Tuesday 6 June 2017

The Ishka Signals: an industry review

Ishka presents a short review, based on results from the first third of the year, of key areas we believe provide important signals in determining the trend and direction of the industry’s many facets. The overall view remains positive, notwithstanding the many pressure points that the industry is experiencing.

Economics, GDP and Oil

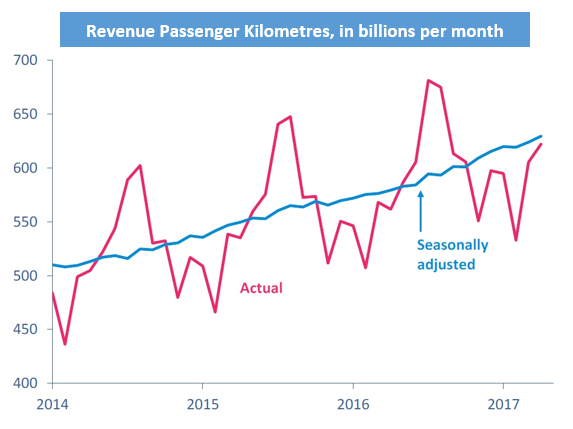

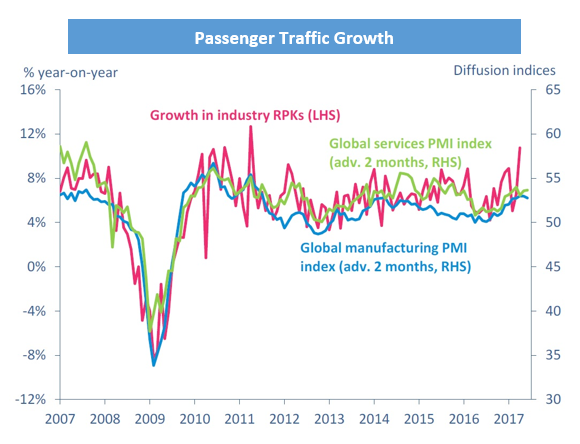

Whilst failing to live up to earlier expectations, global economic growth continues to grow at around 3% per year. Air travel, measured in terms of RPK growth continues to buck this trend and, despite peaking in 2015, is still growing faster than earlier expectations, with 2017 growth forecast at 5.1%. Oil price remains a volatile element in the economic equation, having fallen by two thirds between 2012 and 2016 and then rising by over 50% since. At $55-$60 a barrel, air travel remains incentivised and airlines can collectively operate profitably if they continue to manage their capacity growth.

Signal Strength: Good.

Outlook: Stable.

Source: IATA

Demand for Aircraft and Lease Extensions

Internationally, solid traffic growth continues to be reported for Intra Europe, Intra Asia and Asia-Europe routes. Latin America and Africa are report the same. However earlier in the year capacity growth outstripped traffic growth in North America and the Middle East. Domestically in the first third of the year, we have seen good traffic growth performances in China, India, Russia, and Japan.

Consequently, we are also seeing lease extensions in some markets, where airlines see opportunities to grow routes such as Europe and Asia. We are also seeing lease extensions where near term deliveries have been deferred. Air New Zealand with its A320ceo/neo fleet planning is the latest example. However, we see significant lease returns occurring in markets where expansion is being reigned back, the Middle East especially.

Replacement demand also remains visible, with airlines currently flying 1,700 aircraft that are over 20 years of age.

Signal Strength: Good.

Outlook: Mixed. Regional differences are appearing.

Source: IATA

Supply of Aircraft / Deliveries and Orders

Jet airliner deliveries were close to 1,600 in 2016. The 2017 forecast is for around 1,650 deliveries valued at $120 billion, continuing the upward themes of record deliveries and increased production rates. Order activity has been slowing since 2014 thanks to a mix of buyer fatigue, a lack of near term delivery slots, regional economic weakness and low fuel prices. Some airlines are also cancelling, deferring or modifying their order backlogs as they work to ‘right size’ their fleets for future markets, however this is having limited impact on production rates to date.

Signal Strength: Strong.

Outlook: Stable - OEMs remain keen to deliver but are cognisant of the need to avoid market oversupply.

Aircraft Storage, Retirements and Economic Lives

Annual aircraft retirements rose from 300 in 2007 to a peak in 2012 at nearly 800. By 2016 retirements were back down to 300, a consequence of lower fuel prices making older aircraft more economically viable, giving their owners the potential to extract more operational revenue from their assets, thereby postponing their retirement date. The postponement however serves to add to the overall in-fleet capacity as new deliveries have continued unabated, increasing competition and putting more pressure on lease rentals.

The stored jet population is steady at above 2,200. Within that total, the mix is changing. The number of widebodies (twin aisles) and regional jets out of service, as a percentage of their total fleets, is increasing, while the number of single aisles as a percentage of the total single aisle fleet, is decreasing.

Signal Strength: Stable

Outlook: Mixed - Storage/retirement levels are sensitive and vulnerable to fuel price movements. Widebodies and Regional jets continue to demonstrate their relative market weaknesses compared to the mainstream narrowbody.

Airline P+L, Yields, Route Developments and Failures

There have been mixed results recently for airlines - IAG (parent of BA, Iberia, Aer Lingus etc.) announced record profits in a traditionally weak first quarter, helped by an 11% drop in fuel costs, although revenues were also down 3% due to a fall in the value of sterling. The recent computer systems outage will have spoiled much of that good work. Both Lufthansa and Air France-KLM also posted better than expected first quarter results. However, airberlin reported a loss of €782m in 2016 and a first quarter 2017 loss of €293m, a consequence of the ‘old airberlin business model,’ while Air Canada’s first quarter net loss of $28m was blamed on rising fuel costs and capacity expansion. Collectively airlines remain profitable, but margins are lower than in 2016.

Yield management is growing increasingly sophisticated, and is allowing innovations in the Low-Cost Long-Haul market, which may be the next ‘shape of things to come.’ Scoot, Norwegian, WestJet, WOW, Air Asia X, Level and Eurowings are some of the leading proponents in changing the shape of low cost, long haul travel.

Nevertheless, yields remain under pressure: the global average yield has fallen from US$0.12 per RPK in 2012 to less than US$0.085 in 2017, although very recently a ‘tentative uptick’ in yield has been noted.

Signal Strength: Mixed

Outlook: Under Pressure - Airlines that are quick to respond to the market, have fared well. Airlines carrying the baggage of heritage ‘labour’ problems, other legacy structures, or poor fuel hedging exposures, have fared less well and are destined for difficulties should market conditions deteriorate.

Financing

Funding needs are being met by an expanding and diverse investor and creditor base through an increasingly large repertoire of financial instruments. There is ‘new money’ in the form of Japanese investors, private equity firms and pension funds (incl. North America, Asia and Europe), more insurance companies and hedge funds, as well as a number of Sovereign Wealth Funds (SWF) including China, Singapore and UAE.

However, the attraction of this asset class, especially the market for young aircraft with leases attached, has become highly competitive, congested, and awash with liquidity, resulting in higher initial loan to values (LTVs), aggressive amortisation profiles, and compressed returns. This leaves less room for manoeuvre should markets become stressed. As competition in that segment has eroded margins, meaningful investments have flowed into mid-life and end-of-life aircraft. These sectors will also become increasingly competitive.

Signal Strength: Strong

Outlook: Stable, but some pockets of investments are more vulnerable to market shocks. The appeal of airline and lessor credits, as well as the attractive fundamentals of aircraft as an asset class, suggests continued investment in this sector, as long as the industry continues to exhibit consistent levels of profitable growth.

Technology impact

OEMs are facing some induction problems with the new generation of engines, such as P&W with their PW1100 GTF engine, and there are other supplier issues with interior cabin furnishers for example, which are holding up deliveries or causing operational problems. These problems appear to be fixable and relatively short term, with solutions identified and planned. Of more concern are the delays in the MRJ programme, which is now a few years behind schedule.

There are also new models being introduced, the Chinese COMAC C919 and Russian Irkut MC-21, both made their first flights recently. While these models are entering a market currently dominated by the Airbus A320 and Boeing 737 families, their success will be limited by the simple dynamics of sales volumes and production capabilities, even if their performance and reliability prove to be strong.

In the widebody space, the latest versions of the Boeing 787, 777, Airbus A330 and A350 are either flying or in development. They are enabling airlines to open new routes and markets as well as to serve existing routes more efficiently. Russia’s UAC and China’s COMAC also plan to enter the widebody market in the 2020s.

Signal Strength: Stable

Outlook: Stable - In terms of capability the new generation of aircraft are delivering significant improvements in efficiency and economics. Current teething problems appear surmountable, but longer term programme delays have a tendency to impact on sales and residual values.

Asset Values, Lease Rates, and Depreciation

Market competition is holding down lease rates in the narrowbody sector, while widebodies also remain under pressure with a number of leases coming to an end in 2017, which is adding volume to the availability listings. The potential for the Alitalia fleet to become available has been overhanging the market. The Alitalia fleet is a mix of 120 aircraft worth $1.8 billion, over 100 aircraft of which are on operating lease, managed by up to 20 lessors/asset managers, and of which approx. 30 are held within ABS portfolios.

Depreciation and Economic lives remains a debating topic. A 17 to 20 year life span for many current generation jets has been mooted, where the asset holds some intrinsic value, in which case there appears to be more downside risk than upside if planning against a 25-year depreciation profile to a 15% residual.

Signal Strength: Weak.

Outlook: As much likelihood of upside as further downside in the near term.

Leasing Market

Investors continue to hold and add to their asset portfolios, commensurate with their long-term views of the industry. In the near term, lessors are being increasingly challenged to place aircraft at rates that provide an adequate rate of return. The ability to place widebodies coming off lease this year, into the secondary market, will provide some key guidance in the coming months.

Signal: Stable.

Outlook: Challenging in the widebody space. Deferrals of new deliveries may provide support to the existing fleet inventory.

The Ishka View

Airlines are showing an increased sensitivity to fuel prices, hedging strategies, and capex requirements. Many are responding positively by deferring deliveries and ‘right sizing’ their fleets. New airlines (LCCs especially) born in the internet age have a clear advantage over those legacy carriers that have been slow to adopt revenue-generating technologies and still carry a high labour cost or infrastructure burden. We are likely to see a few more fallers at the next hurdle with fuel spikes or other exogenous shocks coming into play, but the vast majority of leading carriers are currently positioned to deliver a ‘soft landing.’

Sign in to post a comment. If you don't have an account register here.