Tuesday 15 November 2016

CEO interview: Aircastle preps for the downturn

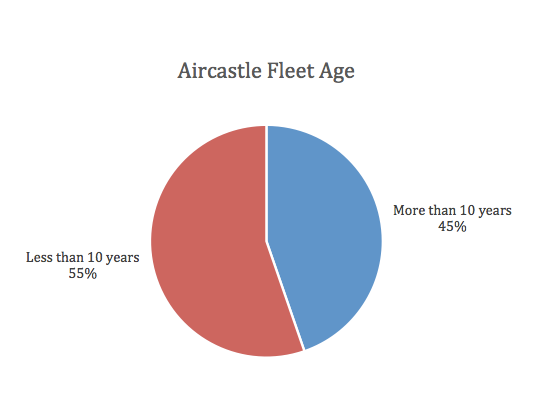

10 years after its IPO, Aircastle remains one of the few listed aircraft lessors. The lessor has grown its portfolio from 42 aircraft back in March 2006 to over 169 aircraft in 2016. What makes it unique is how it has achieved that growth and the range of assets it has on its books. In particular, the firm’s willingness to acquire older assets. As a result, Aircastle stands out among the other publicly listed lessors for having an older fleet. More than 45% of Aircastle’s fleet is 10-years old or older. ALC’s average fleet age (in-service fleet) is around 4.9 years, compared to AerCap’s average fleet age of around 11 years, as per the CAPA Fleets database.

The firm’s CEO, Ron Wainshal, believes that the industry is set for a downturn. The Ishka View is that Aircastle’s debt and trading strategy reinforces the notion that the lessor anticipates a downturn is imminent. Aircastle has moved many of its older assets to its sidecar vehicle and continues its move away from older freighters and widebody exposure, towards mid-age narrow bodies.

Preparing for the downturn

The company has been building up its store of unsecured debt, and now has nearly 70% of its assets unencumbered - close to over $5 billion. Unsecured assets help Aircastle move closer to an investment grade rating but Wainshal states that the move to unsecured debt is also a reaction to a shift in traditional financing. Wainshal notes that traditional aviation bank debt withdrew immediately following the financial crisis and that banks were only prepared to fund new aircraft. In today’s market he argues there is increasing financing for older aircraft but if the market turns then financing for older aircraft assets is likely to change.

“I think it´s inevitable that we´ll have downturns. We live in a cyclical industry and what we have at least tried to do over the past few years is to build the company in a way it can not only withstand the downturn, but can also take advantage of opportunities that arise from it. And so the move towards unsecured debt was very much with that in mind. I think it´s likely that next time there´s a downturn, the same thing will happen and there will be a drying up of financing for things that are not brand new.”

Where are we in the cycle?

The aircraft finance market is cyclical but Wainshal believes that depending on how you measure the cycle aviation may have already peaked. “When I think about a cycle, I actually think about more than one. If I think about rental levels, that´s one way to measure a cycle, another one might be aircraft prices, right. And, if I talk about rental levels, I think we´ve already peaked,” he adds.

The impact of this is that the rental gap between current technology and new technology is now pretty small, according to Wainshal. The rental market has been driven by quantitative easing, fiscal stimulus, low interest rates and a low-fuel price environment. Wainshal states that neither interest rates nor fuel prices will rise: “for a little while, and that´s one of the reasons that we´ve been so aggressive about getting our lease plan in place.”

Wainshal states that while low-interest rates are putting pressure on rental returns, it is having the opposite effect on aircraft prices and because there are reduced returns in traditional investment vehicles, it means that more investors are chasing aircraft assets which drives aircraft prices higher. ““The record low interest rates and an environment where you have all this negative yield in sovereign debt and everybody in the world chasing you, suggests to me that actually prices still have a way to run.”

However, investors looking to buy aircraft now will see less upside than they would have seen six months ago, as Wainshal warns more aircraft buyers are “pricing to perfection”. “I would say buyers of aircraft right now, because of the competition and the low yields are pricing to perfection and are assuming everything goes according to plan,” he explains. “But when things don´t go according to plan - if there´s a lessor default or a lessee default, or what have you - then there´s not much room to absorb the bumps in the road that happen in the world.”

The move away from older assets and freighters

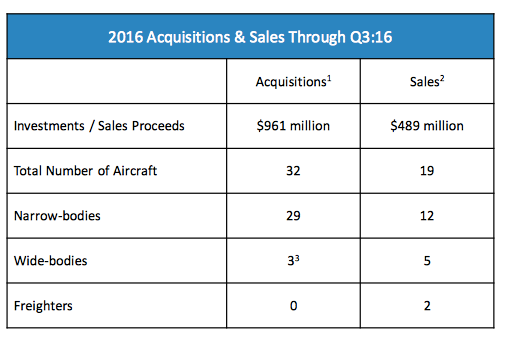

Aircastle’s aircraft acquisition choices this quarter and the assets it has chosen to sell are consistent with a move to de-risk the business and pick more liquid assets. During the first nine months of 2016, Aircastle purchased 32 aircraft with an average age of 6.8 years and an average remaining lease term of 6.4 years. For the full year, it expects to complete $1.5 billion in aircraft acquisitions, of which $1.4 billion will be narrow-body aircraft.

Through the first nine months the lessor sold a total of nineteen aircraft for $489 million including five wide-body and two freighter aircraft. Six of the nineteen aircraft sold were narrow-body sales to the company’s joint ventures with Ontario Teachers’ and IBJ Leasing.

1. Closed deals only through September 30, 2016.

2. Includes approximately $160 million of sales to our joint ventures.

3. All assumed to be on last leases.

Source: Aircastle

Unlike its larger rival listed lessors, Aircastle is not targeting younger or new aircraft. Wainshal claims Aircastle is unique among its larger rivals in that it’s the only permanently capitalised lessor willing to consider mid-aged aircraft. “The big leasing companies have all really focused on new aircraft at the exclusion of anything else,’ explains Wainshal. “It´s been playing to extremes and that´s all fine, but it leaves the rest of the market, kind of wide open and we´re the only big leasing company open to considering something that’s not new.”

Wainshal claims the lessor has adjusted its returns and strategy based on what the market offers. The result is that Aircastle’s trading strategy has evolved. “Our strategy three or four years ago was focused on newer wide-bodies with long lease terms and stronger credits. Most of what we bought fit that description. Today, wide-body market conditions and fuel prices and a lot of other things have changed significantly and where we now see value is in mid-age, current technology narrow-body aircraft.”

The leasing chief states that five to ten-year old 737 NGs and A320 CEO are “good value” offering relatively higher returns versus new A320 NEOs and 737 MAXs aircraft due to increased competition in the sale/leaseback space, particularly from newer lessors. Wainshal adds that returns are difficult to compare because residual value assumptions vary widely. Aircastle is less bullish on the new technology versus its peers because of low fuel prices. According to the CEO, based on Aircastle’s residual value assumptions and a return on asset, as opposed to an ROE, A320 NEOs and 737 MAXs produce returns of around 6% - 7% while A320 CEOs and 737 NGs offer returns between 7% – 9%.

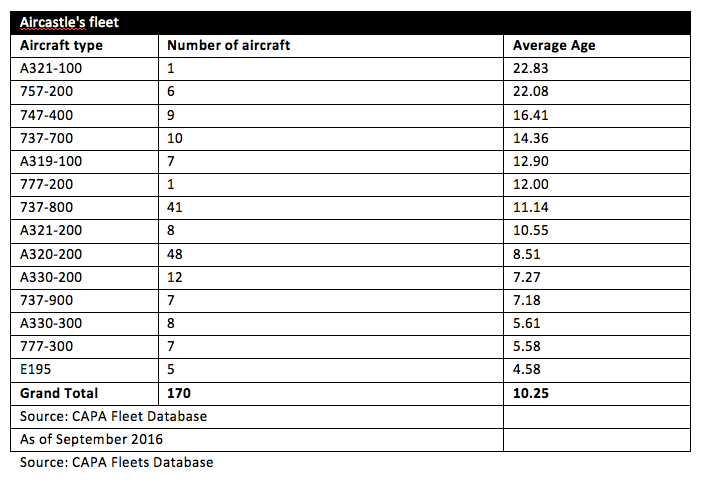

Aircastle’s changing fleet profile

Nearly 45% of Aircastle’s fleet is more than 10 years old. The lessor reports the average fleet age of its aircraft to be around 7.7 years. However, it is important to note that Aircastle calculates its weighted average fleet age based on net book value of its aircraft. This results in the weighted average age being lower than in reality as the value of the new aircraft will be higher than the older aircraft. As per our calculations based on data from the CAPA Fleets database, the weighted average age is around 10.25 years based on build date. This is primarily due to the six 757-200s that are around 22 years old on average.

In addition, the lessor also has a fleet of older 747-400 freighters that are over 20 years old and a single A321 that is also 22 years old. The lessor has stated that all of these older aircraft will exit the fleet in the next year or two once they come off lease. Aircastle has already recorded impairment charges on these aircraft. Nevertheless, since the lessor still has a number of relatively older aircraft, there will remain a risk of further aircraft impairments that could impact profitability in the future.

Aircastle in its Q3 earnings call highlighted that it has seen some softness for freighters and regional jets. The lessor owns nine 747 freighters, four of which are older, converted, 747 freighters. Aircastle plans to scrap the converted freighters within the next 18 months but plans to keep its factory-built freighters, which it states has an average age of 10 years. This will also have an impact on Aircastle’s fleet profile.

The Ishka View

The lessor’s model remains fixed on mid-life aircraft and Aircastle has been effective in carving out this space among other lessors. The Ishka View is that the strategy to phase out older aircraft is an appropriate one. The lessor has already recognized losses on some of its older aircraft, and has sold several older aircraft into its joint venture with IBJ Leasing.

Aircastle’s push for unsecured debt is another useful risk mitigant. It helps the firm move closer to an investment grade rating, but in the event of a downturn it also provides it with a debt cushion which it can, if needs be, supplement with unencumbered aircraft. It also provides Aircastle with an ability to be opportunistic. Many of the other lessors actively trading in older aircraft, such as Apollo, Castlelake, and Merx Aviation Finance, rely on fund money to acquire assets, which generally has shorter investment horizons. In the event of a downturn, many of the lessors could struggle to raise additional funds, which could provide Aircastle with a ‘first mover advantage’ to buy prized aircraft more cheaply.

Sign in to post a comment. If you don't have an account register here.