in Airline trends & analysis , Aviation Banks and Lenders

Tuesday 7 January 2020

Airline bonds Q4 2019: $8.7bn raised to end $31.1bn year

Airlines around the world took advantage of low-interest rates to raise $8.7 billion through 48 unsecured bond issuances in Q4 2019. In total carriers issued $31.1 billion of unsecured bonds in 2019 in various currencies but the vast bulk $21.1 billion (68%) were short-term Chinese Yuan-denominated bonds issued by Chinese carriers with maturities shorter than a year.

Ishka’s calculations exclude bonds issued with company guarantees, government guarantees and EETCs.

2019 overview

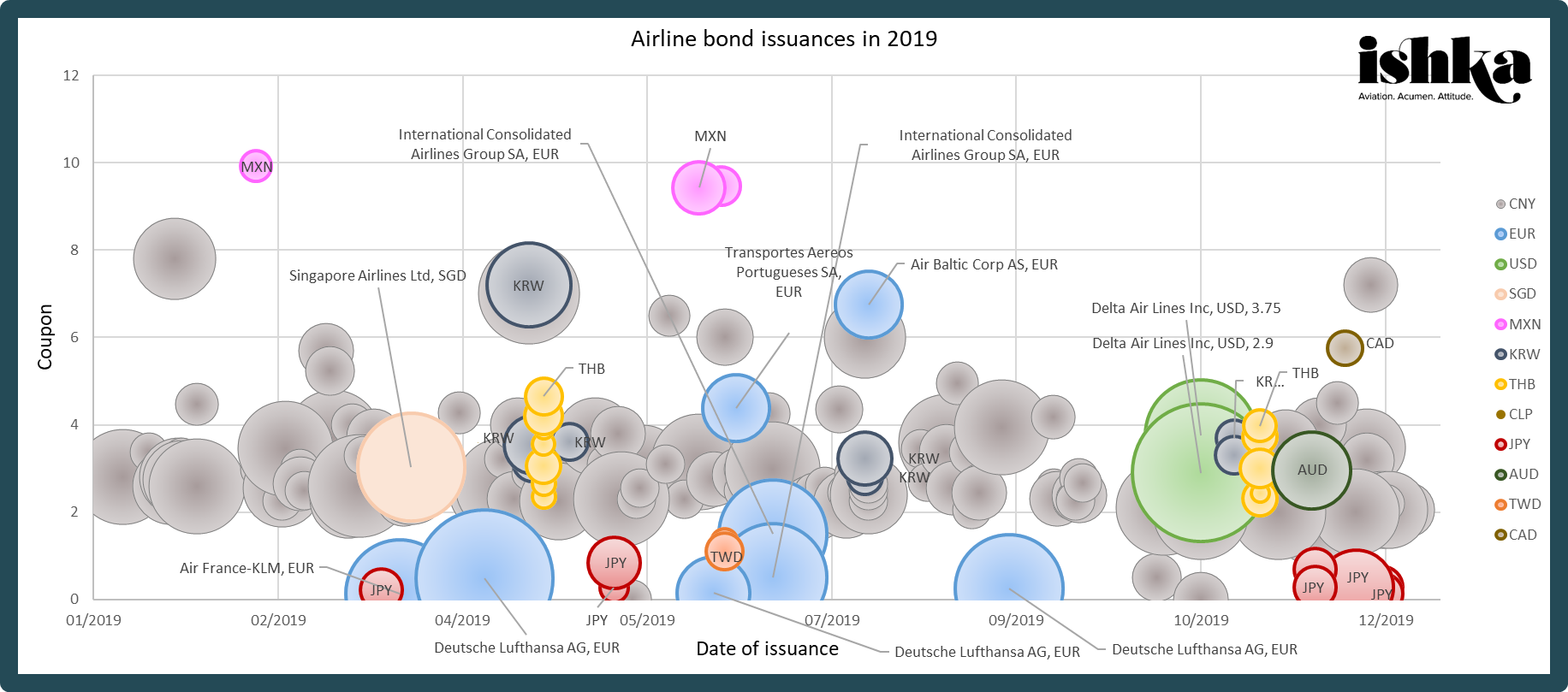

Source: Bloomberg. Data pulled 6th January 2020. Unsecured and senior unsecured airline bond issuances between 1/1/2019 and 31/12/2019. EUR, USD and SGD issuances labelled. For further details download the full table.

Click here to download the data behind the chart.

The $31.1 billion worth of unsecured bonds issued by airlines in 2019 comprised 187 issuances in 12 currencies. The Euro-denominated bond market saw, after Chinese carriers, the most activity with €3.43 billion ($3.67 billion) in issuances during the period by carriers including airBaltic, TAP Air Portugal, Air France-KLM, IAG and Lufthansa. Activity in other currencies included two sizable unsecured USD issuances by Delta in the fourth quarter and comparatively smaller $1.03 billion and $920 million worth of issuances in KRW in JPY respectively.

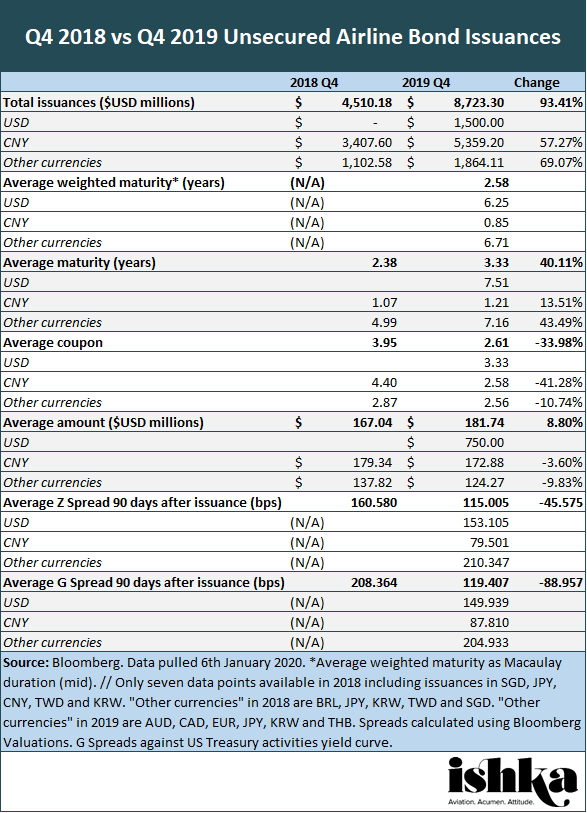

Q4 2019

Click here to download the data behind the chart.

The 48 issuances in Q4 2019 represented a 77% increase from 27 issuances in 2018 by number of issuances. The average amount issued also increased from $167.04 million in the last quarter of 2018 to $181.74 in the last three months of 2019. Due to a lack of data points for Z spreads and G spreads in 2018, meaningful comparisons could not be established.

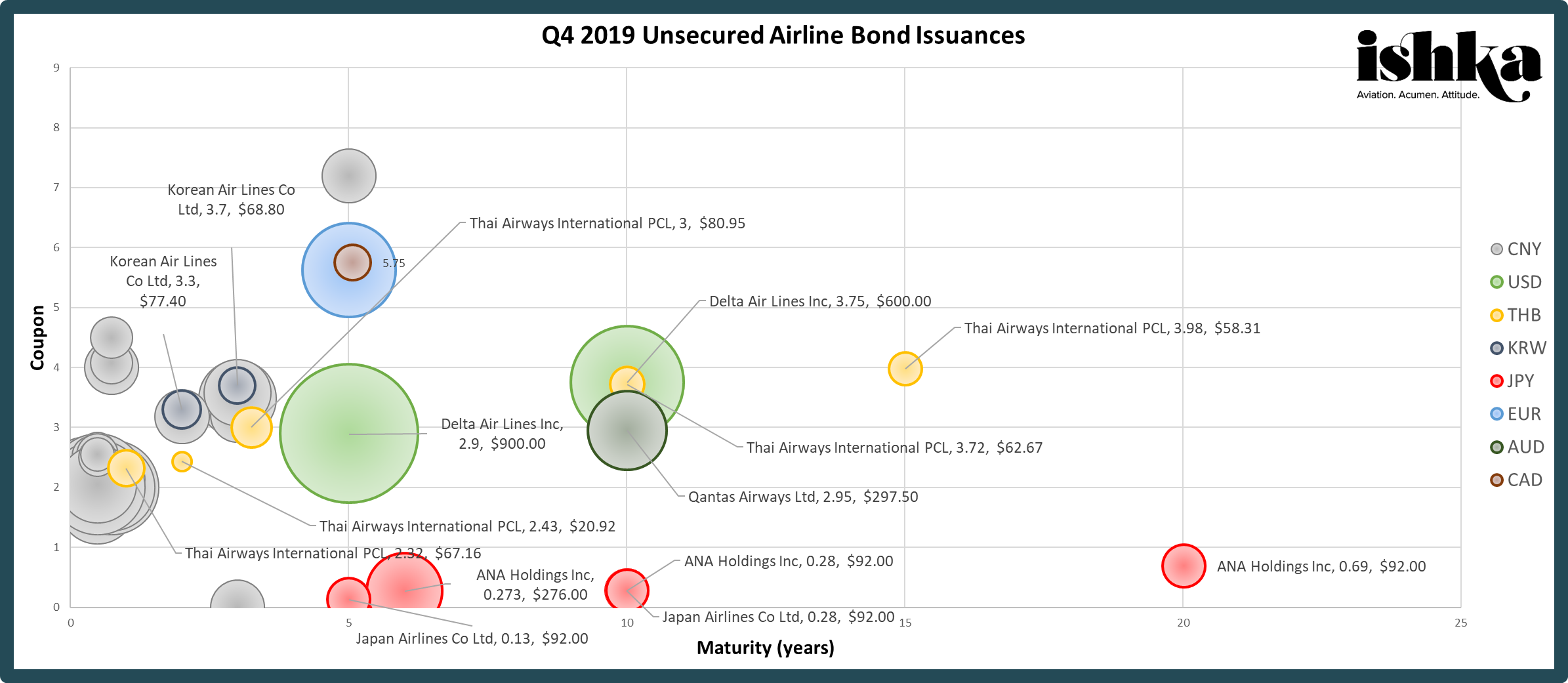

Notable unsecured issuances in Q4 2019, highlighted in the graph below, include two bonds by Delta Air Lines (Delta) amounting to a combined $1.5 billion, five by Thai Airways in various maturity lengths (the second wave of issuances in 2019 after another series in Q2), and five issuances by ANA Holdings and Japan Airlines representing the bulk of JPY notes issued for the year (approximately 70%).

Source: Bloomberg. Data pulled 6th January 2020. Unsecured and senior unsecured airline bond issuances between 1/10/2019 and 31/12/2019. Only non-CNY issuances labelled. For further details download the full table.

Click here to download the data behind the chart.

Delta’s $1.5bn issuance

Delta’s $900 million and $600 million issuances, due in 2024 and 2029, were the biggest and third-largest unsecured bond issuances by any airline in 2019 – the second spot held by Lufthansa’s €800 million ($896 million) 0.492%-coupon senior unsecured issuance in April.

Delta’s bond issuances (DAL 2.9 10/28/24 and DAL 3 ¾ 10/28/29) were chiefly used to raise funds to help Delta’s acquisition of 20% of the common shares of LATAM (estimated to be worth $1.9 billion in a bond prospectus dated 21st October 2019) in addition to investing an additional $350 million into the Latin American carrier. Delta also agreed to acquire four A350s from LATAM’s orderbook with deliveries through 2025.

Other notable issuances

Avianca, Norwegian, SAS and Virgin Australia also came into the airline bond market in the last quarter of 2019 with convertible bonds, private placements of secured debt and notes backed by company guarantees.

Avianca triggered an automatic exchange of $484 million in aggregate principal of May 2020 secured bonds for secured bonds now due in May 2023, as part of its ongoing financial restructuring. Norwegian on 5th November 2019 completed capital raising through a private placement of new shares and convertible bonds of $150 million with a fixed interest of 6.375% payable semi-annually. The bonds are senior unsecured convertible bonds due 15th November 2024.

SAS issued SEK 1,500 million ($159 million) perpetual bond. SAS said it would use the net proceeds from the issue for its general corporate purposes, “including refinancing of financial indebtedness and funding of aircraft acquisitions.” Virgin Australia completed an AUD $425 ($292 million) private placement backed by company guarantees and a 8.125% coupon due in 2024. The airline also issued an AUD $325 ($223 million) 8% coupon bond backed by a company guarantee due in 2024 to finance the buyback of its Velocity frequent flyer programme.

Separately, Reuters reported on 18th October 2019 that Cathay Pacific shelved plans for its first US dollar bond issuance since 1996 due to civil unrest in Hong Kong. The airline reportedly started meeting investors in Hong Kong and Singapore in September. Sources told Reuters the issuance was to be unrated and that Cathay was willing to pay 200 basis points over the US treasury rate to secure three-year or five-year funding.

The Hong Kong-based carrier did, however, issue an HKD $800 ($103 million) domestic bond with company guarantees due in 2022 during the quarter.

The Ishka View

Falling interest rates and continuing strong profitability by airlines around the world have encouraged airlines to continue tapping the capital markets. 2019 was an active year for unsecured airline bond issuances particularly for Chinese airlines. Away from China, several airlines ventured into the capital markets for the first time last year with unsecured notes, such as airBaltic and Volaris, while a few medium-sized issuers returned, including Viva Aerobus for its fourth outing since 2015. Q4 2019, Delta’s large issuance shows the ongoing interest by USD investors in unsecured airline paper when the airlines chose to access that market.

Think we are missing something? This is the second of a series of quarterly Insights reports summarising unsecured airline bond issuances (see earlier Insight: ‘Airline bonds Q3 2019: $7.1bn raised amid shrinking maturities’). For any feedback or relevant information you would like to share, please email the analyst at eduardo@ishkaglobal.com or the editor at dickon@ishkaglobal.com.

Sign in to post a comment. If you don't have an account register here.