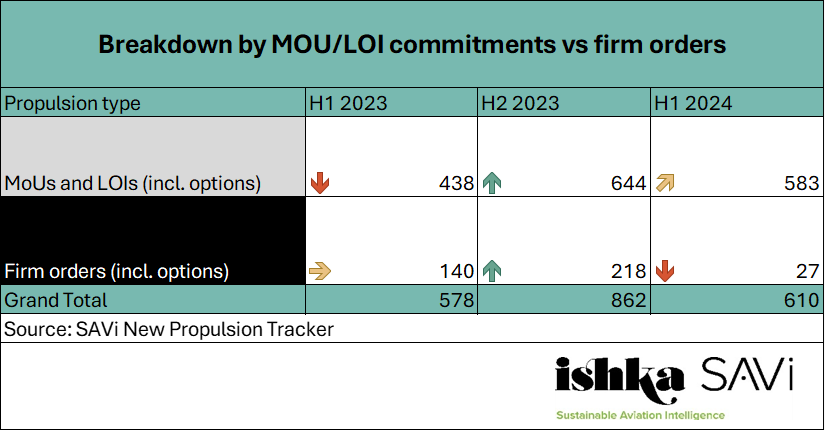

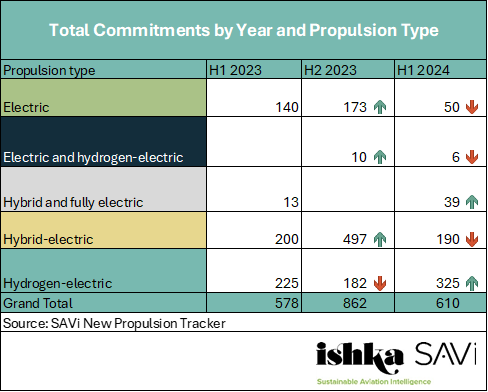

Orders and commitments for new propulsion fixed-wing clean-sheet aircraft as well as retrofit powertrains* decreased slightly in the first half of 2024 with a total of 17 deals recorded by Ishka SAVi for 610 products (aircraft, and an approximate number of aircraft that could be retrofitted with new powertrains), compared with 21 deals for 578 products in H1 2023 – a period that, unlike H1 2024, included the annual peak in announcements of the Paris Air Show in June. However, Ishka notes this increase in the first six months of 2024 does not account for commitment cancellations in the wake of the Universal Hydrogen collapse and includes one sizeable tally adjustment for undisclosed orders by ZeroAvia (240). Without the ZeroAvia adjustment, the H1 2024 tally would have stood at 370 products, a moderate lag as of July when the Farnborough Air Show could make all the difference.

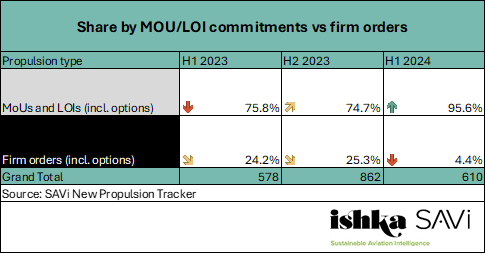

Nevertheless, the H1 2024 numbers were a decrease from 20 deals for 862 products in H2 2023 – a period that also included one sizeable tally adjustment for undisclosed orders by Heart Aerospace (165). Most disappointingly, the proportion of firmed orders in H1 2024 (including options) staggered down to a meagre 4.4%, down from 25.3% of all orders and commitments in H2 2023 and 24.2% in H1 2023.

* As of July 2024, Ishka SAVi’s coverage comprises orders and commitments for 52 products by 35 different OEMs and retrofit solution providers. Orders and commitments are classified into ‘firm’ and ‘MoU or LOI’ based on details in announcements and manufacturer disclosures. Tally adjustments for undisclosed customers (sometimes for 100 or more aircraft) are added to the tracker whenever each OEM provides total orderbook estimates. This means, for example, that a ZeroAvia adjustment for 240 powertrain commitments in January 2024 derived from announcement made that month is likely to be for orders and commitments signed in preceding years.

Lower commitments set high Farnborough expectations

Excluding the tally adjustment for ZeroAvia (240 aircraft conversions), new commitments announced (and likely closed) during H1 2024 would stand at only 370, a slight decline versus previous periods. For Farnborough announcements to boost the year-to-date tally enough to match the 2023 monthly average, commitments for around 200 products will need to be announced by the end of July.

Meanwhile, only three deals sit behind the 27 commitments (4% of all 2023 announcements) marked as ‘firm or firm with options’, all of them for Surf Air Mobility’s Cessna Caravan conversions. Firm commitments as percentage of total commitments had been increasing in the past two years, and the lower percentage of firm deals in H1 2024 is a reversal of that trend. New propulsion customers have the opportunity to make up for this difference at the Farnborough Airshow this month. For others, the announcement of firmed commitments could come later in the year as several demonstrator and test aircraft take to the sky for the first time.

Besides the ZeroAvia tally adjustment, the largest commitments in the first half of 2024 both involved Electra. On one hand, the eSTOL firm signed an MoU with Wilbur Air (a subsidiary of vertiport developer Skyportz) which plans to operate the first 100 Electra eSTOL aircraft in Australia. Electra also signed a bilateral agreement with OEM Surf Air Mobility (SAM) for "preferred delivery positions" for 90 Electra eSTOL aircraft to be operated via SAM’s subsidiary airlines.

Regained momentum for hydrogen-electric

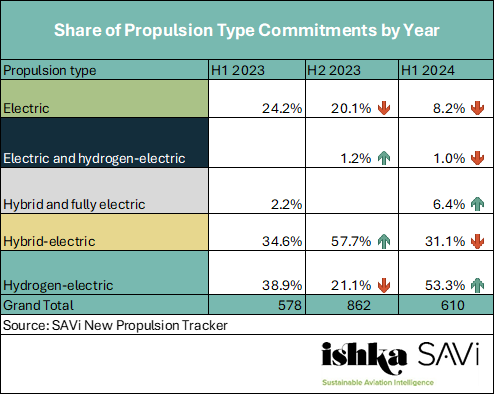

Orders and commitments for hydrogen-electric products in H1 2024 represented over half (53.3%) of all new propulsion deals announced in H1 2024, up from 22.4% in H2 2023. This statistic is skewed by ZeroAvia’s 240 product deal adjustment, but also by the July reconfirmation of ZeroAvia’s 50 aircraft deal with American Airlines. The latter commitment previously existed as a purchase intention first announced in 2022. Hybrid-electric products were down to 31% of all commitments (190) from its peak of 61% (497) in H2 2023.

As noted in Ishka SAVi’s last new propulsion round-up, the sector’s nascency, irregular disclosure of orders and commitments by manufacturers, and the high correlation between product development milestones and commercial announcements, it would be premature to draw definitive conclusions on the commercial fortunes of each propulsion type.

The new propulsion OEMs expected at Farnborough

In June 2023, when the Paris Air Show took place, 390 commitments were recorded by Ishka, more than a quarter of the yearly total. A similar increase in announcements is expected this month at and around the Farnborough Airshow, which takes place the week of 22nd July.

New propulsion OEMs in the fixed-wing space expected to exhibit at this year’s Airshow include ATR (included pending the official programme launch of the hybrid-electric ATR EVO turboprop), Cranfield Aerospace Solutions (CAeS), Deutsche Aircraft, Dovetail Electric, Fokker Next Gen, Heart Aerospace, Hybrid Air Vehicles Limited, Jekta, Voltaero, and ZeroAvia. It is worth noting that new propulsion OEMs not exhibiting at air shows have also made concurrent commercial announcements in previous years.

The Ishka View

The decrease in commercial announcements ahead of air shows is a regular occurrence including for established OEMs, and Ishka expects an increase in commitments in the second half of July. Nevertheless, commercial activity in the space has been particularly tame since the start of 2024. At this stage, this should not be cause for alarm. There are only so many commercial commitments from asset investors and operators that the more promising new OEMs can get over the line before they get their products up in the air and show commercial viability. Surf Air Mobility hybrid-electric and electric conversions and ZeroAvia’s ZA600 powertrains, which are targeting certification in the coming years (2027 and 2025), are leading the charge of firm orders. Other products targeting certification in the near term include Ampaire’s Eco Caravan conversions, BETA’s ALIA CTOL, REGENT’s Viceroy, and VoltAero’s Cassio 330.

This is a summary of recent trends based on the SAVi New Propulsion Orders and Commitments Tracker. For feedback and questions on the data, please email savi@ishkaglobal.com .