Thursday 31 March 2022

An investor’s guide to aircraft impairments: IFRS vs. US GAAP

In a guest report, Niamh Tobin, a director at EY, explains when aircraft lessors may need to report aircraft impairments under IFRS and US GAAP.

As the aviation industry recovers from the COVID-19 pandemic, the invasion by Russia of Ukraine is likely to have a significant impact on the aviation industry. There are a number of uncertainties as the situation unfolds, including the lessor’s ability to repossess all aircraft and engine assets where the lease has been terminated early, the current physical condition of these assets and the ability to remarket any repossessed aircraft. This evolving situation will also have indirect macroeconomic effects on the aviation industry, the extent to which remains to be seen. All of this raises aircraft and engine valuation matters which need to be addressed. As reporting for the first quarter of 2022 approaches, it is important to be reminded of impairment considerations under both IFRS and US GAAP.

An aircraft impairment assessment tests the recoverability of the value the aircraft is being carried at in the financial statements. An impairment charge or assessment does not result in the aircraft being remeasured to fair value. Under IFRS, the majority of aircraft lessors apply the cost model, meaning the aircraft is measured and carried at Net Book Value (NBV), being the original cost less any accumulated depreciation and accumulated impairment losses. Under US GAAP, the cost model must be applied as the revaluation model is not a permitted accounting policy. Therefore, under the cost model, for both IFRS and US GAAP reporters, the aircraft is not recorded at fair value and it is not remeasured or revalued to fair value.

Both US GAAP and IFRS requires the recoverability of aircraft to be tested if, similarly defined, indicators exist which suggest the aircraft may be impaired. The current situation in Russia and Ukraine along with the continued impact of COVID-19 are examples of such indicators. In the current environment, an impairment assessment should be performed annually, at a minimum. Where the results of the impairment assessment indicate that the aircraft carrying value is not recoverable, the aircraft carrying value is reduced by way of an impairment loss being recognised. Under both US GAAP and IFRS, an impairment assessment does not result in aircraft being remeasured to fair value.

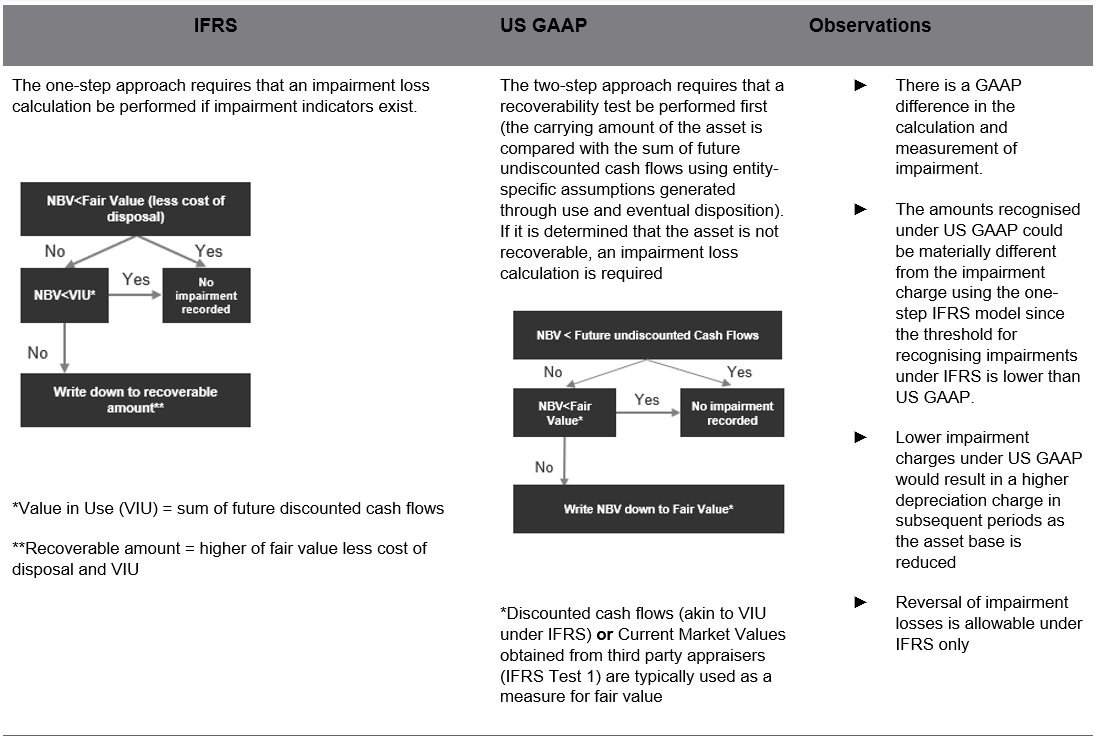

When comparing impairment charges for aircraft lessors reporting under IFRS against aircraft lessors reporting under US GAAP and vice versa, it is important to realise that despite similarities in overall objectives, significant differences exist in the impairment methodologies and ultimate measurement and recognition of impairment under both accounting standards. The key difference between the two standards is the initial use of the undiscounted cashflows in US GAAP, which is not applied in the IFRS assessment.

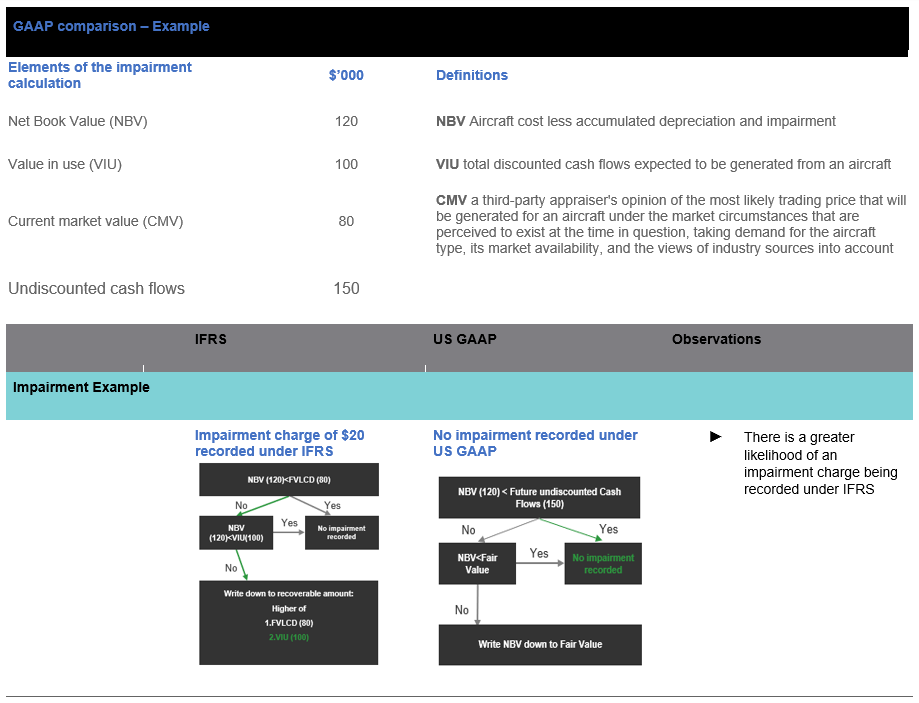

The below tables illustrate the decision-tree approach and also the impact of the different methodologies using illustrative numbers.

US GAAP requires a two-step recoverability test. Firstly, the aircraft NBV is compared to the sum of the future undiscounted cash flows. Where the aircraft carrying value or NBV exceeds the undiscounted cashflows, the aircraft is impaired down to the estimated fair value less cost of disposal (typically discounted cash flows, akin to VIU under IFRS)

IFRS requires an impairment loss calculation be performed when impairment indicators exist. An impairment loss is measured as the difference between the aircraft NBV and the recoverable amount. Under IFRS, in the current environment, a significantly higher proportion of aircraft portfolios fail the CMV test. However, they could then be supported by the VIU valuation basis.

The undiscounted cashflows test under US GAAP versus the discounted cashflow (VIU) test under IFRS, mean the impairment losses recognised under the two-step US GAAP approach could be materially lower from the impairment charges using the one-step IFRS model since the threshold for recognising impairments under IFRS is lower than US GAAP as illustrated in the example above.

Under both IFRS and US GAAP, it is important to consider the variables included in cashflows whether discounted or not. The gross and discounted cashflows typically incorporates an estimate of (1) contractual cashflows, (2) expected future lease cash flows, (3) residual values and (4) an appropriate discount rate, where applicable.

1. Contractual cashflows

Prior to the COVID-19 pandemic and in a stable environment, the contractual cashflows applied discounted or undiscounted cashflows were as per the lease agreement. In the current environment, these cashflows might need to be adjusted to reflect the estimated collectability of such cashflows. For example, if an airline has filed for bankruptcy or a lease restructure is ongoing which is likely to result in reduced contractual cashflows, appropriate adjustments should be considered. Equally, an aircraft in the process of being repossessed early should have the cashflows revised appropriately.

Additionally, the inclusion of any deferred lease payments within the cashflow calculation should be carefully considered.

2. Future lease cashflows

Some lessors include future estimated lease cashflows in their estimate when their strategy is to hold the aircraft beyond the current lease. This approach significantly increases the complexity of the impairment assessment due to the increase in assumptions included. The estimated future lease rates are typically obtained from third party appraisers. There could be a significant variation in lease rates from the third-party appraisers in particular in the current environment where uncertainty exists. Recent lease transactions for similar aircraft types could be more indicative of future lease rates in particular in the short term and could be used to overlay any third-party estimates.

Re-lease terms and downtime assumptions may also need to be adjusted for leases expiring in the short term and for those which have been terminated early. Downtime is likely to be extended and release terms reduced resulting in lower total cashflows. In the current environment and during COVID-19 these variables (including future assumed cashflows) and assumptions have been particularly challenging, most notably for certain widebody aircraft types where demand was supressed coupled with high supply.

3. Residual values

Residual values are typically sourced from third party appraisers and represent the value of the aircraft based on vintage in a balanced supply-demand market. Given the evolving situation with Russia and Ukraine, the impact on residual values for affected aircraft should be considered.

4. Discount rate

The discount rate should be a pre-tax rate which reflects the current market assessment of the risks specific to the aircraft for which the future cash flow estimates have not been adjusted. Determining an appropriate discount rate is subjective, involves judgement and is likely to present additional challenges in the current environment.

The discount rate should ultimately reflect an investor’s required rate of a return in the current market. This rate is estimated from either the rate implicit in current market transactions or from the weighted average cost of capital (“WACC”) of a listed lessor that has a portfolio of aircraft similar in terms of service potential and risks.

Given the increase in credit risk in the market during COVID-19, a significant increase in discount rates was expected. However, this was largely offset by increased liquidity in the market due to unprecedented low interest rates and government supports put in place. As interest rates begin to rise in 2022, a greater increase in discount rates is likely to be seen. This will reduce discounted cashflows and could result in impairment.

Fair Value

Within the aircraft lessor industry, the Fair Value is typically estimated as the current market value (‘’CMV’’) obtained from third party appraisers.

The CMV derived from the third-party appraisers has been defined by International Society of Transport Aircraft Trading (ISTAT) as the appraiser’s opinion of the most likely trading price that may be generated for an asset under the market conditions that are perceived to exist at the time in question. Market values are often value opinions based on each appraiser’s careful analysis of information about recent transactions.

Current market values also consider the perceived demand for the type, its availability on the market, and further takes account of the expressed views of informed industry sources. Current market value assumes an aircraft’s maintenance status is at half-life or benefitting from an above-average maintenance status if it is new.

Given the current level of uncertainty in the aviation industry and reduction in market transactions, there could be a significant level of variation in the third-party appraisal values meaning more than one appraisal value could be needed. In the current environment, the latest valuations could be overlaid, with other qualitative information (e.g., market transactions), to best capture any valuation adjustments.

It is important to note that for US GAAP reporters, a discounted cashflow is often used as the measure for fair value.

Conclusion

Given the material difference in impairment charges, this could have negative impacts on credit ratings, covenant reporting and other important metrics for IFRS reporters. This means that some IFRS reporting lessors may convert to US GAAP from IFRS, where permitted, to circumvent such negative metrics but also to allow for comparability against peers reporting under US GAAP. An impairment assessment is quite subjective with a number of estimates, variables and assumptions. Despite being required to perform an impairment assessment more frequently due to trigger events (e.g. COVID-19), an impairment charge might not necessarily always be recorded. For example, under IFRS, the appraisal values used for CMVs in test 1 could indicate that an impairment charge is not required. Equally under U.S. GAAP, the undiscounted cashflows could also indicate that an impairment charge is not warranted as current and future expected cash flows could support the aircraft carrying value. Under both standards, the residual values used, typically derived from appraisers’ base values (which assumes a perfect market), could be such that an impairment charge is not required. It is important to remember that an aircraft impairment assessment does not mean the aircraft is remeasured to fair value.

However, with all other things equal, an identical aircraft with a lower impairment charge under US GAAP would result in a higher depreciation charge in subsequent periods as the asset base is higher when compared to an identical asset under IFRS which has been impaired.

For both IFRS and US GAAP reporters, given the current market volatility, an impairment assessment is likely to be required at a minimum, for those assets which continue to be impacted by COVID-19 or those with exposure to Russia or Ukraine. There is increased scrutiny and risk across aircraft impairment and as a result there is likely to be a greater focus on all inputs and assumptions included in the impairment assessment.

This is a guest Insight authored by Niamh Tobin, a director at EY.

Sign in to post a comment. If you don't have an account register here.