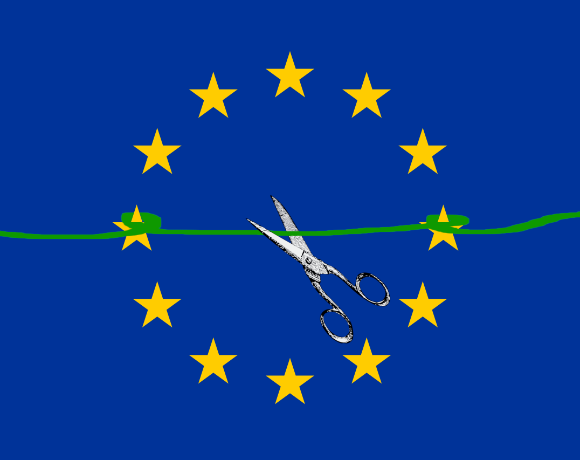

Most aircraft leasing companies could soon fall out of the scope of the EU’s Corporate Sustainability Reporting Directive (CSRD) if a proposal introduced by the European Commission on 26th February goes ahead. An Omnibus package aimed at cutting red tape in the name of spurring European competitiveness would, among other proposals, limit CSRD reporting to companies with more than 1,000 employees. That higher threshold – which replaces a two-of-three checklist based on 250+ employees, €20+ million in assets, or €50+ million turnover – would still cover large enterprises like many airlines or banks, but would see up to 80% of other companies currently in scope of CSRD evade the rules. Those still in scope but due to report in 2026 or 2027, would see their implementation year pushed to 2028.

This report examines the key proposed changes relevant to CSRD and the EU Taxonomy in yesterday’s Omnibus Package. The immediate picture is one of significantly reduced sustainability reporting obligations. However, businesses exempt from CSRD will still be expected to provide data to larger firms they work with, and the upper limit of these requests remains unclear.

Key Omnibus changes for CSRD

The first two Omnibus Packages drop, weaken, or postpone a number of sustainability regulations introduced by the EU in the past five years. They carry a promised cost saving for currently in-scope small and medium-sized companies of €6.3 billion ($6.61 billion) – by Ishka’s estimate that is approximately 0.3% of the annual turnover of the EU’s medium-sized enterprises (50 – 249 employees) as of 2022.

The key proposed changes to CSRD include:

- Scope reduction: Around 80% of companies will be descoped from CSRD; some of them will continue reporting voluntarily. The CSRD rules will now apply to all companies with more than 1,000 employees or a turnover above €50 million;

- Voluntary standard: Those reporting voluntarily will have a simplified voluntary standard for SMEs (VSME) that would ensure consistency and comparability. This standard is to be based on the European Financial Reporting Advisory Group's (EFRAG) VSME standard and adopted via a future delegated act;

- CSDDD alignment: The scope of CSRD will be “more” aligned with that of the CSDDD. For reference, and based on a CSDDD datahub developed by Dutch NGO SOMO earlier this year, Ishka only identified 60 firms with links to aviation, of which 19 were airlines and only two were lessors. However, this it a third-party estimation and it is possible that not all firms with activities in aviation or aerospace have been identified.

- VSME to set data sharing ceiling: Companies that are not reporting and that are included in the value chain of larger companies will be protected from excessive requests to provide information if they have up to 1,000 employees. The VSME standard will act as a “shield” – more on this below.

- Reduction of data points: For companies still having to comply with CSRD, the European Commission will revise the European Sustainability Reporting standards (ESRS) to reduce the number of data points by around 70%.

- Removing reasonable assurance requirement: Scraps a requirement to move from limited assurance to reasonable assurance, which would have required a high level of assurance provided by auditors;

- No sector-specific standards: Removes the possibility that the European Commission could develop sector-specific standards;

- Postponement of reporting requirements: For large companies still covered by the revised CSRD scope that have not yet implemented CSRD and for listed SMEs with more than 1,000 employees (Wave 2 and 3), the implementation would be delayed to 2028.

- Voluntary Taxonomy reporting: For companies still covered by the revised CSRD scope with a turnover below €450 million, Taxonomy alignment reporting will not be required. Those still required to report EU Taxonomy eligibility/alignment will have a new materiality threshold of 10%, allowing them to focus on activities that represent a significant share of their revenues, capital or operational expenditures.

Other proposals in the first two Omnibus Packages include changes to the Corporate Sustainability Due Diligence Directive (CSDDD), a reduction in companies covered by the Carbon Border Adjustment Mechanism (CBAM), and amendments to the EU Taxonomy beyond those already mentioned.

A key change to the EU Taxonomy criteria that could impact aviation finance is the exclusion of non-reporting entities from the denominator of the Green Asset Ratio (GAR) for banks. Ishka understands that if fewer airlines or, notably, lessors are required to report EU Taxonomy compliance due to CSRD scope changes, a bank’s GAR denominator would shrink. For a bank, this could result in a GAR value that does not fully represent the bank’s exposure to entities aligned with the EU Taxonomy, including those currently covered by the EU Taxonomy’s aviation criteria.

Exercise caution: possible amendments and delays

“Companies and stakeholders have repeatedly stressed the need to ensure certainty,” remarked yesterday Commissioner Valdis Dombrovskis during the Omnibus press conference. And yet, paradoxically, the latest Omnibus changes could have the opposite effect in the near future.

It could take several months for the proposed changes to take effect, and depending on the degree of alignment with the European Parliament and member states, there could be further amendments to the proposals laid out yesterday.

The upcoming legislative train for the Omnibus proposals involves a first reading by the European Parliament, initial trialogue negotiations between the Commission, Parliament and Council of member states, a second Parliament reading, conciliation of positions, a third reading in Parliament, and final adoption. It is worth noting that European countries are reportedly split on the proposals, which could lead to extended negotiations and compromises – while purely theoretical, it is even possible that elements of the current CSRD regulation could be retained.

Member states would then be required to transpose the changes into national law. This can be a lengthy process despite EU deadlines for transposing the amended rules. Case in point: some EU countries have yet to incorporate the existing CSRD directive to their national legislation despite a July 2024 deadline – as of last September 17 EU countries were yet to transpose CSRD into their national law, missing a July 2024 deadline.

This paints a picture of the delays of getting EU regulations implemented, let alone further amended. As a result, companies pausing or delaying CSRD preparations could take on a non-compliance risk if yesterday’s proposals are not enacted by the end of this year.

Caveat: contracted partners will still require data

Even if the legislative process leads to a swift adoption of yesterday’s proposals with minimal changes, companies exiting the CSRD scope must still anticipate data requests from their supply chains. For aircraft leasing companies, this could include requests from European banks. To offer temporary guidance, the Commission plans to issue a “recommendation” on voluntary sustainability reporting “as soon as possible.”

Regardless of the Commission’s upcoming guidance, supply chains and financial stakeholders still within the CSRD scope—or those choosing to comply as a best business practice—will continue demanding data from other companies. Even once a finalised and revised CSRD framework is in place, key principles like the prioritisation of double materiality assessments will remain widely regarded as best practices by many companies and investors. This presents an opportunity for businesses to view CSRD compliance as a competitive advantage.

In this regard, Ishka echoes PACE’s view. “Simplified CSRD reporting will not remove the need for financiers to understand their facilitated emissions independent of reporting them as Scope 3, and so continuous emissions monitoring will enable stakeholders to adapt to further financial and regulatory changes, safeguarding asset value and enhancing investor confidence,” PACE notes.

The Ishka View

The Omnibus proposals simplify sustainability reporting more by reducing the scope rather than moving to a less comprehensive framework. For businesses that invested in CSRD or CSDDD compliance, the changes limit the advantages of early ESG transparency efforts. Still, their work remains relevant, especially for those with near-term deadlines, investor scrutiny, or sustainability-focused partners. However, the EU’s shift undermines its credibility as a leader in climate policy, both within Europe and globally.

We got to this point through a combination of political changes, business demands, and – in no small part – Donald Trump’s re-election. The 2024 European Elections last June did see gains for parties on the right and losses for the Greens, backing a more business-friendly attitude towards Green Deal objectives. However, it was only three days after Trump’s election last November that Von der Leyen first mentioned plans for a “simplification revolution” involving the EU Taxonomy and other sustainability reporting regulations. Von der Leyen was still, at that time, awaiting confirmation by the European Parliament for her second term as Commission president.

Von der Leyen remarked again yesterday that, despite the Omnibus deregulation proposals, the EU’s “climate and social goals do not change.” That may still be true, but it does limit investment and lending flows from making more informed sustainability and transition decisions. The reaction by sustainable investment stakeholders has been overwhelmingly negative. Nathan Fabian, a former head of the European Commission’s Platform for Sustainable Finance (PSF) that spearheaded EU Taxonomy criteria for sectors like aviation, commented on a LinkedIn post that the “reductions in corporate obligations go too far.” Helena Vines Fiestas, current chair of the PSF, welcomed many of the developments but also noted that compromise on reporting requirements for medium-sized enterprises is “an area of serious concern.” The European Sustainable Investment Forum (Eurosif) also expressed concern for the proposals, which say “risk undermining investment and competitiveness.” NGOs have also been critical, with Transport & Environment condemning the proposal for limiting sustainability reporting obligations to only 0.02% of European companies.

Ishka SAVi will continue to monitor industry reaction to the latest changes and report on their aviation finance impacts.

Feedback call: Please note that the European Commission is welcoming feedback until 26th March on its Taxonomy amendments.

Further reading: