Thursday 9 January 2020

Recent arrivals: New lessors since 2018

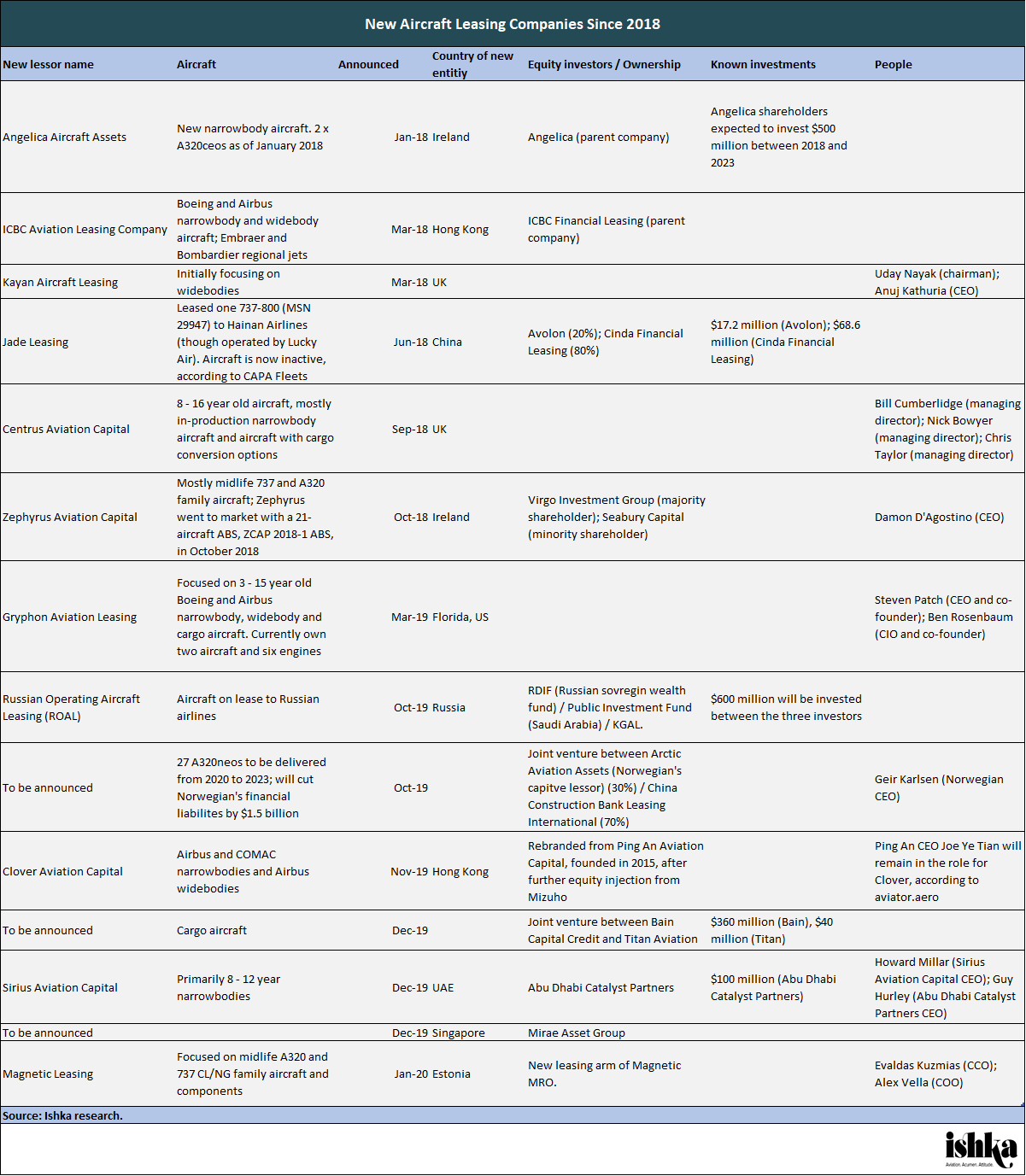

Fourteen new leasing platforms have been established over the past two years, according to Ishka research and is further proof of how the sector has continued to attract capital.

These new lessors are based in ten different countries, with the majority targeting Boeing and Airbus narrowbody aircraft. Four – Centrus Aviation Capital, Magnetic Leasing, Sirius Aviation Capital and Gryphon Aviation Leasing – describe themselves as primarily focusing on midlife narrowbody aircraft.

Investors old and new

Investors from across the globe have funded new leasing companies over the past two years. Several investors have teamed up with established lessors (such as Avolon, ICBC, KGAL) and airlines (such as Norwegian) to create new joint ventures. Other active investors include Russian and UAE sovereign wealth funds and North American institutional investors.

US-based Bain Capital Credit (Bain), which has $40.8 billion of assets under management, is establishing a new cargo lessor as a joint venture with established freighter lessor Titan Aviation. Bain has never invested in aircraft leasing before, but has invested in aviation more generally. It provided a $75 million credit facility to commercial and military aircraft components company, Air Comm Corporation, in July 2019. Bain was advised by Kirkland & Ellis in the creation of this joint venture and Titan Aviation was advised by Pillsbury Winthrop Shaw Pittman. BNP Paribas acted as Titan’s exclusive financial advisor and placement agent.

South Korean Mirae Asset Group, which is establishing its own passenger aircraft lessor, also has previous exposure to aviation, but again not in aircraft leasing. It is expected to close its takeover of South Korea’s Asiana Airlines sometime in Q1 2020. The group – consisting of construction company Hyundai Development Co., brokerage Mirae Asset Daewoo and South Korean real estate assets – put in a $2.2 billion bid for the airline last year (see Insight: 'Airlines on watch: HKA aircraft impounded, Sriwijaya limps on').

Elsewhere, two sovereign wealth funds also invested in aircraft lessors in 2019. Russian and Saudi Arabian sovereign wealth funds, RDIF and PIF, alongside German lessor KGAL, are forming a platform to lease to Russian airlines. KGAL is providing its structuring, deal sourcing and asset management services, along with industry know-how, to the funds. Abu Dhabi Catalyst Partners, which has invested $100 million in ex-Ryanair deputy Howard Millar’s Sirius Aviation Capital (Sirius), is backed by the UAE’s $240 billion sovereign wealth fund through its real asset arm, Mubadala Investment Company. Sirius was originally established in 2018 with the intention of floating on the London Stock Exchange.

The Ishka View

There have been a range of different lessors created since 2018. Some, like Norwegian and CCBLI’s joint venture, fulfil a specific purpose: in this case, lightening Norwegian’s capital expenditure (see Insight: ‘Airlines on watch: Norwegian agrees Chinese JV, Thomas Cook’s subsidiary finds buyers’).

Others appear to be more opportunistic. Magnetic MRO’s expansion into leasing seems to be partially a response to current midlife narrowbody demand, given comments by the company’s Russia & CIS Sales Director Alexey Ivanov at MRO Europe last year. Ivanov stated that narrowbody shortage caused by the MAX grounding made it “close to impossible” to find a good 737-800 for part out – and that “a few 19-year vintage aeroplanes” purchased by Magnetic in 2017 have returned to service, despite the company “not believe[ing] they would” (see Insight: ‘MROs expect aircraft retirement ‘jump’ in 2020’).

Similarly, there is also a reasonable proportion of new leasing platforms focusing on midlife aircraft, as meeting investor return hurdles continues to be more challenging with less risky younger assets (see Insight: 'Leased aircraft returns shrink another 50bps in 2019').

Another pattern has been sovereign wealth funds investing in lessors that will be based in their respective countries. Both Russia and the UAE’s sovereign wealth funds describe themselves as investing in companies that will bring foreign investment and white-collar jobs – and both have invested in aircraft leasing an attractive industry to help achieve those goals. In theory, this might be a pocket of funding other potential lessors could access again in the future. However, sovereign wealth funds may impose certain restrictions. ROAL will only be leasing to Russian airlines, for instance, and it is also likely it will focus on Russian-made aircraft.

After a boom in Chinese leasing companies five to three years ago, there has been a comparative lack of new Chinese lessors since 2018. Avolon and Cinda Financial Leasing’s joint venture Jade Leasing, for example, has only one aircraft listed on CAPA Fleets and that aircraft is inactive (a 737-800, MSN 29947). Instead, the market has seen smaller Chinese lessors being bought up by larger, established lessors – such as Castlelake’s acquisition of CMIG Leasing’s fleet last year.

Are we missing your leasing platform? For any feedback or relevant information you would like to share, please email the analyst at laura@ishkaglobal.com or the editor at dickon@ishkaglobal.com.

Sign in to post a comment. If you don't have an account register here.