Wednesday 14 September 2016

The wait for Airbus ECA cover could be longer than you think

An investigation by the UK’s Serious Fraud Office into Airbus has prevented UKEF, and the other European ECAs from covering ECA, from underwriting any new Airbus deals. Airbus has stated the issue could be resolved by the end of the year. The Ishka View is that this timeline seems overly optimistic given how long previous investigations have taken to be resolved and that there remains a significant risk that Airbus customers may still not be able to access ECA cover past 2016. In addition the continuing lack of Airbus ECA cover should be deeply concerning for several airlines with larger aircraft scheduled for delivery.

The long wait for Airbus ECA cover

In April 2016, the export credit agencies (ECAs) of Britain, France, and Germany were forced to close their doors for Airbus deals while the UK Serious Fraud Office (SFO) decides whether to open a formal investigation into the company. The probe relates to the use of intermediary agents by Airbus when securing overseas contracts. Coface and Euler Hermes promptly followed UK Export Finance in suspending their financing guarantees for Airbus aircraft deliveries.

However, Airbus now believes it is on track for ECA financing to resume by the end of the year. The Ishka view is that market participants have underestimated how long these kind of enquiries can take. Similar SFO investigations have lasted years.

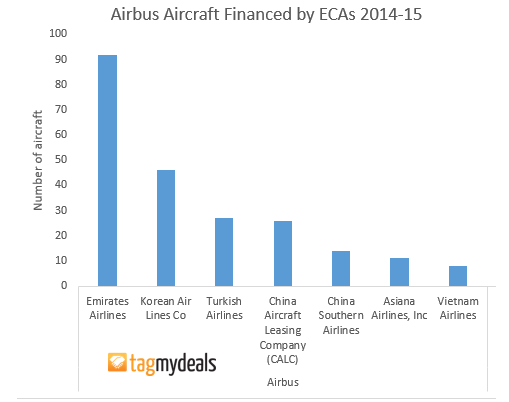

In the meantime, customers are being well served by a highly-liquid debt market that has alleviated the need for ECA cover. Despite this, ECAs remain especially important for deals involving high-value wide body aircraft. As a result, airlines such as Emirates have made use of short-term bridge financing to help their aircraft deliveries.

If ECAs continue to be prevented from offering cover then Airbus could eventually be forced to offer its airlines backstop financing to ease the pressure or airlines may be forced to use alternative financing channels including lessors.

Airbus agrees on a roadmap to restart ECA financing

In July, as part of its first-half financial results for 2016, Airbus indicated that it had found a solution to the impasse. It stated: “the group is working with the relevant ECAs to resolve the issue. A process for the reestablishment of ECA financing has been agreed and is ongoing.”

Banking sources contacted by Ishka speculate that export credit should be available to Airbus by the end of this year, or early 2017. The expectation is shared by Airbus itself which said it was aiming for ECA funding to resume by the fourth quarter of 2016. Speaking to analysts, Chief Executive Tom Enders said: “This is not just an Airbus target; this is a target for all the export credit agencies as well, including the UK export agency.” UKEF is currently still open to applications from Airbus and is still processing and reviewing them, but it cannot approve any.

However, while a roadmap has been agreed between UKEF and the original equipment manufacturer (OEM), the variable in the equation is the ongoing probe by the Serious Fraud Office which has not yet opened a formal investigation. This has the potential to drag on beyond the new year. Sources within European ECAs have warned Ishka that their internal view is that the issue could take much longer than the market currently anticipates.

SFO investigations can take years to resolve

Airbus is not the first exporter in the UK aerospace sector to fall foul of the SFO. Engine maker, Rolls-Royce, has been the subject of a SFO investigation into corruption and bribery allegations since 2013. It took the SFO almost a year before deciding to open a formal investigation. The investigation is ongoing and has since spread to multiple jurisdictions.

Similarly, Bae Systems reached a settlement with the SFO and the US Department of Justice in 2010 following several investigations between 2004 and 2010 pertaining to its compliance policies and processes.

The SFO has not yet opened a formal investigation into Airbus. However, it typically takes several months for the SFO to reach a decision about whether or not to turn a probe into proper enquiry. If there is no investigation, then ECA cover could well resume by the end of the year. On the other hand, previous investigations indicate that the process could be far more protracted than first thought.

ECA support is vital for wide bodies

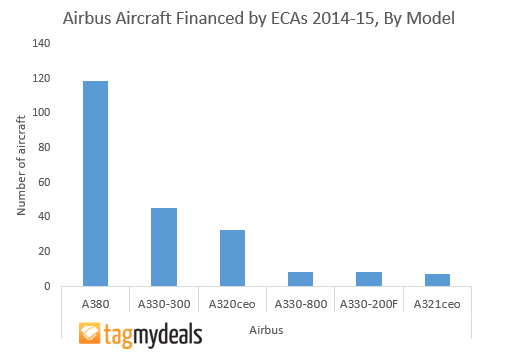

Airlines with wide-body aircraft orders tend to the most active users of ECA financing as banks rely on the ECA guarantee to mitigate the risk on the size of the transaction and the residual value risk. As the graph below indicates, the majority of recent ECA financing for Airbus has been used to assist financing deliveries of A380 and A330-300 aircraft.

Building Bridges

In the meantime, airlines are turning to short-term bridge financing. Emirates — the largest user of ECA financing to buy Airbus aircraft – is rumoured to have raised $2.5 billion in bridge financing for up to ten Airbus A380s which will be delivered before the end of the year. When ECA cover becomes available again the bridge facility is planned to be refinanced. Market sources indicate that bridge financing to cover the absence of ECA financing has been limited to date, with the notable exception of the Emirates financing, but this could feasibly change.

Aviation financiers appear relaxed, for now, about the lack of European ECA cover citing abundant liquidity in the market. Rival aircraft manufacturer Boeing, which is also barred for now from accessing ECA support from the US Ex-Im Bank, has indicated that for the time being, commercial bank credit is not in short supply. “There are multiple commercial credit sources available today that don’t create risk for us – the market is sound there,” Boeing CEO, Dennis Muilenburg said in a July earnings call.

But the financing of such large assets like wide body aircraft, was never intended to be facilitated by short-term loans. And while short-term bridge financing is an option, it’s an expensive option that cannot continue indefinitely. If European ECA’s remain closed to Airbus further in to 2017, then the costs will mount as airlines are forced to refinance without ECA cover, driving up pricing.

One month before the shutdown, UKEF’s chief executive, Louis Taylor, explained that export credit could increase in importance if the aviation cycle begins to turn. “At the height of the financial crisis we were financing a significant portion of Airbus deliveries,” he said. “At the moment the private market is very, very liquid for aircraft and the number of deliveries we are financing is much lower. However, this simply demonstrates that there is a cycle.” ECAs are especially useful during recessions when commercial credit is hard to obtain. In the 2015-16 financial year, UKEF guaranteed financing of 39 aircraft approximately 8% of Airbus’s total commercial aircraft deliveries. However, after the 2008 financial crisis European ECAs were supporting nearly a third of all Airbus aircraft deliveries. If the financing market suffers a new crisis, then Airbus could find themselves without the support of European ECAs precisely when it is most needed.

Scenarios

If European ECAs still cannot offer guarantees past the deadline set by Airbus, then alternative lines of credit may begin to be stretched. In particular, this is likely to affect customers with wide body aircraft on order. If the US Ex-Im shut down is resolved sometime after the US Presidential elections – as some commentators believe – then Airbus may find itself at a disadvantage as its rival enjoys access to ECA financing. This is unlikely to deter airlines from ordering Airbus aircraft but if the financing market turns it would put Airbus customers in a difficult position to fund their aircraft. Under this scenario Airbus could be forced to offer some customers back-stop financing.

The Ishka View

The temporary closure of ECA cover to Airbus is one of the biggest upsets in ECA financing to occur in the last 30 years. The suspension of ECA cover also represents an unusual breakdown in the tight relationship between the government agency and the manufacturer.

The biggest issue for aviation financiers and airlines is that very little is known still about the SFO’s investigation plans. This makes it hard for airlines and banks to plan any future ECA financings for the time being. The worst-case scenario, for Airbus, is that a SFO investigation could run for years as similar SFO investigations have done for both BAE and Rolls Royce. The Ishka view is that based on length of previous investigations there is a signficant risk that Airbus may not be able to access ECA financing within the next six months.

What is the impact for airlines?

Airbus’s airline customers have one less avenue for financing aircraft, and the lack of ECA cover makes it harder for some banks to finance airline debt. This is also a particularly worry for carriers with wide bodies on their order books, which have been the main recent beneficiaries of ECA cover. Some airlines, such as Emirates, have taken advantage of temporary bridge financing. But Ishka takes the view that banks will be less willing to offer this type of loan, especially to smaller credits, unless there is a clear roadmap for financiers, many of whom continue to be confused on potential timelines.

What is the impact for lessors?

Lessors have historically been less reliant on ECA financing to fund aircraft as ECA gaurnatees limit their ability to trade aircraft. Moreover, many lessors tend to have good access to highly liquid international capital markets. However, the shutdown also represents an opportunity for leasing companies which can offer sale/leasebacks as a financing alternative to airlines which cannot access ECA financing.

Sign in to post a comment. If you don't have an account register here.