Monday 7 November 2016

Air Greenland and Air Iceland eye fleet expansion options

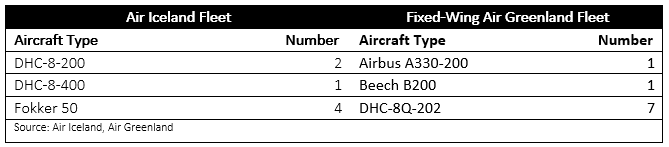

Air Iceland – a subsidiary of the national flag-carrier Icelandair – and Air Greenland, part-owned by SAS Group and the governments of Greenland and Denmark, are two regional carriers with much in common and much to compete over. Both have small, predominantly turboprop fleets serving remote domestic locations, few or no debts, and no aircraft on lease.

But crucially, both seek a greater share of tourism that is booming in both countries. The pair performed strongly last year, and while coy about their exact plans, they are well placed to expand in the near future. Ishka speaks to Michael Højgaard, CEO of Air Greenland, and Sigfús Kárason, CEO of Air Iceland, about the future of their business.

Tourist boom sparks regional competition

Visitors to Iceland, a country still recovering from the financial crisis of 2008, has increased five-fold since 2010 to around two million this year. While tourism in Greenland has grown by 66% in the last year alone. The boom is a boon to the two regional carriers.

Air Greenland has reported strong growth in the last 12 months in particular. Between 2014 and 2015, profits grew by 13.8% to around $8.9 million. Comparable figures are not available for Air Iceland as it part of the Icelandair group. However, the group reported strong profits last year as a result of an expanding international network that the regional carrier has been instrumental in feeding.

“We are in a very unique position because right now on our main routes there is no competition: we have a de facto monopoly,” says Højgaard. However, on routes to Iceland they are flying “wing to wing” with Air Iceland. The carrier is using low prices to compete. Prices dropped 4% across North Atlantic routes in 2015.

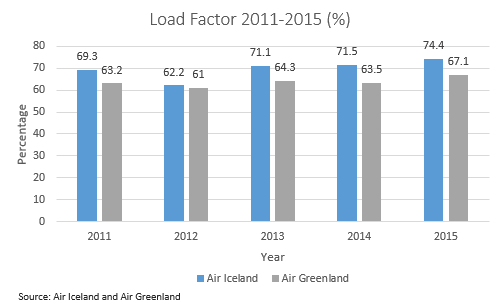

“There has been increasing competition between Air Iceland and Air Greenland. We have similar routes and aircraft but it has not been a fierce competition,” says Kárason. “Iceland is growing almost exponentially, but Greenland is growing more,” he adds. “It is the cream of the crop for us — a premium market with higher yields.” Air Iceland reports consistently higher load factors than Air Greenland and may be better placed to compete on costs as it is part of a larger group.

Changing fleet composition

The two regional carriers have changed their fleet composition in the two years and plan on continuing this renewal in the near future. Air Iceland made the decision to begin replacing its Fokker 50 aircraft with (Bombardier/de Havilland) Dash 8s from 2016. While Air Greenland parted with the legacy Dash 7 aircraft. Both are now expecting significant cost savings through a uniform Dash 8 fleet.

Air Greenland operates a single Airbus A330-200 for international flights and intends to acquire an additional A330-200 in the next two years. “We have absolutely no debt and for the time being we own all our aircraft,” says Højgaard. “But we are in a situation where we would like to go from flying the Dash 8-200 to the -400. And we will need a new A330 which will entail taking on debt within the next two years.”

Greenland has only two runways which the A330 can operate from - at Narsarsuaq Airport and Kangerlussuaq Airport. On the other hand, the dozen or so shorter runways on Greenland are perfectly suited for the Dash 8. In Autumn 2015 the Parliament of Greenland approved an airport package that will support future infrastructure development - specifically longer runways. Without runways longer than 800 meters (1,764ft), up-gauging Air Greenland’s fleet is out of the question. “If runways are not extended then we will need to renew the existing fleet and there will be no possibility of acquiring new aircraft types,” says Højgaard.

International routes help to drive domestic traffic

In the meantime, both carriers are focussing on driving international traffic to their home markets. Iceland has ambitions to be an international hub for cross-Atlantic flights. Its parent company, Icelandair, encourages stopovers of up to a week in the country at no extra cost as a way of boosting tourism.

In March 2016, Air Iceland entered into a codeshare agreement with Icelandair for four flights a week between Keflavik and Aberdeen in the UK, using Q400s. “If that works out we might be adding more Q400s with a view to adding different destinations that don’t fit well for Icelandair but do suit smaller aircraft,” says Kárason. “The aim is to feed the hub and supply onward flights to the US and Canada.” The Aberdeen route is expected to set the stage for a third main revenue stream for Air Iceland alongside its domestic and Greenland operations.

Air Greenland anticipates a shrinking domestic market due to negative population growth and is focussing on bringing new visitors to the country. Last year, the carrier began using the A330 for winter flights to the Canary Islands. But the best growth has come from the British and German markets, 1% and 2% growth respectively, through partnership with travel operators.

Carriers prefer bank loans to lessors, but are open to offers

Bank loans are the preferred method of financing for Air Greenland’s A330 and any future Air Iceland Q400s. Neither company has any aircraft on lease and both believe that turboprop lease rates are currently too high. “We are attacked by so many leasing companies,” says Højgaard. “Why should we lease aircraft as long as we are in this very good position where we have everything on our own balance sheet, but no debt?” Air Greenland operates a relatively old fleet and will have to either renew or, if longer runways are built, up-gauge its fleet. The carrier intends on using cash from the sale of old aircraft for part of the pre-delivery payments.

While Air Greenland has no debt, Air Iceland is paying off its new Q400s. “With the investment in the Q400s, financing other things is going to be tougher,” Kárason. “And although EBITDA will be higher, so will our overall financing costs.” He is of the opinion that the financing costs between Air Iceland and Air Greenland is very similar, and refutes any suggestion that it has greater ease of finance because of its parent company. “Icelandair charges us the market rate, we don’t get any subsidies,” he says.

However, leasing does remain an option for both companies. “For us it is about going to the market frequently to see what is available and what the rates are,” says Kárason. “If you have the opportunity you should always take the best option.” Air Iceland used to lease its aircraft before changing strategy around 12 years ago. “But these things can change.”

The Ishka View

Both of these North Atlantic regional carriers are well positioned to exploit the boom in tourist visits to Iceland and Greenland. Tourism is a sustainable way for the airlines to reinforce their bottom line as both countries continue to recover from the financial crisis of 2008. According to Kárason, the subsequent recession cost Air Iceland 25% of its revenues “almost overnight.” But low debt, high demand and expanding international ambitions makes Air Iceland and Air Greenland an attractive proposition for financiers.

With Air Greenland, there is potential to further increase tourist flows, however, one of the drawbacks is the price of a return ticket – it is relatively expensive for the flight distance. That is hardly surprising given the monopolist position it has since SAS stopped flying the route in 2002, and the fact that almost everything has to be imported. Expanding international flights hinges on the extension of the runways at the capital Nuuk – where half of passenger are connecting to from Kangerlussuaq, and Ilulissat – where there are the largest icebergs to photograph. Lengthening of the runways at these locations would allow Air Greenland to consider the use of single-aisle aircraft to serve direct routes, thereby reducing operational costs and bringing down air fares.

At present it is only possible to use turboprops to fly to, and from, Nuuk. If the runway was extended it would help tourism as the capital would become more accessible but it would be likely to attract other carriers which could deploy single aisle assets to fly to the capital. Accordingly, Air Greenland could face some competition if the runway was ever extended.

Like Air Greenland, Air Iceland sees little or no competition on domestic routes. Its expansion has been well measured in providing a feeder to Icelandair for onward connections. Ishka believes that it will be in the market for further Q400s, as the aircraft is a good fit to service the domestic market as the aircraft are larger and travel time will be shorter – catering for a growing tourist market. Air Iceland should keep doing what it's doing. Its modest expansion plans are working well with its business model.

Sign in to post a comment. If you don't have an account register here.