The allocation of free emissions allowances for airlines will be phased out in the EU and Swiss ETS by 2026, significantly increasing the compliance costs for European airlines, particularly those with heavy intra-European operations. With air traffic (and emissions) now near or above pre-pandemic levels for most airlines, 2023 estimates for ETS bills of major European airlines in relation to their revenues provide clues as to which airlines will likely be most impacted in the next few years.

This report follows a two-part series in 2023 examining EU ETS emissions allowances (EUAs) price estimates – now partly outdated following an increase in EUA auctioning from Summer 2023 – and the EU ETS operational cost estimates for narrowbody aircraft.

Recap: ETS costs for airlines

Since 2012, flights within the European Economic Area (EEA) countries have been covered by the EU Emissions Trading Scheme (ETS) under a cap-and-trade system to encourage airlines to improve their CO2 efficiency. At the end of each annual reporting period (by 30th April of the following year), an airline must surrender enough emissions allowances (EUAs) to cover the emissions from its flights in the preceding period. One EUA is equivalent to one tonne of carbon dioxide equivalent.

Until now, airlines have been granted free CO2 allowances based on historical revenue tonne-kilometres and a CO2 efficiency benchmark. For emissions not covered by the free allowance allocations, carriers must purchase allowances at auction or acquire them from other holders of EUAs in the secondary market. However, airlines will no longer receive free allocations of EUAs starting in 2027, forcing them to pay for all EUAs required to comply with their EU ETS obligations.

As for other ETS systems in Europe, the UK ETS Authority has also decided to phase out free allocation to aviation by 2026 while the Swiss ETS, the other ETS system in Europe, is linked with the EU ETS and follows the same phase-out timelines (allowances are transferable between the EU ETS and Swiss ETS).

EU ETS costs in 2023 vs airline revenues

Much has been written about the inequalities of ETS costs in Europe, both by environmental NGOs wishing to see the ‘polluter pays principle’ applied to more flights (see Transport & Environment’s latest briefing), and airlines with mainly short and medium-haul operations such as Ryanair, which complains of an unlevelled playing field versus rivals that operate more flights to far-flung non-EEA destinations.

This analysis focuses on EU ETS costs (approximated using 2023 verified emissions and the recent average price of EUAs) and airline revenues in the last financial year. It uses data from 57 EU ETS and Swiss ETS accounts (each belonging to one AOC) associated with 21 airlines and airline groups.

For 21 leading airlines, a cost hike of at least $1.5bn

Please use the arrow to navigate between the four pages

The ‘Cost Approximation’ page in this dashboard shows how most airlines in Europe were able to reduce the financial burden of 2023 verified emissions through free allowances. Without those free allowances, the 2023 EU and Swiss ETS bill for these 21 airlines and airline groups would have been approximately €1.36 billion ($1.5 billion) higher. For an airline like Ryanair, one of the largest emitters, it would have been around €238 million higher. This cost approximation assumes €70 per EUA (a rounded average over the past 12 months), but the market price of EUAs is expected to increase in the medium to long term.

The cost impact on airlines of the free allowance phase-out will be material. For an airline like Norwegian, EU and Swiss ETS compliance costs (excluding free allowances) in 2023 would have represented €0.06 for every €1 in revenue, while for Ryanair and AirBaltic the cost would have been closer to €0.05.

Last month, AirBaltic said it had hedged “150,000 tons of CO2” (equal to around 30% of its 2023 verified emissions) at the average price of €70 per ton. For the remaining unhedged emissions, the airline warned, “any fluctuations in the price” can impact its quarterly income by €1.5 million ($1.66 million) for every €10 change in the price of EUAs. Similarly, Norwegian in its annual report said that if 2023 emissions allowance prices had been 1% higher or lower, with all other variables held constant, pre-tax profit for the year would have been NOK 9 million (€760,000 or $850,000) higher or lower.

As for Ryanair, although the airline has successfully hedged the price of EUAs favourably in the past, it warns that ETS compliance is its “most material environmental compliance cost” and could have an effect on its operating results. Based on Ryanair’s ETS exposure for fiscal year 2024, a change of €1 in the average ETS allowance price per CO2 ton would have caused a change of approximately €8 million in Ryanair’s carbon costs.

Environmental costs now factor into OEM pitches

Environment-related operational costs, including emissions pricing via the ETS, are becoming an important consideration in fleet choices. Last year’s Ishka analysis on operational cost differences between popular narrowbody types (based on their average monthly emissions as operated by Ryanair and EasyJet) provides a starting point for understanding how fuel-efficient modern aircraft stand to benefit.

At least in Europe, there is a high likelihood that environmental costs will grow in the next few years beyond CO2 emissions pricing to include other variables, from non-CO2 emissions (a monitoring and reporting system will soon be introduced to the EU ETS), to modulated airport charges to encourage the use of cleaner and quieter aircraft.

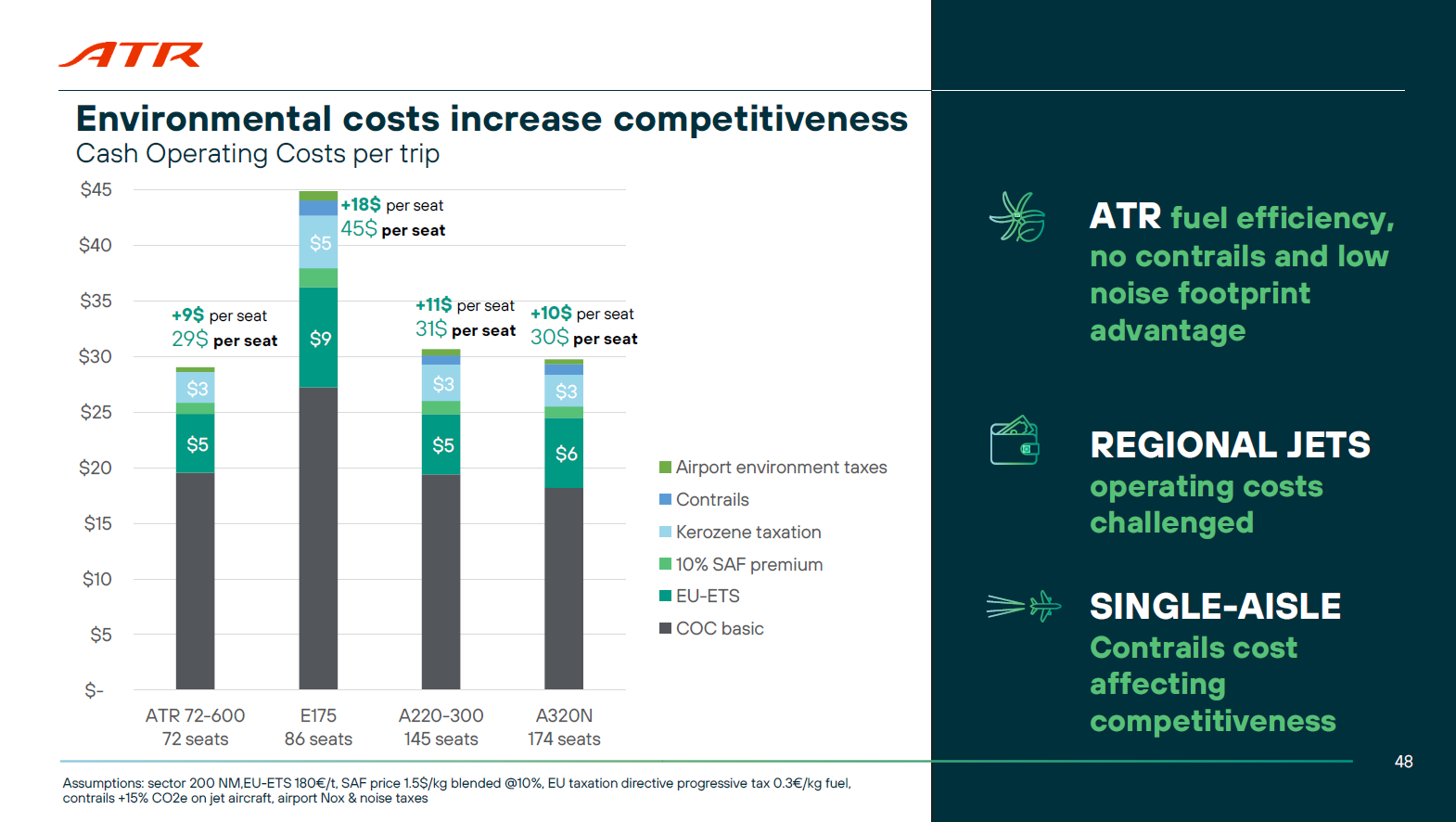

At an aircraft financiers briefing in London earlier this summer, ATR made the case that turboprop aircraft compare favourably to other aircraft types in short-haul routes regarding fuel efficiency and ETS-related costs. They projected costs in 2030, factoring in increased ETS costs, 10% SAF blend, airport environmental costs as well as contemplated taxation on contrails and kerosene. To Ishka’s knowledge, this represented one of the first times an OEM highlighted short and medium-term environmental cost expectations as part of a marketing exercise.

Source: Initially sourced from an ATR presentation in London in July 2024, shared with ATR’s permission. Updated on 21st November 2024 with a revised version shared by ATR.

Source: Initially sourced from an ATR presentation in London in July 2024, shared with ATR’s permission. Updated on 21st November 2024 with a revised version shared by ATR.

To learn more about the environmental advantages of turboprop aircraft, see this Ishka SAVi report.

The Ishka View

Intra-European airline operations have been synonymous with ETS costs and compliance requirements for over a decade, but the cost implications are only now starting to attract attention. Unless flights to non-EEA destinations are added to the EU ETS (a possibility from 2026*), the scope of the ETS systems in Europe will have an oversized impact on airlines that derive most of their revenue from intra-European flights. This highlights a need for airline credit understanding to factor in ETS-related costs, as price fluctuations in allowances could have severe impacts on profitability. The three leading European LCCs (Ryanair, Wizz Air, EasyJet) all take similar approaches, targeting 100% hedging (at least for the current fiscal year). This leaves smaller airlines without hedging instruments more exposed than larger rivals.

One environmental ‘upside’ of the current intra-European scopes of the EU ETS is that the most impacted airlines also stand to benefit the most from free ETS SAF allowance allocations. These free SAF allowances are allocated based on SAF consumption in the previous reporting year and help offset part (and in some cases all) the cost differential between fossil jet fuel and SAF. This will be of particular benefit to Ryanair, which is targeting 12.5% SAF use by 2030, above the industry average target of 10%.

*An Ishka SAVi report examining the possible expansion of the EU ETS scope to include long-haul flights will follow in the coming days.