Monday 10 October 2016

GDP growth vs air travel: A conscious uncoupling

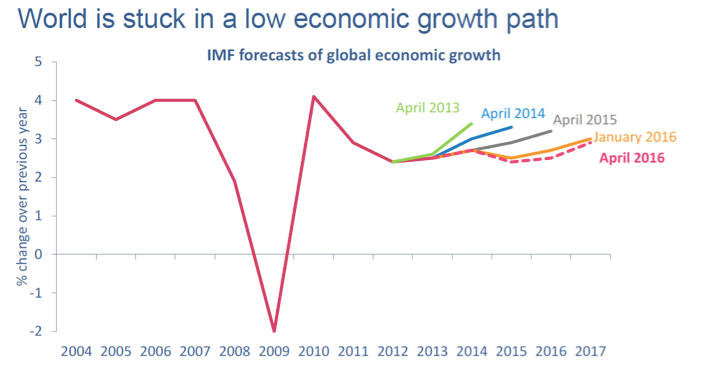

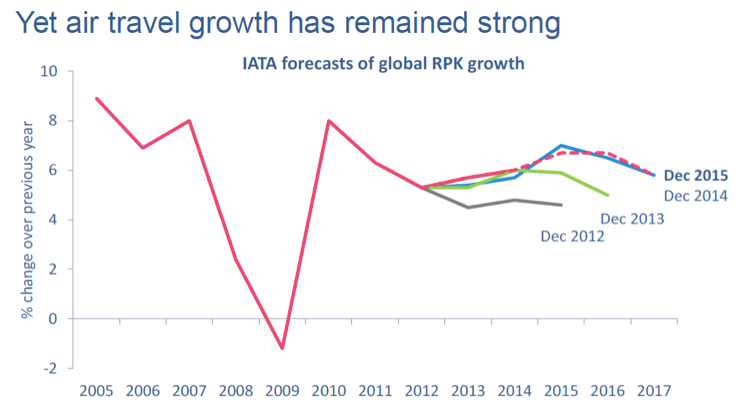

It has long been observed that traffic growth and economic growth (as measured by Gross Domestic Product, GDP) appear in the aggregate to be “correlated”. However, since the global financial crisis in 2008, the demand for air travel has been unexpectedly resilient to such a degree that the period has shown signs of a skewing between the historical GDP and passenger growth relationship.

So is there another relationship that can be used to better indicate the path ahead, or is it a case that once consumer demand begins to retract, there is a likelihood that the market will adjust back to historical trends?

GDP still matches traffic closely... for now

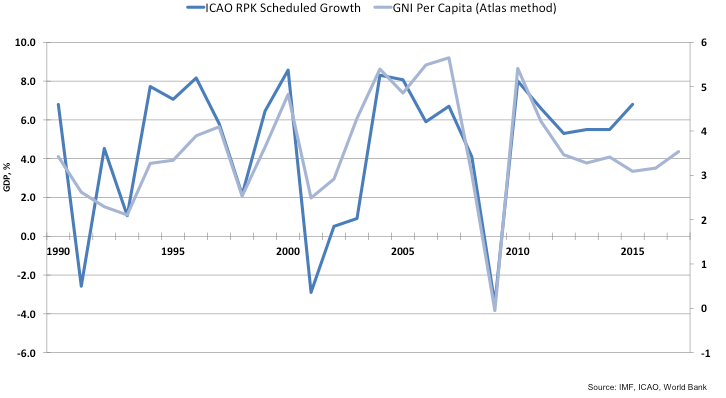

GDP is the single most commonly referenced figure to cover the entirety of a local, national or global economy - and the trajectory it is on - in a single statistic. Whether the synonymous use of one statistic to portray the health, or lack, of an economy is questionable but somewhat outside the remit of this particular Insight. The chart below highlights the historical link between global GDP growth and the expansion of passenger Revenue Passenger Kilometres – the metric used to measure the sales volume of passenger traffic. It should be noted that GDP has been actually closely correlated to traffic growth and has only ever diverged by approximately 3% at any given time during the last 25 years. Traffic has, for most of the last 25 years, lagged behind GDP growth until recently. This further supports the view that the traditional economic cycle, on which policies have been founded, has ceased to apply and with it the historical cause-effect relationships associated with them.

While not fully covered on the chart above, there were a number of large global shocks during 1960 and 1984: the two oil shocks and the synchronised slowing in the rate of price inflation of the 1980s. Since corporates have begun a wider process of globalisation from the mid-1980s, there have been fewer large common shocks and their role in explaining international business cycle fluctuations has declined.

The cheaper cost of flying

Part of the reason why global air traffic has proven so resilient relates to the large declines in the real cost of air travel seen over time. Between 1950 and 1970 - the advent of the jet age - global air passenger traffic increased by over 10% per annum as rapid technological improvements brought down the cost of air travel by an average of over 5% a year. Since 1970, the real cost of air travel has been reduced by over 60%, through deregulation of the aviation market in the 1980s, the development of more fuel-efficient aircraft technologies and the rise of the low-cost carrier model – which has had a big impact over the last 15-20 years. Consequently, more of global population can now afford to travel by air.

Source ISTAT

The resilience of air travel can also be put down to changes in demographics along with socio-economic factors that have contributed over time. The long-term upward trend of people in emerging and developing countries joining the ‘middle class’ looks set to continue with this segment projected to grow from a figure of 1.8billon in 2009, to 3.2 billion by 2020 and on to 4.9 billion by 2030. Moreover, global air passenger traffic is expected to more than double over the coming 20 years.

The Ishka View

GDP remains a close correlation for air traffic, even now, however it is likely that that its role as singular golden indicator for RPK changes is likely to diminish, especially in an age of more open data. This is likely to make room for an alternative measure or measures, to provide an indicator of aviation’s growth over the forthcoming decades. This will only become progressively easier to develop and maintain as improvements are made in global data collection.

It is widely established that the tendency to travel as measured by journeys made, or in RPKs, generally increases with a rise in per-capita income – although this increase varies considerably given a number of factors.

In a closed, or less liberalised aviation market, with newer carriers barred from entry , demand still increases with GDP per capita. However air travel is is normally associated with lower service quality and higher pricing - restraining travel growth.

More liberal markets, with greater choice for passengers, are more responsive to changes in GNI per-capita income. Airlines are more able to add new routes, or to increase frequencies and seats to capture demand – allowing broader access to a populace to make journeys by air. On current trends countries around the world, particularly in developing countries, look set to embrace the latter in the form of even further liberalised air markets. As air travel liberalises further it is likely that even incremental increases in GDP could be echoed by much wider increases in passenger demand, especially in previously tightly regulated emerging markets, and that the correlation between GDP and air traffic growth will stray wider apart.

Sign in to post a comment. If you don't have an account register here.