in Lessors & Asset managers , Aviation Banks and Lenders

Tuesday 17 May 2022

SMBC to buy Goshawk for $6.7bn but rejects Russian-leased aircraft

Aircraft lessor SMBC Aviation Capital announced plans to acquire Dublin-based rival Goshawk Aviation in a deal which offers Goshawk’s shareholders $1.6 billion in cash for a $6.7 billion enterprise value for the firm.

SMBC Aviation Capital states the deal will make it the second-largest global player by number of aircraft with total assets of approximately $37 billion (including orderbook), after AerCap, and the largest Japanese owned aircraft lessor.

Under the terms of the deal SMBC Aviation Capital will acquire Goshawk's fleet including a portfolio of 176 owned and managed aircraft, but will exclude aircraft owned by Goshawk that are located in Russia. Ishka understands this comprises six aircraft.

The deal will mean SMBC will have a portfolio of 709 owned and managed aircraft and what it describes as a $13-billion order book from Boeing and Airbus of 261 new-technology narrowbody aircraft.

The transaction will be financed through a combination of debt and equity. Debt financing for the transaction will be sourced from the shareholders as well as the bank and capital markets. Equity for the transaction will be provided by SMBC Aviation Capital’s shareholders, Sumitomo Mitsui Financial Group and Sumitomo Corporation.

The combined business will continue to operate as SMBC Aviation Capital and will consist of a single corporate structure incorporated in the Republic of Ireland, with headquarters in Dublin. The transaction is subject to the receipt of relevant regulatory approvals and other closing conditions and is expected to close in the second half of 2022.

Peter Barrett, CEO, SMBC Aviation Capital states: "This is the right transaction for SMBC Aviation Capital, allowing us to better serve our customers in a fast-evolving sector whilst also accelerating our growth and delivering significant value for our shareholders. Goshawk is a high-quality business with assets and people that complement our own. The combined business will continue to have a disciplined focus on young, liquid, most in-demand narrowbody aircraft with one of the most environmentally friendly portfolios of any major leasing company together with 261 new generation, fuel-efficient aircraft on order."

Goldman Sachs acted as financial adviser to SMBC Aviation Capital. Cravath, Swaine & Moore LLP and Milbank acted as the legal advisers to SMBC Aviation Capital.

A narrowbody heavyweight

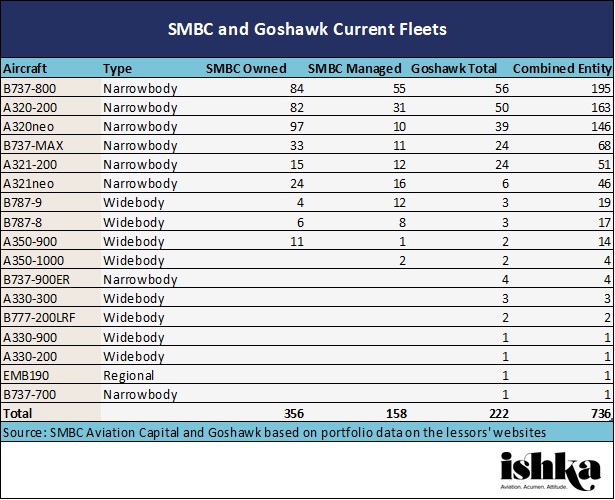

SMBC Aviation Capital and Goshawk are two of the most narrowbody-oriented lessors. Both entities have well north of 90% narrowbodies (by fleet count) including owned, managed, and committed aircraft. SMBC Aviation Capital says the resulting entity will have over 82% narrowbodies in its combined fleet of over 709 owned and managed aircraft, with a further 261 exclusively new-technology narrowbody aircraft on order – for total assets including orders estimate at $37 billion.

The 709-aircraft figure is slightly below the 736 (or 730 after excluding Russian aircraft) current owned and managed portfolio of the two entities, based on figures available on their websites. Of this 736 (see breakdown below), 674 or 92% are narrowbody aircraft, which will make SMBC Aviation Capital the second-largest narrowbody lessor by some margin above Avolon (465 narrowbodies owned or managed).

Consolidated orders, but below SMBC’s new scale

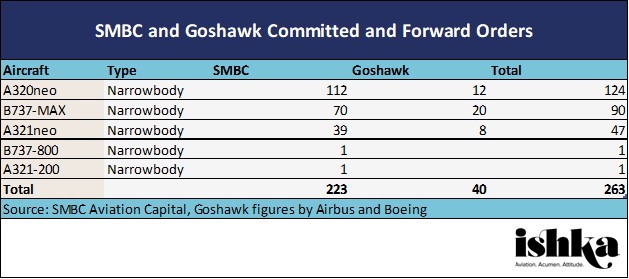

SMBC Aviation Capital says the resulting entity will have orders for 261 all-narrowbody aircraft. Ishka arrived at a similar 263-aircraft figure (see table below) based on pre-acquisition figures by SMBC Aviation Capital, Goshawk, Airbus, and Boeing.

Through this acquisition and based on aircraft count, SMBC Aviation Capital would only be growing its outstanding orderbook by approximately 18%, below the 43% increase in its owned and managed portfolio. This takes SMBC Aviation Capital above Avolon for outstanding aircraft orders (240 outstanding commitments), but still below AerCap (464 outstanding passenger aircraft orders) or Air Lease Corporation (ALC, 451 outstanding orders).

This is not surprising. Despite achieving a Top-20 portfolio size pre-acquisition, Goshawk has never taken delivery of aircraft from its order book. Its current aircraft orders with Airbus and Boeing were both placed in 2018, and deliveries (based on 2018 announcements) are not due to begin until at least 2023.

The Ishka View

SMBC Aviation Capital’s acquisition of Goshawk is the latest M&A to occur in the aircraft leasing sector after several noteworthy deals since the onset of the pandemic, from Carlyle’s acquisition of Fly Leasing to the mega-merger between AerCap and GECAS.

Acquisition is one sure way that lessors can achieve growth and scale. This latest deal is further confirmation of how the leasing landscape is splitting between different business models. Broadly at one end stand the large operating lessors with significant orderbooks, typically aiming to keep a younger fleet, hundreds of airline clients, a cheap cost of funds and an active trading and remarketing arm – all of which reward scale. Examples of these include AerCap, BOC Aviation, ALC, and SMBC Aviation Capital. At the other end of the scale are more niche players, and asset managers, either focused on specific asset types, vintages, or type of credits, and which are generally more centred on addressing certain return requirements of their investor base.

The latest deal is a win for Goshawk’s shareholders NWS Holdings Limited, a Hong Kong flagship conglomerate, which has been exploring potential disposal for the leasing platform for several years, including a potential IPO (see Insight: ‘No rush for an IPO,” says Goshawk CEO’).

Several key senior staff within Goshawk and SMBC Aviation Capital’s management team previously worked together at RBS Aviation Capital before it was acquired in 2012 by Sumitomo Mitsui Financial. Both firms appear to have a similar philosophy when it comes to asset types (favouring single-aisle aircraft), and credits, which should help integration between the two firms.

But that similar philosophy does not appear to result into significant lessee overlap. SMFL notes that the deal gives SMBC Aviation Capital “access to a new customer base” and this is very much the case in Ishka’s view. Based on CAPA Fleets data, the respective lessors only share 28 lessees out of the 125 airline clients they currently serve. The same data shows that only three out of SMBC’s 10 largest current lessees by aircraft count are simultaneously served by Goshawk. This means SMBC Aviation Capital is under less pressure – if any – to sell assets to manage lessee concentration risk than previous lessors after similar M&A deals.

Sign in to post a comment. If you don't have an account register here.