in Other

Monday 12 December 2016

Passenger traffic fails to catch up with capacity

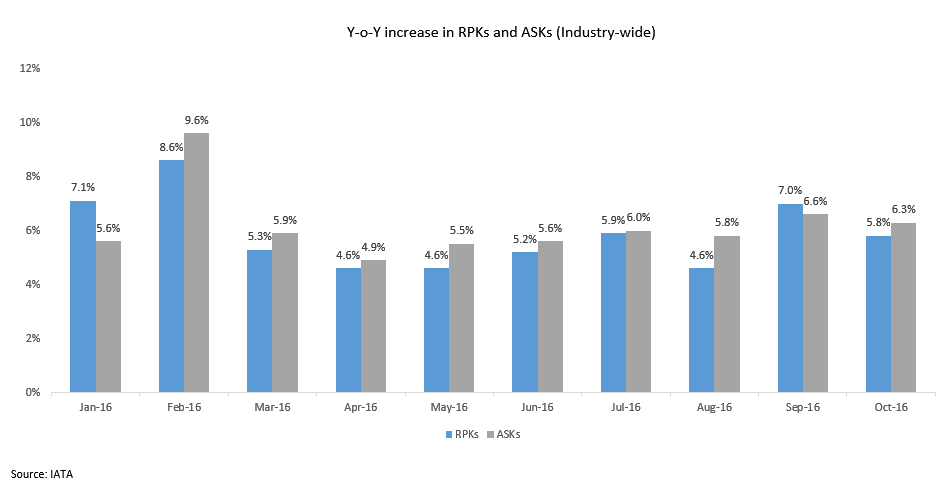

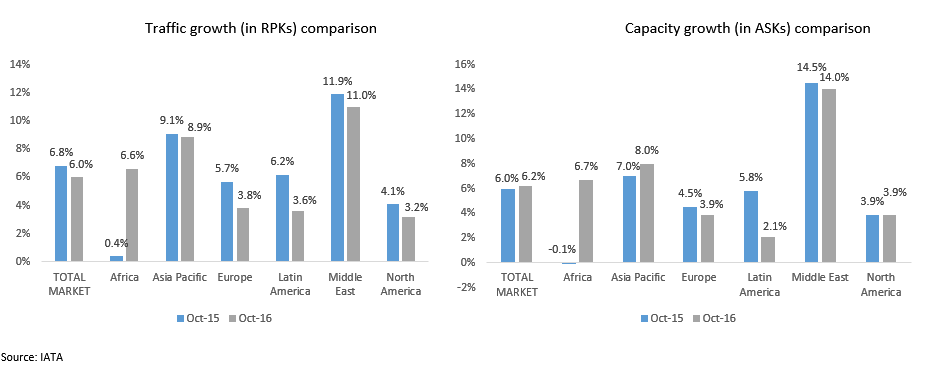

The aviation industry continues to add capacity much faster than passenger demand. Apart from January and September, capacity rose by a higher percentage compared to traffic in every other month in 2016. Traffic grew by 6% between January and October 2016 compared to the previous year. Capacity, during the same period, rose by 6.2% again driven primarily by Middle East, India and China.

The industry appears to be heading towards overcapacity.

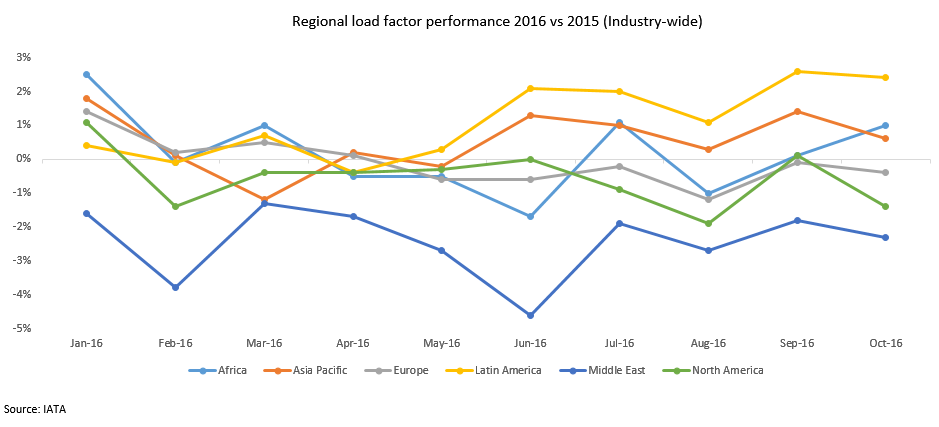

Most of the traffic growth was driven by international traffic from the Middle East and domestic India and Chinese markets. However, while India and China have improved load factors in 2016 both the Middle East and North America have experienced the biggest drops over the same period.

The Ishka View is that the widening gap between capacity versus traffic growth suggests overcapacity. If so, airlines are likely to have to compete more aggressively to fill seats and will inevitably feel the pressure to their bottom lines.

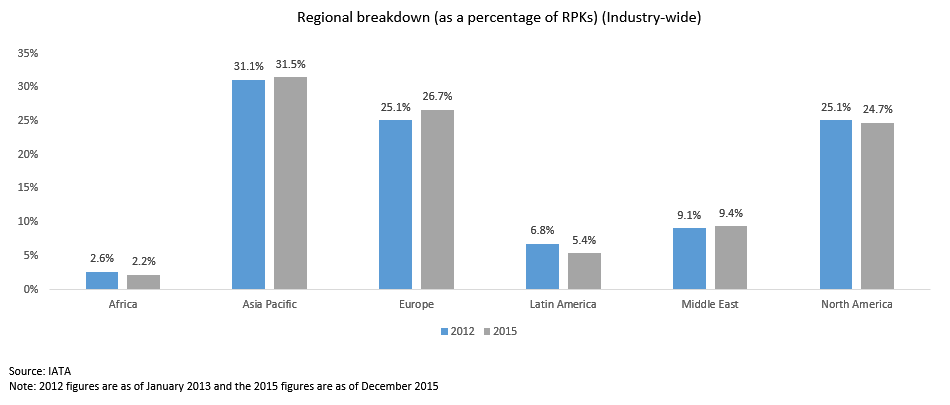

Market share evolution (2012-2015)

In the past three years, Africa has seen a further reduction of its share of world RPKs. Regulatory challenges and weak economic conditions continue to limit the region’s air travel potential. However, after a stagnant 2015, the region has seen some positive growth during 2016. Latin America which has also seen a substantial contraction in its share on account of the harsh macroeconomic conditions prevalent in the region during 2014 and 2015. In contrast, Europe has seen a surge in its share of world RPKs suggesting solid growth over the period. Asia Pacific and North America have seen marginal changes in their share of world RPKs.

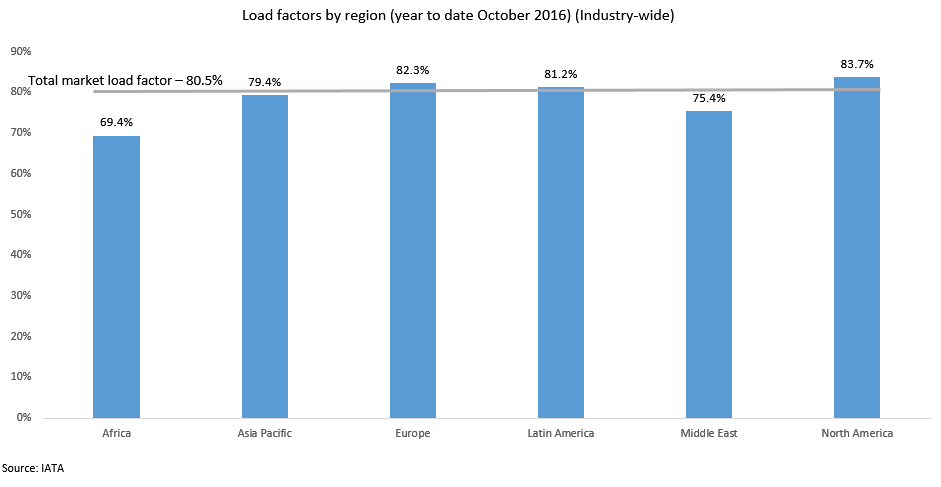

Load factors

Among all regions, the Middle East has come under increasing pressure during 2016. As per IATA, international traffic growth from the Middle East has remained stagnant between July and October 2016 and has achieved moderate growth during the rest of the year. Capacity utilisation has been substantially weaker in 2016 relative to 2015. Africa has traditionally always had lower capacity utilisation.

On the contrary, as Latin America recovers from challenging macroeconomic conditions, it has seen some improvement in its load factors as traffic has slowly started to pick-up but airlines remain prudent at capacity addition. While Europe and North America have seen marginal declines in the load factors compared to the same period last year, they still remain fairly robust compared to other regions. The growth in Asia Pacific segment is dominated primarily by carriers in China and India which are on a completely different growth trajectory compared to carriers in other parts of the region which have significant competitive pressures to contend with.

Apart from Latin America, Africa and Asia Pacific, all other regions appear to have experienced some kind of weakness in capacity utilisation levels vis-à-vis the previous year. Middle East looks the worst hit, with the load factors consistently and significantly lower than in 2015. Lower utilisation has translated into a weaker performance for some middle eastern carriers. Emirates saw its net profit fall by more than 60% during the first six months of its financial year 2016-2017 (as mentioned in Ishka’s previous insight: ‘Emirates profit shock points to overcapacity’).

All these trends point to increasing overcapacity in the market – while traffic is growing, capacity is growing much faster than required. And with more capacity slated to be added, it remains to be seen whether airlines manage to fill those additional seats.

Airlines begin to defer

Some airlines have already started to take steps to revise their growth plans. In November 2016, United Continental converted its order for 737s NGs to the Max model but has not yet specified delivery dates. In July 2016, American deferred 22 A350s by an average of 26 months. The A350s were originally scheduled to start entering American’s fleet in Spring 2018. Earlier, in June 2016, Southwest pushed back deliveries of 67 B737 Max 8s by at least six years. The aircraft will now be delivered between 2023 and 2025 compared to 2019-2020, as scheduled originally. Turkish Airlines, which has been negatively impacted following failed coup and a terrorist attacks, has revised the delivery schedule for 39 of its 167 aircraft deliveries (both Airbus and Boeing) that were originally scheduled for delivery between 2018 and 2023.

RPK vs ASK

Despite airlines globally battling to improve their yields, 2016 has consistently seen ASKs rising faster than RPKs. As a result, utilisation have also consistently weak throughout 2016.

While traffic growth has slowed down across the board during 2016 (except Africa), airlines have continued to add capacity at a similar rate or even at a higher rate than 2015. This has resulted in weaker load factor levels during 2016.

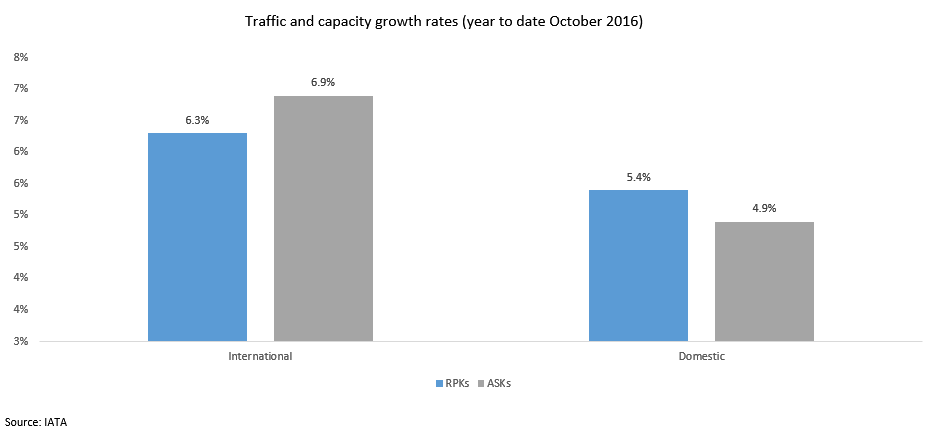

International vs domestic

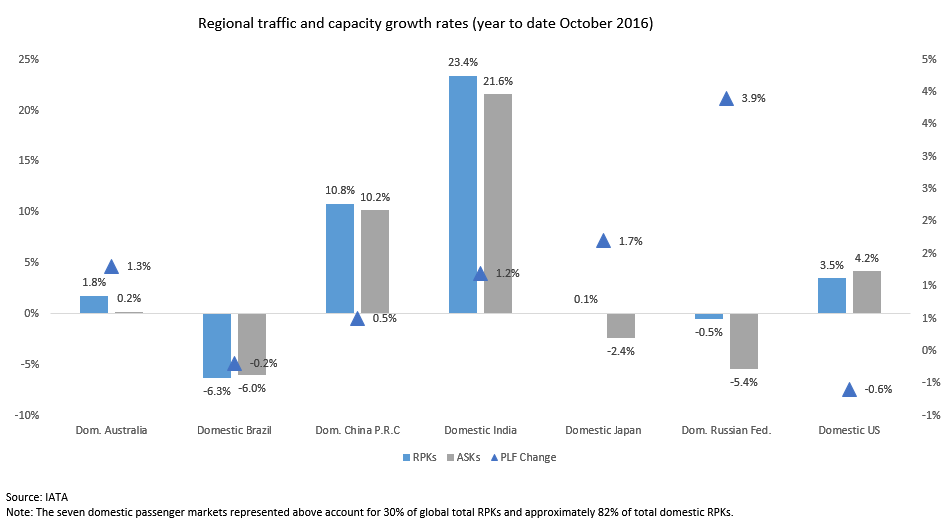

While international traffic growth remains fairly robust, the domestic market has witnessed much more efficient and sustainable growth. This is mainly thanks to the domestic markets of China and India. Both markets improved traffic faster than they added capacity. As per IATA, this is on account of greater flight frequencies (mainly India) and more airport-pairs served (in China and India) which tends to make flights cheaper for customers and fuelling demand. While the international market recorded a higher traffic growth rate compared to the domestic market in 2016, lower load factors have nullified the positive traffic growth to some extent.

In contrast, domestic markets have been more prudent in capacity addition with the likes of Russia (influenced by the collapse of Transaero, Russia’s second largest airline at the time), Brazil and Australia trimming capacity in response to the weaker macroeconomic conditions in the former two countries and the problem of overcapacity in Australia. The international segment also witnessed some weakness and disruption early on in 2016 on account of terrorist related activities.

2016 has seen the domestic segment performing better than international segment influenced significantly by the robust markets of India and China. While China and India are in a league of their own and have experienced extremely robust traffic growth and improvement in capacity utilisation, even the other markets have been optimising capacity which has helped to improve load factors.

Domestic Russia also saw a substantial improvement in its capacity utilisation as it recovers from extremely challenging macroeconomic conditions. Domestic Brazil, however, continues to suffer from the ongoing recession in the country. In summary, domestic segments have shown restraint in adding capacity and have instead focussed on bettering capacity utilisation with the exception of domestic US which added capacity at a rate higher than the growth in traffic. As a result, airlines in the US continue to operate in a weak revenue environment.

The Ishka View

Industry-wide load factors have subsided throughout 2016 suggesting that the robust traffic growth achieved during 2015 is likely to wane. At the same time, airlines have continued to add capacity much faster than the rate of traffic growth. The traffic trends suggest that there is overcapacity in some markets and is likely to only increase going ahead. While some airlines have begun adjusting their growth plans and have revised their delivery schedules for 2017, there are still a number of aircraft that are scheduled to enter service in 2017 and 2018.

The growing signs of global economic and political uncertainties will put further pressure on traffic growth. The two key stimuli for passenger growth, lower oil prices and airfares, possibly behind us, airlines will be forced to be more prudent in capacity growth. Most of the major aircraft deferrals have come from North American carriers, the question is whether we would witness changes in aircraft delivery schedules in other regions as well.

Sign in to post a comment. If you don't have an account register here.