in Capital Markets , Aviation Banks and Lenders

Wednesday 9 October 2019

Carlyle scores tight pricing for AASET 2019-2

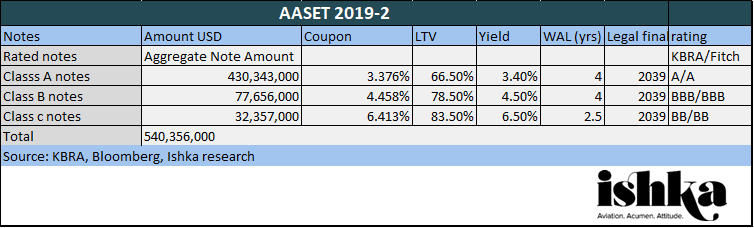

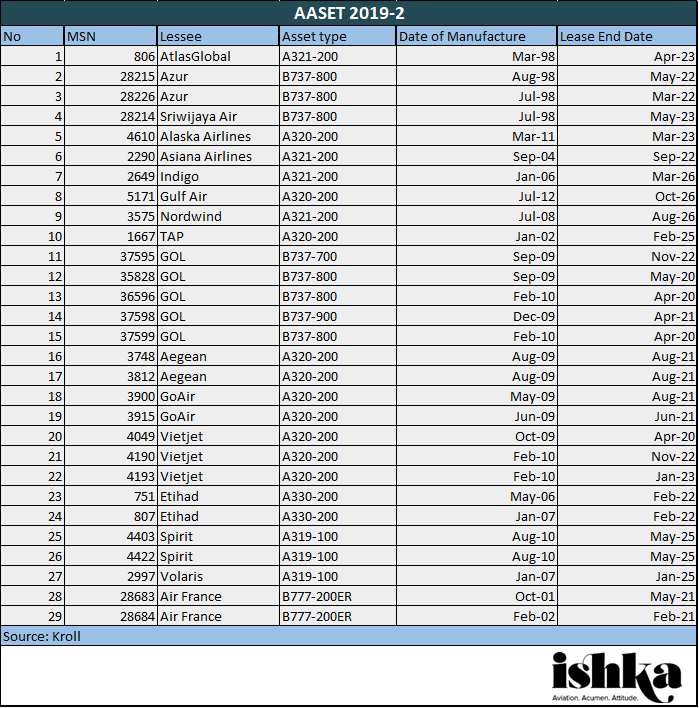

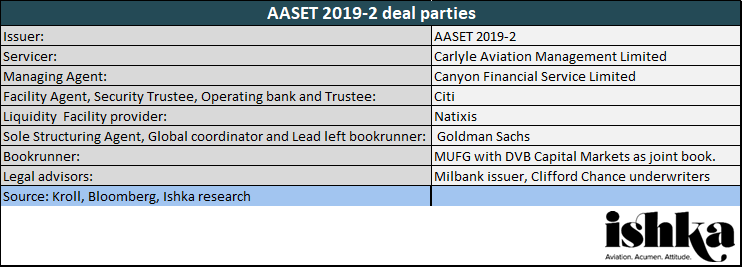

Carlyle Aviation Holdings Limited (Carlyle) has priced a $540.4 million aircraft securitisation, AASET 2019-2 Trust (AASET 2019‑2). The deal is split between three classes of notes and will be used to acquire 29 aircraft with an initial weighted average age of 11.9 years and a weighted average remaining lease term of approximately 3 years.

The portfolio consists of four widebody aircraft (two A330-200s and two 777-200ERs) and 25 narrowbodies. Six of the aircraft, (20.5% by value) have been purchased from another ABS, Harbour Aircraft Investments Limited, Series 2017 (HAIL 2017). Carlyle, through separate funds acquired the e-certificates in the HAIL 2017 transaction and replaced Aergen as servicer. A further nine aircraft in the portfolio are expected to be acquired within a 270-day period. Like its previous ABS deals Carlyle is understood to be retaining the equity in the transaction, a credit positive in Ishka’s view as it helps align issuer and investors’ interests.

The portfolio has a short average remaining lease left of just three-years, shorter than previous Carlyle aircraft ABS transactions which have averaged around 4 years remaining lease life left.

Kroll has identified this as a risk for the transaction while Carlyle has shared its plans for 10 of the aircraft in the portfolio with leases expiring in 2020 and 2021. It plans to sell 2 aircraft, has an LOI to lease two aircraft, has a plan to re-lease a further 5 aircraft and is extending the lease of one aircraft.

Click here to download the data behind the chart.

AASET 2019-2 structure

The class A and B Notes amortize on a 12-year straight-line schedule while the Class C Notes amortize on a 7-year straight-line schedule. The transaction also includes an initial $25.84 million reserve account and a nine-month liquidity facility.

The transaction has a 10% cash sweep for the class A and class B notes which starts in year 5 and which increases to 25% in year 6 and 50% in year 7 until the anticipated refinancing date (ARD) in year 7 and is 100% paid sequentially. Class B Notes have an additional 5% cash sweep starting in year 5, which increases to 10% in year 6 until the ARD while the class C notes have a 25% cash sweep starting in year 4 according to Kroll.

The deal also includes several performance triggers. This includes a rapid amortisation event which will see the excess cash be used to pay down the class A and then the class B notes if, after the sixth payment date either the DSCR is less than 1.15x within a 3-month period or the utilization rate of the portfolio falls to less than 75%.

The Ishka View

A drop in interest rates has helped Carlyle achieve tight pricing and yields on its latest aircraft ABS. The deal follows Wings Capital Partners' (Wings) $678.08 million WAVE 2019-1, which priced earlier this week. Get ready for a rush of aircraft ABS deals as the pricing achieved by Wings, and now Carlyle, has encouraged a range of other aircraft ABS sponsors to launch their deals.

Carlyle’s latest aircraft ABS portfolio has a younger average age, at 11.9 years than its previous ABS transactions while also having a shorter average remaining average lease life of just 3 years. The last seven Carlyle ABS transactions have had an average remaining lease life of just over 4 years and a slightly older average age of 13.9 years.

Carlyle is an experienced servicer but having a shorter average remaining lease term guarantees that there are likely to be a number of transitions, remarketing or part-out events across the life of this aircraft ABS portfolio.

It is interesting to see how Carlyle has acquired the e-certificates and become the servicer for the HAIL 2017-1 ABS and now has acquired some of those aircraft for its latest ABS. It is a nimble way of acquiring aircraft especially as sourcing leased aircraft from the trade sale market become increasingly competitive. Fitch identified five airlines (accounting for 14.%% of the pool) which it deems to be “weaker credits” with an assumed IDR of CCC due to weak operating performance, limited size or short operating history. These airlines include Aero K, Ellinair, Asiana Airlines, Sriwijaya Air, and AtlasGlobal. Ishka also notes the inclusion of Sriwijaya Air in the portfolio which is currently under Ishka’s Airline Credit Profile ‘watch list’.

Correction: This report has been updated to specify that the e-certificates Carlyle acquired in HAIL 2017-1 ABS were not tradeable e-notes.

* There is a contracted and signed second lease for MSN 2649 to Ellinair and MSN 5171 to Aero K for fixed 72-month terms with start dates of April 2020 and November 2020, respectively

Click here to download the data behind the chart.

Sign in to post a comment. If you don't have an account register here.