in Aircraft values, Lease Rates & Returns , Lessors & Asset managers , Investor Briefings

Tuesday 24 June 2025

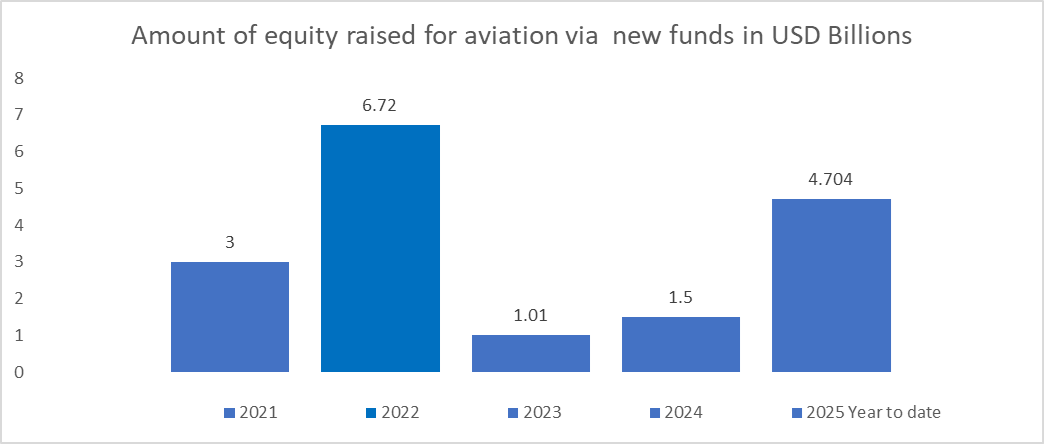

Briefing: Lessors announce $4.7bn of fresh equity raises via funds so far in 2025

Aircraft lessors have announced equity raises for a total of $4.7 billion of fresh equity into aviation funds so far in 2025, according to Ishka research, a significant improvement compared to the last two years.

Leasing sources confirm that raising equity has become easier in 2025 but argue that this process began in the latter half of 2024. Lessors typically announce funds when they have closed, or the fund-raising process has stopped. Most of the historic fund raising has been via closed-end dedicated aviation fund structures, however a few notable announcements have been key joint ventures between an existing multipurpose fund investing into aircraft leasing through an asset manager.

The tally reflects a change in the fundraising landscape compared to 2023 – when a series of hikes in the interest rates set by the US Federal Reserve, and the knock-on impact on publicly traded debt and equity investments, caused many institutional investors to halt their allocations to alternative and esoteric asset classes.

The fundraising environment appears to be becoming generally easier, but several sources have confirmed that the fund-raising process is taking longer. One consultant explained to Ishka that, in the last three years, he has been advising clients that engaging and onboarding a new investor client could easily take 18 months for aviation opportunities. Before that, the process could have taken anywhere between 9 to 12 months, explains the source.

Source: Ishka Research and Bloomberg data* Where there is no information on the size of the fund Ishka has included an assumed amount. Please note this tally includes publicly disclosed aviation equity and debt funds.

Aviation premiums vs other asset classes

Sources share that one reason why fundraising has become easier is that more investors have become disappointed with the returns available in several of the more popular alternative asset classes. These appear to range from infrastructure assets like data centres or cell towers to renewables such as solar and mobile assets like containers.

“Investors often use that as a benchmark, and then they look for a premium for aviation beyond that level. There is sort of a natural floor, depending on market conditions, of around 150 basis points wide of where some of the more mainstream esoteric assets price, like data centres, or digital infrastructure, solar etc.”

Aviation appears to be offering investors a premium compared to these asset classes, as well as a chance to diversify their portfolios. However, sources warn that investors are always conscious of relative returns and can risk on or risk off quite quickly to the asset class.

One question on many lessors’ minds is how investors would view aviation as an asset class with the looming potential threat of tariffs. When questioned by Ishka lessors appeared split on the issue. Several pointed to the increased number of funds being raised, while others confirmed that the tariffs had deterred some investors from finally committing.

The Ishka View

Investors are coming back to the sector. The annual tallies captured in this report, based on public disclosures, are of course only the tip of the iceberg. Many more investors are also offering equity directly to asset managers through bilateral equity mandates (more on this in an upcoming report). There is also a big difference between passive LP investors investing directly into an aircraft debt fund versus more discretionary capital that might consider aircraft investments on a per transaction basis.

But the overall trend is quite clear: more capital is coming back to the sector which is boosting an already active aircraft trading market. There is a natural delay between when lessors begin and finish fundraising for a new fund and their announcement. It is clear that there was some easing last year when it comes to fund raising that has persisted in the first quarter of 2025, despite the uncertainty stemming from tariffs. After so many recent black swans (the pandemic, Russia, etc) it feels dangerous to speculate what the final fund tally might look like for 2025, but lessors are bullish about their prospects. Ishka is aware of at least three funds trying to raise equity at the minute.

Click to read a larger version of this chart

Sign in to post a comment. If you don't have an account register here.