in Lessors & Asset managers , Airline trends & analysis

Thursday 18 August 2016

Widening losses for airberlin should concern lessors

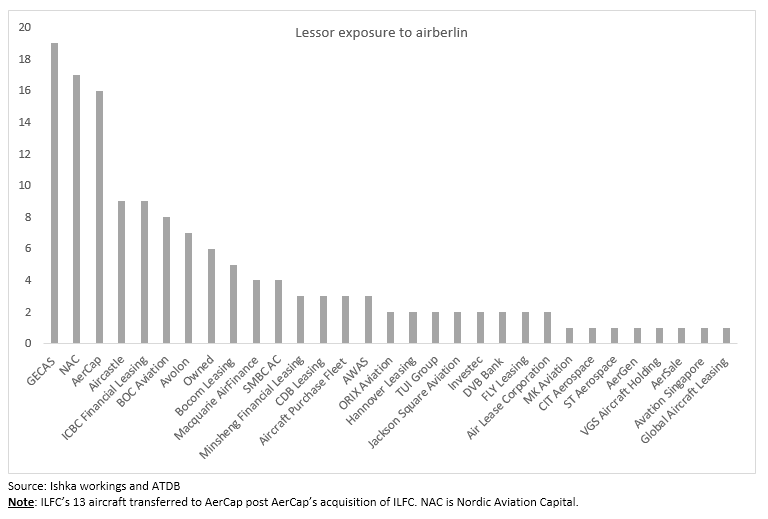

Nearly 96% of airberlin’s fleet is leased, according to ATDB, with Gecas, AerCap and NAC particularly exposed to the troubled airline. Germany’s second largest carrier recorded another heavy loss during Q2 2016. The airline, which is being restructured, is struggling to compete against the low-cost carriers within Europe. In addition, geopolitical and macroeconomic issues (a strengthening US dollar and European terror attacks have created further challenges for the airline. The carrier continues to be supported by Etihad Airways, which owns a 29.21% stake in the carrier. Without that support, airberlin would have struggled to meet even its working capital needs and would have faced a significant financing challenge. The Ishka view is that while Etihad’s backing has given airberlin’s management some breathing space, the airline remains in a critical state.

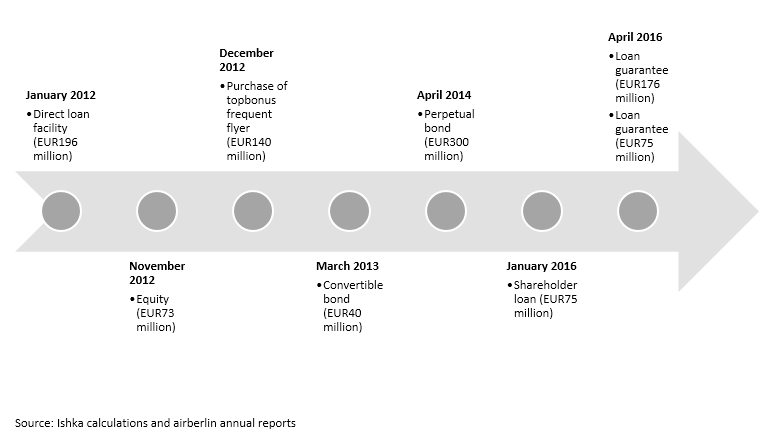

Timeline of Etihad’s direct and indirect support to airberlin

Etihad’s financial support has bailed out the cash-strapped airline frequently. Between 2012 and 2016, Etihad has provided regular support to airberlin through various equity infusions and loans. In addition, Etihad has also guaranteed several loans on behalf of airberlin. While Etihad’s pockets are deep, the carrier may not keep pouring money into the German carrier forever. Airberlin has posted depleted operating profits in FY 2015 and Q2 2016, despite the low fuel price environment. This casts doubt on the airline’s ability to restructure soon. There have been reports that if airberlin fails to improve its fundamentals, Etihad could consolidate the carrier with its other European investments under a single holding company.

Fundamentals remains weak despite persistent restructuring

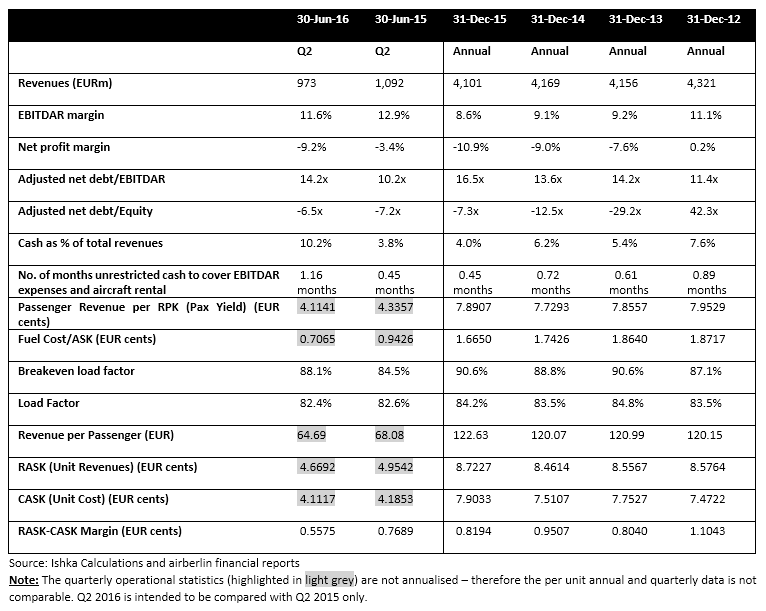

airberlin has posted an operating loss in each of the last eight years and the only miniscule profit in 2012 was mainly due to the gains on sale of its frequent flyer program topbonus. The airline continues to post negative results despite several years of restructuring. In the second quarter of 2016, the airline posted a net loss of EUR89 million ($101 million) - more than double the net loss of Q2 2015.

The carrier’s recent net loss has been driven by a combination of the stronger US dollar, reduced revenues on the back of capacity optimisation (ASKs down by 5% in Q2 2016 compared to Q2 2015) and a rise in the airlines’s lease costs as it leases more of its fleet. The stronger US dollar has limited the benefit of lower fuel price and as a result the operating expenses did not fall in-line with the capacity decline.

While this serves to explain the increased net loss in Q2 2016, airberlin has been struggling with some long-term fundamental issues that have generated depressed bottom-line results for several years. The airline continues to operate on extremely thin liquidity with less than a month’s cash available to cover its operating expenses and aircraft rental expenses. Temporary relief was provided by regular equity infusions and loans by Etihad. The airline also remains highly leveraged with the adjusted net debt more than 14 times the annualized EBITDAR as of 30th June 2016. Equity remains negative and continues to deteriorate despite the new equity infusions. Perhaps the most concerning is the carrier’s negative operating cash flows - airberlin has posted negative operating cash flows in every period we analysed.

Restructuring not yielding results

While airberlin has taken some determined steps to become competitive, the airline has failed to leverage those changes to improve its fundamentals. The route, network and fleet optimisation has contributed towards rationalising airberlin’s capacity, however, the drop in revenues following the reduced capacity and traffic has not been accompanied by a greater or equivalent fall in operating expenses. This means airberlin’s operating income (EBITDAR) has consistently fallen during the period it has been under restructuring. The airline has further extended its restructuring programme and aims to further cuts costs and improve its offerings by rationalising the business model. However, it remains doubtful whether the carrier will achieve any significant progress on these issues through the remaining part of 2016.

Exogenous factors create further challenges

The airline has also had to contend with terror attacks within its target market of Europe and North Africa which have had an impact on the airline’s leisure market. The strengthening US dollar means that airberlin’s fuel prices were not as muted and the aircraft lease expenses were higher than they would have otherwise been. Nevertheless, these issues don’t mask airberlin’s operational and fundamental problems.

Secondly, while it may be premature to talk about the possible impact of Brexit on airberlin, the fact that the airline is registered in England and Wales exposes it to risks of freedom of movement and freedom of establishment. The airline is facing additional costs and administrative hassle if exit negotiations lead to the revocation of, or restriction on, the freedom of establishment.

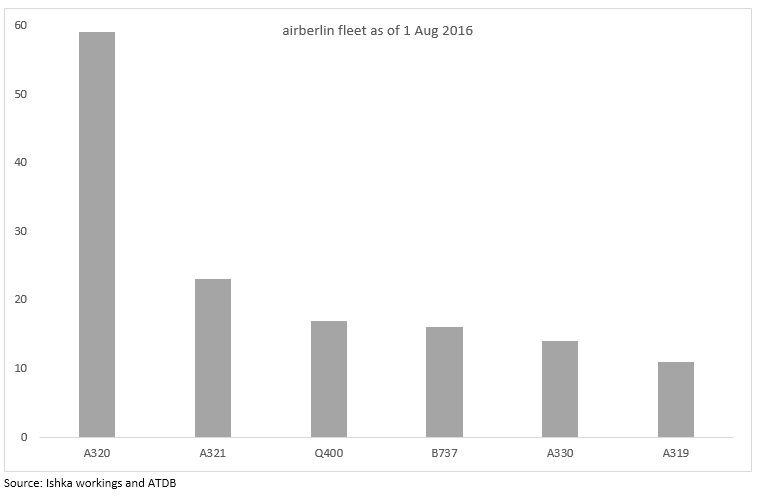

Multiple lessors exposed

As part of its restructuring, airberlin has reorganised its fleet. Between 2012 and 2016, the airline has sold most of its owned fleet and migrated to a predominantly leased fleet. As of 1st August 2016, nearly 96% of airberlin’s fleet was leased, according to ATDB, and there are reports that the airline will eventually sell the remaining owned fleet as well. airberlin leases from several lessors but GECAS, Nordic Aviation Capital and AerCap are the most exposed to the struggling carrier. However, despite the high proportion of leased aircraft, Ishka believes that as airberlin is not likely to start defaulting on lease payments, especially as Etihad continues to support the airline. Nevertheless, a constant review of the exposure is still warranted.

The airline is also moving towards an all-Airbus fleet. In 2014, it cancelled its remaining order for 18 737-800s and 15 787-8s. Currently, airberlin’s widebody fleet consists entirely A330-200s, some of which are now more than 15 years old.

The Ishka View

Ishka believes that airberlin’s problems emanate from its inability to clearly differentiate itself from the competition. Being stuck somewhere between a full service carrier (FSC) and a LCC model makes it challenging for the airline to capture a higher market share. While the airline has taken steps to clarify its offerings and is consciously moving towards a FSC model, at present it continues to be affected by competition from the LCCs on short and medium-haul routes. Therefore, the airline should aggressively pursue its restructuring programme to get rid of unnecessary overheads and become more competitive. While Etihad has committed to continue supporting airberlin, it will not keep pouring money in the carrier forever. Most of Etihad’s other minority airline investments (Air Serbia, Air Seychelles, Jet Airways and Virgin Australia) have already achieved their targets, or are on-track to do so. While this may make Etihad impatient with airberlin, Ishka sees this as a positive sign as it may motivate the German carrier to expedite its cost-cutting.

There are also reports that airberlin’s closest rival, Lufthansa, is planning on inducting a third of airberlin’s fleet including crews and some routes as it looks to expand Eurowings, its LCC unit. While this deal has the potential to be a win-win for both carriers, there are chances that this deal would attract opposition from the regulatory agencies on the grounds of competition.

Sign in to post a comment. If you don't have an account register here.