Wednesday 26 October 2016

Will airberlin succeed with its latest restructuring plan?

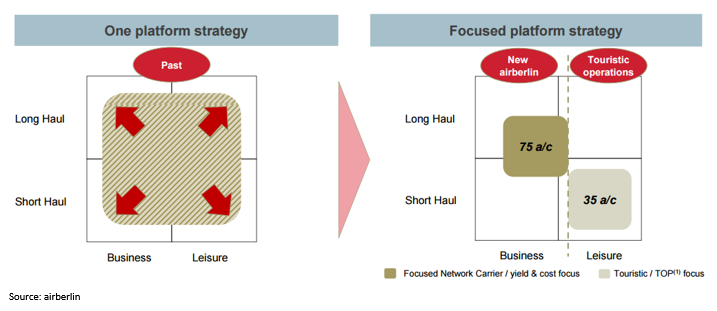

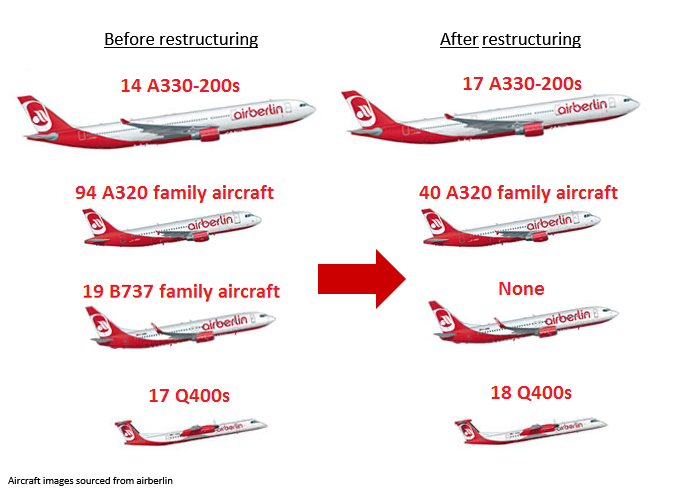

airberlin has opted to chase the long-haul market and stop trying to be both a full service and low-cost carrier as part of a recent restructuring initiative. Under the new plan the carrier will lose nearly half its fleet as it transfers 40 A320 family aircraft to Lufthansa and 35 more to a new leisure carrier that will be carved out of its leisure segment in partnership with TUI Group’s German arm, TUIfly, as part of an organisational revamp.

The Ishka View is that the carrier’s decision to stop competing in several different market segments unsuccessfully and instead embrace one market segment brings much needed strategic clarity. In addition, its new leaner structure should also help lower its costs compared to other major legacy carriers in the region like Lufthansa, Air France-KLM and British Airways.

airberlin’s restructuring plan relies on its ability to agree commercial terms with both Lufthansa and TUI Group. The plan itself is unlikely to face regulatory restrictions but unions have reacted to the inevitable job cuts. Ishka anticipates that regulatory bodies will allow the merger to happen and that unions will not prevent the restructuring from going ahead as planned.

airberlin’s need to restructure

As we highlighted in our previous Insight Report on airberlin, “Widening losses for airberlin should concern lessors”, the airline was operating under serious stress and persistent restructuring efforts had so far failed to improve its financial health. The airline ended each of the last eight years in the red except for 2012 when it posted a small profit, only on the back of gains from the sale of its frequent flyer programme, topbonus. The loss-making trend continued in 2016 with the airline posting a net loss of EUR89 million ($101 million) in the second quarter of 2016 which was the double the net loss in Q2 2015. The balance sheet was also extremely weak as the airline was high leveraged and with the equity also being negative. Perhaps the most concerning was the negative operating cash flows in almost all recent periods that we analysed.

Germany’s second largest carrier has only managed to stay afloat through the support of its majority shareholder, Etihad Airways. Its recent restructuring announcement therefore is not a surprise.

airberlin’s latest attempt to overhaul can be broadly split into two large initiatives. The first is the carrier’s move to reduce its fleet by half and the second is changing the current Air Berlin Group into a core network carrier and the creation of a new, independently managed leisure airline. The fleet reduction will be achieved by transferring aircraft to Lufthansa while the organisational revamp will involve moving airberlin’s leisure segment into a newly created airline along with TUI Group’s German arm, TUIfly. The new airline will also inherit aircraft from the Air Berlin Group.

Fleet transfer to Lufthansa

As part of its comprehensive restructuring, airberlin will be transferring up to 40 A320 family aircraft to Lufthansa. The German flag carrier will wet-lease around 38 aircraft which will be on ACMIO arrangement and will include the transfer of aircraft, crew, maintenance, insurance and overheads. The remaining two aircraft will be on dry-lease. The proposed agreement, which is still subject to regulatory clearance will be valid for six years. Ishka believes that this is a favourable arrangement for both carriers as it allows airberlin to re-deploy its excess fleet allowing it to focus on key network routes and also simultaneously satisfies Lufthansa’s need for additional aircraft. Lufthansa has said that it plans to deploy the majority of those aircraft under its Eurowings brand with a view to capturing a greater share of the European low-cost market. More importantly this capacity reduction will be achieved without significant redundancies and with limited restructuring costs. In fact, airberlin estimates it will earn more than $1 billion from wet-leasing the aircraft to Lufthansa.

airberlin’s lean core operations

The new airberlin plans to operate with a core fleet of 75 aircraft with A330s for long-haul operations and the A320 family aircraft and Q400s for medium-/short-haul operations. After phasing out aircraft to Lufthansa and the new leisure airline, airberlin will be left with 61 aircraft, it plans to source 10 narrowbody, 3 widebody and 1 regional aircraft in 2017 which will add up to 75 aircraft in total.

We view the strategy of limiting the narrowbody fleet to the A320 family favourably. Operating both the 737s and A320 family aircraft adds an unnecessary complication and therefore costs to an already struggling business.

airberlin partners with TUI for new tour airline

airberlin’s existing tourist business will combine with TUI’s German arm, TUIfly, to create the new leisure carrier. The new carrier will also inherit 35 aircraft (including 14 currently wet-leased from TUIfly) from the Air Berlin Group.

Ishka believes there is also merit in this strategy – for airberlin it means the airline can focus on its higher-yielding long-haul operations while TUIfly can join forces with a related business and create a potentially stronger organisation. In addition, the transfer of airberlin’s 737s is compatible with TUIfly’s existing fleet of 737s.

The creation of a new leisure airline and the transfer of airberlin’s existing business to a new airline will require regulatory approval. Regulatory bodies will be cautious to avoid creating a monopoly. However, Ishka does not foresee any real regulatory barriers given the relatively small size of both airlines and the success of mergers of previous European carriers which include Air France and KLM into Air France-KLM, British Airways, Iberia, Vueling Airlines and Aer Lingus into IAG and the Lufthansa Group’s acquisition of several airlines.

Don’t forget the lessors

Amongst the fleet rationalisation and dispersion, is the realisation that almost all the 140+ aircraft are on operating lease. Over thirty lessors are currently involved in the Air Berlin Group fleet, each of which will want to achieve the best outcome for the investors they represent, adding an additional note of complexity to the proceedings.

Union resistance to the merger

One major challenge facing the restructuring is union resistance from both airberlin as well as TUIfly employees. airberlin will need to cut 1,200 staff under the restructuring, or roughly one-seventh of its 8,600 current employees (as of June 2016.)

The proposed merger has already attracted resistance from TUIfly’s pilots who called a strike that led to the cancellation of 108 flights on October 6. As a direct result TUI announced it was delaying a board vote on the new joint venture from the end of October to mid-November. In addition, TUI has made assurances to its pilots that the carrier will remain a German business based in Hanover and offered assurances around pay and contracts. Ishka believes that TUI’s prompt response to staff indicates genuine appetite for the deal from its management, and TUI will press ahead with the merger.

Ishka also anticipates that airberlin is likely to convince its unions to accept the restructuring and the associated redundancies because without any radical restructuring the airline faces the possibility of failure, even with the backing of the powerful Etihad Group.

Sign in to post a comment. If you don't have an account register here.