in Investor Briefings , OEMs, Cargo & Engines

Thursday 18 September 2025

A brief guide to commercial aircraft engine returns

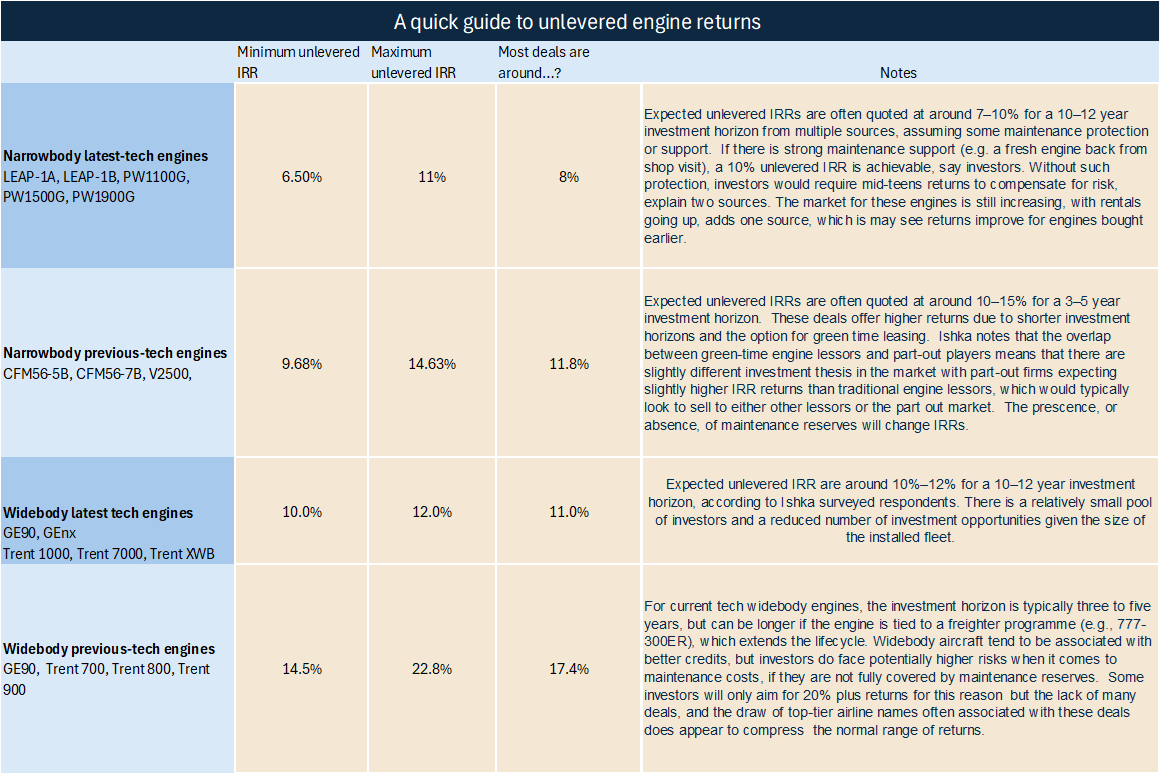

In response to a reader's request, Ishka is providing a quick snapshot of expected unlevered returns for commercial aircraft engines, based on surveyed engine lessors and traders.

Ishka has provided a snapshot report looking at unlevered engine returns. There are multiple investment potential hypotheses and investment cases, particularly when it comes to green-time engines with limited cycles. However, for simplicity’s sake, Ishka has adopted the same methodology as its aircraft returns survey, assuming the engine is traded as a whole asset in a robust serviceable condition.

In addition, Ishka has also avoided including the differing return hurdles that investors might demand for hot and harsh operating environments, which would necessitate a different set of maintenance costs for investors, given the reduced expected number of remaining cycles at the end of a traditional length lease.

Double-digit returns still the norm

According to Ishka research, most engine investments, bar some new-tech narrowbody engines, are still achieving a double-digit unlevered return. Like aircraft leasing, the strength of underlying airline credits appears to be one key determiner in establishing the range of returns, with engines leased to strong operators typically associated with lower returns. Another, and much more important factor, is the current condition, operating, and maintenance history of a particular engine. Respondents were keen to stress the difference that minor discrepancies can have on the long-term residual values, even between sister engines with similar operating histories.

For more information on this point, or to see Ishka’s appraised engine values, please contact Ishka’s advisory team Eddy Pieniazek (Eddy@ishkaglobal.com), Martin Di Fede (Martin@ishklgobal.com) or Noriko Nozaki (Noriko@ishkaglobal.com).

The engine leasing market is also notable for its different niches. Relatively few lessors and investors are actively chasing new-tech widebody engines, and only a dozen (for now) appear to be actively acquiring new-tech narrowbody engines. However, the expectation is that this is likely to change.

More capital is flowing into the engine leasing sector, but most of this capital appears to be targeting current-tech narrowbodies, with many respondents quoting expected unlevered IRR of around 10–15% for a 3–5 year investment horizon. The sharpest rise in investment appetite appears to be for green-time or lower-cycle current-tech narrowbody engines, but more investors appear to be exploring engine investments generally.

Ishka’s final returns are slightly lower based on the aggregated results from respondents, and returns appear to be decreasing slightly in response to more capital flowing to the sector, which has elevated trading prices but slightly impacted returns. The engine leasing market is also notable for its different niches.

This is Ishka’s inaugural review of engine returns. All feedback is welcome. Please contact Dickon Harris (dickon@ishkaglobal.com).

The Ishka View

More capital is flowing to the sector, which appears to be impacting returns. Engine sellers are benefiting from a heightened trading market, which continues to help sellers achieve outsized returns in many instances and compresses returns for those looking to acquire assets. An important caveat is that fully understanding engine condition and maintenance is paramount in preserving returns for engine investors.

One trend Ishka has observed is that more lessors are analysing when and how quickly to invest in latest-tech engines. The dilemma for many is whether to start investing in latest-tech narrowbody engines now, when there are fewer investors, or wait till the technology matures, and the risk abates when it comes to understanding engine performance and residual values. One lessor confides they are watching to see what the introduction of Pratt & Whitney’s upgraded Advantage GTF engine might do to long-term residual values for the current crop of GTF engines. Ultimately, as deliveries ramp up, lessors must adopt latest-tech engines—the challenge lies in how to price them effectively.

Sign in to post a comment. If you don't have an account register here.