Tuesday 28 January 2020

Outbreak: The airlines most at risk of coronavirus

Airlines are readying themselves for the potential impacts of a new SARS-like virus spreading from China. 2019-nCoV (coronavirus) has seen aircraft carriers disproportionally punished in stock markets and governments either advising or enforcing travel reductions to China.

This week, Hong Kong has ordered for flights to, and from, mainland China to be halved in response to the deadly outbreak. The US Centre for Disease Control and Prevention has also advised against all non-essential travel to China.

As Ishka goes to press, there have been 4,682 reported cases of coronavirus in seventeen countries; 106 of these cases have proven fatal. Cases have been reported as far as the United States, France and Germany, including in patients who have not recently been to China.

Hong Kong cuts travel ties

Airlines in Hong Kong have been ordered to slash their operations to 24 mainland destinations from around 480 to 240 flights a week. Hong Kong’s chief executive, Carrie Lam, announced yesterday that Cathay Pacific Airways, Cathay Dragon, Hong Kong Airlines and Hong Kong Express will reduce mainland travel at the end of January. Flights to and from Hubei, where the outbreak originated, have been suspended since 24th January.

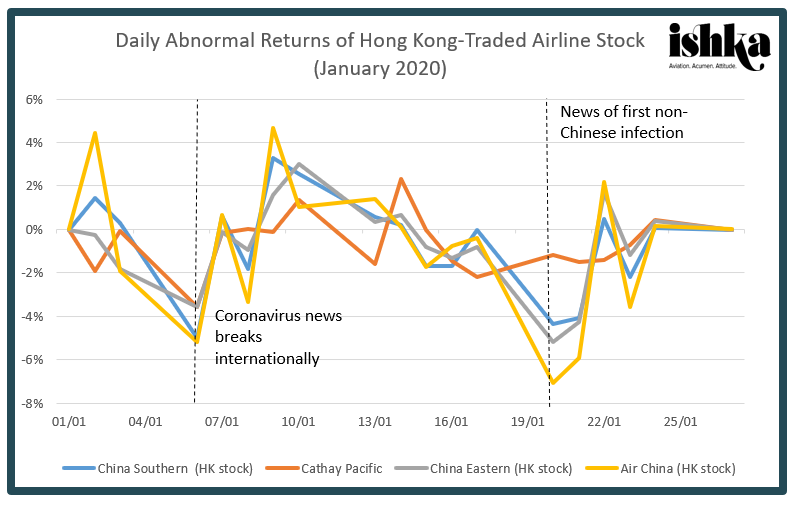

Source: Bloomberg and Ishka calculations. The daily abnormal return of a security is defined as the actual daily return of the security, less its expected daily return, whereby the latter is calculated using the Capital Asset Pricing Model (CAPM). Ishka has made the following choices in its calculations: Risk free rate = 6 Months HKG$ Treasury Bill; market rate of return = return of the Hang Seng Index; beta = the unadjusted raw beta as published by Bloomberg.

Publicly traded airlines that serve routes between Hong Kong and mainland China have seen their stocks tumble as more cases of coronavirus hit the press. While news of an outbreak has dampened stock markets worldwide – particularly in Asia – the outbreak has disproportionately damaged airline stocks. Daily abnormal returns for four Hong Kong-traded airline stocks – China Southern, Cathay Pacific, China Eastern and Air China – all dipped in tandem with first international news coverage of the virus and with news that it had spread internationally.

These airline stocks fell approximately 4% further than expected given their usual correlation to Hong Kong’s Hang Seng Index on 6th January, when news of the epidemic broke internationally.

Hong Kong carriers: Topping off a tumultuous year

Coronavirus comes on top of an already challenging year for Hong Kong carriers. Continued months of anti-Beijing protests on the streets of Hong Kong meant tourism, especially from mainland China, plunged in 2019.

Hong Kong International Airport handled 71.5 million passengers through 2019 – 3.2 million less than 2018 – according to Hong Kong’s Airport Authority. This 4.2% drop is the largest since the global financial crisis prompted a 5% fall in 2009.

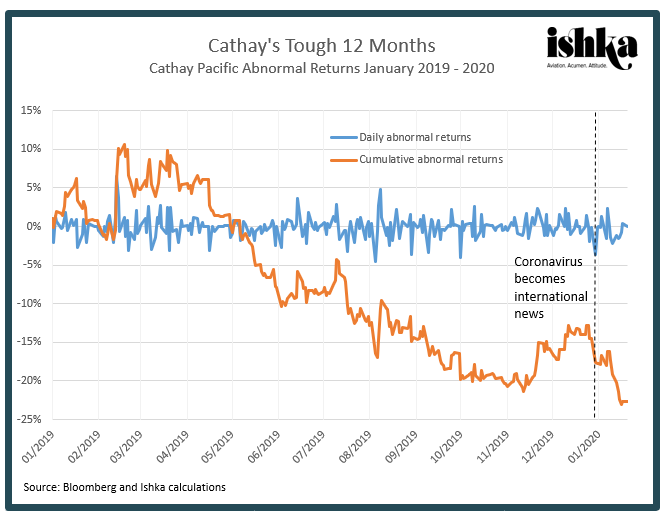

Source: Bloomberg and Ishka calculations. The daily abnormal return of a security is defined as the actual daily return of the security, less its expected daily return, whereby the latter is calculated using the Capital Asset Pricing Model (CAPM). Ishka has made the following choices in its calculations: Risk free rate = 6 Months HKG$ Treasury Bill; market rate of return = return of the Hang Seng Index; beta = the unadjusted raw beta as published by Bloomberg.

Cathay Pacific, Hong Kong’s largest airline, has seen its share price decline away from the Hang Seng Index consistently since mid-April 2019. Its cumulative abnormal returns picked up in mid-November 2019 as the protests fell slightly out of the news cycle, but dropped again when news of coronavirus broke. On the 6th January Cathay Pacific’s share price offered a daily abnormal return of -3.6%.

Hong Kong’s stock exchange currently remains closed after Beijing extended the lunar new year break an extra week.

Global contagion

The first carriers to be affected by the outbreak were Chinese carriers. Airlines including China Eastern, Shenzhen Airlines, Shanghai Airlines and Air Macau have all cancelled flights due to the spread of the virus. This includes suspending flights to Wuhan, the epicentre of the outbreak.

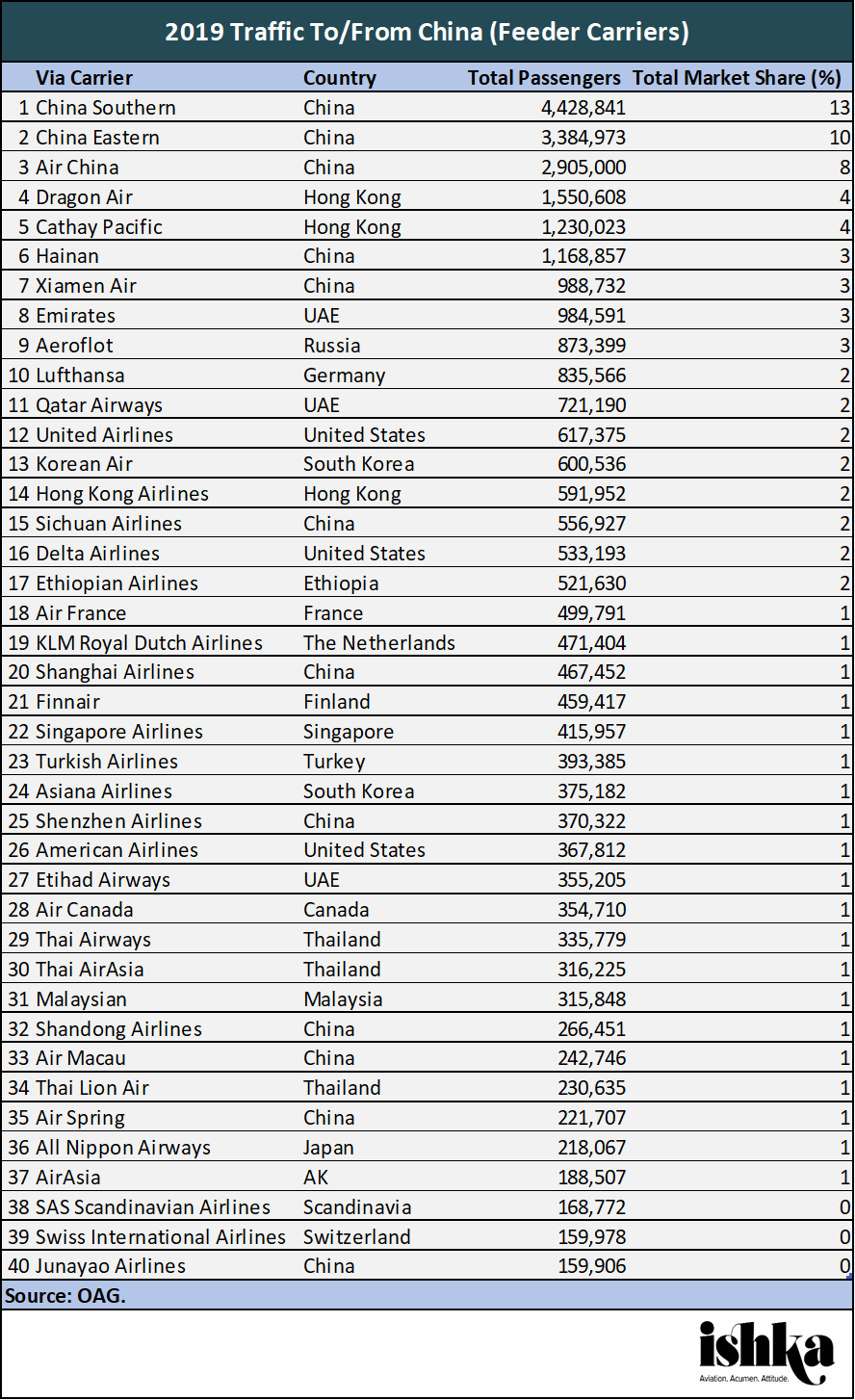

The impact on passenger numbers, however, will hit airlines to varying degrees around the world as travellers are likely to forego China trips. Non-Chinese carriers with the largest market share of direct flights into China include South Korea’s Asiana (3%) and Korean Air (3%); Hong Kong’s Dragon Air (3%) and Hong Kong Airlines (2%); Thailand’s Thai Lion Air (2%); and Japan’s All Nippon Airways (2%).

Also vulnerable are carriers who service a high proportion of feeder flights in and out of China. These airlines are still majority Asian. However, here the market could also see slight some negative impacts on airlines from the United States (United and American Airlines have 2% and 1% market share of the feeder market respectively); Europe (Aeroflot has 3% and Lufthansa 2%); and the Middle East (Emirates serves 3% of the feeder market).

Of the top 40 airlines with the most direct traffic in and out of China, Asiana Airlines (5th), Garuda Indonesia (37th), Hainan Airlines (8th) and Thai Airways (28th) are on Ishka’s Airline Credit Profiles’ on watch list.

The Ishka View

Chinese and Hong Kong carriers are going to be most vulnerable to coronavirus. No national or international health agencies have outright banned flights to China as Ishka goes to press, meaning that these weak passenger numbers are currently coming largely from dampened desire to travel in and out of China or cancelled flights: something that Ishka believes will only get worse as the mortality rate continues to climb and airlines begin suspending routes to China.

The Hong Kong government’s decision to reduce flights to mainland China was probably reached through discussions with Hong Kong’s operators, but it is unlikely that authorities will step in to help airlines recoup losses from such a reduction in their mainland routes.

Here, Hong Kong Airlines is a particular concern. The struggling carrier made news at the end of 2019 when local authorities demanded it find emergency funding or lose its licence (see Insight: ‘Hong Kong Airlines given days to save licence’). Although HKA managed to secure funding, it is also currently being sued by lessors for unpaid rentals (see Insight: ‘ALAFCO sues Hong Kong Airlines as carrier saves licence’).

Currently, two-thirds of Hong Kong Airlines’ flights per week between Hong Kong International Airport and mainland China. The HNA-owned carrier blamed anti-Beijing protests for its financial weakness, citing its high proportion of mainland Chinese routes. Although the coronavirus is a crisis of a very different type, the fact that it will also hit travel between Hong Kong and mainland China does not bode well for Hong Kong Airlines. Given its already weak financials, the airline could be the virus’ first corporate fatality.

Sign in to post a comment. If you don't have an account register here.