Tuesday 29 August 2017

Is Norwegian’s low-cost long-haul model sustainable?

Over the last three years Norwegian Air Shuttle (Norwegian) has embarked on an ambitious path of offering low-cost air travel on long-haul routes. Traditionally, low-cost carriers have limited themselves to serving the short- and medium-haul routes and for good reason. Norwegian has found that offering long-haul low-cost to be very costly. The airline has been buffeted by a spate of recent weak performances and posted an eight-fold y-o-y jump in net losses during 2017. These losses raise the question of how sustainable the long-haul low-cost model really is. One aspect that is routinely ignored when discussing these issues is the opportunity cost of chasing a different business model. To better understand all of the potential costs associated with the long-haul low-cost model Ishka contrasts Norwegian with Hungarian LCC, Wizz Air (Wizz).

Going long in a low-fare environment

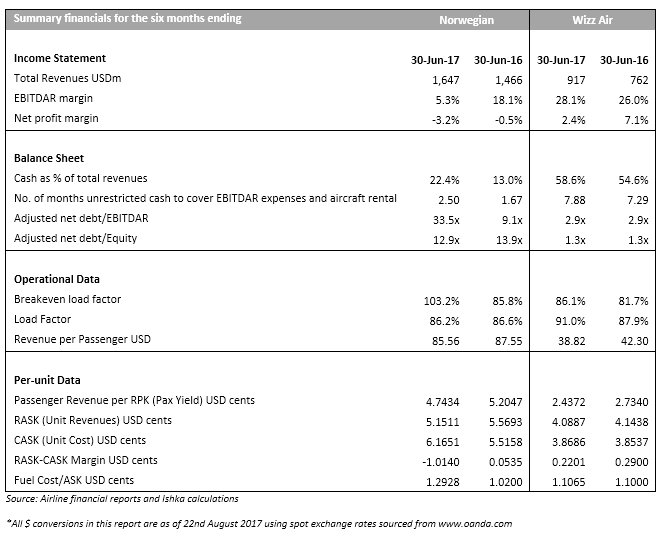

Norwegian posted a net loss of NOK412 million ($52 million) in H1 2017 compared to NOK55 million ($7 million) during the same period in the previous year. While there are several factors responsible for this loss, in summary it all comes down to revenues not keeping pace with costs. Between mid-2016 and mid-2017, the airline has seen its costs per ASK (CASK) climb up by nearly 11% while the revenues per ASK (RASK) has seen a fall of nearly 7.5%. The industry is currently experiencing a low-fare environment and the fall in per-unit revenues is a universal phenomenon.

Even Wizz Air suffered a 1.3% decline in RASK during the same period. However, importantly, the Hungarian carrier’s CASK remained unchanged. Some of the key reasons behind this divergence in cost trends between the two airlines are explained below.

Benefits of a traditional LCC model do not translate to long-haul

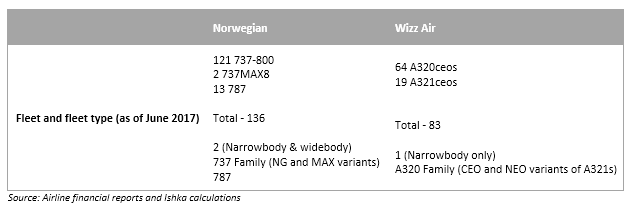

While Norwegian’s approach can be considered as innovative, it still remains unproven. Some of the factors that have made the traditional low-cost model so successful cannot be directly replicated on Norwegian’s model. Long-haul routes mean that the airline needs to have larger aircraft that can fly more passengers over longer distances which cost more to own and operate. This also invariably means Norwegian cannot benefit from the simplicity of operating a single type of aircraft which most traditional LCCs, including Wizz Air, do.

In addition, Norwegian also cannot escape from some of the costs that a typical LCC would avoid e.g. overnight accommodation costs for crew on long-haul routes. This all results in higher cost base than a traditional LCC.

Competition heats up for long-haul

Despite Norwegian’s unique positioning and offering, the airline has started to face increasing competition. Full-service network carriers on either side of the Atlantic which feel most threatened by the airline have responded to Norwegian’s long-haul advances. Some have incorporated low-cost carriers serving the long-haul market or else have offered no-frills ticket options. Eurowings is a Lufthansa’s low-cost brand while IAG recently established Level, which offers low-cost tickets on long-haul routes. In addition, new budget airlines like Iceland’s WOW Air and Denmark based Primera Air are also attempting to tap the transatlantic segment. A growing influx of airlines providing low-cost capacity on the Transatlantic route further is starting to impact yields. In comparison, Wizz Air appears to have much less competition relative to Norwegian. Apart from Ryanair, the next largest airline in the CEE region is easyJet with a 6% market share.

Norwegian operates primarily out of Western Europe while nearly all of Wizz Air’s bases are spread around the CEE (Central and Eastern European) countries. From a macroeconomic perspective, Eastern Europe has more potential for growth which bodes well for Wizz Air. Another aspect that works out in Wizz Air’s favour is the labour market. Since the airline operates primarily out of CEE countries it means it has access to relatively cheap labour compared to Norwegian which is predominantly based in more expensive labour markets. This all contributes to keeping the costs low giving Wizz Air a competitive advantage compared to its rival and one that is not easily available to Norwegian.

Norwegian will need to accept the reality that despite being an innovator, others have quickly imitated their approach. Given the capacity on some of its routes, and the cheaper airline seats available in the market, the Norwegian airline probably will not be to sustain its original ambitious growth plans.

The Ishka View

For LCCs, cost efficiency is key as they have significant downwards pressures on ticket pricing. Profit maximisation depends to a great extent on cost management. Norwegian’s ambitious growth plan and unique business model is a departure from a traditional LCC business which is proving challenging in current low-fare environment. However, while the increased losses during the first half are clearly worrying, it is too early to dismiss the airline’s long-term ambitions. In the present scenario, Norwegian’s business model is increasingly diverging from Wizz Air, however, it is still interesting to speculate on how the Norwegian carrier could have slashed its cost base if it had remained as a traditional low-cost carrier. Wizz Air’s success has proved that a well-funded airline can carve a niche within Europe against Ryanair and easyJet.

Having said that, there is ample opportunity in what the Norwegian carrier is pursuing. In Ishka’s view, there is substantial potential in Norwegian’s model despite its many challenges. However, in-order to reap the benefits in the future, the airline will need to take some difficult decisions in the short-term. Growth plans need to be revisited and re-aligned in-line with current market conditions – there is simply too much cheap trans-Atlantic capacity- and costs need to be cut. If Norwegian hopes to serve the long-haul for the long-term the carrier has to cut costs, and curb capacity.

Sign in to post a comment. If you don't have an account register here.