Thursday 13 October 2022

OEM Update: More delays on MAX certifications, Airbus “confident” in production ramp

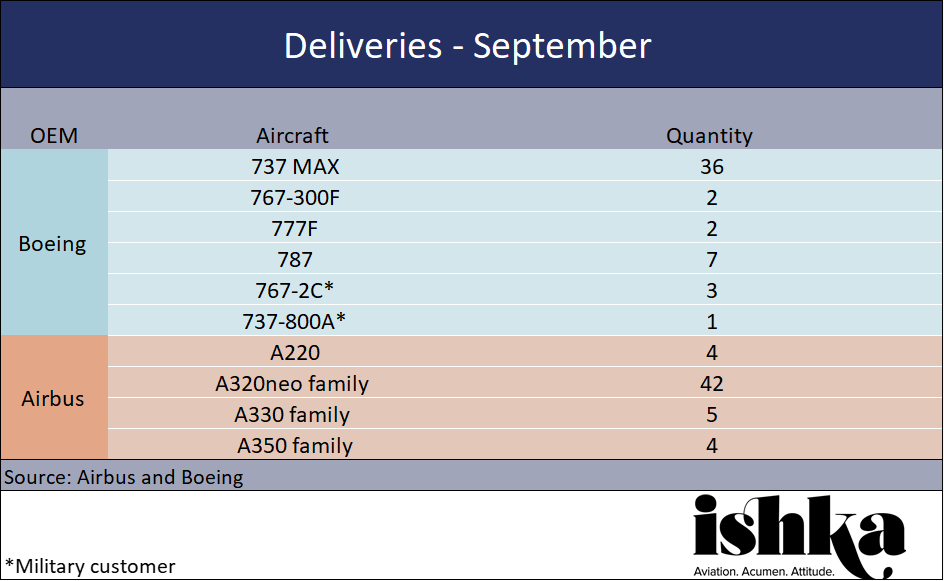

Boeing received 96 new aircraft orders in September, with large orders for both its narrowbody and widebody aircraft. It delivered a total of 51 aircraft to customers, including 36 737 MAX – exceeding its stated monthly target of 31.

Airbus, meanwhile, received 13 new orders, 11 of which were for A320neo family aircraft. However, it just about pipped Boeing to the post on deliveries, with 55 aircraft rolled out to customers. Of these, 42 were A320neo family, slightly below the stated monthly production target of 45.

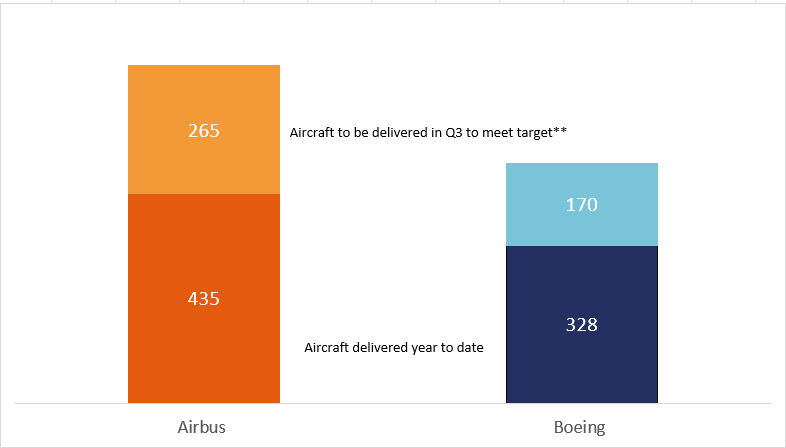

These latest numbers mean that, to date this year, Airbus has delivered 435 aircraft to customers (with 340 A320neo family deliveries), while Boeing has delivered 328 aircraft (with 267 737 MAX deliveries).

The figures quoted in this report are taken from Airbus and Boeing official data, and so may not include orders/deliveries which have been announced but not yet formally added to the manufacturers’ tallies. The numbers shown are for commercial aircraft, but variants for military customers which are counted as ‘commercial’ by the manufacturers are shown to give a view on total production capacities.

Large WestJet order gives Boeing September boost

The largest order logged in September by either OEM was the 42 Boeing 737 MAXs ordered by WestJet, which brought the total orders for the variant to 51 for the month. Boeing also scooped two substantial orders for its new tech widebodies, with an order for 16 787-9s from China Airlines and 12 777X orders for an unidentified customer(s). Lessor BBAM placed an order for, and took delivery of, two 737 MAX aircraft in September.

The Airbus order tally for the month was slightly more muted, with six A320 family aircraft for Sichuan Airlines on 27th September being the largest single order.

Both OEMs surpassed their August delivery totals in September. While the number of A320neo deliveries was just shy of the production target of 45 per month, Airbus’s production of other variants was, for the most part, close to target.

Boeing’s delivery of 36 737 MAX aircraft was above the 31 average target which Boeing aims to “stabilise” around. The manufacturer delivered a large number of 787s throughout the month (7) as it continues to clear its backlog following the recent go-ahead for the variant from the FAA.

Certification for MAX 10 and MAX 7 thrown into doubt

The US Federal Aviation Administration (FAA) has told Boeing that the certification of the 737 MAX 7 and MAX 10 is unlikely to go ahead in December, which could force Boeing to implement a costly and lengthy redesign of cockpits for the two variants. If the certification for the two variants drags into January, then Boeing would be forced to submit a new cockpit design to meet new certification regulations set to come into force after December which would severely delay the entry of the variants into service.

The FAA has cast doubt on Boeing meeting the December deadline given the current status of the submissions of key documents. According to a letter written on 19th of September, and seen by Reuters on the 29th of that month, the FAA’s executive director of aviation safety told the manufacturer that the agency had concerns about the planemaker's submissions and sought discussion "about realistic timeframes for receiving the remaining documents."

A second FAA letter, sent to a US Senator on 3rd October and also seen by Reuters, reportedly states that Boeing’s own timeline for the 737 MAX 10 has the aircraft’s certification placed “no sooner than Summer 2023.”

As it stands, Boeing must meet a December deadline for the 737 MAX 7 and 10 certifications in order to avoid the need to meet new cockpit requirements. The manufacturer had been lobbying the US Congress for more time, but according to documents seen by Reuters on 11th October the latest version of the U.S. Senate's defence bill does not contain an amendment to extend the deadline.

The disagreement has seen pilots’ unions begin to pick sides. Allied Pilots Association (APA), a union representing American Airlines pilots, expressed its “strong opposition” to any extension of the equipment exemption for the two variants on 5th October. American Airlines pilots currently fly over 300 737s for the airline. APA President Capt. Edward Sicher dismissed Boeing’s claim that having two cockpit alert system setups would confuse pilots moving between aircraft, saying that the new safety features would allow crews to “be better able to identify system failures and prioritize corrective actions that could save lives.”

Conversely, the Southwest Airlines Pilots Association has since come out in support of Boeing, with union head Casey Murray telling Bloomberg on 7th October that “We 100% support the extension.” Murray agued that operating similar aircraft with different alerting systems could “cause confusion at a critical time,” adding that he supports the deadline being extended for “a couple of years.”

Airbus “committed” to 75 production rate target for A320neos

Airbus CEO Guillaume Faury defended the manufacturer’s plan to ramp up production of its A320neo family aircraft to 75 by 2025, after comments from Greg Hayes, the CEO of engine supplier Pratt & Whitney’s parent firm Raytheon, cast doubt on the practicality of the target.

Calling Hayes’ comments “unhelpful,” Faury told audience members at the Airbus 2022 Capital Market Day on 23rd September that both Airbus and its suppliers remain committed to the target, but acknowledged the challenges faced in getting there. “We know it is going to be hard,” Faury told the audience, but added “We keep targeting, and they [suppliers] keep targeting 75 with us. They believe in 75. I can be quoted, because I checked.” Faury also indicated that more details on what the production ramp-up would look like over the next few years would be forthcoming in the Airbus full year earnings call.

**Note: Boeing has not given a hard production target for 2022. The number quoted has been calculated by extrapolating Boeing's monthly production targets to the year as a whole for comparitive purposes only. Boeing has stated that it does not expect to make up low H1 delivery rates in H2.

“Ongoing” discussions for Airbus to take A380s back from Malaysia Airlines

Malaysia Airlines is looking to return all six of its owned Airbus A380s to the manufacturer after receiving no bids for them on the secondary market, reports Malaysian newspaper The New Straits Times. Sources have told the paper that the deal is “a work in process,” but that it was tied to the purchase of 20 A330-900s by the airline in August. All six A380s are currently listed as stored on CAPA fleets database. If the move is confirmed, it is unclear what Airbus plans to do with the aircraft.

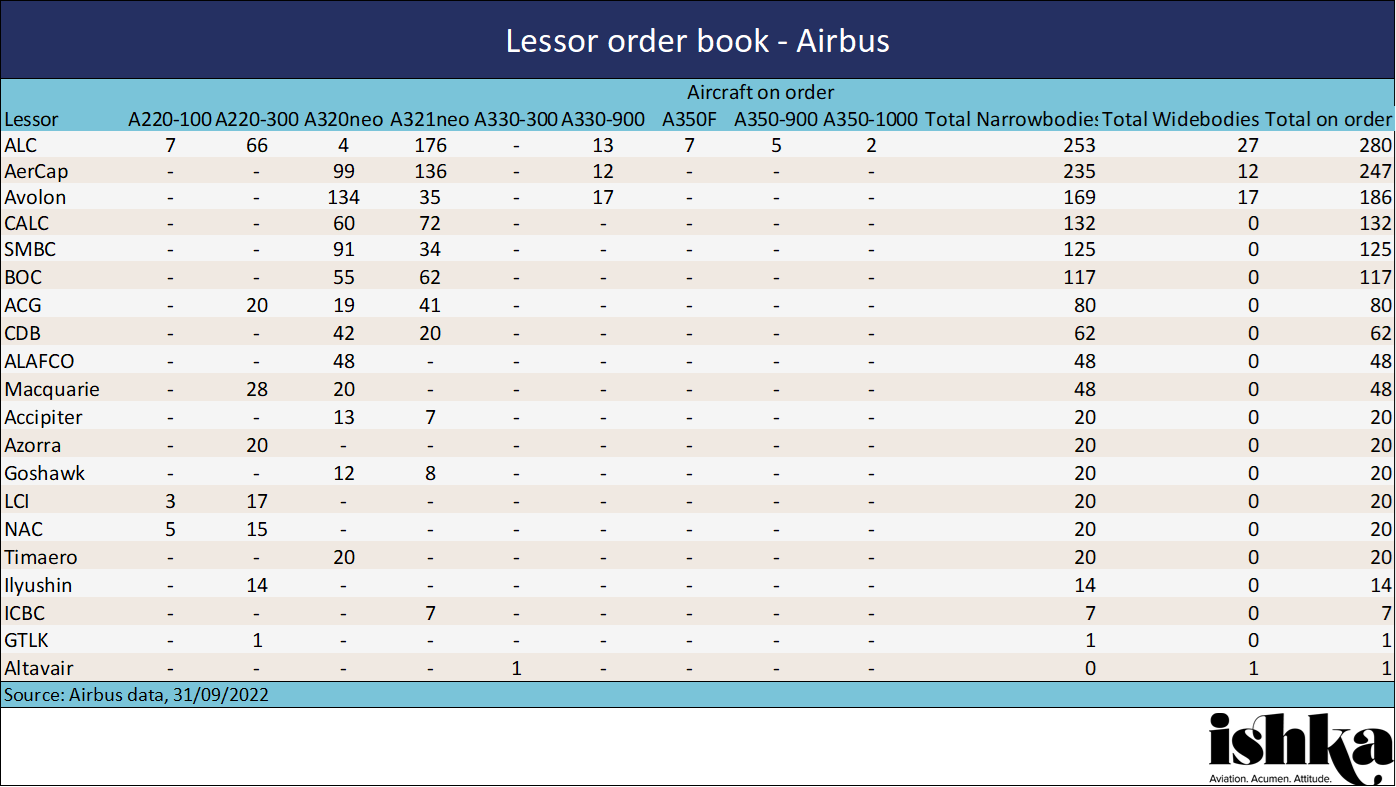

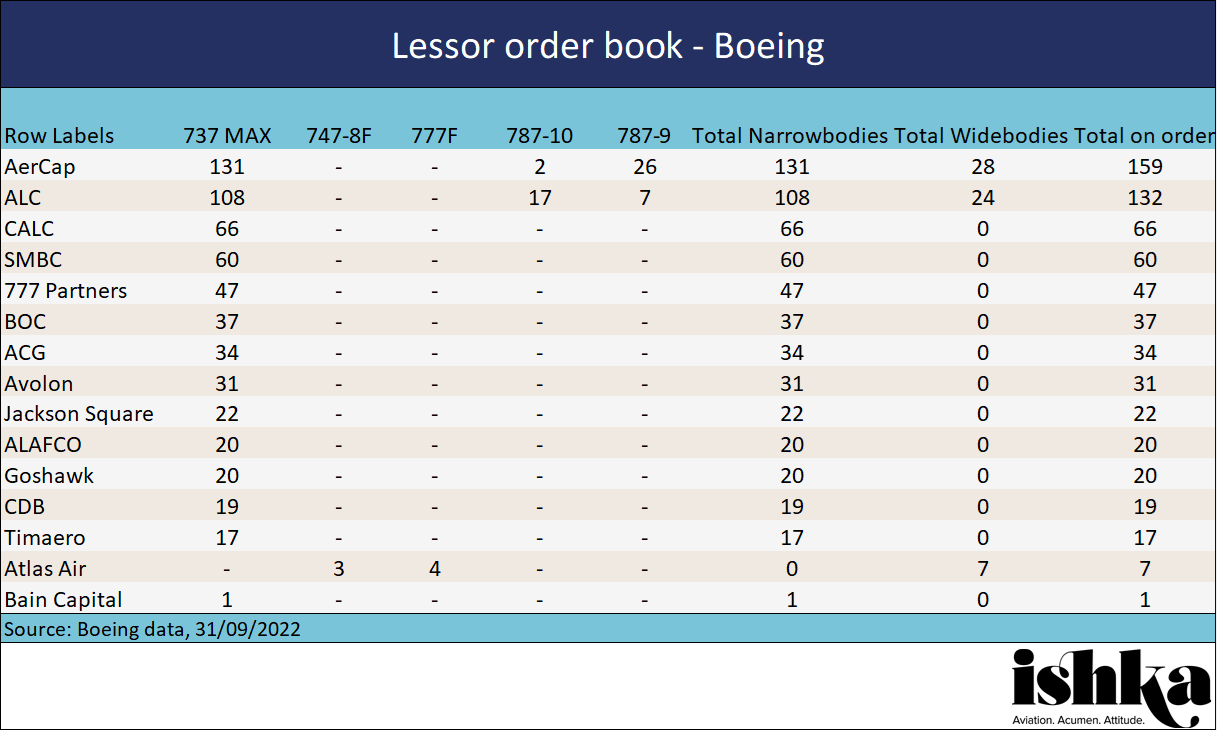

Lessor unfilled orders

The Ishka View

Both manufacturers delivered close to their production targets in September, although the year totals look tricky for the two OEMs. Boeing already conceded in its Q2 conference call that it was not looking to make up lost MAX delivery numbers in the second half of the year. The Airbus target of 700 total aircraft deliveries is still a way off the current 435 tally. However, Faury indicated that Airbus thinks making up the numbers will be “manageable,” although conceded that there was “a hell of a lot of work to be done.”

Boeing CEO David Calhoun recently indicated that Boeing was beginning to remarket some of the 737 MAX aircraft which had been destined for China, while that market remains closed. However, Avolon CEO Andy Cronin, speaking to Ishka on the side-lines of the ISTAT EMEA conference, stated his belief that the Chinese market will not remain closed indefinitely. “At its core, China will need the aircraft and if you look at the growth that's happening in China, even with the challenges of Covid and so on, it's going to need the aircraft,” said Cronin. “So, it's just a case of when.”

Sign in to post a comment. If you don't have an account register here.