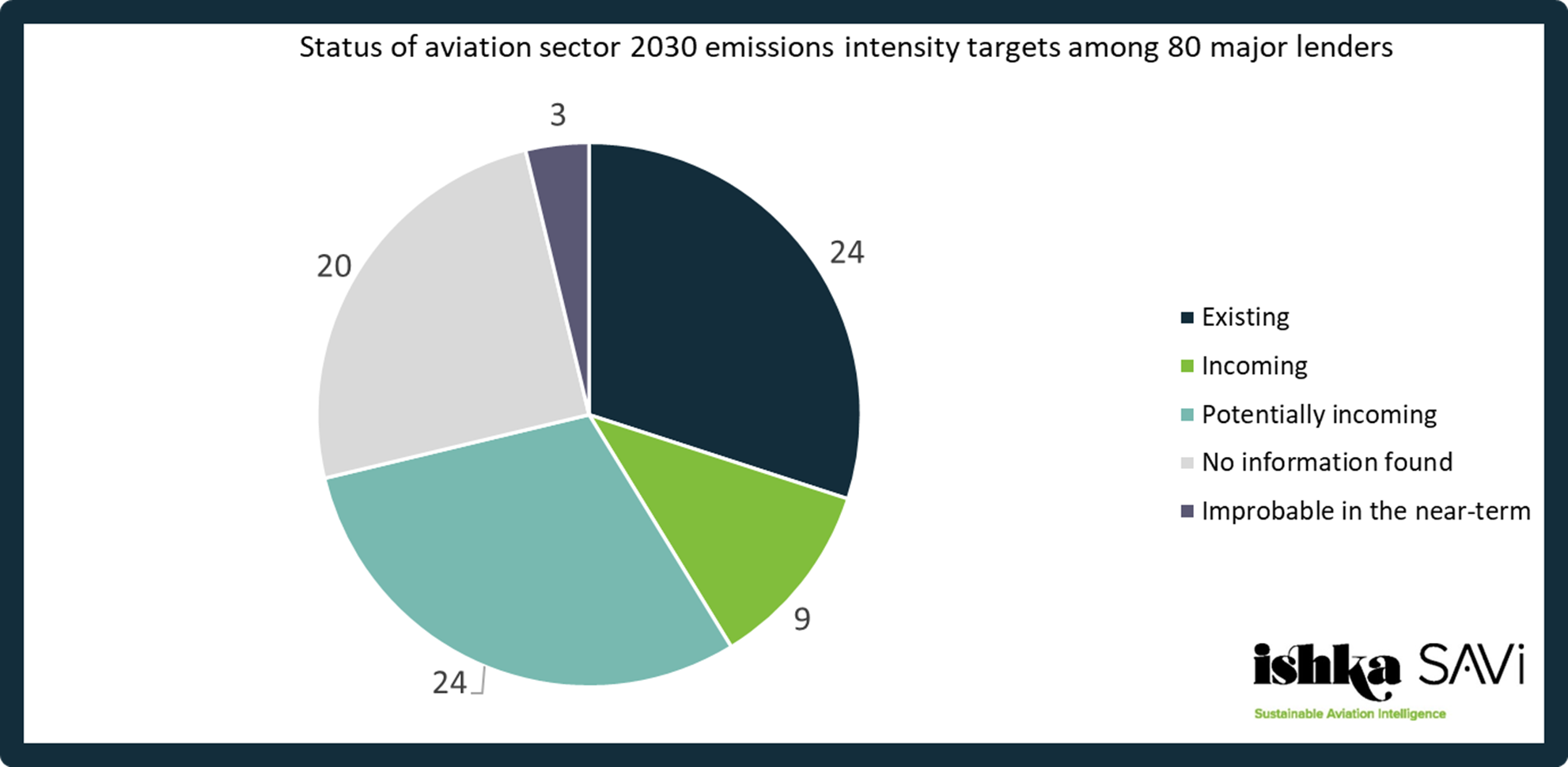

As many as 24 major lenders have now set 2030 aviation emissions intensity targets, and a further nine are expected to announce aviation targets soon, new Ishka SAVi research has found. The findings are the result of Ishka’s analysis of 80 global banks and their sustainability reporting – 15 more than the sample analysed in July 2023. Since the last update, Ishka has identified 10 new lenders with aviation emissions intensity targets, most of which were unveiled in the second half of 2023 and early 2024.

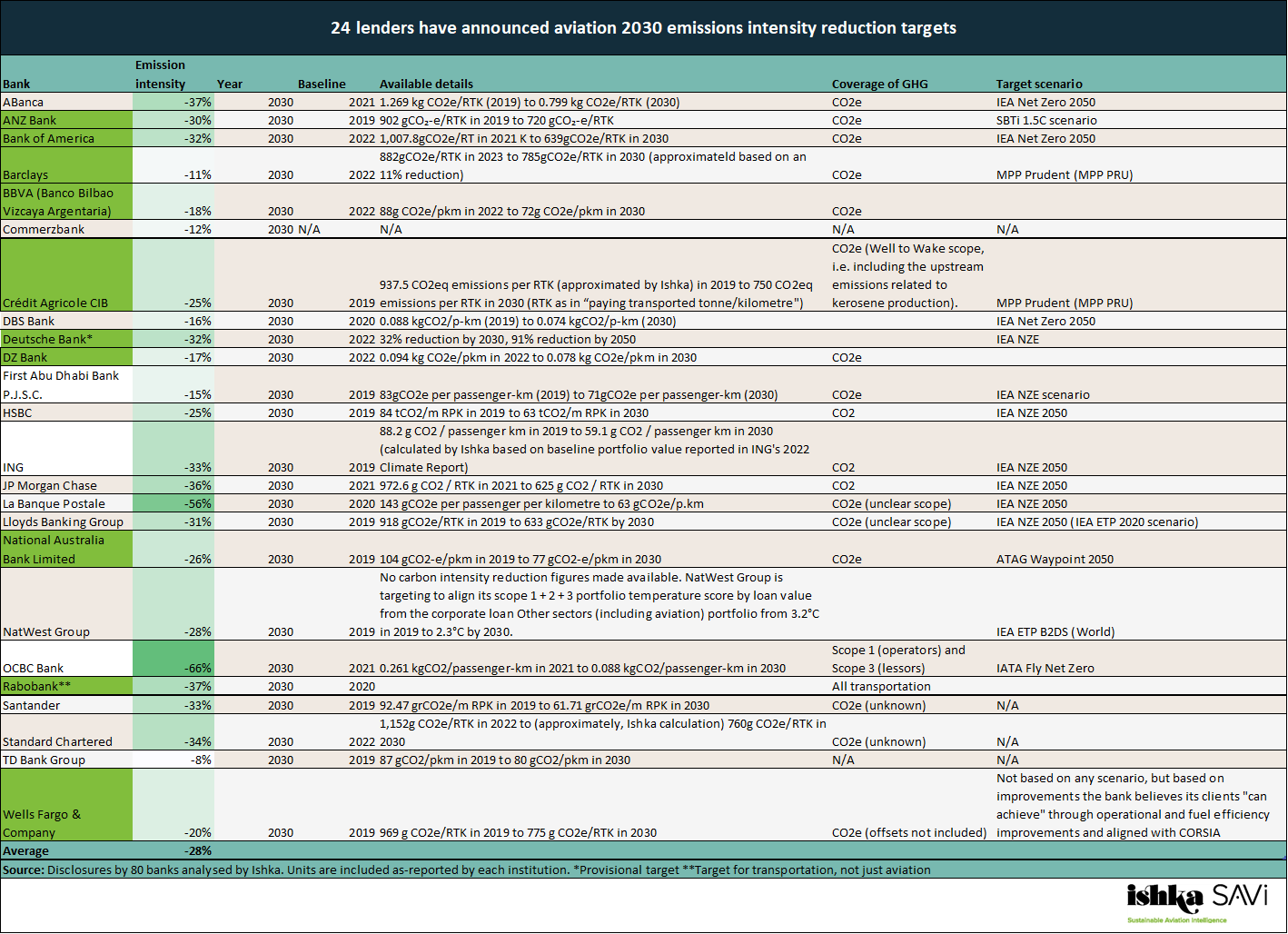

The 24 banks with aviation decarbonisation targets are aiming to reduce the emissions intensity for their aviation lending portfolio by an average of -28% by 2030 versus 2019 to 2022 baselines. As highlighted in prior research, how banks define emissions intensity for aviation varies both in the emissions captured (CO2 or CO2e or various scopes) and in the capacity measurements used (revenue passenger kilometre, revenue tonne kilometre, passenger kilometre, etc…).

Regardless, if double-digit percentage reductions in emissions intensity until the end of the decade are to be met, lenders will need to selectively choose portfolios, asset types, operators, and aircraft utilisation – from SAF usage to how they are operated.

Recap: Why are banks setting emissions intensity targets?

Emissions target-setting for aviation by banks is picking up pace because several lenders joined the Net-Zero Banking Alliance (NZBA) in recent years. NZBA membership requires the setting of initial interim 2030 emissions intensity targets within 18 months of joining the alliance. Transportation (aviation included) is one of the largest sources of financed emissions for most banks and it is one of nine climate-intensive sectors identified by the NZBA.

Even if transportation (including aviation) only accounts for a small portion of a bank’s total lending, its associated emissions and sector guidelines such as the NZBA’s may be enough to warrant them setting specific sector targets.

How prominent are aviation emissions targets among lenders?

For this first update of Ishka’s bank emissions intensity disclosure, 80 global banks were analysed (full list available at the end of this report). The selection seeks to balance the institutions’ global size and meaningful aviation exposure. Some relatively smaller regional banks with aviation decarbonisation targets (e.g. ABanca, a Spanish regional lender) were also included in the interest of identifying first-movers and their aviation targets.

Most banks are members of the NZBA, which covers over 130 banks in 41 countries with over 40% of global banking assets. Considering that the 80 institutions analysed by Ishka include some of NZBA’s largest members, Ishka’s analysis should cover a representative part of the global banking sector.

Source: Disclosures by 80 banks analysed by Ishka.

Source: Disclosures by 80 banks analysed by Ishka.

In addition to the 24 banks that have unveiled interim 2030 emissions intensity sectoral targets for aviation, nine banks are currently working on targets for aviation or expected to update the market soon. A further 24 banks have announced targets for other high-emitting sectors and may expand their range of targets to include transportation, which could include aviation.

The remaining 23 banks have not provided guidance on whether they plan to set transportation targets, or have not set targets for some sectors including transportation due to a lack of reliable data or methodology. Among the banks with no details on emissions intensity targets, one (Iceland’s Íslandsbanki hf.) is instead aiming to reduce the emissions footprint of its loan portfolio (a target that the bank is on course to achieving by way of reducing its aviation exposure).

As Íslandsbanki’s example shows, it is important to note that Ishka’s analysis focuses solely on emissions intensity targets by 2030, not other environmental targets for aviation set by banks. For instance, a number of international lenders are also setting 2050 targets for aviation (ING and DBS Bank, for instance), pledging not to invest in infrastructure that results in increased air traffic (La Banque Postale), or choosing to support SAF production (Bank of America).

24 banks have emissions intensity targets, so what are they?

The ambitiousness of some of these emissions intensity targets (some as large as a -66% or -56% from 2021 or 2020 to 2030) carry a clear message: an increased focus by lenders in best-in-class new technology aircraft with the lowest-possible per-passenger emissions (high seat density, high load factors).

The 10 banks in green have been added since Ishka’s last update in July 2023. They comprise: ANZ Bank, Bank of America (a former member of the RMI-led Aviation Climate-Aligned Finance group now known as the Pegasus Principles), Barclays, BBVA, Crédit Agricole CIB, Deutsche Bank (provisional target, pending a review of the Pegasus Principles methodology), DZ Bank, National Australia Bank (NAB), Rabobank (whose target applies across transportation, not just aviation), and Wells Fargo & Company.

Source: Disclosures by 80 banks analysed by Ishka.

Source: Disclosures by 80 banks analysed by Ishka.

Click here to download the data.

Annual reporting on the progress to meeting these targets over the next few years will be key to track their achievability and, if the banks fail to achieve them, further understand the potential consequences for bank lending into the sector.

So far, few banks have yet disclosed progress on aviation emissions intensity targets. One example of a bank yet to make substantial progress is BBVA, which noted that its 2023 aviation portfolio's emissions intensity was up 1% compared to the 2022 baseline year (89g CO2e/pkm in 2023) although the bank notes it "remains below the market average." On the other hand, ANZ says it is on track to meet its -30% by 2030 target with 2023 emissions intensity of 828 gCO₂/RTK, lower than its 2019 baseline of 902 gCO₂-e/RTK.

The Ishka View

With an increase from 14 to 24 lenders since July 2023, Ishka’s prediction that the number of banks with aviation targets would double by July 2024 remains on track. The impending formal announcement of the Poseidon Principles by Spring 2024 could carry targets for several more lenders. Growing non-financial disclosure by banks – including through NZBA commitments – will in due course begin to reveal which lenders appear to be successful in reducing their aviation emissions intensity and whether they are able to do so while growing, maintaining, or decreasing their overall exposures to the sector.

Ishka will continue to monitor the progress of banks in setting and managing decarbonisation targets for aviation. If your institution is missing from the list below or you believe other banks should be included, please get in touch with savi@ishkaglobal.com

The 80 banks analysed by Ishka comprise: ABanca, ABN AMRO BANK N.V., Agricultural Bank of China (ABC), AIB Group Plc, Australia & New Zealand Banking Group Limited (ANZ), Bank of America, Bank of China, Barclays, Bayern LB, BBVA (Banco Bilbao Vizcaya Argentaria), BMO Financial Group, BNP Paribas, Caixabank, China CITIC Bank, China Construction Bank (CCB), China Development Bank (CDB), China Everbright Bank, China Merchants Bank, China Minsheng Bank, CIC, CIMB Bank Berhad, Citi, Commerzbank, Commonwealth Bank of Australia, Crédit Agricole CIB, Crédit Mutuel Group, DBS Bank, Deutsche Bank, Development Bank of Japan (DBJ), DNB (DnB NOR Bank ASA), DZ Bank, Erste Group Bank AG, First Abu Dhabi Bank P.J.S.C., Goldman Sachs, Hana Financial Group, Helaba, HSBC, ICBC (Industrial and Commercial Bank of China), ING, Intesa Sanpaolo, Investec, Íslandsbanki hf., JP Morgan Chase, KB Financial Group Inc., KfW IPEX-Bank, La Banque Postale, Landesbank Baden-Württemberg (LBBW), Lloyds Banking Group, Macquarie Group, Maybank, Mizuho Financial Group, Morgan Stanley, MUFG Bank (Mitsubishi UFJ Financial Group), National Australia Bank Limited, National Bank of Canada, Natixis Corporate and Investment Banking, NatWest Group, Nomura Holdings, Inc., Nord LB, Nordea Bank Abp, OCBC Bank, PNC Financial Services, Rabobank, Reichmuth & Co Privatbankiers, Royal Bank of Canada, Santander Group, Scotiabank, Skandinaviska Enskilda Banken (SEB), Societe Generale, Standard Chartered, Sumitomo Mitsui Financial Group, Inc. (SMFG), Sumitomo Mitsui Trust Holdings, Inc., Swedbank AB, TD Bank Group, Türkiye İş Bankası A.Ş. (Işbank), UBS AG, UniCredit, UOB, Wells Fargo & Company, and WOORI FINANCIAL GROUP.