in Airline trends & analysis , Aviation Banks and Lenders

Thursday 1 April 2021

Hainan Airlines’ early creditor calls, Thai Airways faces stock’s delisting, Norwegian restructuring scheme endorsed

In this week’s On Watch report, Ishka provides updates on airlines from Ishka’s Restructuring list.

Hainan Airlines' holds early creditors calls

Work has begun on the Hainan Airline restructuring. HNA Group is the first private Chinese airline group to go bankrupt and the largest airline bankruptcy to have occurred within China to date.

The first formal creditors’ meeting is scheduled for the 12th April 2021, however, Ishka understands that the administrators have already held some informal calls with creditors over the weekend, but that not all lessors were invited to participate. HNA did not respond when contacted by Ishka.

Accounts differ as to the total volume of claims. Ishka understands that the total amount of debt claimed against HNA Group’s three listed companies is already up to 400 billion yuan ($61 billion), with Hainan Airlines reportedly responsible for almost half of that total and rising. A Shanghai stock exchange document filed on 30th March 2021, confirms the carrier’s creditors are claiming about 201 billion yuan ($36 billion).

In a stock filing on 30th March 2021 the carrier offered another warning that it may be delisted from the Shanghai Stock Exchange if the firm’s liabilities continue to exceed its assets at the end of the 2020 audited period.

Thai Airways challenges lessor claims

Thai Airways is challenging $7.4 billion in claims from dozens of aircraft lessors and engine service provider Rolls-Royce Holdings, according to a document seen by Bloomberg on 18th March 2021.

The dispute is for 192 billion baht ($6.3 billion) claimed by 48 lessors including BOC Aviation and SMBC Aviation Capital, and another 33 billion baht ($1.59 billion) that Rolls-Royce says it is owed for maintenance services. The carrier claims it is not liable for the money owed because it concerns future expenses and was incurred after the carrier received bankruptcy protection from a Bangkok court. Thai Airways did not respond when contacted by Ishka.

Separately, the carrier said in a filing to the Stock Exchange of Thailand that it expects to generate profits in 2023 and that net assets will be greater than zero in 2030. This comes as the Stock Exchange requires the carrier to have a positive net assets balance before March 2024 or faces a stock delisting.

Norwegian’s restructuring scheme approved

Norwegian Air Shuttle’s shareholders reportedly voted in favour of the company's debt restructuring plan on 18th March 2021, E24 reported on the same day. From the meetings, 99.6% of the shareholders who had connected or submitted a power of attorney said yes to Norwegian's latest rescue plan, and none of its creditors challenged the proposed restructuring.

Additionally, the carrier's examinership was approved on 26th March by an Irish High Court Judge, according to a Norwegian stock filing on the same day. “We can now go forward with the reconstruction in Norway and initiate a capital raise", said Jacob Schram, Norwegian’s CEO.

Separately, Norse Atlantic Airways, a new carrier trying to fill the transatlantic market gap left by Norwegian Air Shuttle, signed lease agreements with AerCap for nine B787s, AerCap said on 29th March. The leased aircraft are three B787-8 and six B787-9, previously operated by Norwegian.

Other updates

- According to SA Express’ liquidator, Aviwe Ndyamara, the carrier's anchor investor, Fly-SAX, reportedly failed to pay the agreed purchase price of R50 million ($3.42 million) of the airline last week, Moneyweb reported on 30th March. The investor’s failure to provide the bank guarantee means the airline is now facing final liquidation.

- Avianca Holdings said in its 2020 annual report that it rejected 12 aircraft leases relating to four ATR 72, four Airbus A320, two Airbus A321, and two Airbus A330, which have been returned to the respective lessor. Additionally, the carrier reported $1.71 billion in total revenues in 2020 and a net loss of $1 billion.

- Chile’s LATAM Airlines is open to signing an exclusive contract with e-commerce operator Mercado Libre in Latin America as it looks to boost its cargo unit due to weak passenger demand, an executive told Reuters on 26th March 2021.

- Smartwings announced on 26th March 2021 that it signed a loan agreement with a syndicate of banks led by UniCredit for a CZK 2 billion ($90 million) with a maturity of six years, as part of the Czech government's Covid Plus program.

- The High Court of Justice in London has set the 17th June 2021 as the date for the hearing of the application from AirAsia X and AirAsia X Leasing Two to set aside the judgement obtained by BOC Aviation to pay the creditor $23.37 million, The Edge Markets reported on 22nd March 2021.

- The High Court confirmed on 26th March 2021 the winding-up of Air Namibia, a month after a provisional order was issued for the airline to be liquidated, The Namibian reported on 29th March.

Click here to download the complete tables with the latest updates.

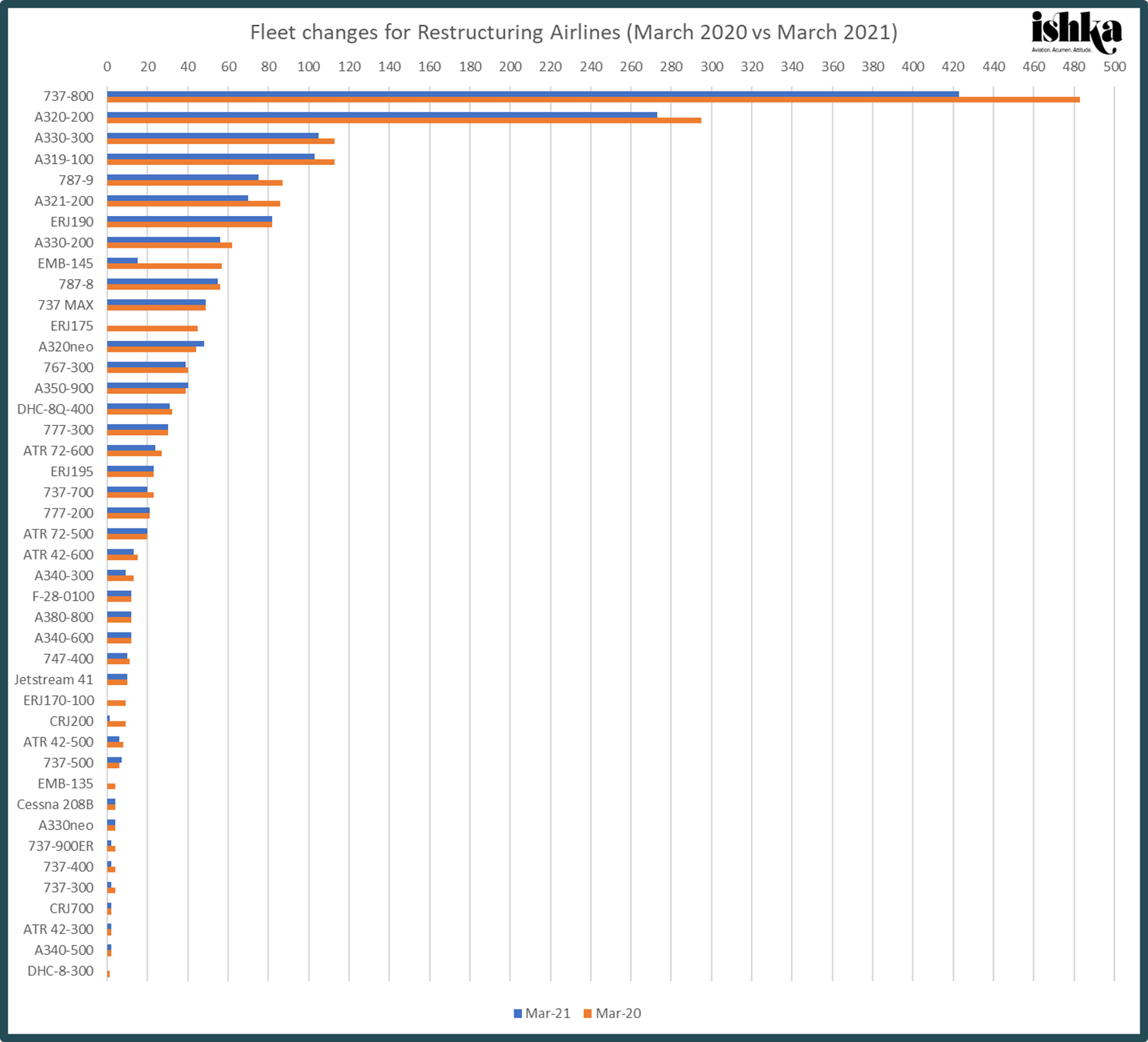

Source: CAPA Fleets

Note to the reader: The Net Aircraft change calculations will now exclude airlines that have emerged from court-led restructuring processes (Ravn Air, Braathens Regional Airlines, Miami Air International, Virgin Australia, CityJet, Comair, Virgin Atlantic Airways).

Click here to download the complete tables with the latest updates.

The Ishka View

HNA Group’s restructuring poses a lot of unknown for creditors and lessors. The total volume of claims for the HNA Group is still being tallied but already exceeds $36 billion for Hainan Airlines alone. The sheer complexity of unwinding HNA Group’s various holdings and creditors' claims means there is a risk that a restructuring could take years to complete.

Hainan Airlines, historically a well-run airline business, is arguably the golden goose of its embattled parent despite the considerable level of debt imposed by the HNA Group. Sources indicate it is not inconceivable that the Chinese state may choose to intervene and split the Group’s airlines between various state carriers. To date there have been very few airline bankruptcies in China, and none which approach the size of Hainan Airlines. Lessors, therefore, have no real precedents to indicate how the airline might eventually choose to treat its leased assets.

Lessors will be hoping to keep their aircraft in place with the airline for as long as possible, but rumours of early and informal creditor calls indicate the unpredictable nature of the restructuring.

Click here to download the complete tables with the latest updates.

Sign in to post a comment. If you don't have an account register here.