Wednesday 21 October 2020

Wizz Air CEO: New opportunities as retreating competitors leave “vacuum”

Wizz Air CEO Jozsef Varadi reaffirmed the airline’s expansion plans this week as many of its competitors are “contracting in a big way and creating a market vacuum behind them” due to the effects of Covid-19.

Speaking at the Aviation Club UK, a professional association, the airline boss stated that Wizz will be one of the airlines to increase capacity fastest after travel restrictions subside: “As far as Wizz Air is concerned, the moment restrictions fall away I think we're going to be back to 2019 levels.”

However, he warned that, moving forward, the airline industry will be much smaller and with fewer players. Varadi stated that airlines operating a hub-and-spoke intercontinental model and relying on business traffic could take “four, five, six, seven years” to return to 2019 traffic levels in comparison to point-to-point ultra-low-cost airlines, like Wizz Air where recovery would be quicker.

In addition, the airline CEO stated that the considerable volume of debt offered to airlines by their governments is “distorting” the competitive playing field. “Let's not be naïve. I mean, all the debt now put into the industry will never get repaid. It will have to be converted into equity, and then here you go again: you will be dealing with governments and nation-states,” he added.

Ishka estimates that governments are preparing or executing $138.36 billion in confirmed bailouts or assistance measures for airlines globally (see Insight: ‘Covid-19 bailouts: Govt support for Malaysia Airlines dims as owner hints at liquidation’.) Varadi believes governments will seek to support flag carriers reducing the number of immediate airline bankruptcies, but warned that many smaller private airlines would still likely go bust.

Wizz’s expansions

Wizz Air is one of the few airlines to have expanded its operations since the onset of the pandemic. The airline has kept the bulk of its bases open and has expanded into new regions. Wizz opened more than 200 new routes in the last five months.

In October the ULCC airline launched a branded joint venture in the United Arab Emirates, Wizz Air Abu Dhabi, and opened bases in Albania, Cyprus, Italy, Ukraine, Germany, Romania and Russia. It is also one of the few airlines expanding in the UK, an “incredibly important” market where several airlines such as Monarch and Thomas Cook recently stopped operating. The airline obtained a UK AOC in 2018 operating initially out of Luton. It now has three bases in the UK, including Gatwick since August.

Varadi states that while Wizz Air remains focused on Central Europe, it is opportunistic in its expansion. The carrier sees “unprecedented” new airport opportunities as airline competitors retreat from routes and cut capacity. He adds that Wizz’s “cash resilience” and low-cost model means that it is in a better position than many of its rivals to exploit these opportunities.

“Our competitors are hit even harder [by the crisis]. It is like the saying: ‘when you meet a bear in the forest you don't have to run faster than the bear, you just have to run faster than someone else’ - and I think this is what we are doing here.”

Aircraft deliveries

One of the ways Wizz plans to outpace its rivals is through investment in new-technology aircraft. Wizz has been one of the few airlines to take aircraft deliveries through the pandemic. The airline received 12 aircraft from Airbus this year and added 40 aircraft in the past 15 months. Varadi states Wizz wants to lower its unit cost further, and the crisis presents an opportunity to continue that process with new-technology aircraft with cheaper operating costs, while rivals see their fleet age.

“The industry has stopped new aircraft deliveries, essentially all airlines have stopped aircraft deliveries or deferred aircraft orders. So, estimates are their fleet is going to age, and their cost is going to creep significantly getting out of Covid-19. So, this is essentially a scissor effect in our favour. Not only that we are just reducing our single unit cost versus industry, but that industry is going to increase its unit cost,” he added.

The Ishka View

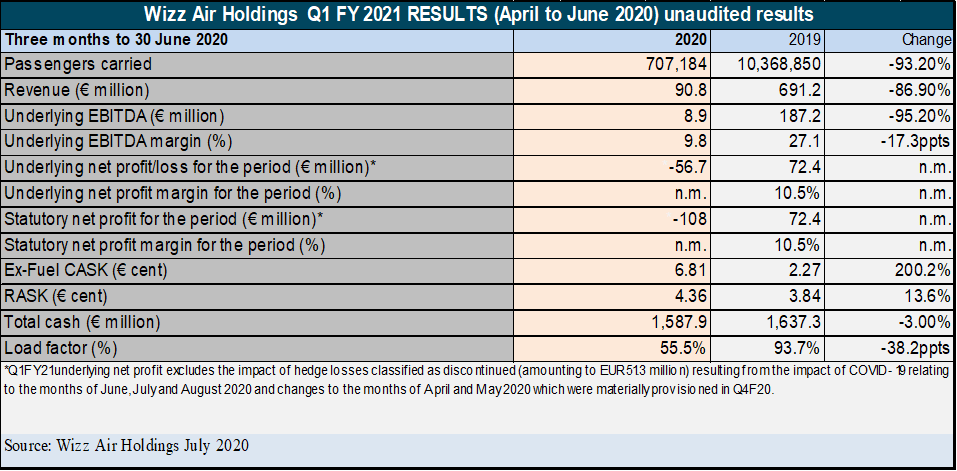

Wizz has not been immune to the crisis, the airline reported a $56.7 million loss in its last quarterly report in June. But the ULCC is one of Europe’s more resilient airlines. In an earlier report, Ishka argued that Wizz is better placed than many of its rivals with regards to the pandemic (see Insight: ‘Airline Credit Profile: Why is Wizz Air among the best-placed airlines to benefit from the COVID-19 crisis?’). Given its cash availability and expansion ambitions, it is perhaps not surprising that lessors are still competing keenly to win Wizz sale/leaseback mandates. Most bankers and lessors that have spoken to Ishka have Wizz in their wish list of 25-30 financeable airline credits.

The airline boss was vocal about the ‘distortion’ stemming from governments offering emergency debt to airlines, which suggests that Wizz is not planning to avail itself of more state support any time soon. The carrier accessed government loans from the Bank of England’s Covid Corporate Financing Facility (CCFF) earlier this year, confirming on 3rd June that it had raised £300 million ($379.5 million) through the scheme. What is clear is that Wizz is set to emerge as a very different airline after Covid-19 subsides.

Sign in to post a comment. If you don't have an account register here.