in Airline trends & analysis , Aviation Banks and Lenders

Tuesday 25 August 2020

State aid vs revenues: Which airlines have secured generous state aid?

A significant portion of the world’s airlines have received state financial support in recent weeks to help them through the Covid-19 crisis. But as governments around the world rally to keep home carriers afloat, one thing is becoming clear: not all airline bailouts are created equal.

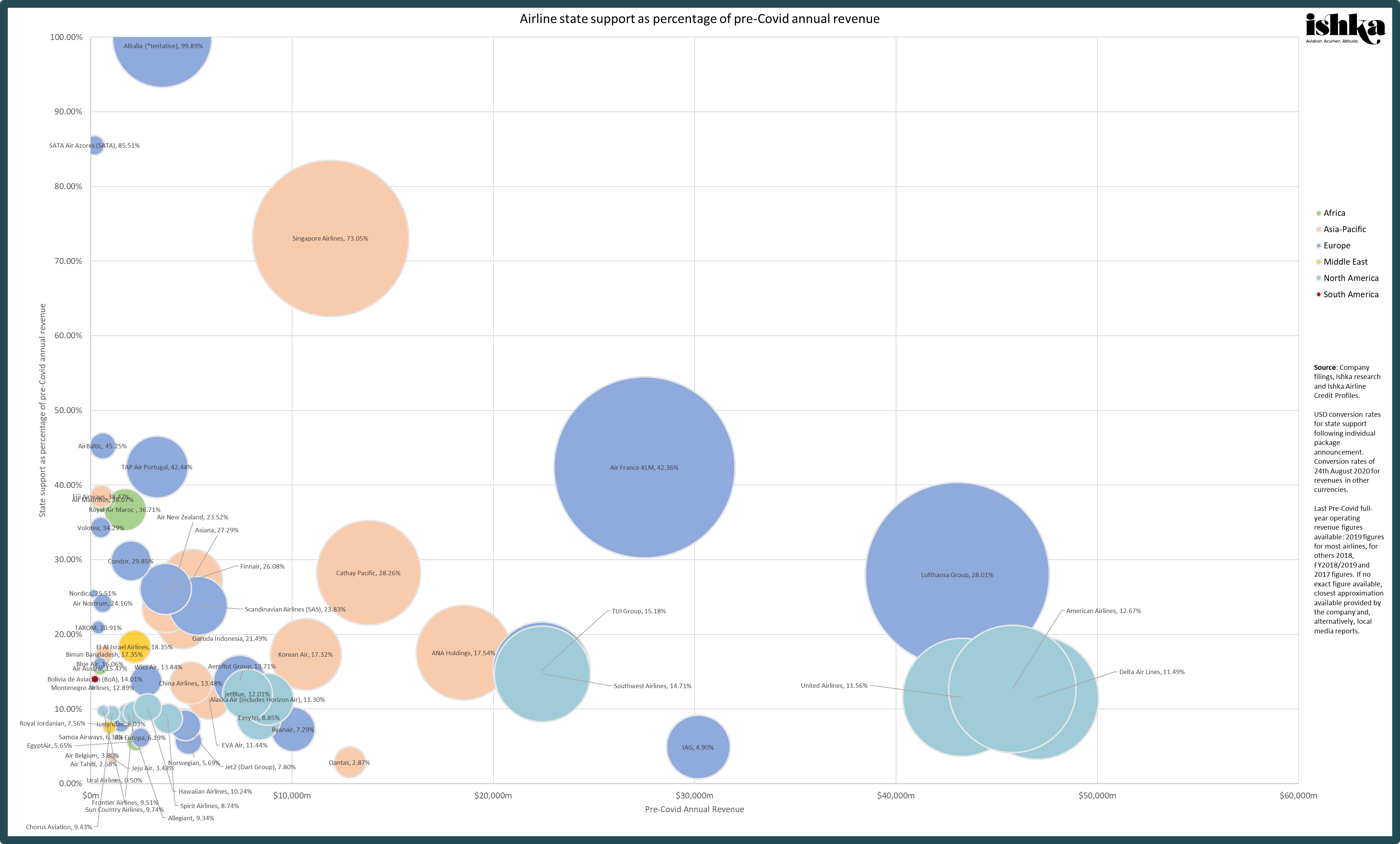

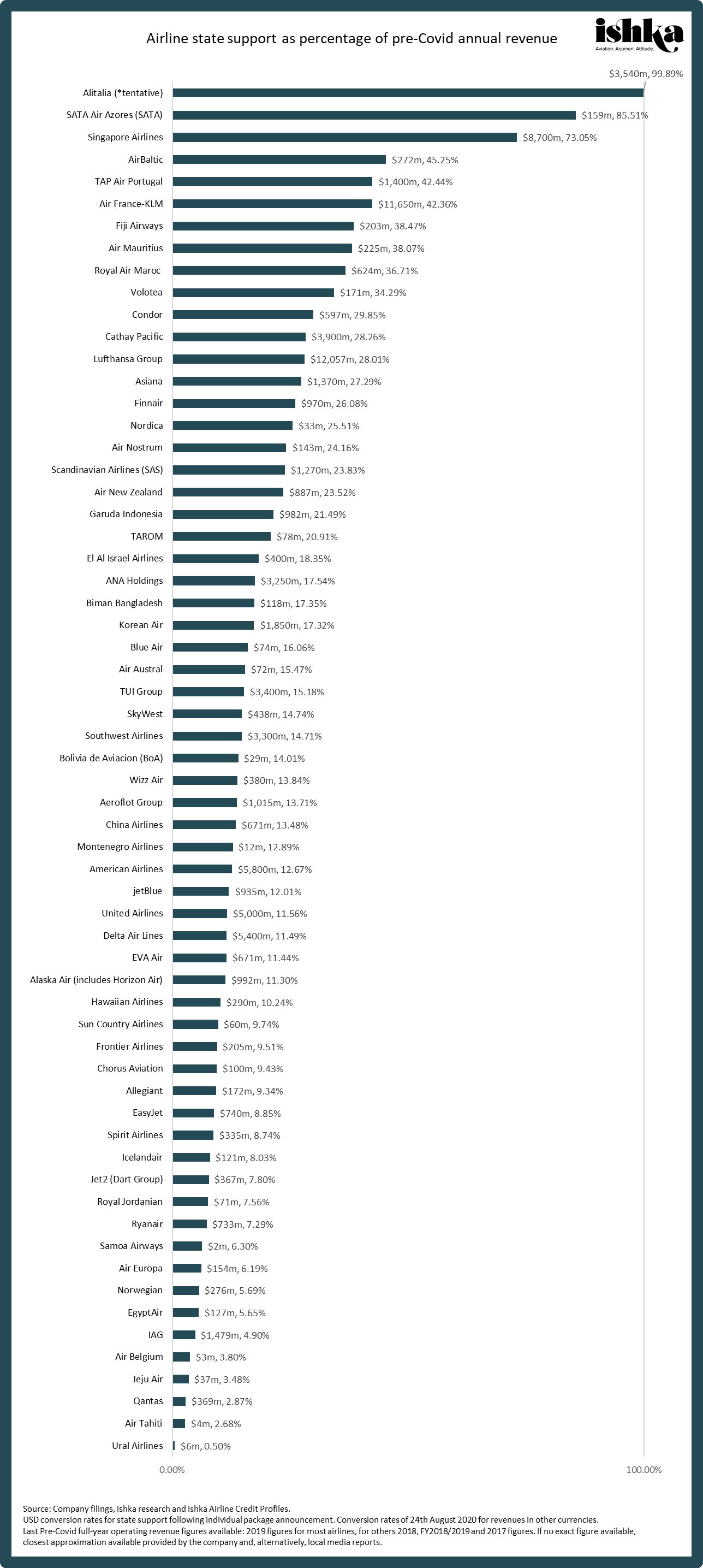

Ishka compares state aid packages for 62 airlines and airline groups against their most recently reported pre-Covid annual revenues to find out which carriers are getting a more generous deal for their size.

62 airlines ranked

Click on the image to see a larger size.

Click here to download the table.

The above list contains 62 airlines ranked by confirmed state support as a percentage of their most recently reported pre-Covid annual revenue. For most companies, total revenue comprises of or is largely made up of the airline’s operating revenue but there are some exceptions, such as the TUI Group, Icelandair Group or Dart Group, which also derive revenue from holiday packages or hotels.

Alitalia, which tops the list, is the only airline for which the state support figure is yet to be confirmed. Italy's government intends to inject fresh capital worth at least €3 billion ($3.24 billion) into a new company created to take over the assets and operations of Alitalia, which is technically bankrupt. However, the European Commission, which needs to approve this plan as well as a €250 million ($295 million) advanced payment decreed in August, has informally expressed some reservations about the Italian plan’s compliance with EU state aid laws.

The 62 carriers include 27 airlines from Europe, 15 from Asia-Pacific, 13 from North America, four in Africa, two in the Middle East and one in South America. State aid for airlines in Europe averages near 20% of their pre-Covid annual revenues, followed by 18% in Asia-Pacific, 12% in North America and 16% in Africa. The less representative samples of the Middle East average 12% while the sole South American carrier (Bolivia de Aviacion) features mid-list with 14%.

Bailouts for the 62 airlines amount to $88.68 billion, which is smaller than the $125.82 billion in confirmed bailouts or assistance measures for airlines globally, including for a smaller number of carriers for which no recent revenue data was found (see Ishka’s airline bailout series for a complete list of state aid measures).

A national affair

Click on the image to see a larger size.

Click on the image to see a larger size.

Click here to download the table.

The above chart shows several European carriers (in dark blue) receiving proportions of state aid that are marginally higher on average than airlines in other regions. Generally speaking, however, a government’s willingness to extend financial aid appears to hinge on the carrier’s unique situation and its national priorities rather than the competing measures of neighbouring countries.

The exception to that is North America, where the amount allocated to airlines so far via the US CARES Act’s Payroll Support Programme (PSP) follows one criterion,: maintaining an even competitive environment. It is worth noting that airlines in countries with universal wage subsidies for furloughed employees did not always report these as part of their state aid packages.

The Ishka View

This is an early analysis for a topic with many moving parts, as each individual state aid package contains a different mix of debt, equity, grants or other relief measures and is tailored to the different needs of each carrier. In certain cases, such as in the US, some carriers may have only received part of what they are eligible to obtain or may choose to withdraw only a portion of funds available. In other cases, the airline may be in conversations for further aid which could be larger than initial allocations.

Nevertheless, measuring state aid against the airline’s pre-Covid revenues offers some clues as to how far state support can go in helping an airline through a partial or full grounding. State bailouts so far have been most generous in developed markets and for dominant carriers. While flag carriers have been a higher priority for governments in many nations regardless of size, the Top-20 of the list contains the likes of Singapore Airlines, Air France-KLM, Lufthansa Group or Cathay Pacific. However, this order of magnitude could change before the end of the year as countries grant further aid to private airlines (US airlines in particular) and more large state carriers are recapitalised.

Sign in to post a comment. If you don't have an account register here.