in Lessors & Asset managers , Capital Markets , Aviation Banks and Lenders

Wednesday 15 May 2019

Goshawk markets debut ABS

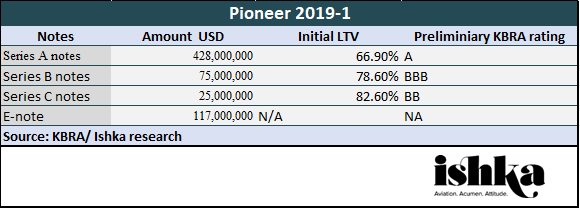

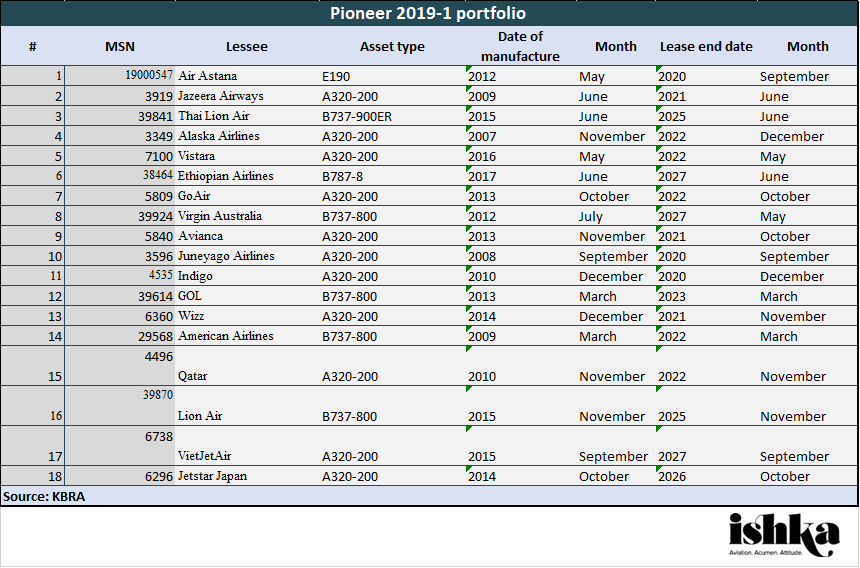

Ireland-headquartered Goshawk Aviation (Goshawk) is in the market with an inaugural $529 million ABS: Pioneer 2019-1 which will acquire 18 aircraft. The deal is split between three series of notes as well as a $117 million 144a/reg-s tradable E-note. The portfolio has an average age of approximately 5.3 years with a weighted average remaining lease term of approximately 5.1 years – making it the youngest aircraft ABS with a tradable E-note to date.

The portfolio consists of 16 narrowbody aircraft (11 A320-200s, 4 737-800s and 1 737-900ER), one widebody aircraft (1 787-8) and one regional jet (1 E109). Goshawk will be the servicer of the transaction.

Click here to download the data behind the chart.

Ishka understands that California fund Beach Point Capital management has acquired a 30% stake in the E-note while Goshawk is keeping 10% of the equity. Goshawk will act as the asset manager for the equity portion of the deal.

The series A Notes and series B Notes amortize on a 14-year straight-line schedule while the Series C Notes amortize on a 7-year straight-line schedule. The deal is expected to price next week.

Milbank is representing Goshawk while Hughes Hubbard is representing the underwriters.

Mizuho is global coordinator, sole structuring agent and lead left bookrunner for the debt and equity. Goldman Sachs is a joint bookrunner for the debt and equity. CA CIB is a joint bookrunner for the debt while Citi is also a joint bookrunner on the debt portion. CA CIB is also the liquidity facility provider.

Click here to download the data behind the chart.

The Ishka View

Goshawk’s debut ABS is the latest in a series of aircraft ABS deals that have hit the market after a relatively quiet Q1. The young age of Goshawk’s leased aircraft portfolio is a reflection of the corporate’s leased fleet and its growth through acquisition of new leased aircraft in the sale/leaseback market.

Given the current demand from investors to acquire leased aircraft, Goshawk could easily have sold its aircraft portfolio through the trade sale market, but the ABS indicates a push to diversify the lessor’s sales avenues.

Beach Point Capital clearly likely what it sees, and has acquired a far bigger chunk of the E-note than the roughly 20% ticket OZ management’s LP took of STARR II’s E-note as anchor investor. The fact that Goshawk has also set itself up as the asset manager for the equity reflects a long-term commitment to trying to do further ABS portfolio sales. The challenge for Goshawk, shared by many other potential aircraft lessor ABS sponsors, is to acquire enough aircraft to become a programmatic issuer.

Sign in to post a comment. If you don't have an account register here.