Tuesday 18 October 2016

CEO interview: GAP relaunches as Altavair

Guggeinham Aviation Partners has been launched as Altavair. The move represents a wider trend emerging within the aircraft leasing market as fund managers reset their expectations on the level of returns. Ishka speaks with Steve Rimmer, the CEO of the firm about his ambitions to create a new aircraft leasing platform.

What happened?

Last week Guggenheim Partners sold its commercial aviation division Guggenheim Aviation Partners (GAP) to its management team, who subsequently relaunched the business as Altavair Airfinance (Altavair).

History of GAP

GAP was launched in 2003 as a joint venture between Stephen Rimmer and Paul Newrick and investment firm Guggenheim Partners as an aircraft asset manager raising liquidity in the private placement market via fund structures. The investors in these funds included the firm’s investor clients as well as outside investors. GAP’s first commercial aviation fund closed at $278 million (equity) in 2005 which it followed with a $737 million (equity) second fund. During its tenure as a Guggenheim joint venture, GAP successfully managed two funds totaling more than $5.3 billion in assets. By the time of its sale, and subsequent relaunch as Altavair, the firm managed a $3.4 billion commercial aircraft portfolio.

Why have management bought the company?

According to Rimmer a more competitive leasing landscape has inevitably put pressure on leasing returns as the commercial aviation market moves to more than 40% leased. “If you look at what’s happened in the aircraft leasing market, it’s matured, we have got a lot of different players in the market,” says Rimmer. Lower lease rates also means that it is harder for the closed funds to reach the “outsize returns” GAP used to advertise when it was created in 2003.

Management are continuing GAP’s asset management business but also plan to raise between $500 million – $750 million of permanent equity. There is an immediate focus on identifying an initial pool of assets which, when combined with this fresh equity, will allow them to access more efficient debt and contribute towards achieving better returns over a longer time period. Guggenheim wants to continue working with Altavair and will consider directing its clients to invest in, or with, the platform, but as a separate entity. Altavair will create separate portfolios of assets that can be stratified to appeal to different investors based on expected returns.

“It’s an alignment of interest,” explains Rimmer. “They very clearly want to be an asset manager and although we need continued access to the fund market we also need access to permanent capital. So we basically agreed it’s better for us to be outside Guggenheim with a continuing access to some of the liquidity and resources they have, but also for us to be able to go out and raise other forms of capital”.

“If we are outside and they don’t have any shareholding there is no conflict of interest of how they allocate client capital, but if they allocate client capital to another Guggenheim entity that creates all sorts of hurdles for them”.

What will the new leasing firm look like?

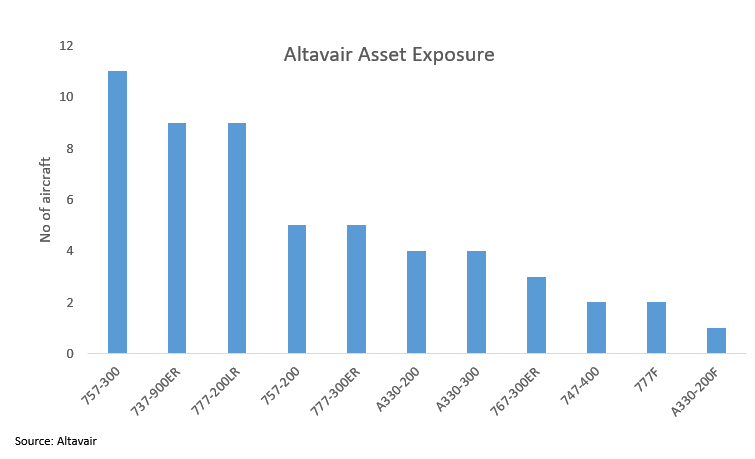

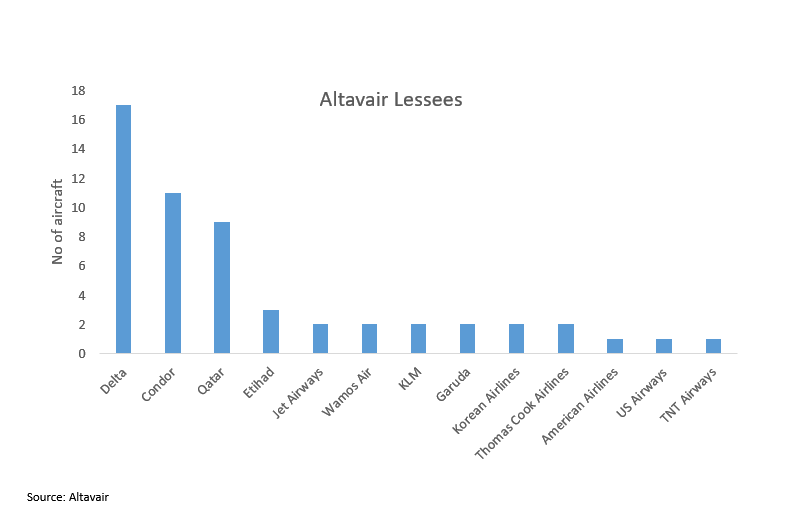

Altavair has staff based in Seattle, Singapore and London. The firm is currently managing a $3.5 billion portfolio which consists of 55 aircraft, mostly widebodies including predominantly A330s, 777s with 9 narrowbody 737-900ERs. The leasing platform will include at least $3.5 billion dollars of assets that GAP currently manages, but will expand to include owned assets. Altavair plans to expand by $1 billion of assets a year, and will aim to purchase young and mid-age narrowbodies. The leasing firm will then look to deploy some of its owned assets into a closed fund type structure which the platform will manage.

Net returns for the leasing platform are expected to range between 8% and 9.5% for the permanent equity investors.

“I see two elements here, I see permanent equity being invested in our existing platform and growing that with assets that we´ll hold long term”, comments Rimmer. “But I also see us continuing with some very specific strategies of dropping some assets into fund type vehicles with very defined strategies, so that we become an investor in that fund but also the manager of the fund and that the fund specific strategy will avoid conflict with the assets owned in the permanent equity entity”.

“Now, how many of those can you do without conflicting with all your partners? I think that´s the key. I don´t think you can do many of them, but I think if you limit the strategies, you limit the conflicts”.

Altavair targets “mainline” assets

The firm plans to acquire a range of assets including both young and mid-life narrowbodies and widebodies, with mid-life assets defined as being between 7-12 years old. The firm is on the look out to buy portfolios from other leasing companies, and possibly even another lessor, confirms Rimmer.

The leasing platform does not intend to order new aircraft. Altavair also has no plans to acquire either regional jets or enter into end of life leasing.

The new platform shows how GAP, and now Altavair, has changed its trading strategy over the years. GAP’s previous funds had focused on “opportunistic investments” and these had primarily presented themselves in the widebody sector and freighter conversions when they were offering better returns. The focus now will be to become more “mainline” with young and mid-life narrowbodies and widebodies.

Rimmer stresses Altavair will avoid chasing extremely popular assets or “ideal aeroplanes” that can be held for 12-year leases. “You´ve got a lot of Chinese money, a lot of new money into the industry which is just going to look for the ideal aeroplanes. These commodity aeroplanes allow them to put it on the balance sheet and hold it, but then you´re going to have to pay high prices for that because there´s a lot of competition,” says Rimmer.

“I see us being able to handle all asset types. I think the strength we´d be playing to is to be able to offer to people the ability to do pools of assets which are not simply one-dimensional: They´re not all brand new single aisle aeroplanes to quality credits”, he explains.

“Before, our liquidity sources drove us to look at very opportunistic investments and arbitrage driven investments. If you look at our first fund, we did a lot of widebody conversions. We also looked at assets which had shorter lease terms and looked to release some of them. We did widebodies when other people were staying away from widebodies. But it was opportunistic. I think what we´re seeing today, to be successful, one needs to be a little bit more mainline”, he adds.

Altavair and the evolution of fund investors

The creation of Altavair reflects an evolution of the closed-fund market within aircraft leasing. Aircraft leasing platforms are beginning to need longer time frames and increased competitions means they offer investors lower returns. Both these things pose a problem for closed funds that prefer 7-year to 9-year time horizons and higher returns.

Leasing returns have dropped from the mid teens IRRs available 12-15 years ago for newer aircraft to around 8% - 9.5% today. Now only the riskier end of life leasing tends to achieve the 12% to 15% returns. As rates become more competitive, leasing platforms require longer time frames to ensure their returns. Fund-based lessors also rarely offer the cheapest cost of capital. Funds typically want a substantial level of risk mitigation, preferring managers to use non-recourse and non-collateralised debt. This approach raises the cost of financing which limits how aggressively lessors can subsequently be in offering cheaper leases to airlines.

In addition, because of the shorter term nature of the funds asset managers are prompted to sell aircraft with leases attached simply to match the realisation horizon of the funds and not necessarily at the best time to ensure a gain, comments Rimmer.

“For arguments sake let’s say you do a 777-300ER for 12 years and you sell it in year 5 because you know your fund horizon is coming at you, if you’ve hedged the interest rate to match the lease term, when you come in 5 years’ time to actually sell the asset you are subject to the vagaries of what the interest rate markets like in that time frame, because somebody is going to buy it from you and calculate their returns based on their cost of financing in that market. And you might lose out,” explains Rimmer.

Funds are also becoming increasingly sophisticated aviation investors. One of the reasons why Altavair is accessing permanent equity is because it is harder to raise funds on a blind pool basis. Investors want visibility on what assets will be acquired and are increasingly reluctant to offer “full” commitment fees during the investment period as they seek to reduce drag on their capital. Rimmer states that an investor today offering $100 million will want up to $35 million dollars spent on Day 1 in assets that have been pre-identified. But there is still a place for funds. Rimmer says that the solution that Altavair will offer is to acquire a diverse mix of assets using permanent equity and then reallocate assets to silo’d investment pools with clearly identified strategies that avoid conflicts of interest with the parent-leasing platform.

The Ishka View

Fund investors continue to evolve and Altavair appears geared to target these new investors’ expectations and demands. As GAP the asset manager was a nimble bellwether for leasing trends for many years, and has changed its trading strategy away from freighter conversions to now embrace young and mid-life narrowbodies and widebodies. The leasing platform faces plenty of competition but appears to be making a bet that it will face less rivalry from new leasing platforms for these slightly older assets.

Sign in to post a comment. If you don't have an account register here.