in Lessors & Asset managers , Airline trends & analysis

Monday 3 October 2016

IFRS 16 “kills sale-and-leaseback” as an off balance sheet option

David Tweedie, the former chairman of the International Accounting Standards Board (IASB), used to quip that before he dies he wants to fly in a plane that is actually carried on its airline’s balance sheet. It has taken six years, but it seems Tweedie will have his way.

The new International Financial Reporting Standards 16 (IFRS 16), published in January this year will significantly overhaul how listed companies report operating lease obligations in their financial statements. For the first time operating leases will be part of the balance sheet. The Ishka view is that airlines in particular need to be aware of how this will affect their main financial metrics when it IFRS 16 takes effect in early 2019.

New rules reflect increase in leasing over last 30 years

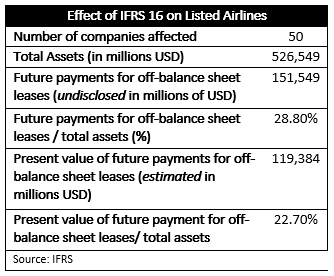

The existing regulations, known as IFRS 17 date from 1982 and “no longer reflect economic reality” according to IASB chairman, Hans Hoogervorst. There is a need for greater transparency as the increase in leasing in the commercial aviation sector over the last three decades distorts the true debt profile of many airlines. The previous distinction between operating leases and financing leases means that operating lease obligations were missing from the balance sheet, even if some airlines published them in the footnotes. On average, the future payments for off balance sheet obligations, amounts to almost 30% of total assets for affected airlines. Hoogervorst believes that to some extent this may have misled some investors. “From now on investors will get a good view of all the liabilities, not just the finance leases as is currently the case.” Investors will also be better positioned to compare risk across different airlines.

Operating leases will now be on balance sheet

From 2019, airlines will have to declare right-of-use assets on their balance sheets both on the asset side and the liability side. “IFRS 16 essentially kills sale-and-leaseback as an off balance sheet financing structure,” Ian Nelson, a partner at KPMG’s told the ISTAT Europe conference this week.

At least 50 publicly listed airlines around the world will be affected. Delta Airlines in particular has resisted the rule changes. As of 31 December 2015, the carrier had total future lease obligations amounting to $12.76 billion – all of which are currently off balance sheet.

The US airline will now see its total balance sheet assets rise from 2019 and a consequence of IFRS 16 is that it will change Delta’s key financial metrics including debt to equity ratios, leverage ratios and operating income.

Bigger balance sheets will reduce airlines’ reported equity

For companies with material off balance sheet leases, IRFS 16 is likely to result in a decrease in reported equity. This is because the lease asset will depreciate faster than the decrease in lease payments over time, though the value of the asset and the liability will remain the same at the beginning and the end of the term. One the one hand, assets depreciate on a straight line basis, while lease total payments are affected by the amount already paid and by the interest reducing over time.

As a decline in equity may have an effect on a carrier’s share price, shareholders need to be informed of the changes.

Existing debt covenants will be mostly unaffected

The impact on key metrics had raised concerns during the consultation process that it could result in a breach of existing debt covenants. By reporting leases on their balance sheets airline’s debt to equity ratios would deteriorate which could inadvertently trigger debt covenants on existing loans. However, the IASB is of the view that existing covenants will be unaffected, though it may result in different conditions on future covenants as a result of more accurate financial data. An August 2011 study by Moody’s shows that virtually all credit agreements analysed contained clauses that protect companies from changes in accounting rules. (Moody’s August 24, 2011 Special Comment: “Loan-Covenant Clauses Protect Companies from Default when Accounting Changes.”) Moreover, many debt covenants already take in to account off balance sheet leases where they are deemed significant.

Effect on borrowing costs will be negligible

IFRS 16 represents a change only to accounting rules and will provide better information about an airline’s existing financial commitments, but it will not change those commitments – the airline is still the same airline it was before the rule change. Regardless, the most sophisticated analysts from credit rating agencies and lenders already estimate the effect off balance sheet leases have on financial leverage. If there are any changes to the cost of borrowing for an airline, it is a consequence of better informed capital markets pricing risk appropriately.

Profit and loss lease expense will be frontloaded and will decrease over time

On the profit and loss account there will be a net lease expense. This will be the depreciation of the asset, combined with the interest on the lease liability to produce a single total expanse. This will be “front loaded” says Nelson. The total value of the lease expense will be higher at the beginning of the lease than at the end. “This is quite different to the lease expense incurred under current rules which is essentially a straight line.”

The Ishka View

Balance sheets are set to become weightier from 2019 as operating leases are added for the first time. This will affect several key metrics on Airlines’ financial statement and will depress the equity value of the company. Going forward, listed carriers are going to appear far more indebted than they did previously. However, borrowing costs and existing debt covenants will remain largely unchanged under the new rules. On the profit and loss account, leasing obligations will be front loaded and will be more expensive at the beginning of the lease. Airlines and lessees will have to think hard about whether to buy assets in future or continue leasing.

What does it mean for lessors?

According to Nelson, the effects on the leasing companies themselves will be minimal. While the lease classification test will remain largely the same, “leasing companies will have to be pretty cognisant of the effect it will have on their customers.” However, some customers may decide to buy assets rather than lease them, particularly if those companies were prepared to pay more for leases because they were allowed to be excluded from the balance sheet.

What does it mean for airlines?

Only listed airlines will be affected. The IASB does anticipate some costs involved in the transition. Mostly these relate to the cost of implementing software to track and manage leases and depreciation of assets. The amount will depend on the size of an airline’s lease portfolio.

Sign in to post a comment. If you don't have an account register here.