Wednesday 12 October 2016

Will Russia react to Aeroflot’s rising dominance?

Russia’s aviation sector has been buffeted by a continuing recession and a drop in passenger numbers. Several airlines, most notably Transaero, have already gone bust. Outbound international travel has been particularly badly affected by the drop in the rouble and terrorism related incidents in Turkey and Egypt. However, Aeroflot, Russia’s largest airline, appears to be a net beneficiary. The airline has consolidated its market dominance in the country and is now very close to commanding a 50% market share. Russia’s aviation sector is at risk of increasingly becoming an Aeroflot monopoly and this does not augur well for the passengers and the industry as a whole in the long-term. The Ishka view is that until the geopolitical and macroeconomic situation improves, more Russian airlines remain at risk of either going bust or being consolidated under Aeroflot.

The lone shining star “national champion”

Aeroflot has benefited from the Russian government’s “National Champion” policy which aims to put Aeroflot at the forefront of civil aviation in the country. A number of Russian airlines including Rossiya, Vladivostok, SAT Airlines, Donavia, Aurora and Orenair were consolidated under Aeroflot between 2010 and 2015. In addition, Aeroflot also took-over most routes abandoned by airlines that went bust (Transaero) or that significantly reduced their operations (UTair). Aeroflot, also, launched a new LCC subsidiary, Pobeda, in December 2014 that gives it a near monopoly on LCC routes. This means that four of the top seven Russian airlines are now under Aeroflot’s control.

Some smaller regional airlines also shut shop between 2010 and 2015 as Russia’s civil aviation authority revoked their licenses following a spate of accidents. This further freed domestic capacity which was taken over by other regional airlines including Aeroflot’s subsidiaries. Aeroflot’s ability to take over routes from defunct airlines has helped prevent potential travel chaos for passengers, but Aeroflot is becoming increasingly monopolistic. There are rumours that it has been eyeing the other major Russian airlines as well, including S7 Airlines and UTair. While S7 has experienced reasonable success so far and would resist attempts of being taken-over, UTair was almost on the verge of bankruptcy in 2015 making it a potential takeover target.

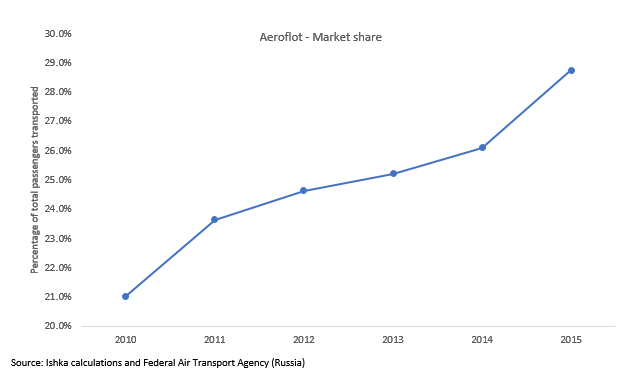

Aeroflot filled the void left by airlines that shut down. The airline leveraged abandoned routes and as a result Aeroflot’s share in the Russian aviation industry went up from around 21% in 2010 to nearly 30% by end of 2015. And this is only Aeroflot’s standalone market share, if its subsidiaries are included in this statistic, the combined Aeroflot group commands nearly 45% of the Russian air transport market.

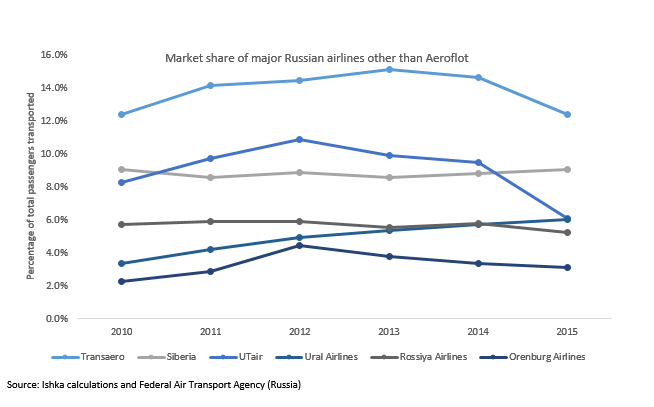

In contrast, other major Russian airlines have seen their market shares fall or remain more or less static since 2010.

It is quite surprising that no single major airline other than Aeroflot has managed to make further inroads into Russia’s civil aviation space over the last five years. Ishka understands that market share is a function of several factors including airline strategy, quality of service and value for money. However, state-backing gives Aeroflot a significant competitive advantage especially in a soft market and also the fact that several airlines were consolidated under Aeroflot gave it access to quite a few routes allowing it to increase its market share.

Signs of growing discomfort by the government?

An Aeroflot monopoly is not healthy for customers. There have been conflicting reports coming out of Russia about the rising concern in the country’s Ministry of Economy over the increasing supremacy of the Aeroflot Group and the need for maintaining healthy competition in the industry. It has also been reported that both the Ministry of Economy and Ministry of Transport were keen on separating Rossiya Airlines from its parent Aeroflot into an independent privately owned airline. However, Aeroflot recently denied that it has any plans to sale Rossiya.

The government has previously appeared to be in favour of maintaining healthy competition within the aviation sector. In a meeting held in 2013 on regional aviation, Maxim Sokolov, Russia’s transport minister highlighted analysis by Russia’s Federal Antimonopoly Service showing that one additional carrier could reduce the airfare on any given route by up to 30%. The government in 2013 approved a series of antimonopoly policies that also covered the aviation sector.

There is clearly awareness among senior Russian politicians about the importance of promoting and maintaining competition in any industry including air transport. However, the situation on the ground has been contradictory. Aeroflot increase in size is largely due to the consolidation of a number of regional airlines within its portfolio and its acquisition of Transaero’s assets and abandoned routes, but it is likely that the government could react if the carrier chose to acquire more competitors.

Sign in to post a comment. If you don't have an account register here.