in Aircraft values, Lease Rates & Returns

Thursday 8 August 2024

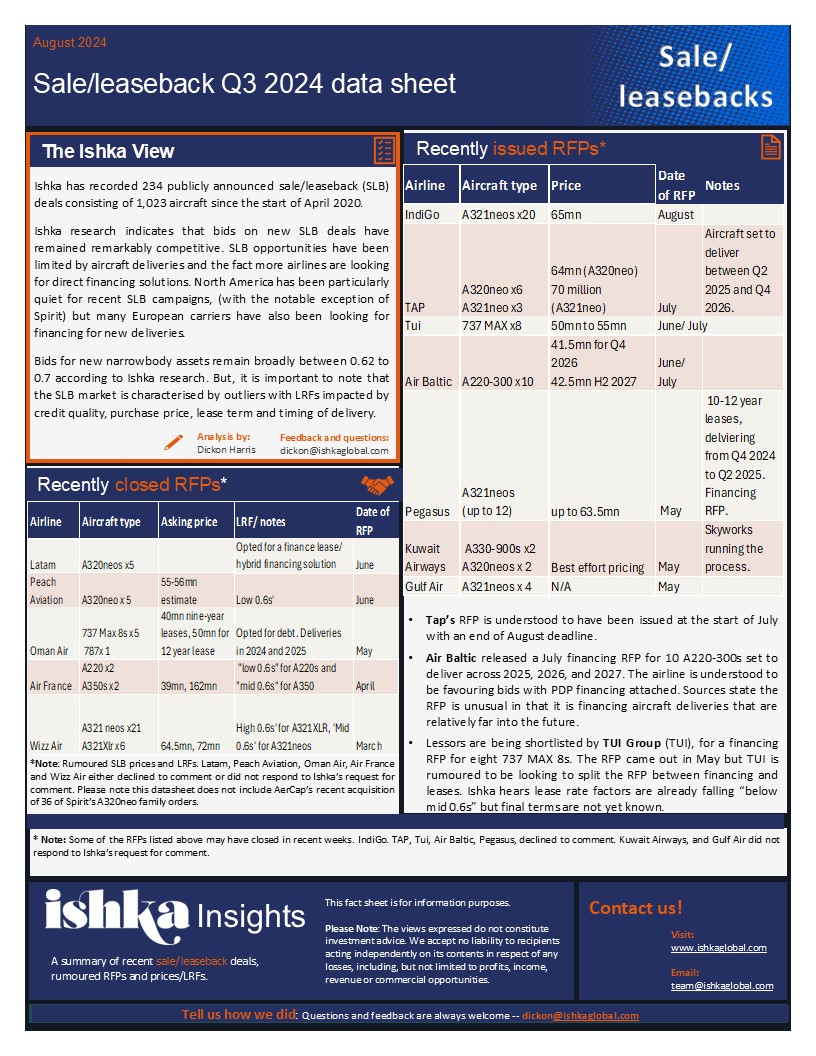

Sale/leaseback update Q3 2024

SLB market overview

Ishka has recorded 234 publicly announced sale/leaseback (SLB) deals consisting of 1,023 aircraft since the start of April 2020.

Ishka research indicates that bids on new SLB deals have remained remarkably competitive. SLB opportunities have been limited by aircraft deliveries and the fact more airlines are looking for direct financing solutions. North America has been particularly quiet for recent SLB campaigns, with the notable exception of Spirit (see below) but many European carriers have also been looking for financing for new deliveries.

Rumoured bids for new narrowbody assets remain broadly between 0.62 to 0.7 according to Ishka research. But, it is important to note that the SLB market is characterised by outliers with final LRFs impacted by credit quality, purchase price, lease term and timing of delivery.

AerCap acquires 36 A320neo family orders from Spirit

In its recent earnings call AerCap revealed it acquired 36 of Spirit’s A320neo family orders in July, with associated pre-delivery payments, to be delivered between 2027 and 2028 – and leased directly to Spirit. An additional 52 A320neo family orders held by Spirit are to be backstopped by AerCap, with the lessor stepping in to purchase the aircraft in the event of cancellation.

The deal, described by Kelly as “well-priced,” allows AerCap to essentially jump the queue on what is a packed-out OEM waiting list. “It provides us with… the most attractive aircraft in the world, the A321neo, in a time slot that would be impossible to get,” Kelly told analysts. (see Insight: “AerCap Q2 2024: Why engines are driving mid-life demand, lessor buys 36 of Spirit's A320neo family order”)

The Ishka View: AerCap always seemed unlikely to place a direct aircraft order in the current environment, but has found a way to top up its shrinking (although still sizeable) order book with the acquisition of 36 Spirit Airlines A320neo family orders. The delivery timeframe is also several years shorter than that for a brand-new order, allowing AerCap to ‘jump the queue’ at a time of high demand for new assets. Although the precise nature of the “bilateral” negotiations with Spirit is unknown, acquiring the orders this far in advance means that the lessor will not have to go through a potentially competitive SLB process for the aircraft.

Kelly also intimated that AerCap will be open to pursuing similar transactions going forward. “We have plenty of capacity on our balance sheet to take advantage of any opportunities that comes in. I'm not concerned about that. It's just having the discipline to pick the right opportunities,” Kelly told the call. “We're looking at many different asset acquisition opportunities on a daily basis, but we hit very few of them. The ones we’ve managed to do are ones where we've worked on a bilateral basis with a partner, a customer who's been a partner for a long time and tried to do something that works for them and for AerCap.”

Click here to see a larger version of this data sheet.

Sign in to post a comment. If you don't have an account register here.