Wednesday 22 February 2023

Understanding Impact’s milestone concept for aviation sustainable finance

Listen to the article

How much progress is an airline making towards decarbonising its operations? A simple question, but often one with an overabundance of answers: intensity targets, efficiency practices, alternative fuel uptake percentages, best-in-class aircraft adoption…

Sustainability-focused aviation finance association Impact is proposing a return to the nuts and bolts of the question: how quickly is a given airline cutting down on its carbon emissions relative to its operational capacity? Decarbonisation relative to growth (decoupling), and time-stamped decoupling goals (milestones).

Milestones, not perishable benchmarks

As with its previous white paper (see Insight: ‘Impact’s new white paper argues for decoupling growth and aviation emissions’), Impact is breaking rank with commonly accepted approaches to aviation decarbonisation evaluation.

In a new white paper released this month (‘The milestones to decarbonize aviation’ – available here) the association proposes a departure from decarbonisation benchmarks at the mercy reassessment (for example, targets updated to suit new decarbonisation trajectory assumptions) in favour of unbiased decoupling milestones.

For readers new to Impact’s work, decoupling refers to what extent are CO₂ emissions coupled (or not coupled) to underlying capacity trends. In other words, are total emissions growing slower than their associated capacity (relative decoupling) or declining even as capacity grows (absolute decoupling – the ultimate objective).

Rather than setting intensity benchmarks at specific points in time (a common approach of many sustainable finance transactions involving airlines), the association advocates for measuring how quickly an airline crosses decoupling milestones. Philipp Goedeking, board member of Impact, remarks that Impact’s departure from conventional intensity benchmarks is not a desire to “move” away from the mainstream. “The strict focus on intensity benchmarks doesn’t serve the industry’s purpose,” he explains.

A three-step scoring system

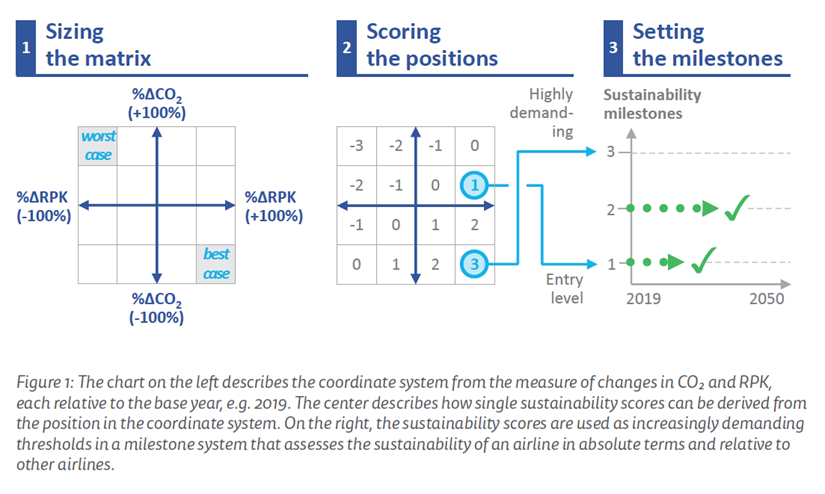

Impact says a milestone scoring system to evaluate the decarbonisation progress of airline borrowers will be “as watertight against greenwashing as conceivably possible.” In simple terms, a lender or lessor will assess the counterparty airline’s changes to their operational CO₂ emissions every year (generally versus a 2019 baseline) and capacity (RPK). The percentage change is plotted in a two-dimensional matrix (see Step 1 below) and a score (Step 2) is awarded based on the corresponding quadrant. The sooner an airline achieves a certain decarbonisation milestone, the more its decarbonisation efforts should be rewarded.

Source: Impact on Sustainable Aviation. The matrix in Step 1 is a simplified version of the 16 x 16 quadrant matrix Impact proposes (see page 11 of Impact’s The milestones to decarbonize aviation whitepaper)

Impact is proposing a 16 x 16 quadrant matrix to track changes (the 4 x 4 matrix above is only for basic illustrative purposes). Goedeking says Impact ran thousands of simulations of various scenarios and it concluded that 16 x 16 was the best ratio to capture meaningful shifts in an airline’s decarbonisation efforts. For an idea of magnitude, if a hypothetical airline with no capacity growth or degrowth since 2019 reduced its CO2 emissions by 12.5%, then its score would move down by one quadrant along the vertical axis of a 16 x 16 matrix.

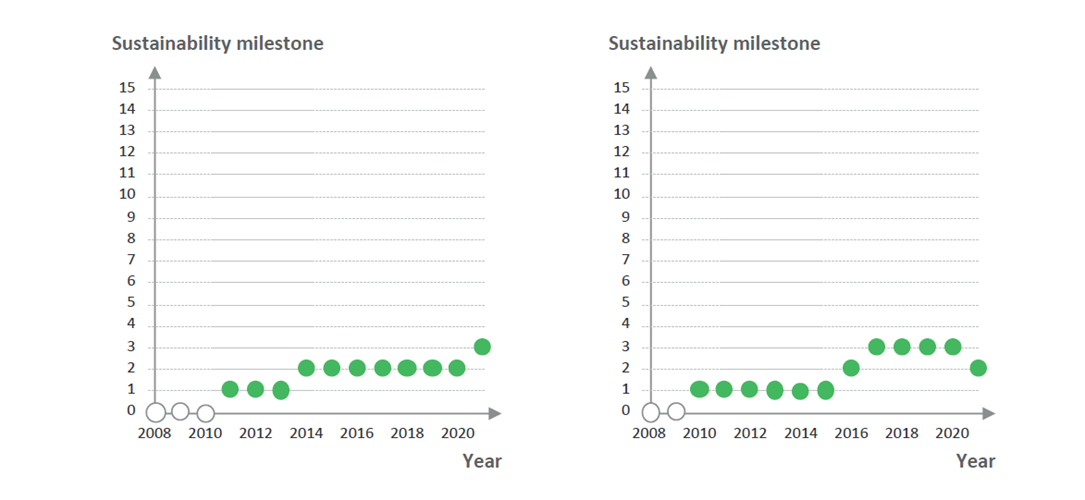

Over time, this scoring system delivers a milestone timeline like the ones below. These two illustrative examples use 2008 as a baseline and compare one major flagship carrier (left) with one major low-cost airline (right). The milestone timelines Impact proposes will use 2019 as a recommended baseline.

Source: Impact on Sustainable Aviation.

Source: Impact on Sustainable Aviation.

From 2030, relative decoupling rewards frozen

To ensure that airlines are not maintaining financial rewards for relative decoupling (lowering intensity, but still growing overall emissions) beyond 2030, the points achieved through relative decoupling are to be frozen at their current levels from that year.

“Could be 2031,” Goedeking admits when questioned about the choice of year, but he warns it should be not much later than that, as the end of the decade is when major decarbonisation levers like sustainable aviation fuel (SAF) and carbon capture should become widely available. “2030 is certainly ambitious, but the wording we use is pre-SAF, pre-carbon capture. Once those mechanisms become available, you don’t have an excuse to stick in the realm of mere relative decoupling.”

Dublin Week reaction

Impact released a preview of its milestone concept via its Year in Review 2022 on the eve of the January Dublin Week. Ulrike Ziegler, president of Impact, says it was “very well received” by stakeholders in Dublin. “We had people swarming over us to find out more. People very much liked the simplicity, taking off substantial red tape out of this super important and super complicated subject,” Ziegler reflects.

Consulted stakeholders included several major leasing platforms. Traditional aircraft lessors are being increasingly acknowledged by Impact as financing parties that could benefit from its proposed methodologies, although the association acknowledges it has yet to fully address the added complexity of aircraft-linked financing.

“The lessor problem is more complex than the lender problem […] the lessor has two dimensions: a particular type of aircraft leased to a particular type of airline, so we have a ‘dot’ [a specific aircraft type] in a coordinate system. What does that dot look like? How risky is that dot? How big is the dot…? So that needs to be discussed,” explains Goedeking.

Impact has also approached airlines, banks, advisors, and other external stakeholders in relation to its latest whitepaper. Beyond aviation, the association also held discussions with the automotive industry about how its proposed KPIs and milestones could support their decarbonisation efforts.

The Ishka View

In the space of 12 months, Impact has gone from launch to become the leading proponent for transition finance metrics and methodology in aviation. In the absence of aviation transition finance standards, the association has done an excellent job of balancing the views of its largely bank and asset manager membership (35 members and counting) with empirical decarbonisation priorities. Among its 2023 objectives is to continue expanding its membership with a particular interest in stakeholders in the US and Asia, as well as investors and insurers.

The association is continuing to work alongside other stakeholder groups on best approaches to operator emissions reporting and standardisation (a priority since inception), and it is in discussions with the scientific community to steer its thinking. This engagement with international academic and research groups is set to grow in 2023. “We need to have a real-world check, our thinking has to be validated,” Ziegler emphasised. Illustrating its ambitions for wider stakeholder outreach, on 17th February Impact announced it has joined the European Commissions’ Renewable and Low-Carbon Fuels Value Chain Industrial Alliance.

Ishka is a founding member of Impact on Sustainable Aviation. For more information on Impact (Initiative to Measure and Promote Aviation’s Carbon-free Transition e. V.), please visit: impact-on-sustainable-aviation.org

Sign in to post a comment. If you don't have an account register here.