in Aircraft values, Lease Rates & Returns , Capital Markets

Friday 20 September 2024

New aircraft ABS notes achieve yields below 5.5%

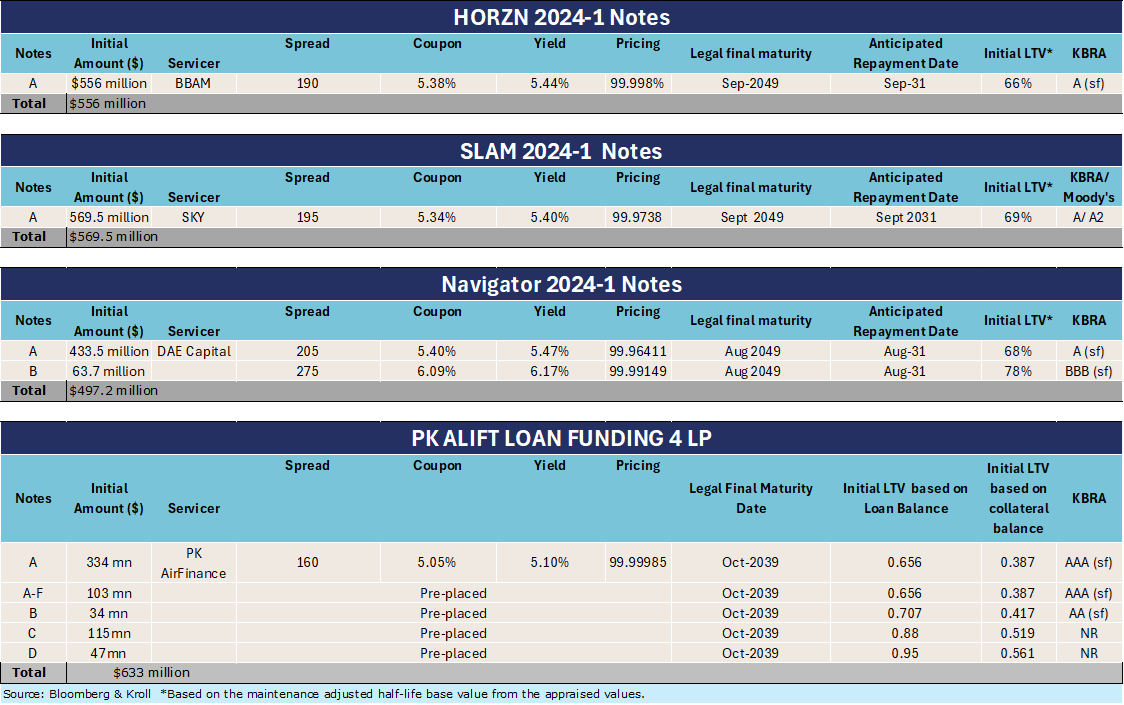

Senior notes for new aircraft ABS deals are scoring yields below 5.5%, as investors warm to the asset class. September saw a flurry of activity as three aircraft lease securitisations and one aircraft loan ABS came to market, all of which have priced in the last 10 days.

Lessors SKY Leasing, BBAM, and DAE Capital are the servicers on three separate aircraft lease securitisations while aviation alt lender PK AirFinance issued a $633 million aircraft loan securitisation.

All three recent aircraft ABS lease deals priced near each other with comparable yields across the deals, (see table below) but only DAE Capital’s deal has so far issued and priced a second tranche among the most recent group of issuers. PK AirFinance’s ABS did initially have three subordinated traches, but these were retained at the time of issue.

Carlyle is the only other aircraft lessor to have issued subordinated ABS notes in the last 12 months. The aircraft lessor initially brought its 2024 ABS to market in June, with a single $428.1 million A-1 tranche issuance and a portfolio of 12 aircraft, but then quickly followed with a new $321.2 million A-2 notes issuance, adding a further eight aircraft to the portfolio, and then finally adding a $81.44 million of class B notes to its aircraft ABS AASET 2024-1. The B notes were assigned a preliminary BBB rating by S&P and have an initial non-depreciated LTV of 84.2%. The coupon for the B notes is 6.9%, according to Bloomberg data.

The Ishka View

Recent aircraft ABS pricing must be encouraging news for aircraft lessors given the extended pause on new issuances. It sets a benchmark and shows there is a steady demand among investors for new senior aircraft ABS notes, whether there is demand for subordinated tranches, however, is still not clear.

But the recent cut in interest rates bodes well for potential new sponsors thinking of bringing deals to market, and could push yields closer to 5% (see Insight: “US Fed rate cut likely to boost aircraft trading”). Ishka notes there has been no real change to structures for recent deals, but it is noticeable that most new portfolios that have come to market have adopted a “sweet and sour” approach of sprinkling new-tech narrowbodies in their portfolios and limiting the number of widebodies. Questions moving forward include: How ready are investors for new subordinated notes, given historic performance? And will investors be open to accepting new deals which use predominantly older aircraft as collateral?

Sign in to post a comment. If you don't have an account register here.