The undisputed sustainable finance leader among airlines, Air France-KLM, is likely to miss an emissions intensity KPI on its two 2023 sustainability-linked bonds, potentially setting a discouraging precedent for the wider market. The potential sustainability performance target (SPT) miss, which has an observation date at the end of 2025, would trigger a 0.75% payment at maturity for the 2026 bond and a coupon step-up of 37.5bps for the 2028 bond.

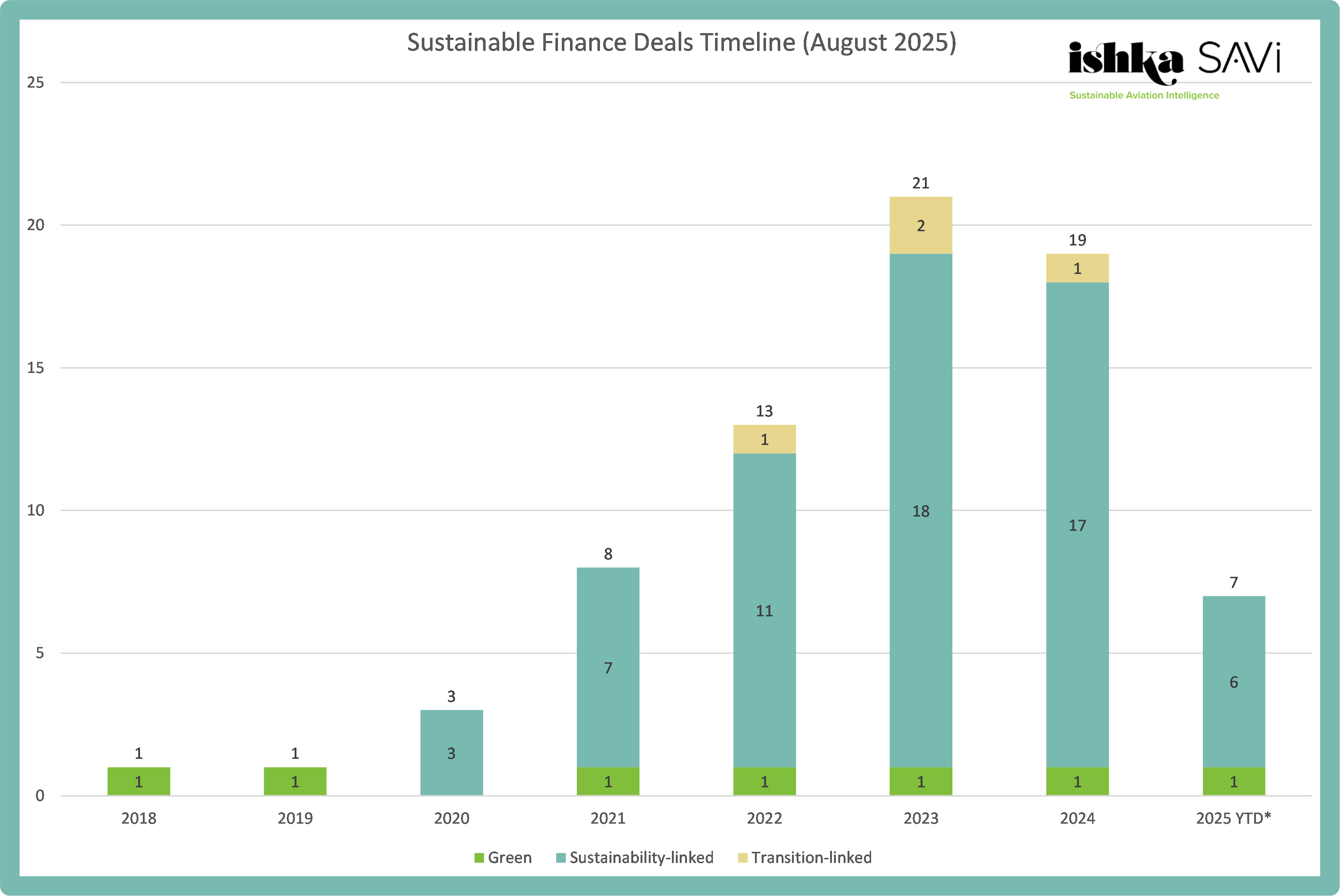

Meanwhile, sustainable finance deals in aviation involving airlines and lessors or with aircraft as a collateral remained stable in the first half of 2025, compared to the same period last year. Ishka identified seven transactions worth at least $2.04 billion through H1 2025 – six sustainability-linked transactions and one green bond – compared to also seven transactions for at least $7.9 billion in H1 2024*. It is worth noting that deal volumes are only disclosed for some transactions, as of early August 2025 this is only the case for one of the seven deals recorded for H1 2025. Five of the seven recorded transactions support new aircraft financing.

*Note: H1 2024 totals have been updated since initial publication to include additional transactions that became public after the reporting period

AF-KLM ‘unlikely’ to meet emissions intensity SPT

On 31st July, Air France-KLM noted in its Q2 results that it is “unlikely” that the 2025 target of its Sustainability Linked Bond (SLB) will be reached. The SPT in question, one of two in the transactions, requires a reduction of its well-to-wake scope 1 (emissions from direct activities for Air France-KLM Group). A step-up will occur if the company fails to reduce by 31st December 2025 its tCO2e/RTK by 10% over a 2019 baseline. The step-up premium is of 0.75bps for the 26s and 37.5bps for the last two years of the 28s. The target is shared across two SLB tranches in its 2023 €1bn issuance: a 7.25% bond due in 2025 and an 8.125% bond due in 2028.

The company says the likely SPT miss would respond to “events beyond [its] control”. They include: delays in executing the fleet renewal plan due to constraints in the supply chain, engine issues with part of its new generation aircraft fleet (such as several Airbus A220s), and higher fuel consumption due to longer flight time on certain routes caused by different geopolitical circumstances.

The Anthropocene Fixed Income Institute (AFII), a non-profit that aims to influence fixed-income market decisions towards positive climate impact, on 5th August published this report detailing the ins and outs the likely SPT miss. AFII assumes that there is a 75% probability of the SPT being missed, putting the SLB’s running option value at 64.6bps for the 2026s and 19.4bps for the 2028s.

Activity holds, thanks to returning issuers

*January to June 2025

*January to June 2025

Note: The number of transactions for each year is based on deal announcements. In the case of aircraft financing, each transaction can involve more than one aircraft. For example, in 2023, at least 15 aircraft deliveries were funded through sustainability-linked transactions, but proceeds from other facilities were also expected to support aircraft acquisition. Data collected by Ishka SAVi as of early August 2025.

At the half year, the 2025 outlook remains stable. The H1 2025 deal announcements comprise:

- In early January, Crédit Agricole CIB (CA-CIB) and Cebu Pacific closed an Airbus A321neo Sustainability Linked JOLCO. The aircraft was delivered in late 2024.

- In mid-January, MUFG Bank, Sumitomo Mitsui Banking Corporation (SMBC) and Korean Air closed Korea’s aviation industry first sustainability-linked loan, for two Boeing B787-9. The aircraft delivered in February 2024 and January 2025.

- In late February, Aviation Capital Group (ACG) and Air France agreed a sustainability linked lease for an Airbus A350-900, delivered to the airline as part of a multiple aircraft sale-leaseback transaction. This transaction marks ACG’s inaugural lease agreement with an airline to include sustainability-linked KPIs.

- In early March, Bocom Leasing’s Two-Tranche Green bonds, due 2028 and 2030 – issuance amount unknown. The lessor issued its first green issuance in November 2023 for $856 million, followed by a second issuance for $650 million in June 2024. The issuances were aligned with the Green Bond Principles (GBP), with eligible use of proceeds for aviation including procurement of SAF or investments in projects/companies aimed at increasing available SAF. Ishka notes Bocom Leasing has qualifying investments besides aviation towards which these funds may be directed.

- In late March, TUI Group’s sustainability-linked revolving credit facility for $2.044 billion. Financing costs are linked to the fulfilment of KPIs (not specified) in relation to emission reductions, in line with TUI Group’s Science Based Targets Initiative (SBTi)-approved emissions reduction target. By 2030, TUI aims to cut emissions by 24% for its airline, 46.2% for Group-operated hotels, and 27.5% for cruises, all compared to 2019 levels.

- In May, SMBC Aviation Capital sustainability-linked facility for an Airbus A320neo family aircraft, supported by export credit agencies. This is the first ECA-supported sustainability-linked loan for an Airbus aircraft, and also the first sustainability-linked loan supported by Bpifrance Assurance Export acting as lead ECA.

- In June, Kasikornbank and Thai AirAsia’s sustainability-linked foreign exchange agreement, whereby Kasikornbank will provide preferential FX rates to Thai AirAsia upon meeting certain milestones tied to Thailand's Low Emission Support Scheme (LESS).

Logged on SAVi’s Sustainable Finance Tracker but not included in the H1 tally:

- In July, CDB Aviation’s sustainability-linked facility for $775 million, given a best-in-class SQS2 rating by Moody’s investors services. The transaction follows last year's $700 million facility, which was also secured by a portfolio of Airbus and Boeing aircraft. SPTs are unknown, but previous CDB Aviation issuances were based on two environmental and one social KPIs related to: 1) reducing the carbon intensity of the CDB Aviation’s fleet, focusing on the most fuel-efficient aircraft (improving the CO2 emissions intensity by 1.5% annually to 2025 vs a 2019 baseline); 2) increasing the share of new generation aircraft in the lessor’s fleet, pursuing its target to reach 60% of new generation aircraft (by number of aircraft) by the end of 2025 versus a 2022 baseline; and 3) increasing the level of Diversity, Equity, and Inclusion (“DEI”)-related training hours for the workforce by 60% by 2025 versus a 2022 baseline.

- Also in July, Crédit Agricole CIB (CA-CIB) and Jet2 sustainability-linked JOLCO for an undisclosed amount of Airbus A321neo. KPIs and other details pending closure.

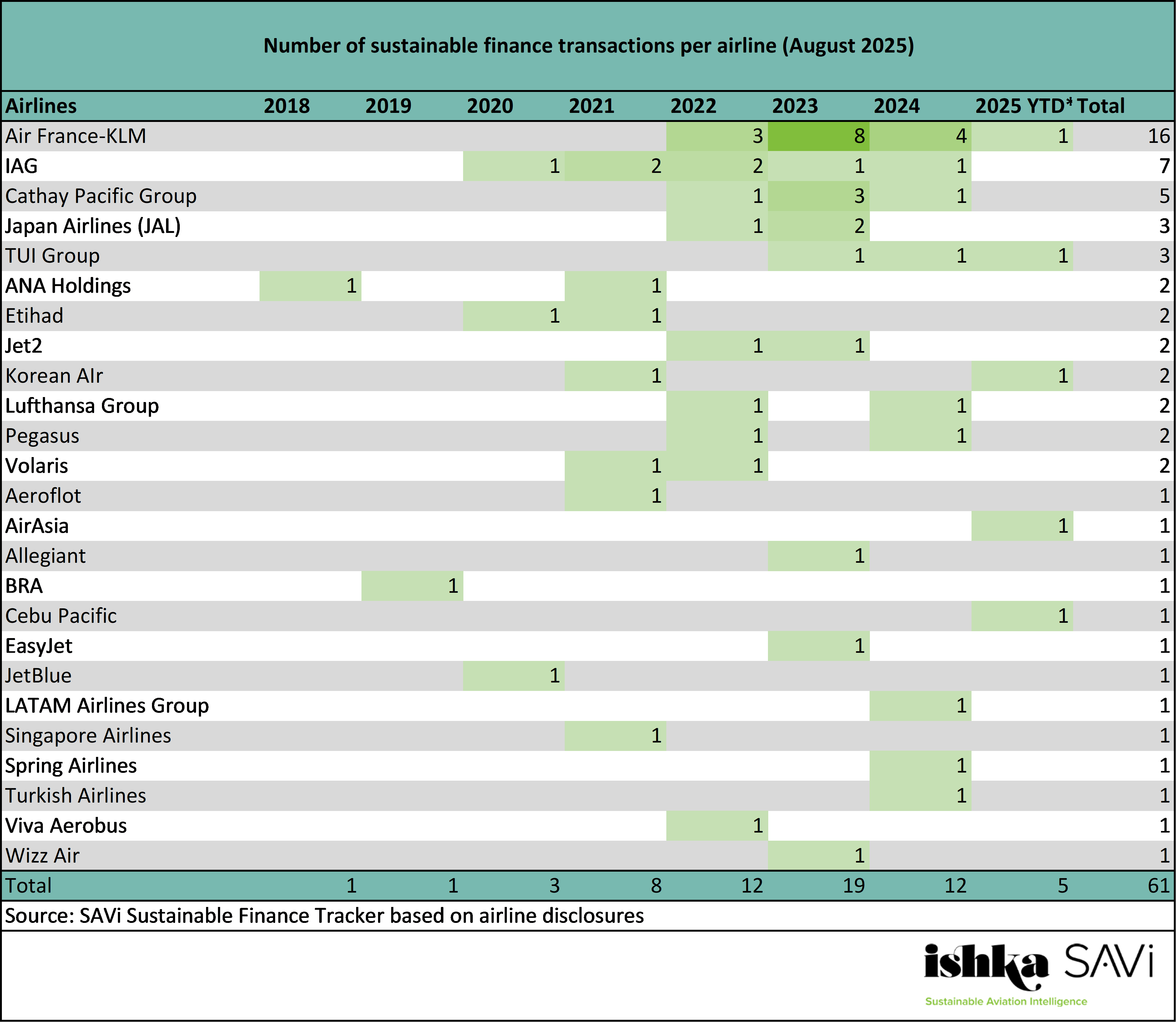

Repeat issuers have been the drivers of aviation’s sustainable finance market, and this year is no exception. Jet2, CDB Aviation, SMBC Aviation Capital, TUI, Air France, Bocom Leasing, and ACG are all return issuers. Also in keeping with a trend observed last year, half of the transactions recorded this first half year involve lessors – in 2024, lessors were present as transaction parties in 10 of the 18 deals, versus 12 for airlines. New issuers are all APAC-based (Thai AirAsia and Cebu Pacific).

An aviation banker with knowledge of the sustainable aviation finance market tells Ishka that there is a degree of “pushback” or “reluctance” by new airlines to consider these structures. Market pressures outside of the control of airlines, from SAF shortages in some regions to, primarily, the slow pace of new aircraft deliveries, put emissions-related KPIs that already exist at risk, and create uncertainty for airlines seeking to set them. “After the initial excitement and then when we get closer to the first KPI waypoints, there's a realisation that it may be challenging [for airlines] in some cases […] some airlines don't want to overcommit.”

Issuance overview

*Jet 2 transaction was signed in July 2025 and is not included.

*Jet 2 transaction was signed in July 2025 and is not included.

Note: Data collected by Ishka SAVi as of early August 2025. This table excludes non-airline borrowers (lessors), but transactions can involve airlines and lessors simultaneously, such as the ACG/Air France sustainability linked lease.

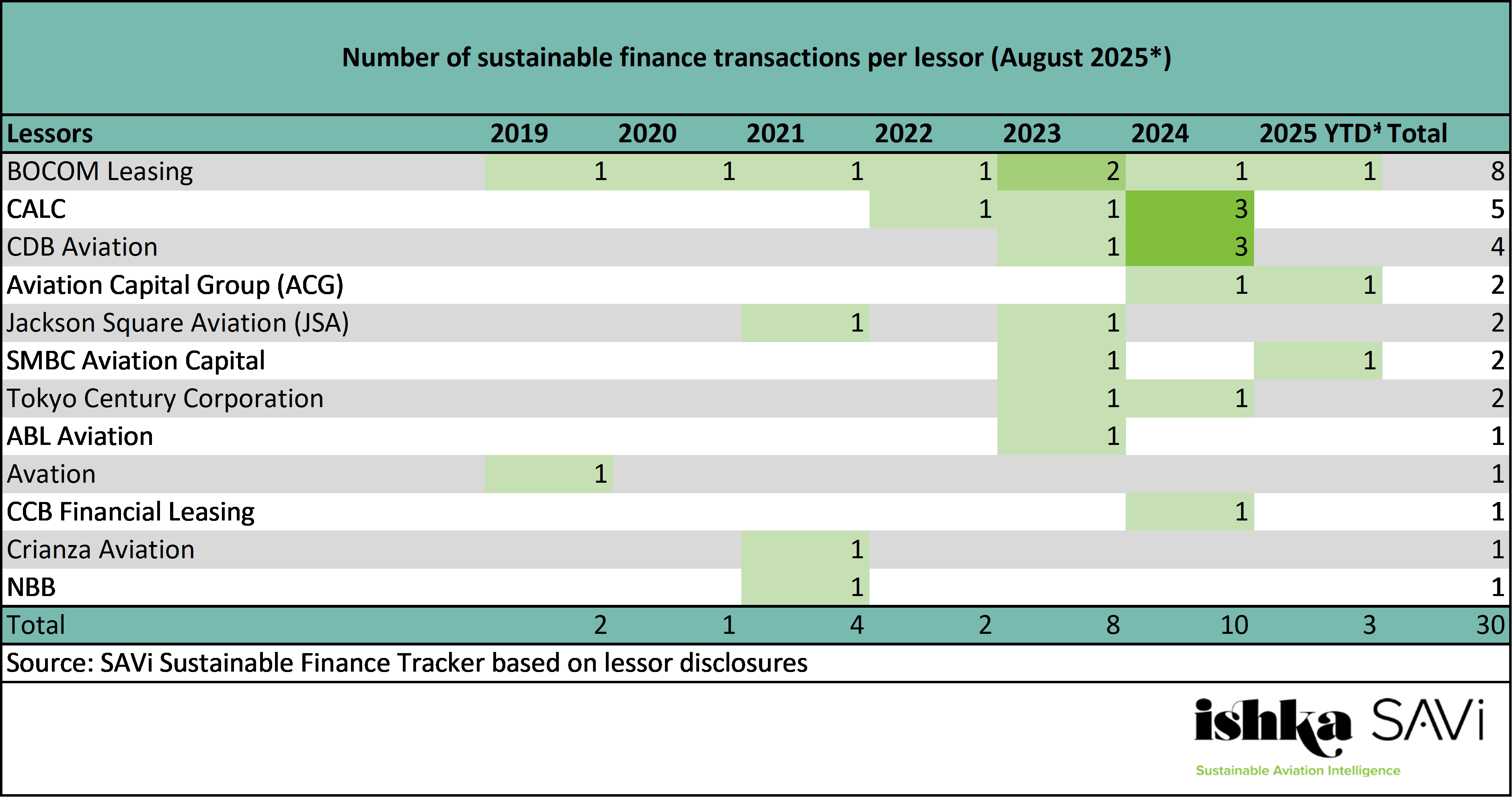

Very little has changed in the airline leadership board, with Air-France KLM still markedly ahead with 16 deals so far, followed by IAG with seven deals. Lessors accumulate a total of 30 deals, and with four added so far in 2025 (including three in H1 2025) they maintain, for now, their increased 2024 activity level into 2025.

* CDB Aviation’s sustainability-linked facility was announced in July 2025 and is not included.

* CDB Aviation’s sustainability-linked facility was announced in July 2025 and is not included.

Ishka notes Bocom Leasing’s sustainability issuance consists of green bonds and loans, the proceeds of which may be used for eligible green projects under categories described in the firm’s framework, such as clean transportation, which includes but is not limited to sustainable aviation. The firm's green eligible use of proceeds includes procurement of SAF or investments in projects/companies aiming at increasing SAF availability.

The Ishka View

Declining sustainable finance issuance in aviation in 2024 stemmed, Ishka believes, mainly from reduced new aircraft deliveries, and the questions this created for airlines meeting (and setting) targets. The warning by Air France in its latest results crystalises that fear, and shows that these pressures are likely to bleed into 2025. Nevertheless, the market is holding, and it remains to be seen how things will evolve in the traditionally more active second half of the year.

Air France’s struggle to meet its SPT could send a discouraging signal to other airlines considering their first (or further) sustainability-linked transactions. Equally, however, it raises the question of what these targets are meant to signal in the first place - critics have often warned that weak baselines and soft penalties risk stripping these instruments of their impact. One speaker at Ishka Financing Sustainable Aviation earlier this year called for higher step-ups for missed targets, arguing that in order to drive real progress, the financial stakes must be significant enough. In that light, missing these targets should not be seen entirely as failure, as it reflects positively on the level of ambition by airlines and lessors adopting these structures.