in Lessors & Asset managers , Capital Markets

Wednesday 12 October 2022

volofin eyes turbulent ABS market

Alternative aviation lender volofin Capital Management (volofin) stated that it is exploring the possibility of eventually issuing a potential aircraft loan ABS. Speaking at the ISTAT EMEA panel in Marrakech in late September, volofin’s senior MD and co-founder Stewart Tanner explained that the firm was looking at the possibility of issuing an aircraft loan securitisation via the ABS market as the lender anticipates its loan book increasing next year.

“I think looking ahead we have got to the point now where we're $750 million [in] committed [financing]. I can see that probably doubling by the middle of next year. I think we've got plans to do a Stonepeak-type CLO deal. Whether it's a public or a private placement we haven't yet decided. I think that will be largely driven by how the portfolio diversification grows over the next six to eight months until we get to the scale we need to," explained Tanner at the conference.

SALT 2021-1 sets an interesting precedent for alt lender volofin

On the panel, Tanner referenced Bellinger and Stonepeak Infrastructure Partners’ $893.5 million debut ABS: SALT 2021-1. The ABS was a breakthrough transaction last year which refinanced Bellinger and Stonepeak Infrastructure Partners’ acquisition of the National Australia Bank (NAB) aircraft loan portfolio in May 2021 and marked the first time that a portfolio consisting entirely of aircraft loans, rather than leased aircraft, had been successfully securitised via the ABS market.

Bellinger Aviation is the servicer on the transaction which is secured by 26 loan facilities comprised of 116 loans – all bar one of which are secured. Ishka understands that in total the deal was three times oversubscribed with an oversubscription on every single series of notes in the transaction from the class AA notes to the class D notes.

volofin was formed when Bob Peart, previously the Portfolio Manager at Magnetar Capital LLC, teamed with Erste Bank’s senior aviation lending team, Robert Jack and Stewart Tanner, to launch a dedicated aviation lending platform. They were later joined by other former Erste Bank team members including Jan Bockelmann, now a director at Volofin, and analyst Adam Kubas. The lender is backed by an undisclosed life insurance firm.

The widespread reduction in bank lending during the first 12 months of the pandemic created an opportunity for many alternative lenders and volofin, which launched in 2019, was well-positioned to offer secured aircraft transactions. During the pandemic, volofin was one of the more active alternative aviation lenders. In August Ishka reported the lender's book consisted of 63 aircraft, with an average age of 10 to 15 years (See Insight: "How aviation alt lenders have carved out a non-recourse niche”).

A tough ABS market

The aircraft ABS market has been notably volatile since the Russian invasion of Ukraine. There have been just two aircraft securitisation issuances in 2022 to date (Carlyle Aviation Management Limited’s AASET 2022-1 and the $609 million BJETS 2022-1 for business jet lessor Global Jet Capital) – a stark difference from the 15 issuances including business jet and engine securitisations throughout 2021. The Carlyle transaction in June priced a $522.5-million single A note aircraft ABS with a 67% LTV and offered investors a yield of 6.558%.

Speaking at the same conference, a panel of lessor CEOs argued that it could take three to four years for the aircraft ABS market to return to the record issuance volumes seen in the last five years (See Insight: "Lessor CEOs: Aircraft ABS market could take three to four years to fully recover”).

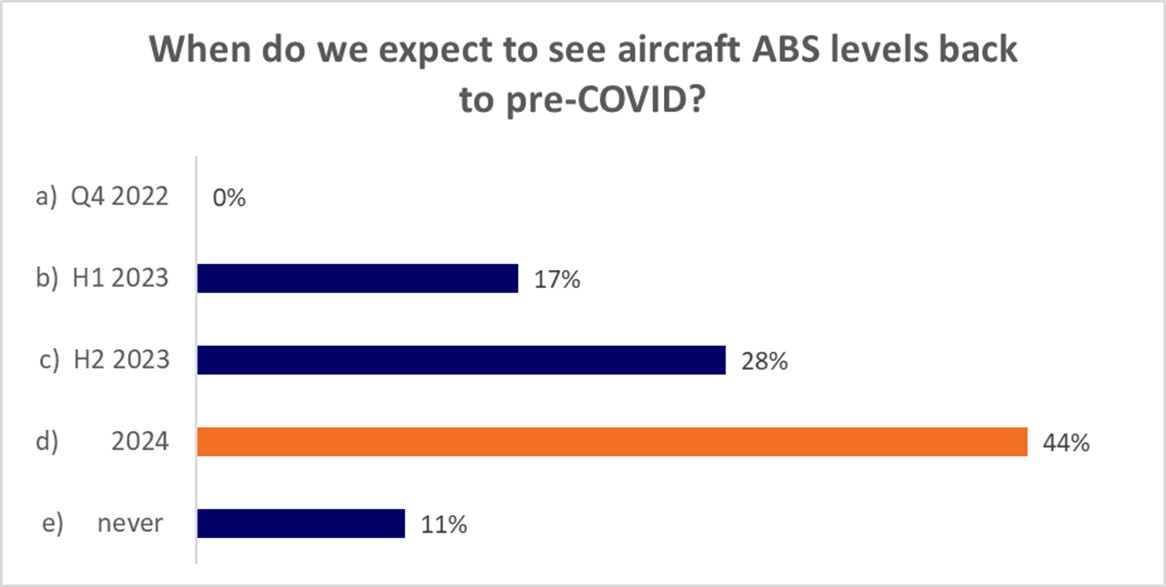

An audience poll at the conference highlighted that most respondents believed that it may take till 2024 before the aircraft ABS market resumes to pre-Covid levels of issuance. A common theme across the conference was increased pessimism about near-term aircraft ABS issuances due to the high spreads likely to be demanded by investors.

One investment banker speaking at the same panel as Tanner stated that investors liked SALT 2021-1, partly because a loan portfolio makes for "easier" analysis compared to the risks around "re-leasing or residual value risk" associated with leased aircraft portfolios. However, she also warned that debt costs in the current aircraft ABS market could make a potential near-term issuance less feasible.

"The issue right now is similar to what we're seeing on the lease side, which is that assets have to generate enough return to support the cost of the debt that you're going to raise, as the cost of that debt today is higher than it was. If you have a portfolio of floating rate loans that are adjusting with the market, or maybe you hedged it or something, then that market could still make sense for you. But if you have a bunch of fixed-rate loans that were underwritten before rates went up, then it's going to be a lot harder to make the math work. So, I don't think there's an investor interest issue. I think it's just: 'does the market make sense?'," explained the banker.

The Ishka View

volofin has been one of the more active alternative loan providers during the pandemic, and the covid-19 crisis created an unusual market opportunity. The fact that the firm is now looking at potential securitisations is indicative of the success and volume of transactions volofin has successfully concluded so far. It is also not a surprise that volofin is looking at a potential ABS given the team's expertise in the sector. CEO and founder Bob Peart has experience investing in ABS securities in his previous roles at Guggenheim Partners, and Magnetar. Separately, the firm recently appointed Nolan Heske, as MD capital markets who also has experience in trading in aircraft EETCS and ABS at Jeffries.

SALT 2021-1 was a standout ABS last year, judging by the level of oversubscription, which bodes well for any eventual volofin transaction. However, the current market volatility, and the near-term risk of further rate rises, means that is not clear when the ABS market may reopen for aviation borrowers.

Sign in to post a comment. If you don't have an account register here.