Wednesday 10 November 2021

Aircraft ABS issuers price $3.4bn flurry of deals ahead of Thanksgiving

Five separate aircraft ABS transactions totalling approximately $3.4 billion have priced in the last seven days – signalling a notable revival of the aircraft ABS market and marking the busiest week to date for the asset class.

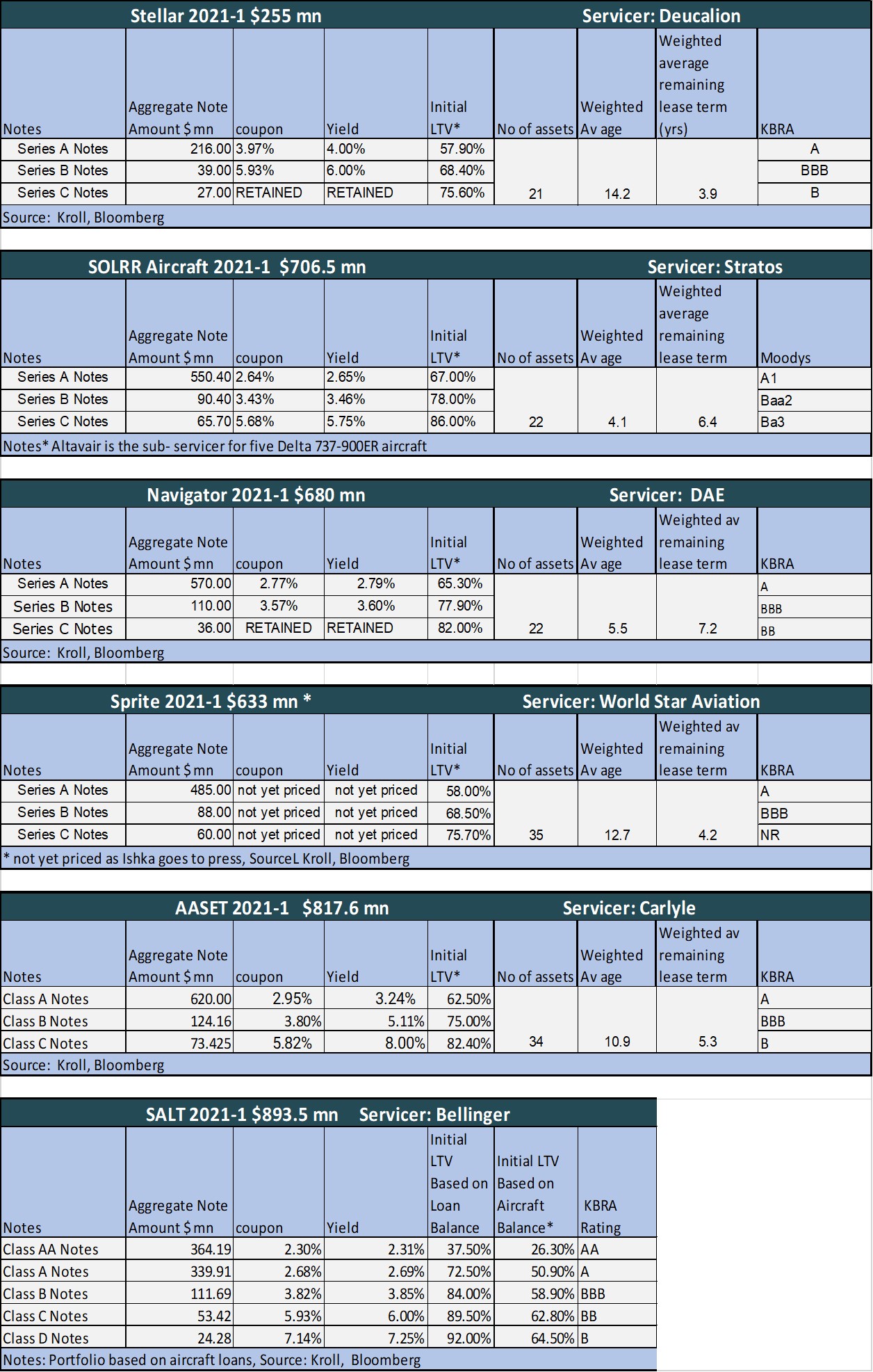

A sixth aircraft ABS deal, the $633 million Sprite 2021-1, is also in the market but was yet to price as Ishka goes to press. In total, five of the ABS issuances are backed by aircraft leases with one debut ABS, SALT 2021-1, funding a portfolio of secured aircraft loans – a first for the sector.

Financiers explain that October and November have always been busy months for ABS issuances as large institutional investors near their end-of-year targets, making the start of Q4 usually an extremely efficient time to launch an ABS. However, sources admit the last 10 days has been unprecedented for the asset class.

“A lot of sponsors have been chasing the pre-Thanksgiving sweet spot but this has been the busiest week in aircraft ABS history with five simultaneous deals in the market, several of which are pricing at very tight spreads,” explains one source familiar with the market.

Panellists at Ishka+’s North America conference admitted that documenting and structuring billions of complex aircraft ABS securitisations within a short period has placed a “strain” on the ratings agencies as well as some bankers. Because of the shortening window of issuance before Thanksgiving some financiers speculate that further aircraft ABS issuances could be delayed to the start of 2022.

The flurry of new deals during Q4 means the total volume of this year’s aircraft ABS issuances has exceeded the 2018 tally of approximately $7.5 billion (including engine and business jet ABS deals), making 2021 the second-largest year for issuances behind 2019. This is in marked contrast to 2020, when the market effectively closed for new aircraft ABS issuances by March as the coronavirus pandemic took hold in Europe and the US.

The return of mid-life aircraft ABS and Stonepeak’s aircraft loan ABS debut

The recent wave of aircraft ABS varies widely in terms of credit quality of the underlying lessees, the average weighted age of the aircraft, and the average remaining lease term.

The average age of the assets and the quality of the underlying credits ranged from the 4.1 years of SOLRR 2021-1 to the 14.2 years of Stellar 2021-1 (see table below). Several ABS deals have mid-life portfolios in sharp contrast to ABS issuances in the first half of 2021, which were predominantly younger aircraft portfolios (see Insight: ‘New aircraft ABS deals achieve record pricing as market ‘bounces back’’).

One source comments that recent ABS issuances range from effective refinancings to new issuances based on leased aircraft acquired during the pandemic. They include one novel debut, ABS SALT 2021-1, which securitises secured aircraft loans for the first time.

At $893.5 million SALT 2021-1 is also the largest aircraft ABS since Castlelake’s $916 million CLAST 2016-1. Ishka understands that the deal is being used to refinance Bellinger and Stonepeak Infrastructure Partners’ acquisition of National Australia Bank (NAB) portfolio in May 2021. Bellinger Aviation is the servicer on the transaction which is secured by 26 loan facilities comprised of 116 loans – all bar one of which are secured. Sources indicate that there was an unsurprising and significant overlap from aircraft lease ABS buyers, many of whom, were familiar with the counterparties in the underlying loans.

Speaking on Ishka+’s Capital Markets Catch-up podcast Clay Smith, a partner at advisory firm Split Rock, stated the deal could become the “preferred way forward” for many non-bank lenders, as the structure incorporated collateral loan obligation (CLO) technology but crucially allows lenders to include both syndicated as well as direct loans.

Record pricing

As Ishka goes to press, five of the aircraft issuances have priced (see table) while the latest ABS, the $633 million Sprite 2021-1, was yet to price. Pricing varied considerably between deals but a mixture of strong portfolios and a favourable rate environment has allowed some of them to price at record spreads.

SOLRR 2021-1 notably scored extremely tight pricing, achieving a spread of 150bps on the A notes and a spread of 230bps on the B notes. Ishka understands that the A notes achieved an oversubscription of x3.3, the B notes x9.5, and the C notes x1. The deal is understood to be the “tightest three-class issuance” aircraft ABS issuance to date from an implied spread basis across all three classes of notes, according to one source.

The Ishka View

This was a significant week for aircraft ABS with a record volume of transactions pricing. The rush of issuances and the resurgence of mid-life aircraft ABS portfolios indicates a far quicker revival of the aircraft ABS market than many had expected given the impact of the Covid-19 pandemic on commercial aviation.

Historically, sponsors have used the ABS market to fund portfolios of older aircraft. The recent pricing of several mid-life portfolios, most notably Stellar 2021-1 (see Insight: Avenue prices older aircraft ABS Stellar 2021-1), shows ABS investors are now open to older aircraft portfolios - particularly if it grants them Investment-grade rating equivalent rating yield on senior notes.

However, Ishka notes that there appears to be reduced engagement from investors for C Class notes since the onset of the pandemic, even for some of the younger aircraft transactions. Before the pandemic, C Class notes had managed to achieve significant oversubscriptions, but recently several ABS issuers have opted to retain their C notes. In the first half of the Covid-19 crisis in 2020, many legacy aircraft ABS transactions tripped their debt service coverage ratios (DSCR) with cash diverted to the senior notes. Investors appear to have responded to this trend by largely sticking to senior notes for aircraft ABS, for now.

Sign in to post a comment. If you don't have an account register here.