in Airline trends & analysis , Capital Markets

Monday 8 August 2016

Ishka interview: John Plueger ALC CEO

Ishka speaks with Air Lease Corporation’s CEO, John Plueger, about pressure on leases and increased competition, the 777x, the future of the CSeries and Boeing’s plans for a middle market aircraft.

John Plueger was named ALC’s CEO in July this year replacing ALC founder and his business partner for the last 30 years Steven Hazy. Hazy will assume the role of executive chairman of the ALC board.

Ishka: Can you explain a bit more about your new role and Steve’s role at ALC?

John Plueger (JP): Any time that there is a CEO transition you want to be very transparent with your investors. I think it boils down to some very simple things. This was all part of a fundamental long term succession planning from our board from day one of this company. Our company is in fact on a great footing right now, the business performance, our earnings, our margins, all of those metrics are great. We are well beyond our start-up phase. We started in March 2010 and now we are more than 6 years old, we are publically held, we have an investment grade rating, and the business has come along really nicely. So, it’s actually a perfect time from a business perspective to implement a change like this.

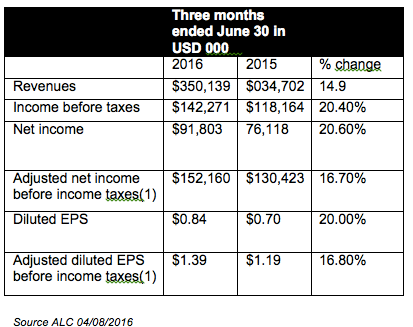

ALC released its 2016 Q2 results in August and reported a record quarterly revenues of $350.1 million, a rise of 14.9% compared to a year ago and a quarterly net income of $91.8 million with a pre-tax margin of 40.6%. The lessor has placed 91% of its order book on long-term leases for aircraft delivering through 2018 and 80% through 2019.

Congratulations on your recent results. Do you think there are any market pressures that could perhaps put a challenge on that? You have been hitting a quarterly adjusted margin of more than 40%. Is there anything that could impact not just you but all lessors out there?

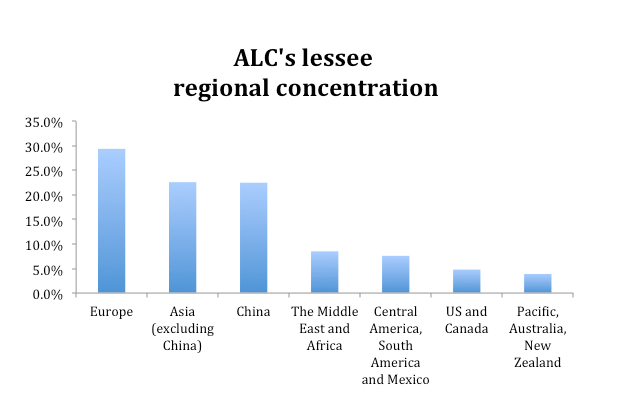

JP: Well, I can’t predict what the world will look like in a year or so. All I know is that our strongest market is in Asia including China, the demand there remains very robust, very strong, and as I said in our last earning’s call, we have not seen any evidence of an overall global reduction in demand for the new aircraft that we have, like the NEO’s, the MAX’s, the A350s and all the latest technology aircraft. We have seen an increase in airlines wanting to extend their leases on younger or midlife current-generation aircraft for a year or two or three, but I don’t think an airline is going to make a 30-year bet that fuel is going to stay down.

We have seen a little bit more consolidation in the leasing space. Both Orix and Avolon are rumoured to be currently bidding for rival US aircraft lessor CIT. Would you be tempted to buy a portfolio of aircraft like CIT?

JP: CIT is pursuing a dual track of finding a buyer and so they have had their first rounds with buyers, but they are also pursuing a spin off or IPO. They will probably take whatever path gives them the best price. We are very much into our mainline business, which is buying brand new aircraft from manufacturers at high volume and placing them over a long period of time. That gives us a great predicable growth, and it gives us great pricing under large volume purchase orders. So buying portfolios of used aircraft is not our main focus. Our main drive is placing our new aircraft.

If we find a really good deal on any group of aircraft we are not afraid to seize upon it, but our primary mission now is to continue placing our new aircraft and that’s what it’s going to remain. So if we saw a fantastic opportunity, and we can make a great deal yes, but you know we are probably not going to do that if it’s a 15-year-old aircraft.

Do you see a bit of pressure in terms of leases and do you foresee long term leases continuing as they are or not?

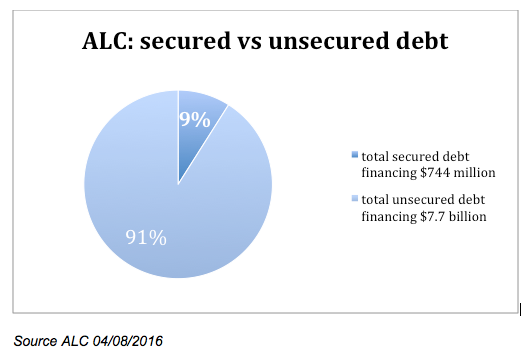

JP: Well I think we are in an area of increased competition, there are a lot of people. But you have to also remember that I would say the majority of that competition is still in the sale/ leaseback market, which is not what we really do. When an airline wants to do a lease back on 10 airplanes or 5 airplanes or 20 aircraft they have a lot of banks, and there is a lot of competition. I would say that market has been much more impacted by competition, because you have very well financed players with low cost to funds all bidding on that business. A bit less so for the operating lease environment, and when I say the operating lease environment I mean those of us who have large orders, large firm orders well into the future for aircraft, and that is our main business model. But we have more competition in that sector as well. Now for us, that’s nothing new, as a management team myself and Steve have been through periods of increased competition before. If you have an increase in competition that may result in some of your deals maybe being at a lower margin but it balances in portfolio and you have a few other deals that will do better. The on-going drive for us is to keep driving our cost of funds down. We are an investment grade credit. We are BBB- by S&P but we are on positive outlook S&P and we are A- by Kroll. I am hopeful that this year we will have an action on a positive outlook from S&P that will help us a little more in the bond market. So we feel pretty good about where we are, the strategy that we have taken, and where we are going. We still think we have the right strategy and the right balance.

You mention increased competitions in the leasing space. Are you actually bidding on sale of leasebacks generally?

JP: No we do it occasionally. But it is clearly a very small part of our business. We do it sort of opportunistically or sometimes strategically if we get into a program where we place some of our own aircraft on lease as well as do a sale lease for the airline itself, so I would say it is a very small part of our business. Not even 9% or 10%.

Have you noticed a related change in lease rates due to fuel price? A couple of lessors have said that lease rates say between CEOS and NEOS have a 10K-20K premium in term of leases- but this isn’t the 50K premium that you would expect. There is apparently a wider premium between the Max versus the NGs. Is this putting a pressure on actual acquisition price of either the Max or the Neo? And are OEMs adapting the price accordingly?

JP: Well, I think everyone knew and expected that, when you have the next generation aircraft come out initially there is a bigger premium, and, as time goes on, that premium does diminish. And we are seeing that premium kind of diminish in the market but that again is expected, with the same thing that happened when the 737-300 and 400 were phased out in favour of the 737-700 and 737-800.

I think that actually with the OEMs it’s more a function of competition between Airbus and Boeing, and the pricing of these aircraft are more now a function of demand and the accomplishment of Airbus at the moment. In any given campaign I have never seen competition greater between those two companies and that goes for the MAX versus NEO campaigns etc. So I think the real driver as to the real prices for the next generation aircraft is driven a lot by the competitive environment between Boeing and Airbus. But as a natural cycle phenomenon, when you have a new generation aircraft there is initially a premium there, but that premium does disappear over time.

But lines are drawn. There needs to be a price below which neither Airbus nor Boeing will go. That threshold may differ with different campaigns.

And are they going anywhere near those lines yet?

JP: No.

Okay, the other thing we have heard about is that competition has heated up to a certain degree and the lessors are relaxing certain restrictions to win sale/leaseback deals. Are we seeing any loosening of the restrictions for operating leases?

JP: The first thing I would point out is that if you look at our results over the last several years one of the other metrics that has been consistently increasing is the average duration of our lease portfolio remaining, so in other words, what is the remaining average term of our leases and now I think we have the longest. Across our entire portfolio of aircraft we have an average duration of 7.2 years. Another key advantage is that we have very few leases expiring in the next three or four years.

So my point here is that we don’t know. We are not negotiating a lot of lease extensions whether those extension rates are up or down etc. There is less volatility in our fleet because we have leases locked up for a long period of time and we have very few leases coming up for renewal.

So, having said that, I think most of the lessors will tell you that, that on the new aircraft especially, there has actually been a trend towards lengthening of lease term. Because that is one of the ways that you can offer competitive terms if you are in a really contested competitive campaign against another operating lessors. So one good by-product of this present environment is that leases have been getting longer.

I think every lessor has their different mix of what they like to see, some elements of lease transactions are more important to one lessor than other elements. I think there is no strong trend that I see emerging there. But, for example, the Chinese are very well known for saying ‘we want the best deal but we will give you a long lease term’. We will give you 12 years on a single aisle out of the box. Airlines do want the best deal and they understand this, so very often there has been a bigger willingness to trade off a little bit of lease rate against lease terms and that’s a good economic trade off.

We do see lessors acquiring more planes. There was some sort of talk a while ago about lessors owning 50% of the world’s fleet. If this ever comes true this would mean more competition among lessors.

JP: You know it’s hard to say. I mean every given year the rate of aircraft acquisition could increase. One would expect that it generally would increase but maybe at a slower rate. Don’t forget this industry has gone 30 plus years now of growth. I was always sceptical frankly that it would ever reach 50%. I remain sceptical that it will reach 50%. It is roughly 43% now and it was a big deal when it hit 40%. But still over time it has continued to increase and I think the leasing community is providing a tremendous service to the airlines both in the flexibility the lease provided and as a source of capital. There is no way, no way that this industry, that the world’s airlines and the OEM’s would have grown so quickly without the capital provided by the leasing companies. There is just no way.

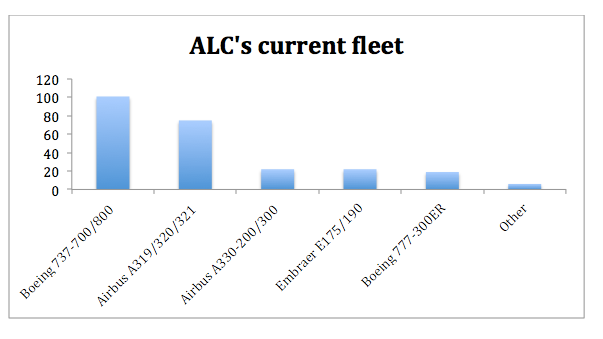

In terms of assets you are now out of regional jets effectively. Are there any other wide bodies and narrow bodies that you are choosing to forego or perhaps appear less attractive than other assets?

JP: Well the only new widebody that we have not purchased yet is the 777x. Our order book is roughly about 25 A330 NEOs and about 23 A350s, so that’s just under 50 on the Airbus new generation aircraft. As to Boeing, on the 787-9, and the 787-10 where we are a launch customer, again we’re just under 50 there. So we basically have every single new single and twin aisle product with only the exception of the 777x.

Of course, we have current generation A330s, current generation 777-300s, current generation 737- 800s, A320 and A321 CEOs. Literally the only product on the new aircraft platform we don’t have is the 777x.

When will we see an ALC 777x announcement come through?

JP: You know it comes down to a couple of simple things, price and customer base. And if those two elements get to the point where we think we can have a good business case, there is no reason why we wouldn’t. But, you know, sales of the largest twin aisle and twin engine aircraft have slowed in the last couple of years. I mean there has not been a 777x sale for quite some time. These are very big expensive airplanes and we want to make sure that we get that right. So we are happy with the A350-1000, we are happy with the A350-900, in fact most of our order book on the A350 is for the A350-900.

What do you think about the recent CALC order for 30 Comac ARJs with options? Could a deal like this make sense for ALC?

JP: Having now sold our ATR and E-Jet fleet, we’ve publicly stated that we are really concentrating on our mainline business, which is Airbus and Boeing, so it’s hard to see a case for the ARJ or anything else like that right now. However, the CSeries is still something that we are looking at. Just because we have sold our Embraers and sold our ATRs still does not mean that if we see a good building case with a CSeries we wouldn’t do it. We actually think it is a good airplane but the same basic principles for the 777x also apply to the C series: price and customer base. And if those two align for us, and we felt there was an opportunity, there is no reason why we wouldn’t go for that airplane – again provided that we were assured of a very good business case for the long run. Air Canada or Delta are really two pivotal orders for Bombardier that were hard fought and well won. So I think it’s put the C Series firmly on the map. Having said that one always wants to see continued orders by large and credible airline as can be mustered.

Can you comment on the middle of the market (MOM) aircraft. Are we going to see a brand new plane or are we are going to see just another variation?

JP: Boeing has identified the need for the middle market aircraft. I think there is no question that that gap is there. You’ve heard now Boeing has made public statements that they think they can sell as many as 5000 and others have said I don’t know 1,500. Here’s my answer: tell me what the airplane costs and I will give you a better idea of how many units over the production line you are going to be able to sell. And I think for me that really is the key question. It’s not a question of being able to build the airplane from an engineering perspective. My sense is that it’s probably a small twin aisle aircraft. But the question is, what will the airplane cost when it’s delivered. I made a comment the other day that I think it has got to be closer to a single aisle cost than a twin aisle cost.

In order to drive the production life of 5000 units, which is the number that I keep hearing Boeing quote, that’s a function of the price of the airplane at this point. There is no doubt that we have the technology, we can do it. There is some discussion about whether the engine technology is there or not. GE is the first one to say absolutely it is there. I think Rolls would say the same thing. So I think that airplane will really be defined by its cost. Airbus’ competitive response could be just cutting the price of the A330. I know that Boeing is analysing that business case really hard.

Sign in to post a comment. If you don't have an account register here.