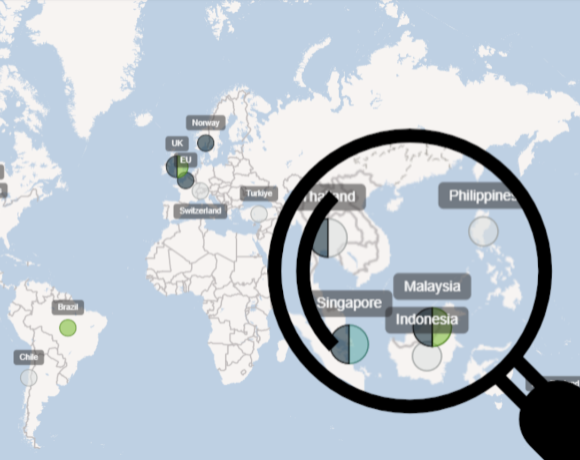

This is the 4th edition of the SAVi SAF policy map, of policy efforts around the world to increase SAF uptake. This edition features 19 updates across nine countries, including eight new entries since April 2025. Of these, four new policies are final or in force, while the remaining four are either expected or in draft stages. Developments expected as of previous updates are now materialising, notably progress around the creation of a UK Revenue Certainty Mechanism, Switzerland’s alignment with ReFuel EU, changes to US federal SAF support, and progress of various US state level supportive policies, along with new initiatives such as proposed SAF mandates in Turkey and Taiwan, or tentative production support policies in Japan.

As noted in previous updates, over 80% of the world’s ASKs by country of departure are now under or soon expected to be covered by SAF demand and supply policies.

Major policy developments

UK

The UK government on 14th May 2025 introduced to the UK Parliament a bill to make provisions about SAF, a piece of secondary legislation awarding power to ministers to design the world’s first SAF Revenue Certainty Mechanism (RCM). The investment-enabling RCM will minimise annual SAF price fluctuations and will be industry-funded through a levy on aviation fuel suppliers. Under this mechanism, SAF producers will enter into private law contracts with a government-backed counterparty. These contracts will establish a strike price for SAF: if the SAF is sold below this price, the counterparty will pay the producer the difference; if sold above, the producer will pay the difference back to the counterparty. The government will now engage with industry on the details of the RCM, including pricing, to deliver the scheme by 2026. On the same day, the UK Department for Transport (DfT) published the cost-benefit analysis of the RCM and the government’s response to its last consultation, which received 76 responses.

US

- Uncertainty surrounding Biden’s Inflation Reduction Act (IRA) tax credits, notably the 45Z SAF Clean Production Credit, was finally dispelled as The One Big Beautiful Bill (OBBBA) updating (or eliminating) many of the IRA’s incentives for cleaner energies was signed into law on 4th July 2025. The budget reconciliation bill carried key changes for federal SAF incentives. The 45Z SAF Clean Production Credit, worth up to $1.75-per-gallon in 2025 ($1.86 after an inflation adjustment), was extended from the end of 2027 to the end of 2029 (shorter than the extension through to 2031 that had been proposed by the House). It is worth noting that after 2025, the 45Z credit will be capped at $1.00 per gallon pending inflation adjustment in future years. For fuel produced after 31st December 2025, emissions attributed to indirect land use change (ILUC) will no longer be factored into credit calculations, resulting in no penalty for corn ethanol. Additionally, to qualify for the 45Z credit, fuels must be made exclusively from feedstocks grown in the US, Canada, or Mexico. For anyone looking for a one-page visualisation comparing Biden’s IRA incentives with those post-OBBBA, look no further than the second page of this Columbia Business School Climate Knowledge Initiative presentation.

- Michigan on 1st May proposed a bill creating a new tax credit for companies producing or blending SAF in Michigan, effective 1st January 2026. Qualified taxpayers could claim a base credit of $1.50 per gallon of SAF produced in the state and sold to an aircraft departing from a Michigan airport. The credit can increase up to $2.00 per gallon if the fuel reduces greenhouse gas emissions by more than 50%, with the credit increasing by $0.02 for each additional 1% reduction. The bill passed the Senate in June 2025 and is now under consideration in the House.

- Iowa’s Senate File 657, which establishes an incentive for SAF production in Iowa for the next decade, was signed by the Iowa governor on 6th June 2025. Eligible SAF needs to be produced in the state and achieve a greenhouse gas emissions (GHG) reduction of at least 50% versus conventional jet fuel using the US GREET model. The 25-cents-per-gallon tax credit can be claimed for fuel produced between 2026 and 2035, up to $1 million per year per applicant across five different years.

- On 16th June 2025, Washington State’s Department of Ecology proposed updating the state’s Clean Fuel Standard to promote the production and use of alternative jet fuels. This proposal is separate from the changes to the Clean Fuel Standard set under House Bill 1409, which will strengthen the program’s carbon intensity requirements - passed during the 2025 legislative session, the new law requires a 45% reduction in carbon intensity by 2038, up from the previous requirement of 20%.

Switzerland

The revised Federal Act on the Reduction of CO2 Emissions introduces a binding blending mandate for SAFs, aligned to the EU’s ReFuelEU Aviation mandate of 2% by 2026 and 6% by 2030, with progressively higher yearly minimum shares of synthetic aviation fuels starting at an average 1.2% share in 2030-32. Non-compliance triggers substantial penalties. Fuel suppliers face a financial penalty equivalent to twice the price gap between SAF and fossil jet fuel for any shortfall, plus an obligation to compensate for the missing volume the following year. Airport operators that fail to provide adequate infrastructure incur a fine, and aircraft operators failing to meet their refuelling obligations must pay twice the average annual market price per tonne of aviation fuel for the untanked quantity. All collected penalties are earmarked to support the expansion and adoption of SAF.

The updated CO₂ Ordinance articles concerning the blending mandate will take effect on 1st January 2026.

Norway

In May 2025, Norway's transport minister said the country was planning to implement the EU's ReFuelEU Aviation regulations "as soon as possible, and no later than 2027". The country, which is not part of the EU, had a blending target of 0.5% in 2024/2025, rising to 30% in 2030. Norway had previously planned for possible alignment with ReFuel's EU target in 2025 (2%), but this was ultimately postponed.

Japan

- The Agency for Natural Resources and Energy, part of the Ministry of Economy, Trade and Industry (METI), launched on 27th June 2025 a public call for applications for FY2025 subsidies under its Next-Generation Fuel Production and Utilisation Technology Development Project. The programme will fund up to one-third of capital investment costs and up to two-thirds of technology demonstration costs for projects producing next-generation fuels – including SAF feedstocks such as bioethanol, biomethanol, and e-fuels – as well as supply chain development.

- Also in June, a public-private taskforce coordinated by the METI, announced it would launch a subordinate taskforce which will aim to publish a report by the end of 2025 with “feasible SAF promotion measures” to be pursued. Notably, according to Argus sources, the taskforce will focus on “how to cover the difference in prices” between SAF and conventional jet fuel.

- Announced on 9th May 2025, the Tokyo Metropolitan Government's Domestic Sustainable Aviation Fuel (SAF) Utilization Promotion Project will subsidise the price difference between domestically produced (by Cosmo Oil) and imported SAF at Haneda Airport. One media report says the selected contractor for the project, Cosmo Oil, will receive a subsidy of 100 yen per litre. According to this media report, the subsidised quantity is 2.5 million litres and the support period lasts until 31st March 2026.

Taiwan

Taiwan’s Ministry of Transportation and Communication (MOTC) “aims to reach 5% SAF use on international routes operated by domestic carriers by 2030”. For now, this does not appear to be a binding mandate but rather an "aim". It is unclear whether legislation would be introduced to make this binding. The Bureau of Standards, Metrology and Inspection (BSMI) in June 2025 published the SAF National Standards.

Turkey

Turkey’s civil aviation authority announced on 26th June 2025 plans for a SAF mandate on airlines operating international flights and jet fuel suppliers, aligning with ICAO’s CORSIA, which becomes compulsory in 2027, by aiming to cut international aviation emissions by 5% by 2030. As such, the mandate would cover, for operators, flights departing from Turkey to countries listed in the Section 3 country pairs document, CORSIA countries covering the relevant reporting period of ICAO CORSIA. Under the new rules, airlines operating international flights involving Turkey would have to use enough SAF to meet the 5% emissions reduction goal, and jet fuel suppliers in Turkey would be required to procure and distribute SAF accordingly. The authority also announced that airline operators would be required to load “at least 90% of the jet fuel they are required to use at airports departing from Turkey”. It further specified “the minimum emission reduction per litre achieved through the use of SAF” would be published “between January 1 and December 31 each year” and that airlines and suppliers would face penalties for any non-compliance.

Ishka SAVi SAF Policy Tracker

Other notable SAF policy developments

- The UK government made £400,000 ($531,000) available in funding for SAF producers to support the testing and qualification of new fuels, for which companies can apply until 1st September 2025. The country further awarded £63 million ($84.6 million) to 17 companies developing SAF as part of the government’s Advanced Fuels Fund (AFF) in July 2025.

- The Netherlands, which has a 2030 blending target of 14%, higher than the EU’s mandated 6%, published its national SAF roadmap in April. Its plans include studying” the initiatives necessary to realise production by private parties and the supporting conditions, such as permits and, where necessary, subsidies”, though it is unclear whether these would be national or EU-level subsidies.

- According to local press reports, Thailand is expected to issue specifications on the country's first SAF standard for the aviation industry, possibly critical to SAF support policies, in 2026. It would be based on an international standard to hasten efforts to cut carbon dioxide emissions from aircraft, says the Department of Energy Business. There is still no binding SAF mandate in place.

- Deleted from the tracker is Nevada’s Assembly Bill 481, which would have established the Sustainable Aviation Fuel Incentive Program, which would have offered $2.50/gal for SAF produced and purchased in Nevada, and $1.75/gal for SAF purchased in Nevada but produced elsewhere. The bill failed on 2nd June 2025.