Wednesday 6 August 2025

Air Lease Q2 2025: ‘We still do not view pricing of new aircraft orders to be attractive’

Air Lease CEO John Plueger indicated that the company has no immediate plans for new aircraft orders, describing current pricing as unattractive during its recent Q2 2025 earnings call. The lessor has already placed 100% of its orderbook for aircraft deliveries through 2026 on long-term leases and 87% for 2027.

"We are very disciplined buyers of aircraft, and we still do not view pricing of new aircraft orders to be attractive,” said Plueger.

The lessor is open to sale-leasebacks (SLBs) but only where it can find a unique opportunity with an airline, for example, attaching a portion of SLBs to a broader aircraft placement.

"We know what we pay for aircraft, we know [what] we get for leases,” Plueger continued.

“We're happy to take a look at any sale-leaseback opportunities, but it's hard to see that there's going to be a material shift in that marketplace versus the order book marketplace.

“I think that the sale-leaseback marketplace will still tend to be overly competitive and will probably still return a lower lease."

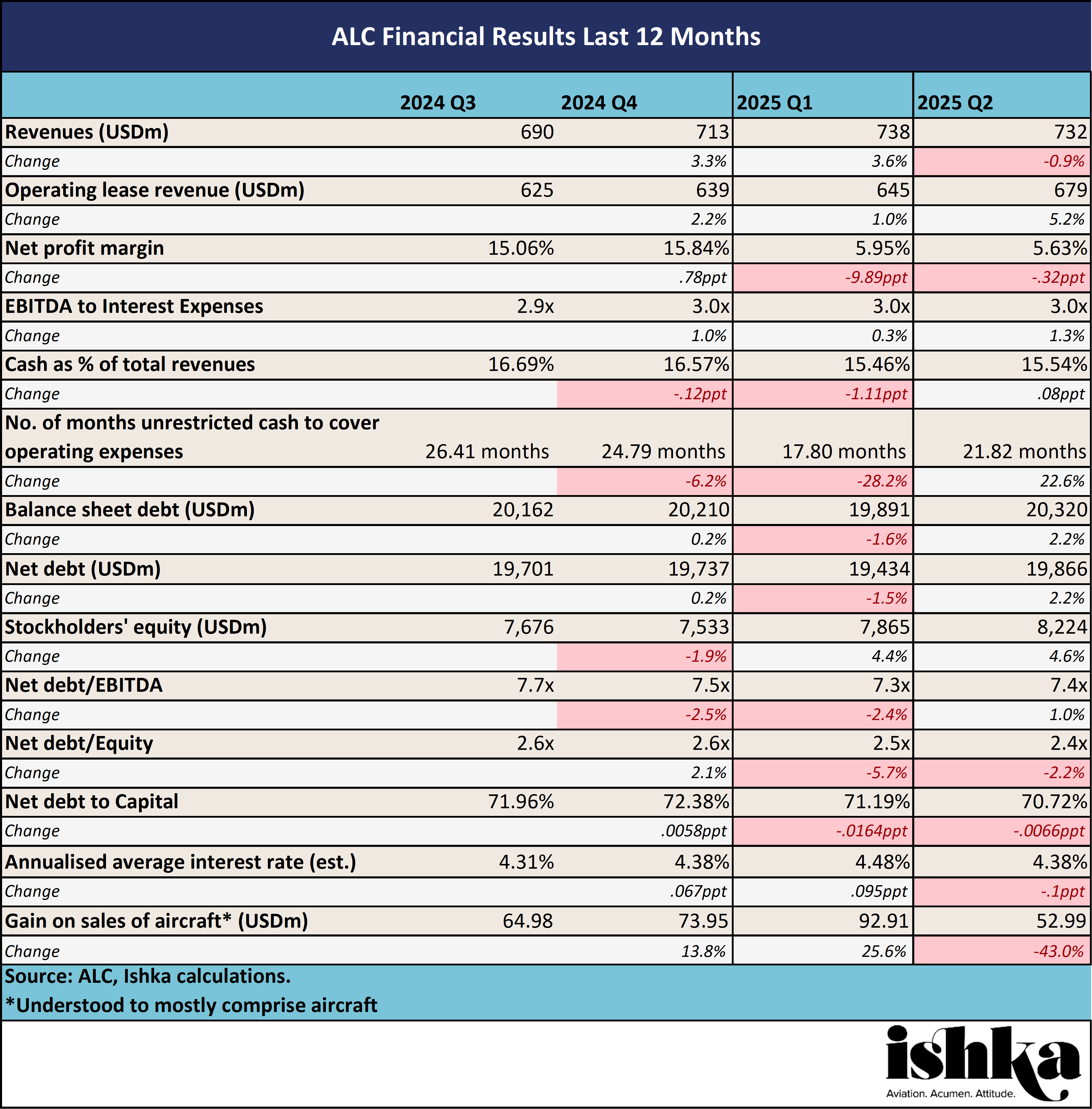

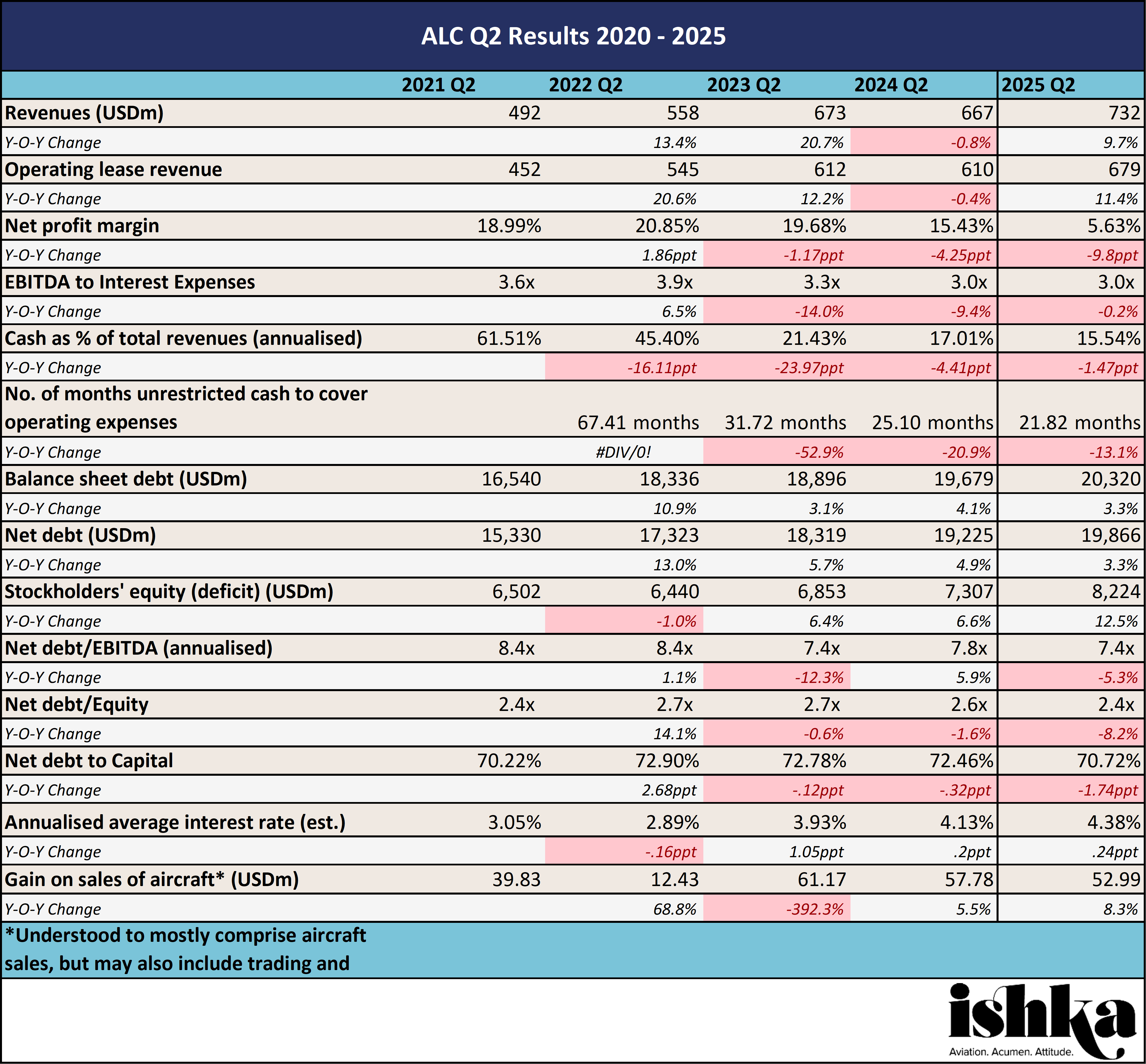

Air Lease’s total revenues rose to $732 million in Q2 2025, up 9.7% year-on-year, boosted by a $344 million insurance claim settlement stemming from the Russia-Ukraine aviation insurance dispute (see Insight: London High Court rules in favour of lessors in $4.5bn aviation insurance dispute). The lessor expects a further $60 million in Q3 from additional claims.

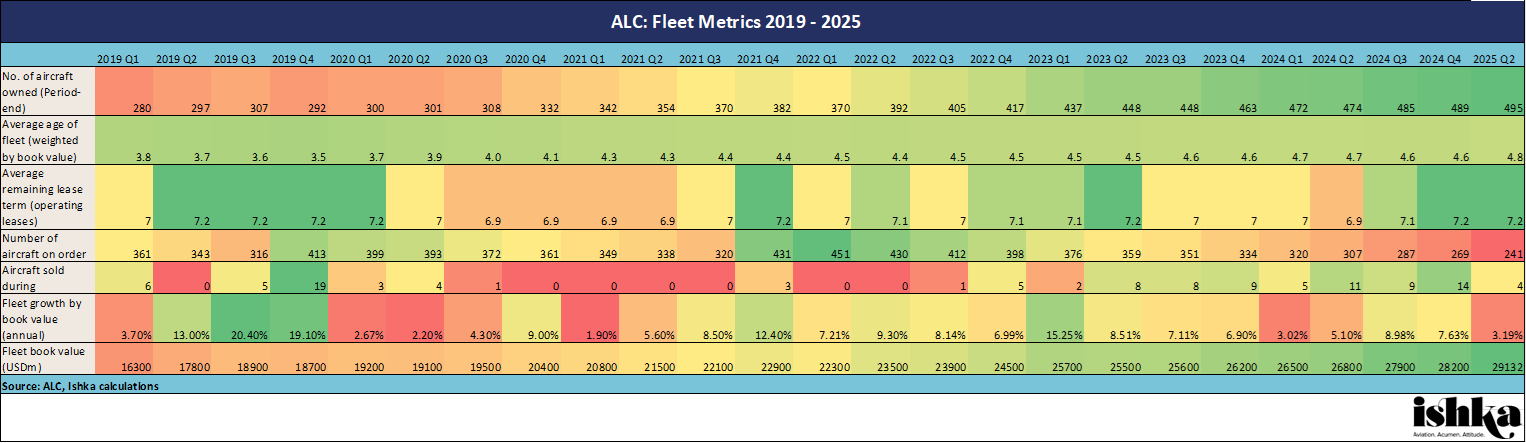

Air Lease took delivery of 12 aircraft during the quarter, investing $892 million, and sold four aircraft for proceeds of $126 million, generating a $16.7 million gain. It has a further $1.4 billion in aircraft sales lined up, including $524 million in assets already classified as held for sale and $851 million under letters of intent (LOI).

The lessor expects around $600 million in deliveries during Q3 and is confident in meeting its full-year delivery targets. “So far, we've delivered about $1.7 billion of aircraft out of our expected outlook for full year order book deliveries of roughly $3 to $3.5 billion, and we believe we're likely to hit the upper end of our full year expected range," said Plueger.

Air Lease also reaffirmed that it is largely able to self-fund its order book with expected operating cash flow and aircraft sales activity.

Widebody extension rates climbing up

Air Lease described demand for commercial aircraft as “robust,” noting continued strength in lease extensions with lease rental revenues climbing 11% to $679 million.

“Nearly all customers [are] choosing to extend rather than let aircraft go to competitors or other airlines,” said Plueger. “And the lease rates we are garnering on these extensions are strong, higher than a year or even eight months ago, including recent wide-body extensions of A330 and Boeing 777 aircraft.”

While narrowbody extensions remain in the four-to-six-year range, widebody extension terms are lengthening.

“What’s good to see is that widebody extensions are now pointing to longer extensions in the 4 to 5 area range. That’s [been] pretty much a slam dunk for single aisles, but the wide-bodies are now at that longer extended term length as well.”

Tariff relief welcomed amid cargo market caution

Air Lease welcomed the news of zero-for-zero tariffs on commercial aircraft and parts in the US-EU tariff agreement announced last week, describing the trade framework as setting a "clear precedent" globally for aviation (see Insight: Embraer left exposed as US-EU strike aviation trade deal).

Plueger was also keen to remind analysts that under the lessor's lease agreements, tariffs would be the responsibility of the lessor's customers, while in purchase agreements with manufacturers, the OEMs' ability to increase prices is limited by escalation caps.

While Air Lease's customers remain cautious about continued geopolitical uncertainty, Plueger said demand for passenger aircraft has remained strong and conversations have been positive. However, he acknowledged that freighter demand had been more volatile.

“Our sense is there has been a little bit of caution in the cargo markets. Not that we're a huge provider of cargo aircraft, but the freighter markets have had a little bit more fluctuation in the tariff era, as I would call it,” Plueger said.

"And that was one of the things that we thought about, in reference to [the cancellation of] our A350 freighter order.”

Air Lease confirmed in the earnings call that it has cancelled an order for seven A350 freighters made in December 2021. The majority of those A350 freighters were already more than one year late for delivery, with the cancellation freeing up over $1 billion in forward capital expenditure commitments.

The Ishka View

Air Lease has not made any new orders from either Boeing or Airbus since 2021 and has had a steadily diminishing orderbook, with 241 aircraft on order as of the end of Q2, 66 fewer than the same quarter last year. However, it seems that no new orders are on the horizon as the lessor bides its time on opportune pricing.

The company's cautious tone on sale-leasebacks also contrasts sharply with competitors. The currently highly competitive nature of the market makes orderbook placements a more attractive prospect than sale-leasebacks from a yield perspective, noted Plueger. Meanwhile, rival lessor AerCap stated in its own recent Q2 earnings call that deals are beginning to present themselves and expects the sale-leaseback channels to soon open further on the back of improving OEM production rates. (see Insight: AerCap Q2 2025: Sale-leaseback deals “are beginning to present themselves"). However, both lessors seem aligned on the question of new aircraft orders, not right now.

Sign in to post a comment. If you don't have an account register here.