Monday 28 November 2016

Emirates profit shock points to overcapacity

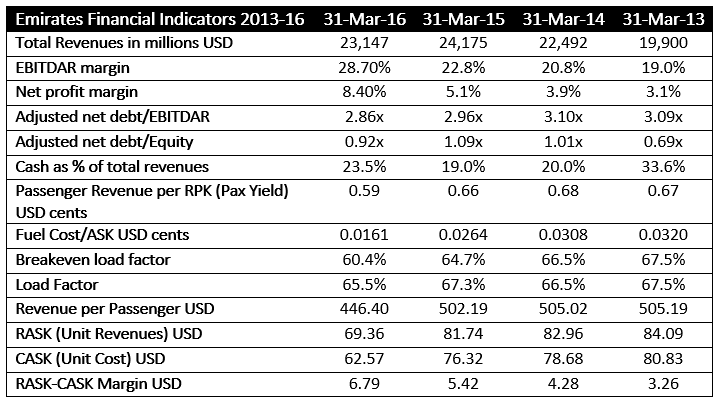

Emirates Airlines, the oldest and largest of the ME3 carriers, has reported a 64% fall in net profit for the first half of the financial year, to $364 million. The results end a record streak of increasing profitability for the airline, which continues to expand.

Much of Emirates’ fall in profits were due to a spike in debt repayments, rising jet fuel prices, and an appreciating US dollar. The carrier is also facing increased competition from low-cost carriers which have hurt revenues. Capital expenditure remains particularly high as the carrier has moved to an all Airbus A380 and Boeing 777 fleet. Group CEO Sheikh Ahmed bin Saeed Al Maktoum was unduly pessimistic about Emirates' prospects when he commented: “the bleak global economic outlook appears to be the new norm, with no immediate resolution in sight.”

The Ishka View is that the government-owned airline remains a strong carrier going forward. Emirates can expect a bumpy second half for 2016 but should look forward to a reprieve in the new financial year. The carrier’s debt repayments are set to drop considerably next year while a swathe of innovative financing structures will help drive pricing down. What is more concerning is what Emirates’ results spell out for the rest of the industry.

If Emirates' Fuel Cost/ASK has halved since the 2013 figures, yet passenger yield is down 12%, load factor down 2% and revenue per passenger is down 12% over the same period, then what pressures are weaker airlines going to have to handle? Ultimately, Emirates’ results speak more about the forces that the world’s airlines now face. The real question is how well will these airlines deal with them?

Source: Emirates and Ishka calculations

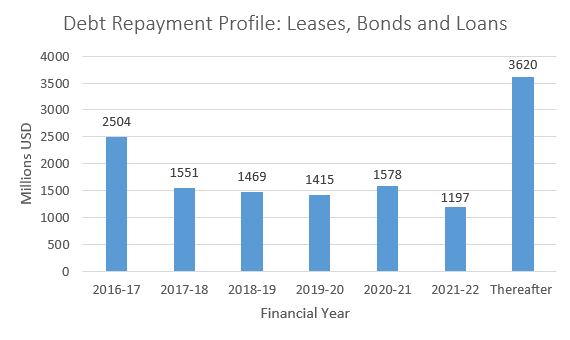

Debt, fuel and currency changes are behind profit drop

In a statement, Emirates attributes the fall in profits to an ongoing investment in new aircraft as well as infrastructure projects and bond repayments. As the graph below shows, debt repayments for the 2016-2017 financial year will total $2.5 billion. This is a 136% increase on the previous year’s $1.1 billion. The effect on the first half result for 2016-17 is therefore likely to be reflected in the final year results. However, repayments are set to drop by $953 million in the next financial year which indicates that this is a short-term issue and not a long-term concern.

Source: Emirates

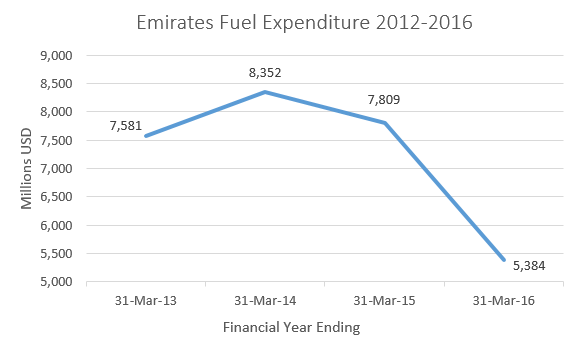

In 2016, fuel prices have started to rise again which has squeezed the profitability of the carrier. As the chart below indicates, Emirates’ fuel costs have fallen by around 40% between 2012 and the financial year end in March 2016. This has helped contain costs but has conversely crimped demand for premium booking from the oil and gas sector. However, the price of jet fuel has climbed significantly since the beginning of 2016, when it reached a 13-year low of $35 a barrel. According to IATA, jet fuel prices are around 48% higher in dollar terms than they were at the beginning of the year. This has amplified the effect of declining revenues.

Source: Emirates and Ishka calculations

The climbing value of the US dollar has also pushed costs up. Though the dihram is pegged to the dollar, much of Emirates' income in denominated in other currencies. “Our performance for the first half of the 2016-17 financial year continues to be impacted by the strong US dollar against other major currencies, and by increased competition, as well as the sustained economic and political uncertainty in many parts of the world,” said the group’s CEO. Emirates can do little about macroeconomic pressures but it can try take measures to increase revenue.

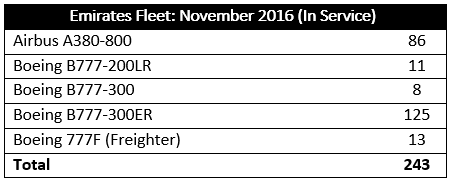

Emirates moves to an all A380 and B777 fleet

Since January 2015, Emirates has retired 18 A330 and five A340 aircraft from its fleet with an average age of 16.5 years. The carrier now operates a fleet entirely composed of Airbus A380s and Boeing 777s. It is due to receive 25 more A380s between now and 2019 and another 25 from 2021 onwards, from its $112 billion order book. Continued expansion has helped decrease the company’s cash pile by 35% since March 2016 to $4.1 billion in September. The extra capacity is on top of a 9% capacity growth in 1H 2016-17. The danger is that such capacity growth may be putting downward pressure on revenues.

Emirates aims to increase revenue by using higher density aircraft on short haul routes. Increasingly the carrier is using A380s for short-haul services on high-density routes. There are now seven Emirates routes serviced by the A380 on distances of less than 1,000 km. On ‘normal’ routes the A380s scale generates a lower operating cost per seat, although fares are lower on shorter flights. However, the new A380s have 25 more economy seats than their predecessors and fewer seats in business class.

Clark has described the A380 as the carrier’s “only unique selling point.” But does it make sense to use the world’s largest airliner for short haul routes? The higher density services might be expected to raise yields but could also depress passenger revenue. There is of course precedence where larger aircraft have been successfully used on short haul routes simply to satisfy volume demand, with the high density 747s that operated domestically in Japan, a classic example.

Source: Emirates

Low-cost, long-haul competition is hitting profits

Emirates is also facing pressure from an increase in low-cost carrier activity covering long-haul routes. “More and more international network carriers will be starting to move into the long-haul, low-cost market,” Emirates president Tim Clark. “That will be the shape of things to come.”

Low-cost, long-haul carriers have so far been confined to the Asian market, with players such as Jetstar and Scoot challenging the legacy airlines. However, it is increasingly spreading to European and trans-Atlantic routes with the arrival of Norwegian and others. Clark says the airline “has to change its approach to long haul pricing to combat increasing competition.

Source: Emirates

Banks have been approaching concentration lending limits

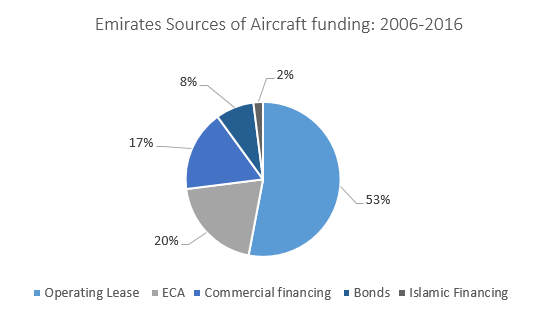

Given the number of high-value widebodies that have been delivered and those that are still in the orderbook, some lenders are closing in on their concentration limits. As the chart above shows, funding over the last decade has been heavily reliant on commercial debt and ECA financing.

In 2015-16, Emirates raised a record $7.3 billion in aircraft financing and secured further financing for deliveries up to 31 March 2016. But, the size of Emirates’ orderbook has been putting pressure on banks’ concentration lending limits, which encouraged the carrier to innovate with its financial structures.

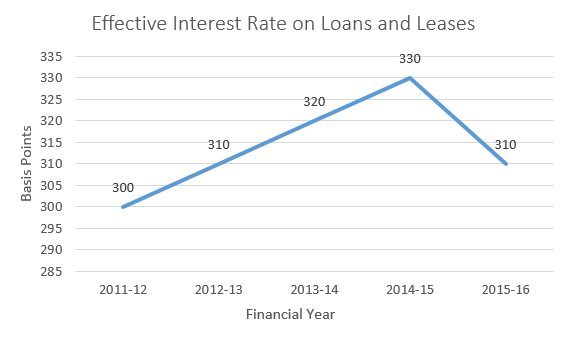

In the 2015-16 financial year, Emirates experimented with an operating lease structure that used German banks, instructional lenders and Islamic debt. It also closed the first ever operating lease on an A380 financed entirely by the Korean institutional market. The carrier also secured an $913 million sukuk bond guaranteed by UKEF, the largest ECA backed capital market offering in aviation to date. This innovation could help explain the fall in the carriers cost of financing last year, see graph below, which would be a welcome development. As of March 2016, 92% of Emirates’ liabilities are on a fixed interest rate and only 8% are on a floating rate.

Source: Emirates

The Ishka View

Emirates remains a strong credit and its continued fleet expansion offers considerable opportunities for financiers. Despite the 1H 2016-17 shock to profitability, the long terms sustainability of the carrier looks stable. It has flexibility within its fleet ownership to fine tune and can respond to any further changes in demand, both negative and positive. The carrier’s large orderbook of 50 A380s has reduced cash levels, and recent deliveries may have led to slight overcapacity and depressed revenues in the near term. This has been compounded by several factors including a rise in debt repayments last year, but which are expected to drop in the 2016-17 period), as well as rising fuel costs. In addition the carrier suffered from the appreciating strength of the US dollar, and increased low-cost competition on long-haul routes. The carrier can, however, look forward to a lower cost of financing resulting from new financing structures. Many other airlines will not have the critical mass or stability to be able to ride out such turbulence. Emirates results probably carry a stronger message for the rest of the airline market than they do for Emirates themselves.

Sign in to post a comment. If you don't have an account register here.