in Capital Markets , Aviation Banks and Lenders

Tuesday 5 November 2019

ALC drops GAPS/CAPS for TBOLT III

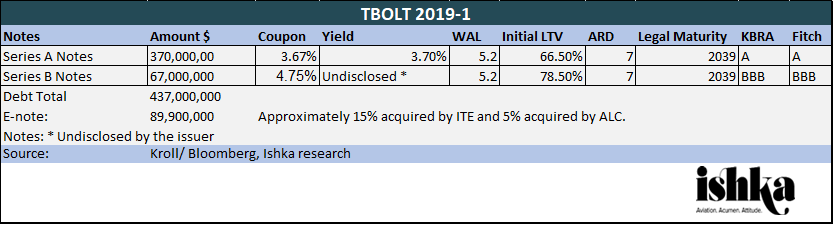

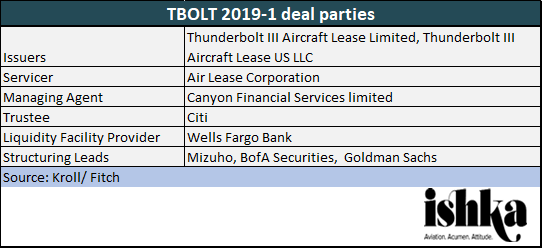

Californian aircraft lessor Air Lease Corporation (ALC) has priced a $437-million ABS, TBOLT 2019-1, which will be used to acquire 19 aircraft.

The debt notes are split between the $370-million A notes, which achieved a coupon of 3.761% and a yield of 3.70%, and the B notes, which achieved a coupon of 4.75%. Thunderbolt III Aircraft Lease Limited is the issuer while ALC will be the servicer of the deal. The deal also includes $89.8 million in 144A tradeable e-notes. ITE is the anchor investor and is understood to be retaining 15% of the equity while ALC is retaining 5%. The e-notes have a 22% expected IRR based on appraisal values. ALC declined to disclose the yield on the B notes.

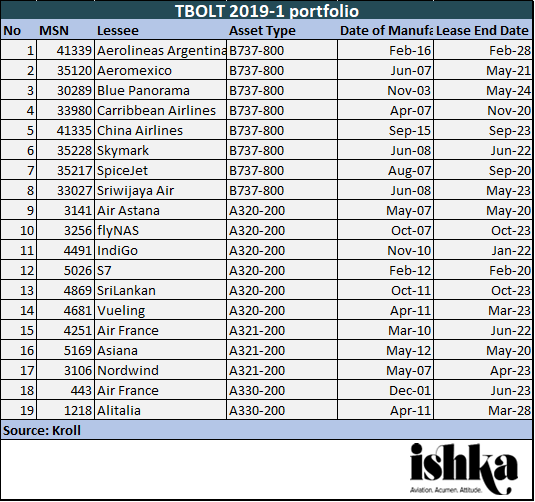

The portfolio is split between 17 narrowbody aircraft and two widebodies: a 2011-vintage A330-200 on lease to Alitalia and a 2001 A330-200 on lease to Air France. The portfolio has a weighted average age of 9.7 years and a weighted average remaining lease term of 3.8 years.

The A and B notes have a 14-year straight-line amortisation schedule over the first five years, followed by a 13-year straight-line schedule.

Aerolineas Argentinas and Alitalia’s inclusion

As Kroll points out, two of the top three lessees are either in bankruptcy or experiencing financial difficulty. The portfolio includes one 2011-vintage A330-200 on lease to Alitalia which accounts for 11.9% of the portfolio by value. The airline filed for bankruptcy in 2017 and is subject to a government deadline for binding offers of 21st November. According to Kroll, ALC believes the A330-200 (MSN 1218) is core to Alitalia’s fleet strategy and states the airline is current with its lease payments. ALC added it has five other aircraft on lease to Alitalia which continue to operate “as usual” and has no plans to repossess them.

Separately, the ABS includes one 2016-vintage 737-800 (MSN 41339) on lease to Aerolineas Argentinas (7.6% by value). The airline has been operating at a loss and has required government subsidies. Kroll states that the airline is 45 to 60 days late on its rental for the aircraft.

TBOLT’s earn-out structure

As Fitch points out, TBOLT III, like its TBOLT predecessors, includes a unique “earn-out” structure compared to other aircraft ABS where the equity is not retained by the sponsor. Using Ascend future aircraft value projections, ALC receives 50% of all proceeds generated above set benchmarks which will be paid after debt holders but before any distribution to equity holders. Fitch states it views this positively as it provides a strong incentive for ALC to adequately service TBOLT III.

The ABS includes a range of increasingly standard structural features for aircraft ABS deals including rapid amortisation for the series A and B notes after seven years, a nine-month liquidity facility, a debt service coverage ratio (DSCR) of 1.20x and an early amortisation trigger in which the excess cash will be used to pay down the series A notes and then the series B notes if the DSCR is less than 1.15x or the utilisation of the portfolio falls below 75%.

The Ishka View

TBOLT 2019-1, or TBOLT III, has dropped the innovative tradeable equity GAPS/CAPS portfolio share scheme that ALC championed for TBOLT II. Instead, the lessor has used the increasingly popular 144A tradeable e-certificate format. In Ishka’s view this is proof of an increasing level of standardisation among ABS deals. ALC has, unusually, declined to disclose the yield on the B notes.

Ishka also notes the inclusion of an aircraft on lease to an airline late with its rent and another that is technically bankrupt and ‘on watch’ by Ishka. ALC is an experienced investment-grade aircraft lessor and a capable servicer, but the ABS pushes the envelope a little further on which airline credits are being included into ABS portfolios. Ishka understands that the deal was oversubscribed on both the A and the B notes.

Sign in to post a comment. If you don't have an account register here.