Monday 19 May 2025

FPG launches F.bit - a Japanese publicly traded retail investor aircraft product

Aircraft leasing firm and JOLCO arranger FPG has introduced "F.bit," Japan's first publicly offered, fractionalised aircraft investment product tailored for individual Japanese investors.

Investors are being offered the chance to invest in an A320-200 leased to Spanish flag carrier Iberia.

Investors are buying into a trust with a minimum investment of ¥1 million ($6,900) per unit. FPG says that F.bit has a projected first-year pre-tax yield of 6.0% and a two years and ten-month investment period.

FPG Group will handle the entire process — from aircraft selection and lease arrangement to eventual sale using three separate subsidiaries, FPG Securities, FPG Trust, and FPG Amentum Limited (aircraft investment management). FPG’s F.bit brand will encompass future fractional investment products developed by the company using this trust structure.

Applications will be accepted from 30th June to 18th July 2025.

The Ishka View

This is the first publicly traded aircraft retail investor product aimed at the Japanese market. It is also a landmark product launch for the aircraft leasing sector which typically relies on institutional investors and PE firms for equity investments in leased aircraft assets. There have been efforts to offer retail investments in aircraft in the past which have had mixed results.

German retail investors were offered the chance to invest in A380s via the KG market, while UK investors had the chance to invest in A380s via closed-end fund structures, typically backed by a single asset through the AIM market.

It is important to stress the differences in risk and approach. FPG is using a liquid narrowbody aircraft type, the A320-200, as collateral with a short investment window and leased to a blue-chip airline credit for its initial launch. FPG has experience in using fractionalised ownership model through its subsidiary “and owners” which offers investors the chance to invest in art and supercars. In addition, the Japanese market is a core client base for FPG, one which the firm has cultivated over decades. The new F.bit offering combines multiple aspects of the business and could create a new investor base for aircraft leasing investments.

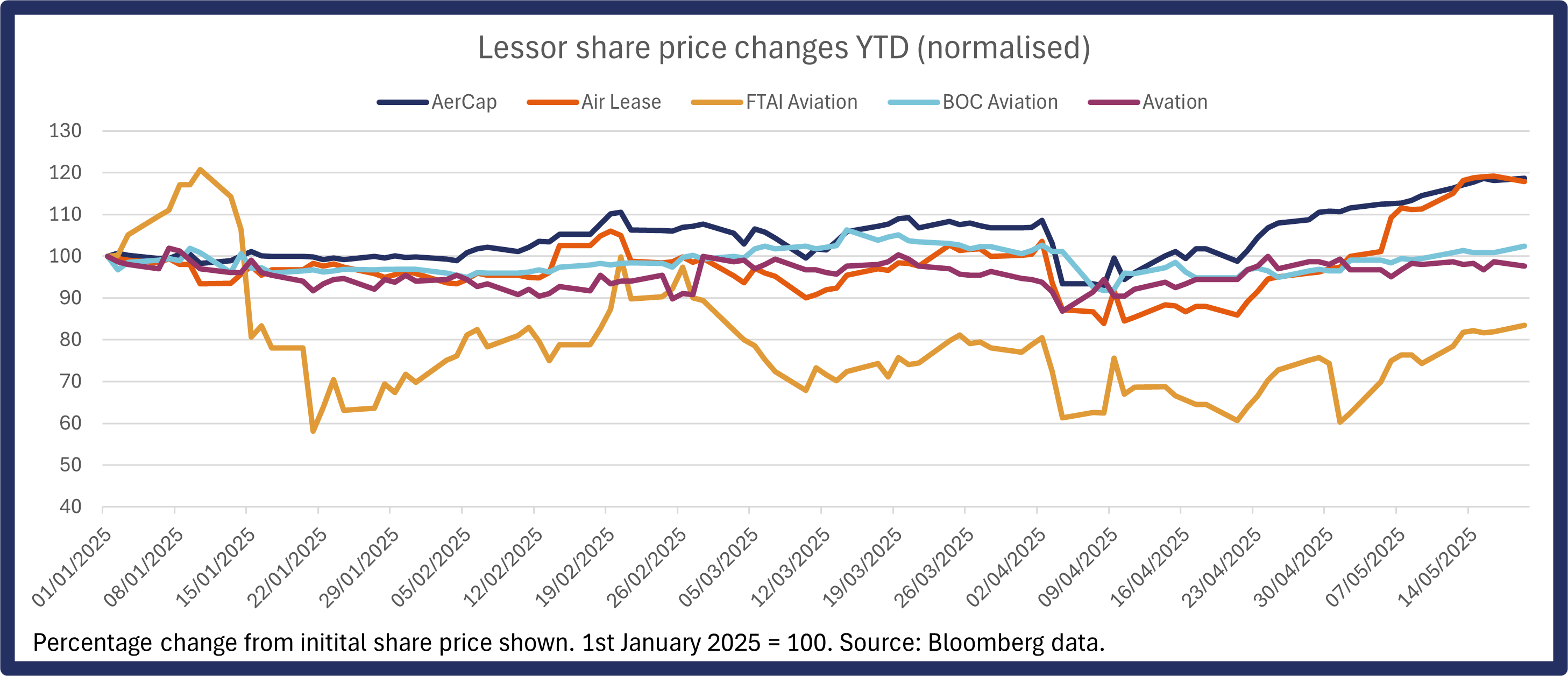

Spotlight chart: Lessor share price changes YTD

Publicly traded lessor stocks appear to have largely rebounded from the post-tariff tumble seen by many stock markets around the world. While lessor share prices, like many others, had a noticeable drop after ‘liberation day’, most have either recovered to or exceeded the levels seen before 2nd April.

AerCap and Air Lease stocks have made gains in recent weeks and now sit just under 20% higher than at the beginning of the year. FTAI Aviation stock, meanwhile, is now just under 85% of its value on 1st January, having experienced volatility even without tariff impacts (see Insight: Quick Takes: FTAI Aviation share price volatility continues, AerCap and Avation make yearly gains).

Sign in to post a comment. If you don't have an account register here.