The Aviation Climate-Aligned Finance (CAF) standard has entered its final stages of drafting and is expected to launch on 30th January 2024, delivering on an 18-month aspiration spearheaded by six of the world’s largest lenders to create an aviation equivalent to shipping’s Poseidon Principles. Like Poseidon, the Aviation CAF framework will equip financiers to evaluate the emissions intensity of their aviation portfolios relative to an established decarbonisation trajectory.

For the financiers using the Aviation CAF, the soon-to-be-launched methodology will enable (although will not require) aviation portfolio alignment with a 1.5°C scenario and – in many cases – support them in fulfilling their commitments under the Net Zero Banking Alliance (NZBA). As Ishka highlighted last July, at least 14 banks have now fulfilled NZBA requirements of setting 2030 emissions intensity reduction targets for aviation but many more are yet to do so, mainly due to insufficient data, lack of guidance, and absent methodology.

Ishka speaks with the RMI Centre for Climate-Aligned Finance and one of the Aviation CAF Working Group members, Crédit Agricole CIB, to distill the progress of the past 18 months and what lies ahead.

Methodology development timeline

The Aviation CAF working group was launched in April 2022 and was followed by six months of weekly meetings involving the six working group banks and RMI experts to deliver an initial NZBA-compliant framework. In November 2022, a wider group of aviation finance stakeholders were invited to provide feedback via an expert industry consultation.

Their feedback resulted in tweaks to the initial framework to make it more implementable and harmonise it with other market standards, including SBTi – which corporates including banks and airlines rely on to set their own net-zero roadmaps. Subsequently, in January this year, a review group by over 10 additional financial institutions, beyond the working group members were invited to provide their feedback to ensure the Aviation CAF is “fit for purpose,” while lessors, airlines and trade groups were further consulted in June to test the reporting guidance. According to Lucy Kessler, aviation manager at RMI’s Centre for Climate-Aligned Finance, airlines and lessors examined the proposed reporting documents to ensure it was “straightforward, and they can report against it.”

Now, in the final stretch of preparations and starting this month, RMI senior associate Nicholas Halterman is leading a data qualification process for third-party data providers. Any data provider can participate, but RMI has been working specifically with five firms whose main role would be to supply third-party emissions and traffic data to financiers, especially for their lessor clients. “In the long run, that might change, and lessors might gain more access to [lessee emissions] data,” Halterman explains in reference to emissions data gathering efforts spearheaded by Aircraft Leasing Ireland (ALI).

RMI is also still finalising the governance principles for the Aviation CAF, which will largely resemble those of the Poseidon Principles. This process is being supported by Watson Farley Williams (WFW), which since February has been advising the initiative as pro-bono counsel.

More financial institutions called to join

Finally, there is the recruitment of new signatories. “[At this point] the standard isn't going to change. We have the roadmap, we have the metric, we have a lot of the data requests […] so we're not asking for feedback, we're now inviting financial institutions to join,” comments Kessler. This call for additional signatories began in May this year with a soft launch in Dublin and remains underway.

On 30th January next year, the Aviation CAF methodology will be launched during Dublin Week and published in full on RMI’s website. Financiers who are interested in using the standard are being invited to become signatories of the initiative and join a ‘membership-based’ platform to get access to a number of things: a place in the Aviation CAF steering committee, the list of qualified data providers, emissions data reporting templates for borrowers, implementation support and guidance from the RMI secretariat, and inclusion in the annual report in a similar way to how Poseidon Principles makes its annual disclosures (see pages 22 to 50 of the 2022 Poseidon Principles Annual Disclosure Report for reference, which currently features 30 signatory banks).

“That sort of membership-based platform with the steering committee to govern the process and sign-on by financial institutions is the same way that the Poseidon Principles is structured,” explains Halterman. RMI points out that participating in these disclosures is in the interest of transparency and comparability, and represents a chance for banks to highlight their climate leadership. “On the day of launch we anticipate we will have a number of financial institutions representing a large swath of the global aviation loan book worldwide,” Kessler predicts.

The metric: Well-to-wake intensity reigns

There are many ways to measure emissions, but the aviation industry is slowly moving towards well-to-wake calculations that not only take into account tailpipe emissions from the aircraft but also the emissions produced during the entire process of fuel production and delivery – the part where SAF can deliver the largest emissions savings versus fossil kerosene.

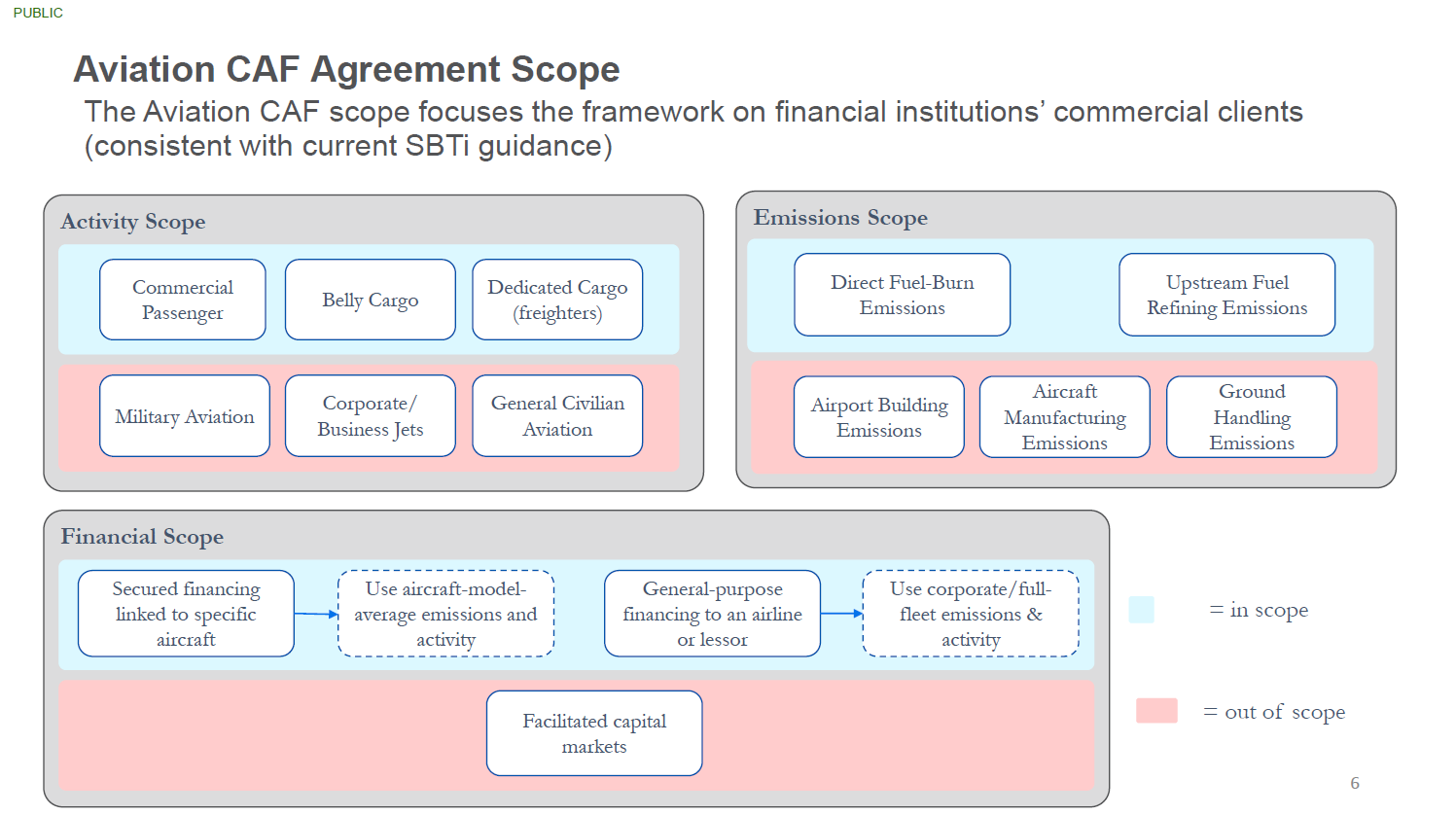

This is also the choice made by the Aviation CAF, which will measure progress based on an emissions intensity metric (CO2e/RTK), where CO2e can vary significantly depending on the type of fuel used (following ICAO's CORSIA default fossil kerosene lifecycle values, which follow the GHG Protocol - the global standardised framework to measure and manage greenhouse gases) and RTK accounts for passengers, belly cargo, and dedicated cargo. “Where we've landed, the intensity metric used by CAF and the scoping and calculation methodologies, are all either directly based on or very close to SBTi at this point,” explains Halterman.

Source: H. Calamvokis, Standard Chartered. ISTAT Learning Lab: Supporting Financial Institutions in the Aviation Net-Zero Transition, 6th September 2023

Source: H. Calamvokis, Standard Chartered. ISTAT Learning Lab: Supporting Financial Institutions in the Aviation Net-Zero Transition, 6th September 2023

To calculate portfolio exposures, lenders will either capture the fleet-level intensity of the lessor or airline borrower in the case of general-purpose financing and non-aircraft secured financing, or aircraft model sub-fleet data at the operating airline for aircraft-secured lending (including when the lessor owns the aircraft, known as a ‘look-through’ basis approach). The resulting average carbon intensity of each lender’s aviation exposure will be benchmarked annually by each individual financier, with the Mission Possible Partnership (MPP) aviation decarbonisation 1.5C Prudent scenario serving as a reference to contextualise disclosures.

Banks are “encouraged” and expected to source “a decent amount of data” (such as total fleet or sub-fleet fuel consumption) directly from clients including airlines. In cases where this is not possible, particularly for lessors with large lessee portfolios, they may rely on third-party data providers.

More details on the framework will become available after its official launch on 30th January 2024. In the meantime, Hal Calamvokis, director for aviation finance at Standard Chartered (one of the six Aviation CAF founding members), offers a comprehensive overview in this recent ISTAT webinar (minutes 6:00 to 25:00).

Could Aviation CAF shift lending preferences?

Under the Aviation CAF methodology, a lot more factors than simply aircraft type choices will move the emissions intensity dial: seat density, load factors, optimal stage lengths, or percentage of blended SAF, among others. This begs the question: Will lenders' scrutiny of asset configurations and operational decisions have knock-on impacts on aircraft financing?

“The intention is not to try to influence the way the finance capacity needs to be allocated towards one airline against others,” tells Ishka José Abramovici, global head of asset finance group of Crédit Agricole CIB, one of the Aviation CAF Working Group founders. Abramovici concedes that the Aviation CAF methodology will favour airlines operating with higher load factors, the ability to fill belly capacity with cargo, or airlines using a higher SAF blend ratio. But in his view, the multitude of variables around well-to-wake emissions intensity means that airlines doing more to decarbonise will fare better, regardless of whether they excel or lag on any single lever.

This means that the Aviation CAF framework will not automatically hinder aircraft types or configurations from accessing bank financing, “The quality of the airline in terms of carbon intensity is being taken into account in what we are doing, but we don't want to influence the market. We are neutral.”

Abramovici, who in addition to aviation also heads shipping, rail, real estate/lodging sectors at CA-CIB, recounts the experience of working alongside five of its competitors – Bank of America, BNP Paribas, Citi, Societe Generale, and Standard Chartered – “the best human experience” of his job so far. He expects several more banks to join in as signatories of the Aviation CAF by next January to benefit from the 18 months of work by the working group, with some banks already expressing “strong interest.”

The Ishka View

The Aviation CAF is a tool for lenders, but its significance has a broader reach: together with the Milestones concept being developed by Impact*, it is the first example of aviation finance decarbonisation commitments being put into action. It will also increase emissions disclosures and compatibility within aviation finance. Although primarily an accounting framework, annual disclosures by the Aviation CAF will enable comparisons between lenders’ portfolio climate alignment scores. The 1.5C MPP Prudent scenario is also anticipated to be updated “as needed” in the coming years to take stock of market developments, which could raise the bar for portfolio alignment, potentially limiting lending for certain assets, airlines, or lessors if signatory banks double down on portfolio alignment.

At the same time, it is worth noting that while Impact and the Aviation CAF have overlapping similarities – both are bank-led associations aiming to harmonise airline and lessor Scope 1 / Scope 3 emissions reporting – they take potentially complementary approaches. Whereas Impact’s Milestones Concept proposes a scoring system that encourages the decoupling of emissions from capacity growth, the Aviation CAF will be more concerned with equipping financial institutions to measure carbon intensity of their aviation portfolios and enabling independent target-setting by each signatory.

Ishka understands it will be possible for one bank to use the Aviation CAF methodology to support NZBA target reporting on its respective portfolio while at the same time introducing Impact’s Milestones Concept via sustainability-linked provisions in finance agreements. Through their formation, the two initiatives have also catered to different organisational preferences. On one hand, a nimble small group of six major banks led by the multi-sector expertise of RMI’s Center for Climate-Aligned Finance developed a tailored standard, in consultation with industry, experts, and financiers, which will be open for adoption by any financial institution upon launch. On the other, the larger multi-stakeholder collaborative effort of Impact’s nearly 40 aviation finance members supports ongoing work across several aviation sustainability issues. The two organisations also intend to work together going forward in the interest of metric harmonisation.

* Ishka is a founding member of Impact and the author of this report contributes to Impact’s work. For more information on Impact (Initiative to Measure and Promote Aviation’s Carbon-free Transition e. V.), please visit: impact-on-sustainable-aviation.org