in Aviation financings , Capital Markets

Friday 16 June 2017

Alitalia – a test case for the modern ABS

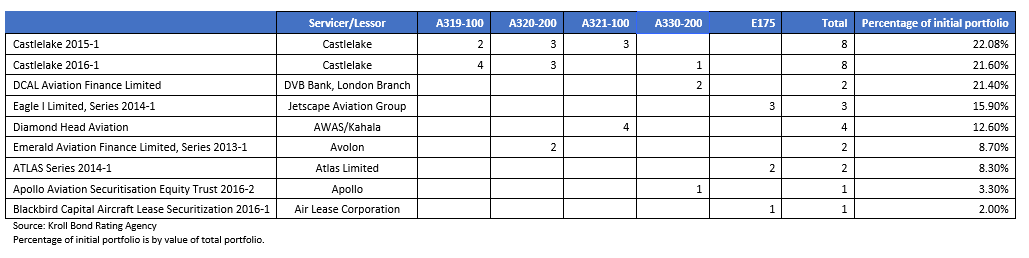

Italy’s long-struggling flag carrier, Alitalia, was put under administration (Italian equivalent of US Chapter 11) in May 2017 after employees voted against a restructuring plan proposed by Etihad, its 49% shareholder. Alitalia’s fate is particularly important for the investors in structured finance products as nine separate aircraft backed securitisations (ABS) have some exposure to the Italian carrier. However, three ABS in particular are significantly exposed to Alitalia: Castlelake 2015-1, Castlelake 2016-1 and DCAL Aviation Finance Limited.

In this Insight, Ishka highlights some of the key structural elements of the three transactions that are most exposed to Alitalia. Modern (post 2008) aircraft-backed ABS have very rarely been tested with a bankruptcy case and especially of the size of Alitalia. However, not all tranches are equally exposed as structural protections geared towards primarily protecting the interest of senior tranches. The waterfall structure means that junior tranches and equity note holders are more vulnerable to any default event. The Ishka View is that the airline’s administrators have a huge challenge in rescuing Alitalia because of the limitations of its business model, market conditions and rigid labour unions. Alitalia’s fate will be keenly watched by the aviation finance community particularly by the ABS investors.

Alitalia’s dubious track record

Alitalia, Italy’s flag carrier, is one of the oldest airlines in the world but also one with a dubious record when it comes to profitability. In its nearly 60 years of operation, the airline has been in the black only a handful of times. In the last decade, the situation worsened following its failure to adapt to changing market dynamics. Despite having the backing of Etihad Airways since 2014, the airline failed to restructure successfully and create a sustainable business model. Finally, in May 2017, after employees voted against a restructuring plan proposed by Etihad, the airline was put under administration (Italian equivalent of US Chapter 11).

Alitalia’s path to its current fate has been widely covered. Below is a summary of some of the key reasons for its current predicament.

|

Key reasons behind Alitalia’s failure |

|

High cost base making the airline uncompetitive against LCCs |

|

Strong competition from LCCs like Ryanair, Vueling and easyJet |

|

Unaccommodating labour unions unwilling to contribute towards restructuring the airline |

|

Dated business model & inefficient management for failing to adapt the airline in-line with the changing industry dynamics |

|

Macro factors (terrorist incidents in Europe) have made the situation worse for the carrier |

Untested structural protections

There are several ABS that have exposure to Alitalia.

Along with collateral performance and lessee credit standing, a well-defined structure is also instrumental in protecting the investors’ interests. In the absence of sufficient structural protections, defaults events can easily result in senior tranches realising losses.

Structural Highlights

Castlelake Aircraft Securitization Trust 2015-1

Security deposits were not transferred by the sellers (funds managed by Castlelake) to the issuers at the close of the transaction. As such, the issuer does not have any provision against defaulted lease payments. In-order to mitigate this security deposit risk, the transaction has a provision to collect a top-up security deposit reserve in the collective account payments. However, these payments are very junior in priority. The limited protection for maintenance expenses, especially for a portfolio that has a weighted average age of 15 years does make the ABS weaker.

The transaction has a liquidity facility to cover nine months of scheduled interest on Series A and B notes. The liquidity attracts an annual fee of 1% and any drawdowns need to be reimbursed at a rate of LIBOR + 3.0% per annum.

Castlelake Aircraft Securitization Trust 2016-1

Unlike the 2015 issuance, Castlelake’s 2016 ABS issuance has significantly stronger protection for maintenance reserves. The ABS has a heavy maintenance reserve account especially for all but one of Alitalia’s aircraft in addition to a maintenance support account.

The transaction has a liquidity facility to cover nine months of scheduled interest on Series A and B notes. The liquidity facility has an annual fee of 2.5% which is to be paid monthly. In addition, any amounts drawn under the facility have to be reimbursed along with interest that accrues at LIBOR + 3.0% per annum.

DCAL Aviation Finance Limited

While DCAL has only two aircraft leased to Alitalia, both are A330-200s and account for a sizeable portion of the total portfolio. DCAL has a maintenance support account, however, the account would not receive any payments following an event of default. DCAL also has a liquidity facility that covers nine months of scheduled interest on Series A and B notes along with certain other expenses and hedge payments. Any withdrawals will attract an interest of LIBOR + 3.5% per annum.

Even though these ABS appear to have sufficient structural protections, including DSCR (debt service coverage ratio), utilisation triggers, liquidity facility, they have rarely been tested with a major bankruptcy or default scenario. Despite the protections, a default event will still stress these ABS e.g. while all ABS has a liquidity facility which is sufficient to cover nine months interest expenses for Class A and Class B noteholders in the event of default, access to the liquidity facility is fairly expensive. As noted above, Castlelake’s 2016-1 ABS has a liquidity facility that charges a 2.5% annual fee. In addition, any amounts withdrawn need to reimbursed at a rate of LIBOR + 3.0% per annum.

Alitalia’s sale process won’t be easy

The Italian government has put Alitalia up for sale while extending a EUR600 million loan for six months. Commissioners have been appointed to oversee Alitalia’s administration process and eventual sale which is scheduled to be completed by October 2017. The government has ruled out re-nationalisation and is keen to sale the airline as a whole. The most likely scenario for the carrier is to emerge from the administration process as a much smaller carrier. This means the airline will have to return several aircraft and sell some of its assets.

The airline’s unions are also likely to object to any redundancies. As part of the administration process, the special commissioners proposed to terminate around 1,400 jobs which includes pilots, cabin crew and ground staff. They believe that such restructuring is essential to make the carrier more attractive for potential buyers. However, the labour unions immediately resorted to strike action that resulted in nearly 200 cancellations. And there are more strikes planned in response to the proposed severances. Unless workers accept a restructuring plan it is very unlikely for current owners to receive a reasonable price for the airline.

News reports suggest that the carrier has received interest from more than 30 potential bidders. In addition, both, Malaysia Airlines and Lufthansa, have also indicated that they would consider acquiring or re-leasing Alitalia’s fleet. Market sources point out that several of Alitalia’s leases are high-yielding. The question is whether these aircraft can be replaced with equivalent high-yielding leases in these ABS transactions. While the expressions of interest are encouraging, without a credible restructuring plan and the cooperation of all stakeholders, Alitalia’s sale process is more likely to end-up as a distressed transaction.

ABS under watch by rating agencies

After Alitalia entered administration, Kroll, a US credit rating agency, reviewed all the ABS exposed to Alitalia. Several ABS are rated by the agency and following its review the agency concluded that the recent administration would not affect the ratings of any ABS. However, the agency will keep Alitalia on the watch and regularly report on the possible eventualities for Alitalia.

The Ishka View

ABS with considerable exposure to Alitalia appear to have provisions for, and have, factored in potential bankruptcies. However, they are yet to be tested with an actual case of the scale of Alitalia. Not all tranches are equally exposed as structural protections geared towards primarily protecting the interest of senior tranches. The waterfall structure means that junior tranches and equity note holders are more vulnerable to any default event. There are a number of challenges in rescuing a carrier like Alitalia. The airline has fundamental issues including a business model that is unsuitable for the current market conditions in Europe. The government has ruled out re-nationalisation and therefore the most likely scenario for the carrier is to emerge from the administration process as a much smaller carrier. This means the airline will have to return several aircraft and sell some of its assets as well. Those aircraft will have to be re-deployed with other carriers. While there have been some expressions of interest from other airlines regarding their willingness to re-lease some of Alitalia’s aircraft, the chances of securing high-yielding lease rates are slim. However, on the positive side, the fact that the airline has received expressions of interest from over 30 potential bidders suggests that there is still hope for the airline to survive. Ultimately, Alitalia is likely to test the structural defences incorporated in these ABS transactions. The question is whether these defences will hold-up and if future ABS issuances will need further protections or not.

Note: This information has been sourced from publicly available sources. Ishka is not in a position to have access to any privileged information regarding Alitalia or any of the ABS. These ABS might have other characteristics which could be their additional strengths and weaknesses. The purpose of this report is not to criticise or judge the creditworthiness of any of the ABS mentioned. As an industry observer, Ishka’s objective is to highlight some of the important elements of key ABS exposed to Alitalia.

Sign in to post a comment. If you don't have an account register here.