Tuesday 28 May 2024

Engine lessor CEOs optimistic on GTF ‘resolution’, but warn supply chain issues likely to persist

A number of engine lessor CEOs have expressed new optimism about engine manufacturer Pratt & Whitney’s ability to reduce the number of grounded aircraft as it continues engine inspections triggered by concerns of cracked powdered metal components.

Jeff Lewis, Hanwha Aviation’s recently appointed CEO, argued that both CFM and Pratt & Whitney would be able to address their various performance issues within two years. Speaking at Ishka’s Trading Summit: Midlife, Engines & Part-Out event held in Dublin earlier this month, Lewis stated: “I believe that in the next 24 months, the LEAP and the GTF issues will be resolved.”

Another engine lessor CEO in the same panel confirmed that Pratt & Whitney had communicated that it believed it could “resolve” the number of grounded aircraft caused by GTF engine inspections within two years – the same guidance the firm has given publicly – while it continued to address performance issues. Last year the engine OEM was forced to ground hundreds of Airbus A320neo family aircraft to allow it to inspect PW1100G engines (see Insight: ‘RTX: hundreds of additional GTF inspections to ground A320neos’).

Lewis also defended the architecture of the GTF engine, despite its performance issues. “I don't think the industry gives Pratt enough credit to what they've achieved with the GTF,” reflected Lewis. “The GTF engine is an amazing platform […] It's a leap in manufacturing technology, it's a leap in material technology, and it's a giant leap in engine architecture. You can't achieve all of that without having problems. Unfortunately, these latest issues are related to material issues in the manufacturing process, but actually not related to the architecture of the engine and the technology that it represents.”

SMBC Aero Engine Lease CEO, Roger Welaratne, highlighted that Pratt was now producing what it calls “full-life engines” – GTF engines with no powdered metal issues – which he described as a “big, big thing” for the manufacturer. “I'm a bit surprised they're not trumping the horn on this one…. That's huge, because we could have easily been in a situation where Pratt were still producing faulty parts for another year.”

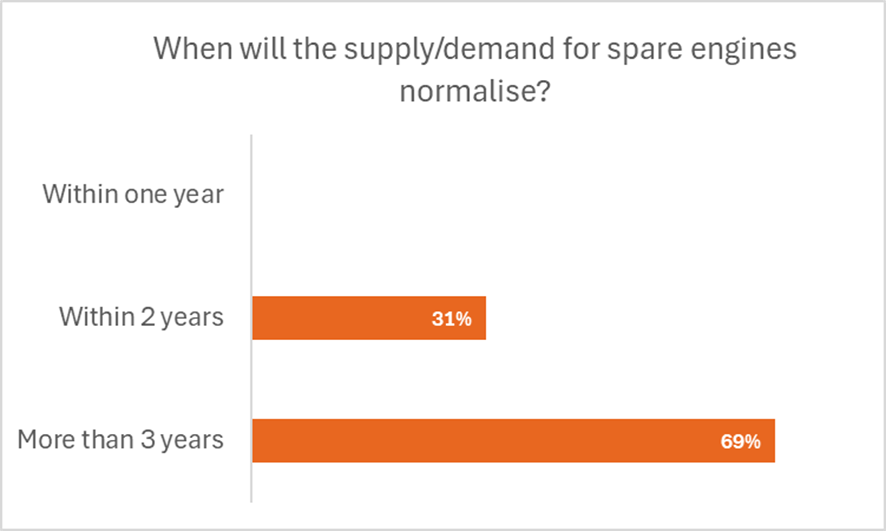

However, other panellists argued that supply chain issues and the heightened need for current-gen aircraft spare engines would likely to continue for at least three years, a sentiment that was echoed by audience polls through the conference (see poll results below).

Just over a year ago, India's Go First filed for bankruptcy, blaming Pratt & Whitney after it was forced to ground roughly half its fleet. One engine lessor CEO also confirmed that airlines without backstop positions in their maintenance contracts could face bankruptcy because of cash flows issues due to grounded aircraft. He explained that a carrier would need at least $5 million in annual revenue just to cover the basic rent for one new A320neo. “But some airlines have penalty clauses in their maintenance contracts and some cover, and some don't…. it's a difficult market.”

Boost in engine lease rates

Engine lessors confirmed the heightened demand for current-gen engines as a shortage of parts was delaying MRO times adding a premium on available spare engines. Ishka is in the process of compiling its Q2 engine values and lease rates but the Q1 engine lease rate and values report showed that engine leases and values had dramatically increased over the last 12 months (see Insight:’ Q1 2024: Engine buyers predict lease rates will continue to rise’).

ELFC's CEO, Richard Hough, stated that given the uncertainty around new aircraft production rates, the shortfall in performance as well as the fact that induction times and turnaround times were each still taking up to six months each (due to shop capacity and material supply constraints) that it was “impossible” to know with any certainty when the demand for new-tech spare engines would normalise. Adding that it was likely that the manufacturers would initially overshoot production but then taper off output allowing the market to eventually balance supply and demand.

The Ishka View

Engine lessors have benefitted from a remarkable rise in engine lease rates due to longer MRO turnaround times, and the boost in demand for current-gen aircraft. Some engine traders have expressed regret at the prices they were selling engines at just seven or eight months ago as the market has rapidly changed.

Most predictions seem to suggest that engines will likely trade at a premium for at least the next two years. One debate at the Ishka conference is whether there will be a cliff drop in current-gen engine valuations or a gentler landing in two or three years. It is a hard question to answer as it depends on MRO turnaround times, the number of aircraft being parted-out, and the ability of the manufacturers to successfully ramp-up production.

“The difficulty is in understanding how and when all the agents involved will act – improving MRO turnaround times, increased production of spare engines and spare parts, parts price escalation, access to USM, and last but not least affordability will all play a part,” reflects Ishka’s head of advisory, Eddy Pieniazek. He adds: “The good news is that the industry is well aware of these issues and their anticipated timelines, so the potential for a soft landing exists. In the meantime, there is the bow wave of demand that is geared to keep everyone busy at a heightened level for the next 24 months.”

Sign in to post a comment. If you don't have an account register here.