in Aircraft values, Lease Rates & Returns , Aviation Banks and Lenders

Tuesday 28 April 2020

OEM slowdown: Boeing and Airbus down to single digit deliveries

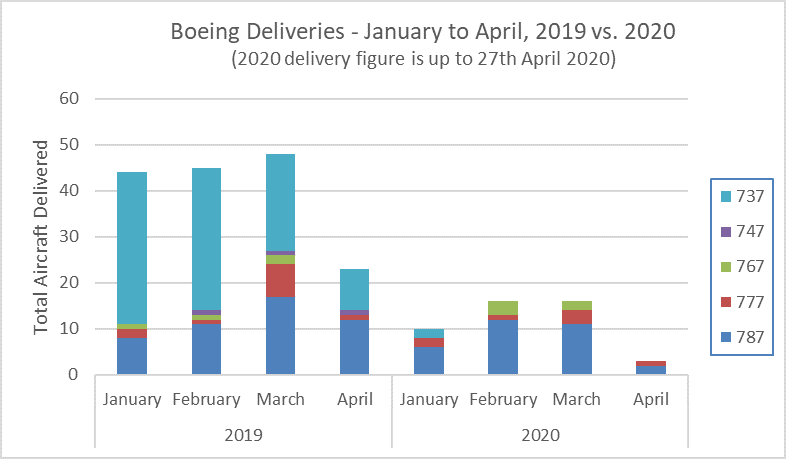

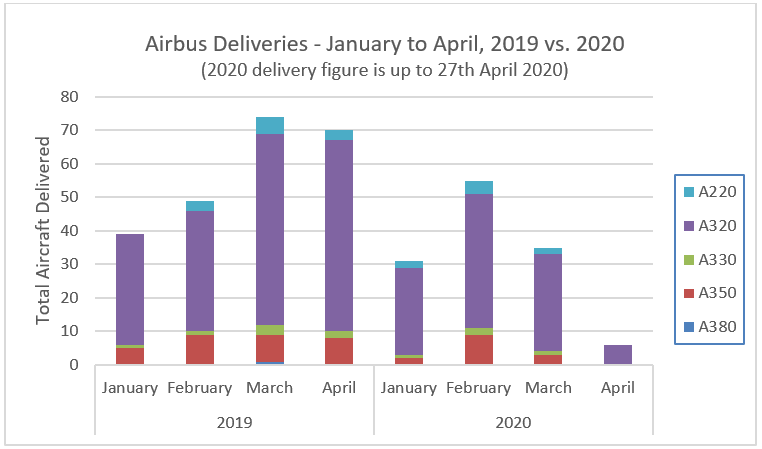

The world’s two largest aircraft manufacturers, Airbus and Boeing, are feeling the weight of the Covid-19 crisis as both experience a dramatic slowdown in deliveries for the first quarter of 2020.

Aircraft delivery figures for Q1 2020 were the lowest first quarter on record as the crisis prevented planned deliveries from being made. The first three months of 2020 saw a 45% reduction in deliveries from the same period in 2019, with 172 deliveries between January and March 2020.

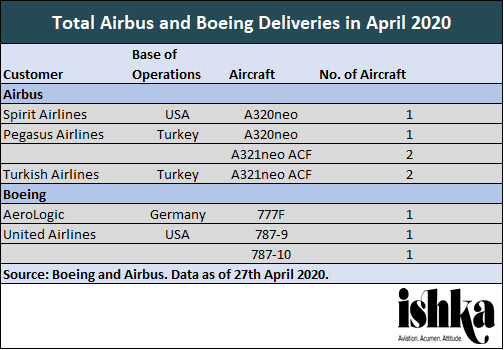

The early signs suggest that the total number of monthly deliveries are set to fall even further. According to Ishka calculations, Airbus and Boeing have collectively delivered just nine aircraft in April at the time of publication of this article. Other manufacturers also appeared to have fared badly. Ishka is not aware of any April CRJ, E-Jet or ATR deliveries.

Summarised below are the airlines that have taken delivery of aircraft so far in April 2020.

For Airbus, there are believed to be more than 60 aircraft produced during the first quarter of 2020 that remain undelivered to customers due to the Covid-19 crisis. Estimates put another approximately 30 aircraft on top of this for aircraft produced in April. The company delivered 35 aircraft in March, down from 55 in February, reflecting customer requests for delivery deferrals and what Airbus has referred to as “other factors” related to the pandemic.

Airbus’ slashed production rates

In response to the outbreak, Airbus had initiated sharp production rate cuts to roughly a third of its pre-coronavirus average rates throughout the Airbus product line.

Airbus’ new confirmed monthly production rates include 40 A320s per month (from 60-63), two A330s (from 3.5) and six A350s (from 10). In February, Airbus had already announced a reduced A330 production rate from 53 in 2019 to 40 in 2020.

Ishka views this as a positive step in preventing the unnecessary build-up of further aircraft but believes that these rates are likely to be trimmed further as, even at these reduced rates, supply is going to exceed demand.

There is also concern over the weakness in the near-term orderbooks for large twin-aisles. On the A220, Airbus has told suppliers it is targeting a production rate of five aircraft per month on the programme, according to a securities filing from Spirit Aerosystems Holdings Inc. Plans to ramp-up production at the Mirabel facility have been delayed until at least mid-2021.

Airbus has also apparently shelved plans, announced in January 2020, to use the Lagardere A380 production plant in Toulouse for an extra A321neo production line.

The present situation will now ease production bottlenecks at its Hamburg facility and allow it to ‘catch-up’ on the various issue that have been facing the plant. This leaves a large question mark hanging over the A380 plant, where some of the last aircraft for Emirates are due to roll off the line this year.

Despite this, the industrialisation of the A321XLR long-range single-aisle programme is underway. By early 2020, the first long-lead components for the initial A321XLR flight-test aircraft were already in production – with Safran producing the forgings for the main landing gear and the first parts for the centre wingbox by Airbus in Nantes. Flight tests are due to commence in 2022.

In an attempt to continue delivering aircraft, Airbus has expanded the scope of its electronic transfer-of-title capability – something it has been using for over the last 12 months for around 50 aircraft – and implemented an ‘e-delivery’ process for new aircraft deliveries. This encompasses the Technical Acceptance Completion tasks, electronic Transfer of title (ToT) through an ‘e-SalesContracts’, and, lastly, a ferry flight to a customer location. Although Pegasus Airlines was the first to use this enhanced service, Ishka questions whether it will be widely adopted by airlines and lessors. Delegating technical acceptance to the manufacturer, or a local third-party, is an emotive subject which places a considerable level of trust in Airbus. However, it does provide a feasible solution in the current era of social distancing and travel restrictions for many customers. Whether it really can become the “blueprint” for Airbus and its customers going forward remains to be seen.

Boeing resumes production but 777X faces uncertain future

Unlike Airbus, Boeing had already reduced its production rates, but the OEM has been forced to take a continued financial hit from its grounded 737 MAX aircraft programme, that would under normal circumstances contribute to over 70% of all deliveries. The full extent of the cost to Boeing will be clarified in its earnings call later this week.

Boeing shut down most production activity in the Puget Sound area towards the end of March, after Washington declared a state of emergency due to the Covid-19 pandemic. What was originally going to be a two-week closure ended up being almost a month. Work on the 737, 747, 767 and 777 lines resumed the week of 20th April, while the 787 programme returned later that same week. Boeing’s production line in Charleston, South Carolina is set to resume operations next week.

Overlooking the 737 MAX situation, there are a number of 777s and 787s in the pipeline that are effectively ready for delivery or have been completed and are going through acceptance checks. Airlines with 777-300ER aircraft ready for delivery are China Southern and Aeroflot; for the 777F, FedEx has one aircraft completed but has yet to have its first flight. Airlines with 787 aircraft in the final stages of completion or undergoing acceptance checks include China Southern, British Airways, Norwegian, Juneyao Airlines, Air Europa, El Al, Qatar Airways and Vistara, Gulf Air, United, American and Singapore Airlines.

The 777X resumed flight testing last week – but is flying into an uncertain future. Reports have recently surfaced of Cathay Pacific and Lufthansa wishing to amend, if not cancel, their orders for the type. The orderbook was already looking wobbly after Emirates trimmed 24 aircraft from its original order. The Etihad order is also in question given the troubles associated with the airline.

The Ishka View

Boeing is set to announce its results later this week, but the picture already looks bleak for airframers and Ishka expects a brutal second-quarter for aircraft deliveries generally. There is simply no demand at the present time and the limited number of scheduled flights can be mopped-up by aircraft currently within airlines’ existing fleets. As a result, Boeing will likely face further cancellations for its troubled 737 MAX programme (see Insight: “CDB Aviation's MAX cancellation piles further pressure on Boeing”).

Airbus has been forced to drastically cut its production rate in just over a month, a process which, from an OEM’s perspective, would ideally take place over a year or so to help manage suppliers. Airbus’ CEO, Guillaume Faury, is reported to have warned employees that the company is “bleeding cash” which could threaten the firm’s survival while Boeing has already warned of thousands of worker lay-offs.

Ultimately, Boeing and Airbus are probably too big to fail. Ishka believes that both companies will survive this crisis, most likely with some form of government support, as states seek to protect jobs and ensure that both firms, which also retain key defence contracts, remain solvent.

Sign in to post a comment. If you don't have an account register here.