Friday 25 January 2019

New beginnings – a review of the new airlines of 2018

Following the recent Insight analysing those airlines that came to a halt in 2018, here Ishka takes a look at those airlines that came to life in 2018, and asks the question – how secure are the plans for some of these start-ups?

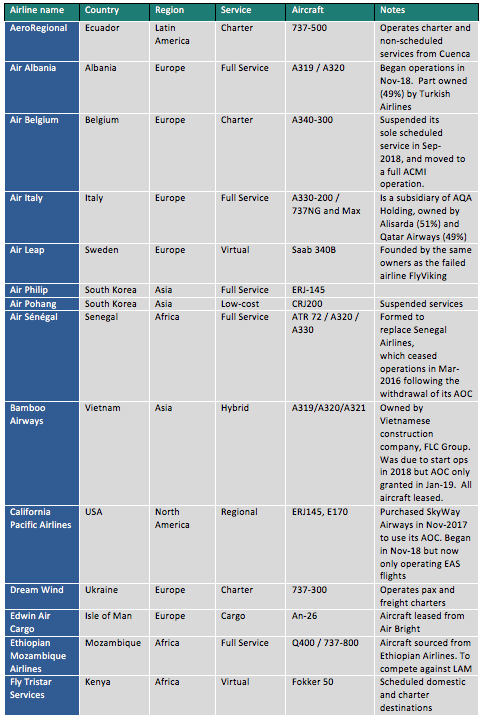

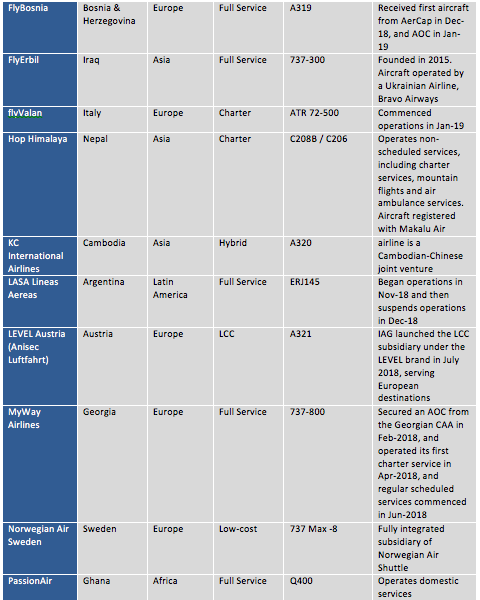

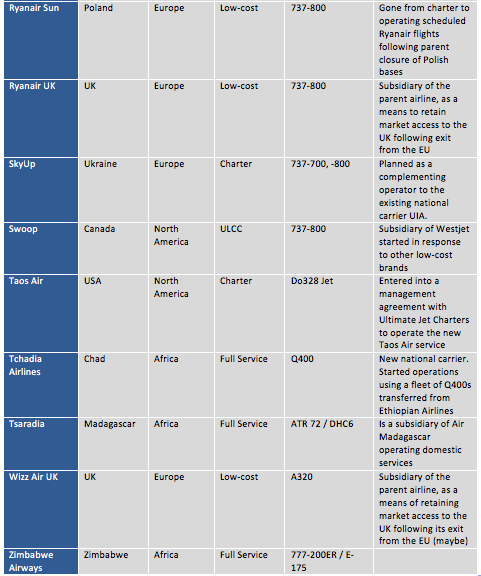

The table below attempts to cover all those airlines that commenced operation during 2018. A number of these have spent a considerable gestation period since their formation, either sourcing financial backing, sourcing aircraft, while seeking the appropriate from the local aviation authority.

In addition, Ishka has focused on those airlines that have been newly set-up. This includes subsidiaries of existing airlines if they have been granted their own separate AOC. However Ishka has excluded any airlines that are merely a reincarnation, or resurrection, of an old airline that has been dormant for a number of years.

We have also included any airlines which began operating that slipped over into the beginning of 2019 as well. Further, there have been several airlines that have been formed during 2018 and which may have already received the necessary approvals but have yet to begin operations. In these instances, we have omitted them from the analysis.

Click on the charts below to download a larger version.

Click on the charts above to download a larger version.

Source: The Ishka View

The Ishka View

While sustained passenger growth over the last several years has led to a continued set of new entrants into the market, the headwinds of low air fares and overcapacity has been putting smaller, and indeed mid-sized, airlines under mounting financial pressure. Some of those that have recently entered the market are already showing signs of a wobble.

While Europe tops the list (again) of newly established carriers, this should be tempered by the fact that there are four airlines which have been set-up as subsidiaries of the main parent. If these were disregarded, the region would nonetheless still maintain its status at the head of the table.

With the North American market having undergone wholesale consolidation, there are fewer opportunities for new entrants. A lack of any real new airlines highlights this fact. Several new African airlines have started, again, looking for a foothold in the region, although the various social and operational challenges make their impact minimal.

In the charter market, the whole service model has recently come under pressure. The signs are ominous for new firms entering that space at this juncture.

Finally, Ishka notes the limited number of start-up airlines operating twin-aisle aircraft. This is partly due to the sheer amount of capital needed to operate such assets but also, Ishka suspects, because of the challenges for new carriers trying to launch scheduled long-haul operations outside of the charter market.

Sign in to post a comment. If you don't have an account register here.