Monday 6 January 2020

Aircraft leasing funds raise billions of fresh equity in 2019

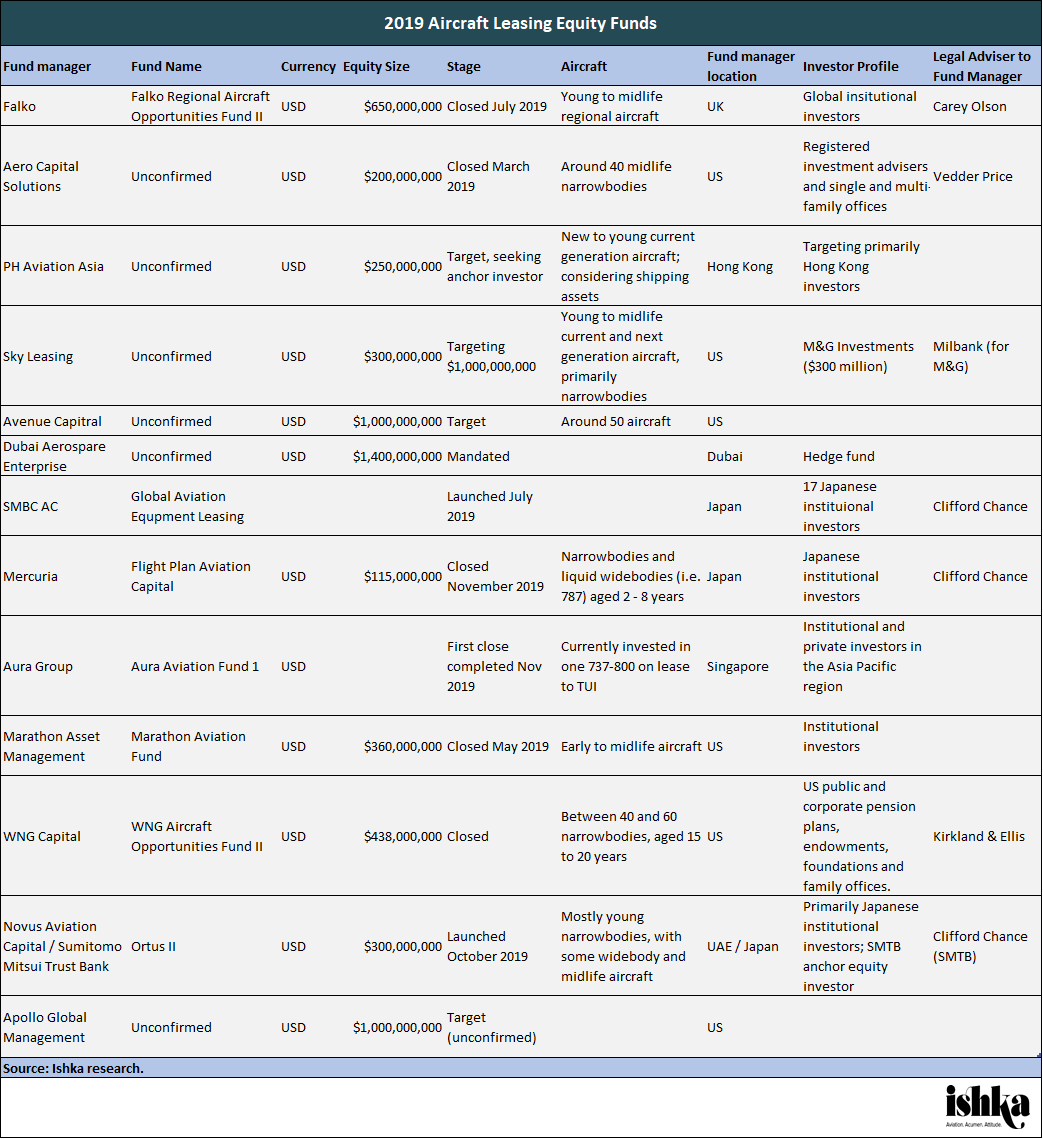

Investors have placed at least $5.6 billion of equity into new aircraft leasing funds in 2019, according to Ishka research.

Most of the new aircraft leasing funds targeted young to midlife narrowbody Boeing and Airbus aircraft.

The majority of funds brought in institutional investors, but funds have approached family office outfits and a few have attracted hedge funds. In September, Dubai Aerospace Enterprise stated it received a $1.4 billion mandate from an unnamed hedge fund.

All the funds were also USD denominated – despite Asian institutional investors making up a relatively high proportion of targeted investors. SMBC AC, PH Aviation Asia, Novus Aviation Capital, Mercuria and Aura Group all primarily attracted investors from the Asia-Pacific region, often just Japanese investors.

A recent Ishka survey of asset managers found that unlevered equity returns on leased aircraft shrunk by around 50 basis points last year, with unlevered returns for young narrowbodies hovering around 3% – 4% and around 6% – 7.5% on midlife narrowbodies (see Insight: ‘Leased aircraft returns shrink another 50bps in 2019’).

More aircraft leasing funds on the horizon

Ishka is also aware of several funds coming to the market or closing in early 2020. Ishka understands that Spanish fund manager Dunas Capital is currently in the process of closing a €650 million fund for Spanish investors. EnTrust Global, a New York and London headquartered asset manager, is also said to be currently in the market with a new aircraft leasing fund.

Ishka has previously reported that Japanese firm Mercuria, which closed its $115 million fund, Flight Plan Aviation Capital, in 2019, is looking to launch a second aviation leasing fund this year (see Insight: ‘Japan’s Mercuria to launch two aviation equity funds’). Elsewhere, German fund manager KGAL is considering another iteration of its Euro-denominated Core Aviation Portfolio Fund series, along with a new Core Plus offering that opens KGAL’s in-house lessor, GOAL, to external investors (see Insight: ‘Fund watch: KGAL considers two new aviation investment products’).

The Ishka View

The total amount of equity invested into aircraft leasing funds last year is likely to be higher than the $5.6 billion reported here as many transactions remain private. Leased aircraft funds remained an attractive asset class for investors in 2019’s low interest rate environment, despite contracting returns (see Insight: ‘Leased aircraft returns shrink another 50bps in 2019’). Fund managers speaking with Ishka complain instead of the struggle to acquire aircraft – especially young narrowbodies – after raising capital.

Nonetheless, most funds remain focused on these liquid young narrowbody aircraft, especially if targeting investors new to aviation. Most fund managers added, however, that they needed to incorporate some riskier assets – midlife or widebody aircraft – to meet investors’ return requirements. Falko’s regional jet fund further shows the opportunities for investors away from Boeing and Airbus aircraft.

The relative dominance of Japanese funds and investors highlights the capital powerhouse Japan has become in aviation finance and the appetite for aircraft leasing funds from Japanese investors.

Notably, these funds brought in yield-seeking Japanese investors, not the tax-motivated investors Japan is often associated with through JOLCO structures. That all these funds were still USD-denominated proves that there is currently no real move away from aviation as a USD asset class.

Sign in to post a comment. If you don't have an account register here.