in Aircraft values, Lease Rates & Returns

Monday 14 October 2019

Midlife A319, 737-700 part out driven by strong demand for engines

Many aircraft lessors are eyeing the part-out market for their midlife A319s and 737-700s due to the high demand for spare engines. Ishka knows of four midlife A319s that have gone to part-out in recent months, including two that were only eleven years old.

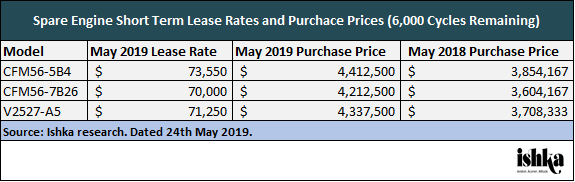

A319s and 737-700s are powered by in-demand engines such as the CFM56-5B. Lease rates for these types of engines have remained firm and there has been increasing competition between stub lessors, engine lessors and part out companies to acquire assets. As a result, more firms are buying used narrowbodies to ensure access to green time engines, Ishka research confirms. An Ishka survey of engine lessors in May 2019 found that spare engine purchase prices had increased 20% year-on-year (See Insight: ‘Spare engine purchase prices soar by 20% in twelve months’).

Ishka understands that 15-year-old A319s now have a market value of between $15 million and $17 million for part-out. A half-life CFM56 engine would account for between $4.5 million and $6 million of that value, sometimes even as high as $7 million. 15-year-old A319s are seeing lease rates of between $150,000 and $200,000.

737-700 lease rates, on the other hand, are between $100,00 and $150,000 with a top tier carrier and around $200,000 with weaker credits.

One engine lessor suggested V25 lease rates had softened to around $70,000 as the market corrects itself following premature shop visits a few years ago. “The peak for V25s is over,” said the lessor. “The lease rates couldn’t have gotten much higher.” Around 60% of CFM56 engines are still on their first run and should hit their shop visits in 2023.

More A319s on the market

There are currently several midlife A319s coming to the market. Four were swept up in the recent round of airline failures: three with Adria Airways and one with Aigle Azur. One Adria A319-111 (MSN 1000) was ferried for part out on 7th October. Another Adria A319, this one a -132 (MSN 4282), was delivered to Volotea Airlines the same day; the final Adria A319 is in storage. The Aigle Azur A319 (MSN 2870), owned by DVB, is in storage in Castellon.

Teardown company Touchdown Airways is currently parting out one 18-year-old ex-Aruba Airways A319 (MSN 1583). The company also tore down two ex-Germania A319s (MSN 3533 and 3560) in the second and third quarter of 2019. These aircraft were aged just eleven years.

S7 Airlines is currently phasing out 16 A319-114s and one A319-111, averaging 17.1 years. GECAS owns 16 of the aircraft, with AerCap the lessor for the single A319-111, according to CAPA Fleets.

The Ishka View

A robust spare engine market has driven a range of investors to seek available used narrowbodies with green time engines. This has helped residual values for certain aircraft types, like the A319 and 737-700, which have attractive power plants, but are arguably harder to remarket given a smaller operating base compared to other narrowbodies. A lot of this demand has stemmed from capital flowing into the spare engine, part-out and stub-leasing market. Many investors have been attracted by current spare engine lease rates. Engine lessors have certainly been enjoying impressive premiums on their assets – but how sustainable are these rates?

Airlines have been flying current generation aircraft for longer than intended following the MAX grounding. This has undoubtedly inflated engines and parts values. But engine lease rates began firming around three years ago, well before the MAX crisis. Demand for used serviceable material and a dearth of spare engines, combined with MRO overcrowding, had already placed high demand on current-generation engines. Troubled entries into service for new generation engines exacerbated this demand, an effect that will continue as long as new generation engines require coveted life limited parts (LLPs) from their predecessors. Ishka believes that the current level of demand for narrowbody engines is likely to continue for at least another 2-3 years. This means that investors with mid-life 737-700s and A319s coming off lease will continue to look to the part-out and stub leasing market to extract value while they can.

Sign in to post a comment. If you don't have an account register here.